Like most cryptocurrencies, Bitcoin is a highly volatile digital currency. For example, in November-December 2017its price has increased by more than 220%. In contrast, in January-February 2018, the price of BTC underwent a sharp correction, losing almost 60%, after which it plunged into the bear market for several months. 2019, with the return of the bull market, only confirmed this extremely volatile nature of Bitcoin.

</p>If the question of refusing to invest in Bitcoin due to high volatility is not worth it, it is important to ask the right questions and think about the factors driving its ups and downs.

Plus, you must have noticed thatmost cryptocurrencies usually correlate with Bitcoin. That is, its fluctuations equally affect most cryptocurrencies, both in the direction of growth and in the direction of decline. Identification of the factors behind the ups and downs of Bitcoin will allow us to better predict and understand the development of the cryptocurrency market as a whole.

In addition, it should be noted that the influence of thesefactors on the price of Bitcoin and other cryptocurrencies are often disproportionate. This is because the world of cryptocurrencies is new and therefore unknown to some investors, which may lead to a disproportionate reaction to a purchase or sale.

So, I propose to get acquainted with the 5 main factors of the rise and fall of Bitcoin price. Of course, this is not an exhaustive list, but these factors are key.

1. The law of supply and demand

Anyone who has taken a basic economics course understands that Bitcoin, like other cryptocurrencies,obeys the law of supply and demand.

Bitcoin's offer can be compared to gold,since a predetermined maximum number of bitcoins can be put into circulation, just like the total amount of gold on Earth is limited. The similarity does not end there, because while gold miners have to mine gold in mines before being delivered to points of sale, Bitcoin miners also need to make an effort to create new bitcoins.

To do this, they must rely on computationalpower your computers and solve complex mathematical equations. Miners who solve a mathematical problem are rewarded with bitcoins, which increases the supply of bitcoins in the market.

The demand for bitcoin acts similarly to the demand for gold and other valuable resources. The more investors want to buy bitcoins, the higher the price.

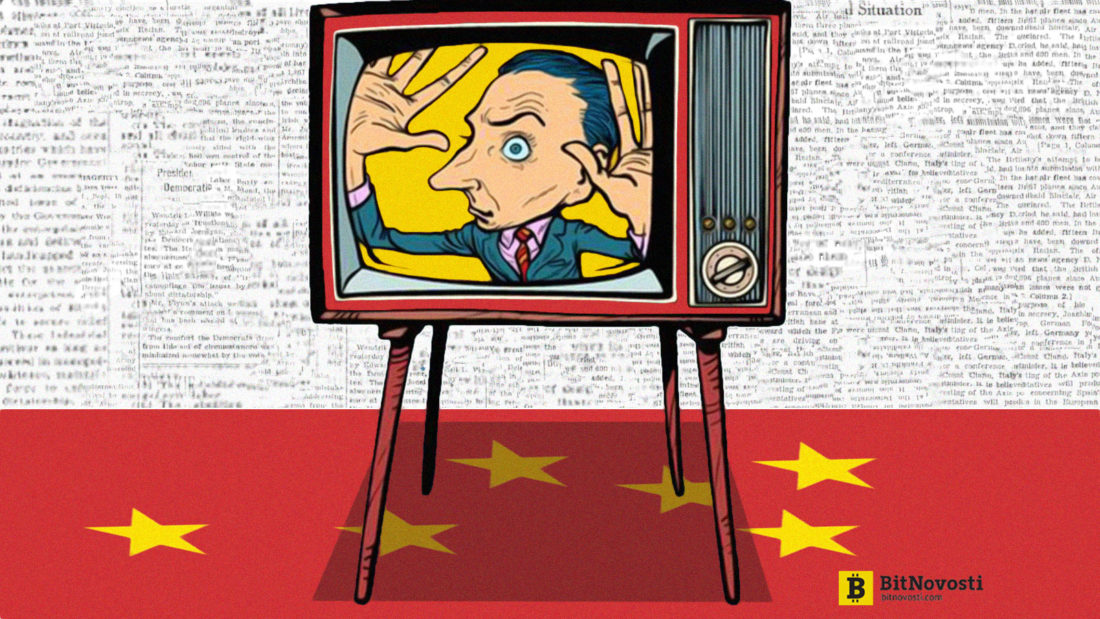

2. The influence of the media

Images: BitNews

Studies show that media is cruciala source of influence on the price of bitcoin and other cryptocurrencies. More media coverage leads to a better understanding of cryptocurrencies and Bitcoin by the general public. This can potentially attract new people to cryptocurrencies.

