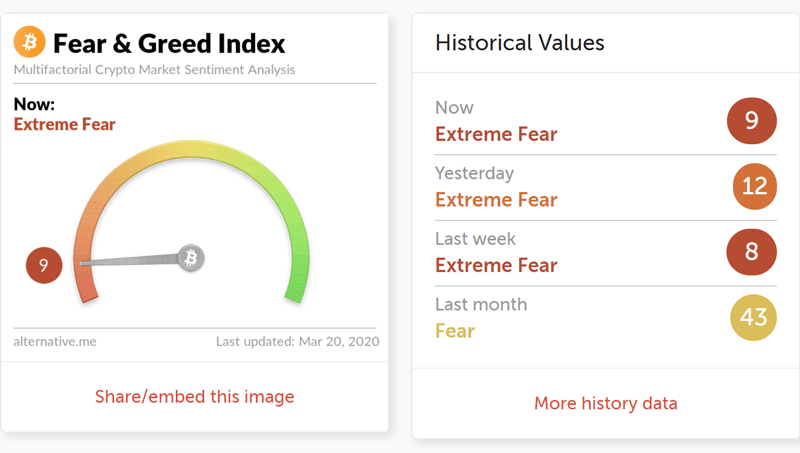

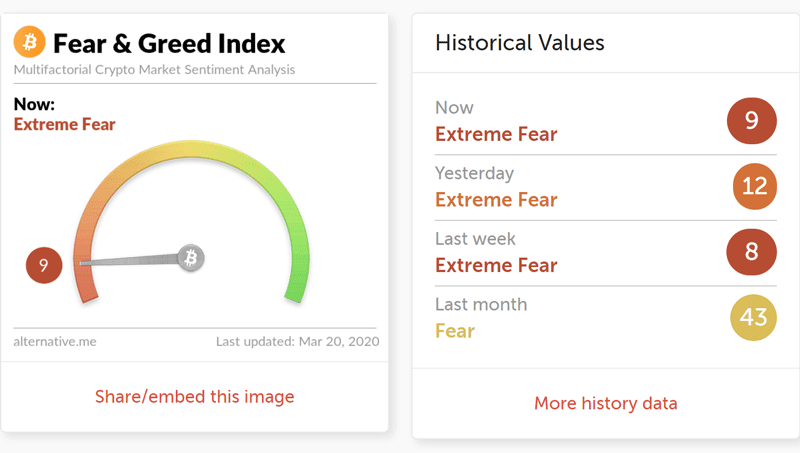

Last week, the Fear &Greed index showed “extreme fear” after the sudden collapse of the crypto market on March 12.This index reflects overall investor confidence inrelation to the cryptocurrency market. The metric uses multiple sources, including social media, to calculate a number that reflects investor sentiment.

A small number has historically correlated with high market volatility and “fear”, while a higher number indicates that investors are moving into “greed” territory.

According to the index, the behavior of the cryptocurrency marketvery emotional. People become greedy when the market rises and this brings with it FOMO (fear of missing out). In addition, seeing red numbers, people often sell their coins out of emotion.

When economic uncertainty duethe coronavirus pandemic has led to lower prices, cryptocurrency markets have been in "extreme fear" since March 8. After a sudden market collapse on March 12, when the price of bitcoin went below $ 4,000, the index fell to the lowest mark since August 2019.

As follows from the index values, extrememarket sentiment may signal a potential price change. Extreme fear indicates that investors are “too worried” and can provide a good buying opportunity, while greed indicates that the market needs to be corrected.

At the moment, the index shows a value of 9, which signals a clear underestimation of BTC and this can serve as a good signal for buying a leading cryptocurrency:

Rate this publication