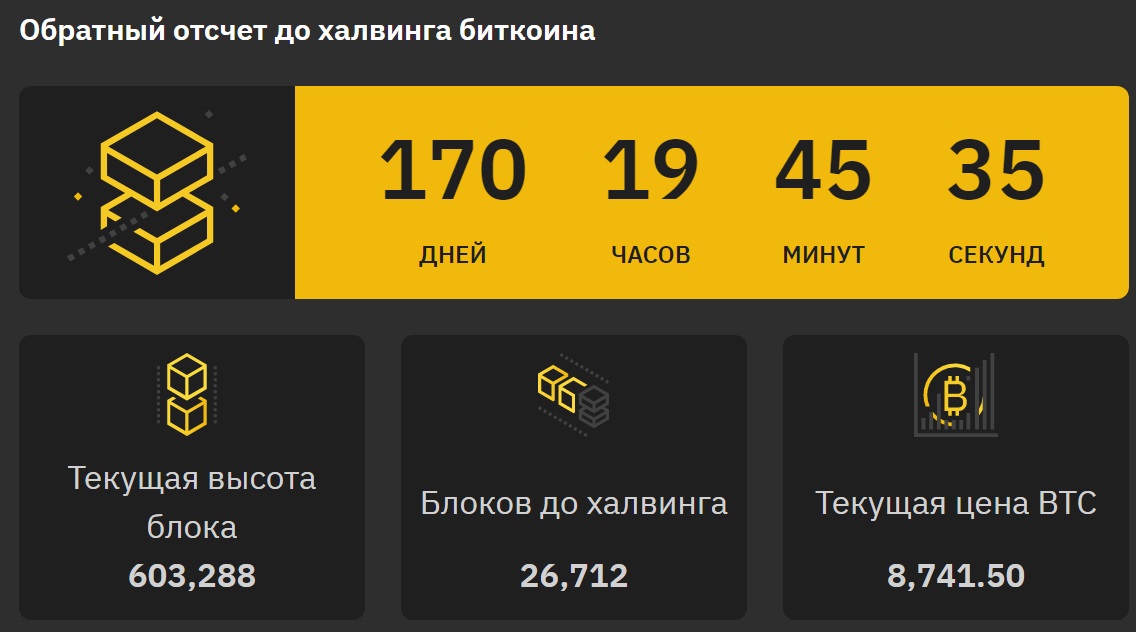

Previous Bitcoin halvings in 2012 and 2016led to an increase in the cryptocurrency rate. The next reduction in the reward for a mined block will take place in May 2020, and many are expecting another pump from it. However, there are strong arguments against this opinion.

Opinion of Russian experts

BitCluster Industrial Mining Operator Development Director Dmitry Shuvaev notes that miners may suffer the most from halving:

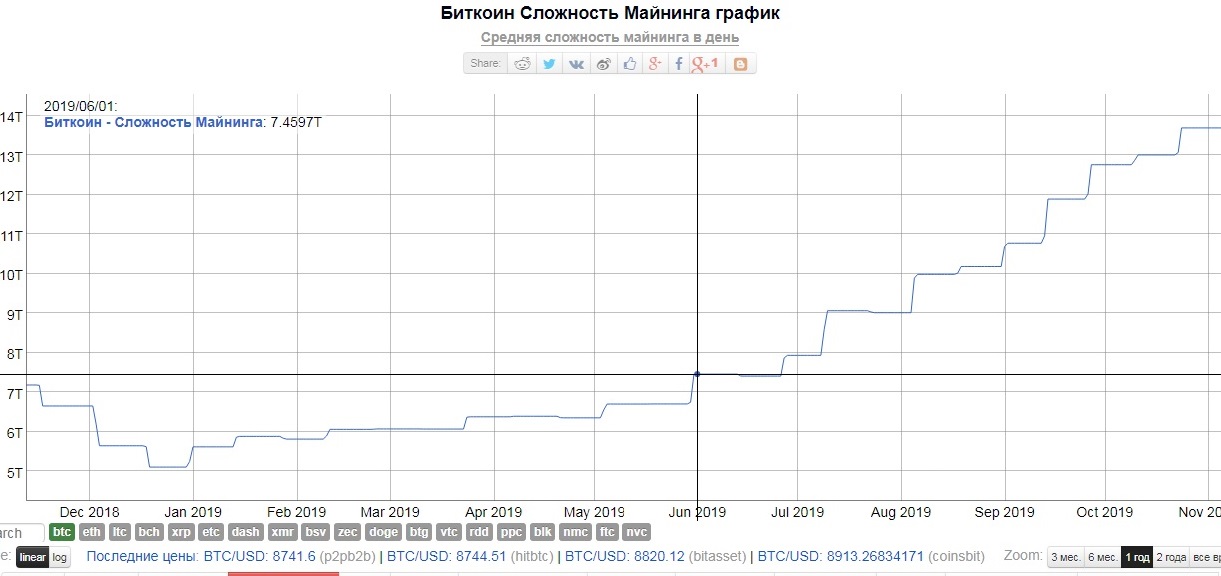

“It is important to understand that the Bitcoin halving will primarily affect the income of miners. If the currency pricewill remain unchanged, then profitabilitywill fall by half. It is necessary to take into account the complexity of the network, which has increased by 58% since June 2019. By May 2020, we expect from +60% to +120% in difficulty from the current level (depending on the exchange rate dynamics during this period).”

