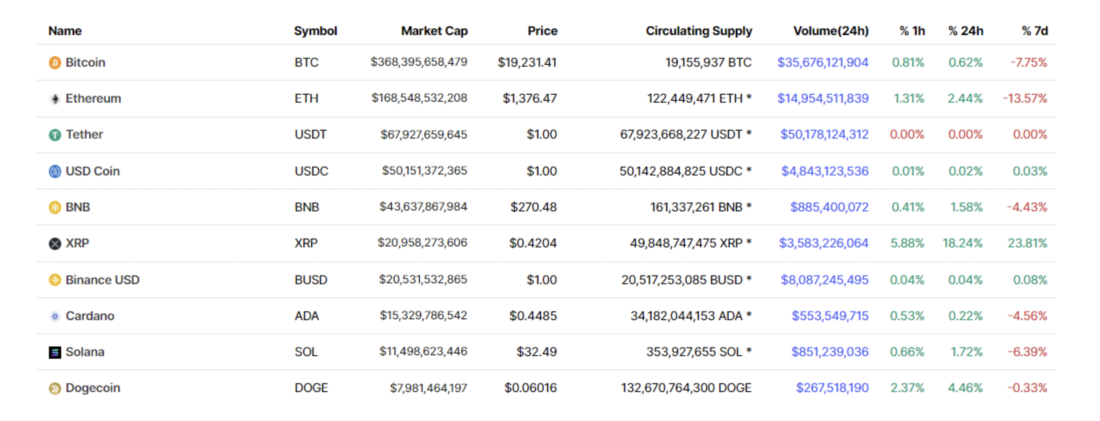

This week, regular Technical Roundup contributors discuss (another) BTC/USD pullback to the range low and priceETH action after the merge.Among the altcoins, XRP is showing relative strength. From traditional markets, let's pay attention to the S&P500, which is trading below the technical support level on the weekly chart. In conclusion, we will talk about the pairs trading strategy in a bear market.

https://coinmarketcap.com/coins/views/all/

Bitcoin is back to range lows

Bitcoin/USD is again testing the lows of the range in the $19k area. It depends on how you count, but this is already the fifth test of this support. In general, this is a bad sign.

First, purely technically, the more timesin a row the level is tested from the same direction, the higher the probability of its breakdown. The level's demand eventually dries up, and this usually results in impulsive movement through it.

Second, consolidation in the $20K area.not only speaks of technical weakness, but also resembles the situation with the breakdown of the $6,000 support in 2018. Then the situation played out according to a similar scenario: the market in a downward trend stuck to the support level, volatility dried up, and eventually the support was broken.

Either way, BTC/USD needs to break away from these range lows to stop looking weak.

Optimistic options remain a return to the upper part of the range or a clear unsuccessful breakout of its minimum ($19 thousand) with a quick recovery.

A less optimistic option is a real breakdown of the support of $19 thousand: then it will be time to take out our dusty charts with a monthly cluster at $14 thousand from the archive.

And the more time the market spends at the current support, without any defining movements, the worse.

Ethereum at weekly support

The ETH/USD rate is at the weekly support of $1300-1400.

We are still not particularly optimistic about this instrument, although on timeframes below the weekly timeframe, from the TA point of view, the situation may promise some opportunities.

The main reason is the sale on the backgroundsuccessful update. All available data suggests that in the short to medium term, The Merge has proven to be a sell-on-the-news event. This is confirmed by both the continued weakness against the dollar and the new weakness in the pair against bitcoin.

We believe that the market will need sometime to digest post-merge ETH price action and we are not at all tempted to resume buying in the absence of a coherent catalyst and signs of strength in terms of TA.

Although the weekly chart is at the support level ($1300-1400), this is the result of a clear lower high and lower low on the weekly timeframe.

The daily timeframe is signaling a breakout, with more clear support above the previous consolidation area at $1200.