Positive coverage of Bitcoin in the media, as a rule, leads to an increase in prices, and negative coverage has the opposite effect on cryptocurrency prices.

It’s also important not to neglect the mass effectcertain news in the media. A crypto investor who finds certain information in the media will quickly share it with his colleagues, and they will do exactly the same. Thanks to the power of social networks, news spreads like wildfire, affecting the price of BTC.

Let's take a simple example of the well-known in the world.traditional finance of a large company that has expressed a very strong interest in the Ripple system and wants to test it in real terms in the near future. Such a simple statement of intent will cause a sharp increase in the price of the XRP token. Many investors, having read about this statement, will decide that Ripple is legitimate, as a large company has expressed its intention to support it. This will encourage them to invest in this token.

Thus, it is necessary to follow the latest news about Bitcoin and cryptocurrencies so as not to miss future bullish or bearish waves.

3. Political events

: Medium

As with traditional currencies, political events affect cryptocurrency exchange rates.

However, Bitcoin price changes caused bypolitical events are usually the opposite of what happens to central bank currencies. Distrust in the economy of a country encourages people to trust cryptocurrencies instead of traditional currencies.

Since Bitcoin is a symbolic leader among cryptocurrencies, its price rises first before it affects other currencies in the market.

One can recall the example of the Greek crisis of 2015.when many Greek traders began investing in Bitcoin. A similar effect was observed when Britain decided to leave the European Union or when Donald Trump was elected president of the United States.

Finally, in recent months, the price of bitcoin has also been influenced by the U.S.-China trade war and Donald Trump’s more than complicated relationship with Iran.

4. Governmental changes in regulation

Since Bitcoin and cryptocurrencies are newconcept, it is not easy for governments to take one or another medium-term position on them. Governments are constantly changing their approach to taxation and more.

Although Bitcoin is decentralized and independent ofthe influence of central governments, the regulation determined by the latter directly affects the system, since it is applicable to cryptocurrency investors. Concerns arising from government statements or decisions can lead to a drop in the price of Bitcoin.

When China, the world's largest cryptocurrency market,At the end of 2017, he made very tough decisions on Bitcoin and closed a number of trading platforms, the price of Bitcoin dropped significantly. We also remember, for example, the collapse of the cryptocurrency market by $100 billion in just 24 hours in February 2018. This happened after the announcement of potential regulatory changes by several Asian governments(China, India, South Korea).

On the contrary, it was enough for the Japanese government to officially recognize Bitcoin as legal tender so that the price would recover in the coming months.

Thus, the influence of government decisions on the price of Bitcoin and other cryptocurrencies should not be neglected.

5. Changes in the Bitcoin community

Roger Ver, who supported the split of the Bitcoin community and the holding of a hard fork, after which the Bitcoin Cash currency was founded.

Another instability factor associated withBitcoin, caused by the fact that the community is trying to find consensus regarding its medium and long term future. In addition, community decisions affect the Bitcoin blockchain and, therefore, the ecosystem as a whole.

When consensus fails, as was the case inin the case of an increase in block size in 2017, a hard fork may occur, leading to the division into two blockchains, following different rules. That is how Bitcoin Cash appeared in August 2017.

Such periods of community instability due toBitcoin's rules and its future often adversely affected the price. However, after the fork, there was a tendency towards price recovery. So this may be a chance to invest while the price of bitcoin is low, then to get a good profit.

Conclusion

Like financial markets, Bitcoin andCryptocurrencies have their ups and downs. Due to the novelty of the blockchain and Bitcoin, the growth and recession cycles are much stronger here. Therefore, you should be as informed as possible and be aware of the factors affecting the price of Bitcoin in order to respond as best as possible or even act ahead of the curve.

It is likely that after Bitcoin and the cryptocurrency market as a whole mature, such strong volatility will disappear and the risks will become less.

</p>