Currently, at the BTC rate of $8700cost of mining one bitcoin using the Innosilicon T3 device – 50Th/s is $5500. Estimated cost of mining 1 BTC using Innosilicon T3 devices – 50Th/s in May 2020 will be $10,000-11,000. In order for the rate of mining profitability to remain at the current level, after halving the cost of BTC must be at least $18,000.

Smart Block Laboratory PR Director Timofei Fortunatov prefers not to rush to unfounded forecasts:

“The cryptocurrency market is still tooyoung At the moment, there are not enough historical market events accumulated to build accurate correlations and make accurate forecasts. Yes, reducing miner rewards can lead to a reduction in the volume miners sell, which in turn will create an imbalance in supply and demand. This can indeed contribute to a sharp increase in price, but, as we see in the example of Litecoin, surges are temporary, and they can be caused by completely different events.”

In his opinion, the cryptocurrency rate is influenced bymany factors - from the launch of futures to government statements. That is why we cannot expect that another rally will follow the new halving. As practice shows, the crypto market most often reacts in the opposite way to expected events.

Just remember the hype around the launchplatform for institutional investors Bakkt ‒ remembering the rapid growth of the rate in December 2017 after the launch of Bitcoin futures, a new “native moon” was predicted for the main cryptocurrency. However, in reality, everything turned out differently - after the opening of the first fully regulated platform for trading Bitcoin futures, BTC lost almost $1000 in price.

Statistics of past halvings

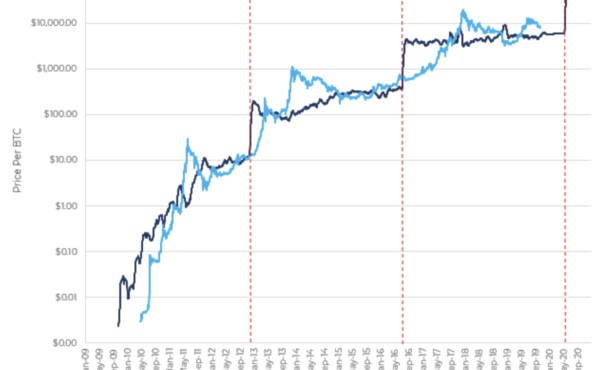

The graph shows that before eachBy halving, the Bitcoin exchange rate began to rise (light blue line), which continued for some time. However, the data sample for a detailed analysis is extremely small - the market experienced only two such events. To make forecasts, it is necessary to operate with other data. For example, fundamental analysis of supply and demand for Bitcoin.

Supply or demand

Well-known cryptocurrency trader TourDemeistre notes that Bitcoin could hold above $8,000 until the next division with an influx of investment of $2.9 billion. This will offset the deflationary effect of new coins entering the network. Assuming that investment growth remains constant with fewer new coins on the market, the rate is simply bound to rise.

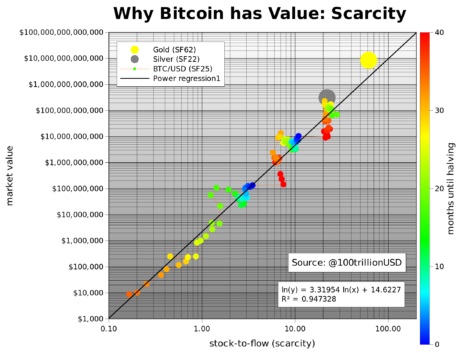

A trader under the nickname PlanB published a post in 2018 in which he described in detail the behavior of the BTC course after a halving. According to his research, growth should be expected immediately after May 2020.

There is a statistical relationship between the volumeinventories and market value. Based on this relationship, an S2F model was built, which considers the ratio of inventories (current units) to their flows (production per year). This model has been widely used to predict prices for gold and silver, but is also suitable for Bitcoin. Overlaying the BTC figures with the S2F model gives an expected Bitcoin rate of $60,000 by the next halving. Demand is not taken into account in this method.

Smart investors are aware of all the factors thatshould affect the rate of bitcoin, so they should have already made an adjustment to the offer in their models and taken a waiting position. That is why there is an opinion that growth from $ 3,000 to $ 12,000 this year is already part of the preparations for the upcoming May event.

However, analyst and TV presenter Alex Kruger does notbelieves. He argues that the Bitcoin price is influenced more by demand than supply. Kruger is confident that supply is completely deterministic and has no impact on the price, so the impact of halving on the cryptocurrency rate has no direct relationship.

Whether to buy BTC before halving

Trusting historical correlation andan increasing news background, investors will buy bitcoin in 2020. Only this fact will make cryptocurrency rise in price. The likelihood that the S2F model is erroneous and will lead to a loss of money is less than the likelihood that the model is correct and will bring an income of 500%. If a price rally begins by May, the offer-based models will be correct. In this case, they will already become a regularity.

The noise around halving the rewards cannot be avoided andthis fact will attract even more investor interest. In any case, the emergence of forecasting models can only be attributed to positive factors in the development of cryptocurrencies.