It is also clear to us that bitcoin/dollar continues to“dancing on the edge of the abyss”, and if it slips from this edge, then the fall should be expected in ETH / USD, and it is likely that it will again be deeper than in bitcoin.

Depending on the specific "performance",ETH's decline towards $1200 may look like an attractive opportunity, but we see no point in trying to get ahead of the game by trading likely structures before they have formed.

XRP Shows Relative Strength

XRP chart… doesn't look that bad. And I must say, this is high praise in the current bear market.

Against the background of endless rumors about the successful resolution of their lawsuit with the SEC, XRP looks pretty confident in pairs against BTC and against the dollar.

XRP/BTC is finally breaking away from support at 1500 SAT, with the range high being closer to 3000 SAT.

The pair against USD is trading in a tight range between $0.32 and $0.39 at the time of writing, but a likely breakout would leave room for the next resistance level at $0.60.

Let's not foam at the mouth to admire thissetup, but there is some kind of favorable narrative here and the schedule is not exactly sucky. This is pretty good for an altcoin in the current market conditions, but even here it is important to think like a “mercenary”, trading from level to level, and not be tied to a position.

With one obvious caveat: good news from the lawsuit = Express to the Moon.

S&P500 below support level ahead of Fed meeting

The macro agenda, unfortunately, does not lose its relevance for the crypto market.

Among the nearest catalysts, the decision of the Federal Reserve Commission on interest rates will be published on Wednesday. Markets are expecting a 75 basis point hike.

At first sight and in the short termrate hike by 75 bp (ie, in line with expectations) could provide some rebound in the markets, given the apparent lack of new bearish surprises. But overall, the fact that the Fed has to raise rates so aggressively to fight inflation does not seem like a reason for optimism.

In other words, the macroeconomic situationstill sucks, and it serves as a headwind for risky assets. Especially now that the only crypto-market-specific catalyst (the Ethereum upgrade) is behind us.

As for TA, the S&P500 closed lowerweekly support cluster $3900–3940. Absent a recovery, we expect the downtrend to continue towards recent lows ($3,640), with the next key weekly cluster at $3,400-$3,500.

Pair trading in a bear market

Pair trading is a fairly popular downtrend trading strategy.

By definition, pair trading means going long.on one asset and an equivalent short on another in order to create a kind of synthetic deal on the ratio of the value of these assets, even if they are not directly traded among themselves.

For example:Let's say you think Ethereum will outperform Solana. You buy 1 ETH/USD contract and sell 1 SOL/USD contract. So your market exposure is broadly neutral and the only thing you need to be right about is that Ethereum will be stronger than Solana. If the market rises and Ethereum/USD rises stronger than Solana/USD, you make money on the difference. If the market drops and Ethereum/USD drops less than Solana/USD, you make money on the difference.

Pair trading limits a trade to the relative returns of one asset against another (or one basket of assets against another).

Another example, a bit more focused, islong BTC/USD plus an equivalent short basket of altcoins against the dollar. This is essentially a bet that Bitcoin will outperform altcoins against the dollar in a downtrend.

Pair trading in a downtrend can also be combined with catalyst trading.

Suppose coin A has some futurecatalytic event, and coin B expects a major token unlock or supply increase. If you want to bet coin A up, but without the full directional risk on that position, you can go long on A plus the equivalent short on B as a hedge.

In a bull market, pair trading is usedless frequently, as participants generally seek to obtain a full directional exposure for the underlying assets of interest. They would rather take a simple long on a particular token, or a basket of them, to maximize their expected payoff. For example, if you are long 1 contract Cardano/USD plus short 1 contract Polygon/USD, if they both skyrocket, you will earn much less, or you may end up with a loss.

In a downtrend, the considerations are different:traders generally eschew crypto collateral [on derivatives] and tend to be more hedged and modest in staking instead of full unidirectional exposure.

In summary, pair trading can be useful inin a downtrend because it narrows the range and context of the bet: you only need to correctly assess the strength of one asset relative to another, without having to worry about the direction of the market as a whole.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>