The turmoil continues in the cryptocurrency market:Bitcoin is trading below the key support of $20k, one after another is facing the problem of payment of obligations, and public miners are increasing sales.

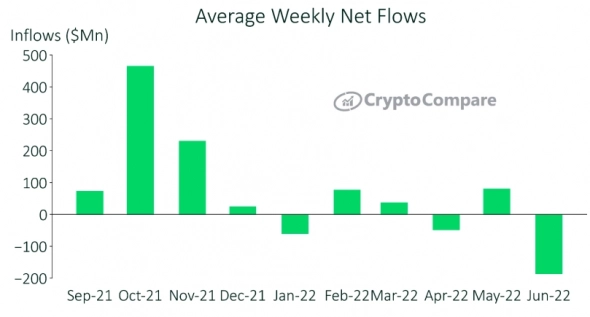

The risk of a further fall in the price scared institutional investors, whose weekly net outflow of funds from investment products reached a record $188 million in June.

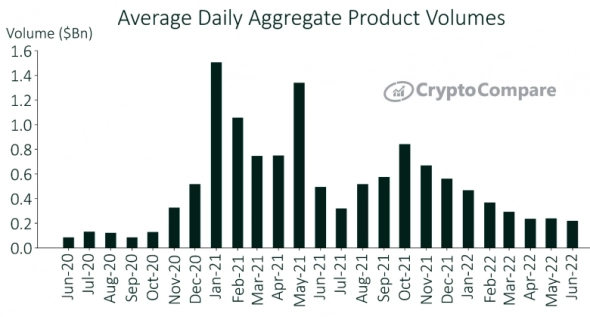

Image source: cryptocompare.com

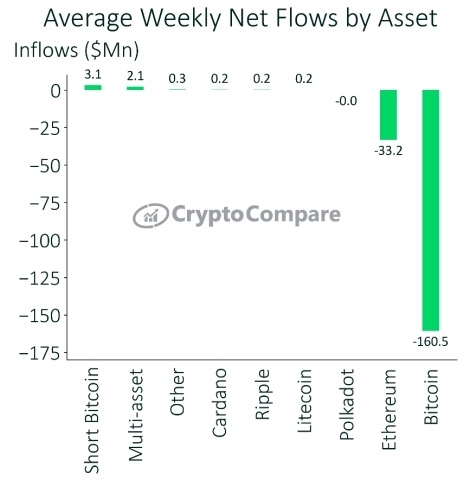

Most active last month, investors got rid of Bitcoin, the weekly net outflow exceeded $160 million.

Image source: cryptocompare.com

Trading average daily activity in investment products is at its lowest levels since the fall of 2020. Since May, the decline was 7%, the figure dropped to $221 million.

Image source: cryptocompare.com

The turmoil began with the collapse of the Terra project,included in the TOP-10 with a capitalization of $40 billion. A number of cryptocurrency funds invested in it, including one of the largest Three Arrows Capital (3AC). In turn, other crypto platforms have invested in 3AC, for example, the Voyager Digital crypto broker.

3AC failed to pay on time, amountobligations to Voyager Digital exceeds $600 million. And now the crypto broker has announced a freeze on both trading activities and client funds. On Friday, the company's shares collapsed by 32%, and since the beginning of the year, the decline has exceeded 97%.

Image Source:investing.com

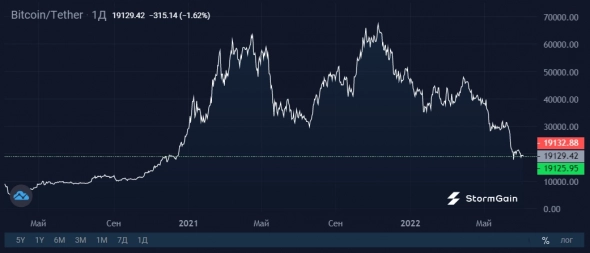

A similar situation is observed among publicmining companies that increased production capacity on credit. According to Bloomberg, the total debt of miners is $4 billion. Now companies are forced to sell Bitcoin “cheaply” due to the need to pay interest and to cover operating costs. Thus, Core Scientific alone sold 2,000 coins worth $60 million in May, and in mid-June Bitfarms sold half of its reserve of 6,349 BTC.

Image Source: Cryptocurrency ExchangeStormGain

Mutual credit obligations lead tochain of bankruptcies, and the lack of liquidity in credit institutions and the need for miners to pay interest on loans lead to an increased supply of Bitcoin. All this continues to have a depressing effect on both the price of Bitcoin and the investment attractiveness of the industry as a whole.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)