A post-Soviet marketer is a potential scammer, a scammer.looking at the protracted showdown “Torshina vs.Fadeev”, where the parties perhaps did not leak each other’s medical records, but everything is moving towards this. Or by looking at the stories of Ilya Balakhnin (one, two) and Kirill Gotovtsev, who ensured the operational efficiency of agencies at the expense of the salaries of their employees. Or by looking at the famous and extremely shameful case “BBDO Russia vs Holodilnik.ru”. After all, looking at what the marketers who popped up in the crypto scene have become. Just look at very specific examples.

= = = = =

Alexander Borodich.Once Marketing Director of the Mail.ru (and also the Director of Internet Marketing at the Luckychance online casino). Founder of scam startups Wish Coin and Universa, which, apart from scandals, have not produced anything useful.

Nikolay Evdokimov. Talented salesperson and project marketerSEOPult was so talented that it sold the client the services of this service even when it was not ready at all. Then he left the business, made a big living, married a beautiful woman (Maria Batura) and opened a couple of startups. The result is predictable - the money for all these hobbies has run out, but the talent remains. As a result, the talent was spent on the creation of two large-scale financial pyramids: Cryptonomics and Decenturion. Now Kolya is hiding within the Russian Federation from the masses of people who want to see him in the ground or in prison; in the USA, SEC proceedings have been opened against him - life is good.

Ilya Boev.Marketer from Zheleznodorozhny near Moscow.The founder of the never-appeared crypto trading academy and the ridiculous project CryptoTrust (sic!). A number of people owe cryptocurrency, including the famous case of Inna Ionova(photo of the debt receipt is available), loans to banks and on the lists for debt collection from the FSSP. I also remember the drunken calls “give me money” and promises to cut off my finger - but, of course, I lied.

Vladislav Utushkin.Marketer, later Marketing Directorthe sensational scam Mark.Space with Evgeni Malkin and a couple of other hockey players on board (one, two, three). Interestingly, he was kicked out of this project by Oleg Ershov for incompetence. Now he has organized a project tothemoon.game, which suspiciously resembles a financial pyramid.

Maria Mavrech. A person who has successfully made his way from being an employeeadvertising agency "Maxima" to the scam project Play2Live and removal to the forest. Moreover, it is not at all noticeable that she has become wiser after that episode. Does anyone want to send Masha on a forestry trip again?

Arthur Lipatov. A patient who has successfully made his way from being a marketer to becoming a participant in more than one crypto scam. Incurable.

Ivan Sologub. Man and steamship: swindler, socionicist, infogypsy, cryptomarketer. Also incurable.

= = = = =

All in all,if you see a marketer with experience in front of youIf you work in crypto, (b) LochChein and with the experience of opening your own crypto projects, then you should ask yourself exactly one question: “But do I see scum and foul rats lying before me?”.

It's time for a remake of the classic joke:

— Dad, meet Yura, he’s a marketer.

- That is, a fag.

- Dad, you don’t understand, Yura organized a crypto startup!

- Hmm, it would be better if he was a fag.

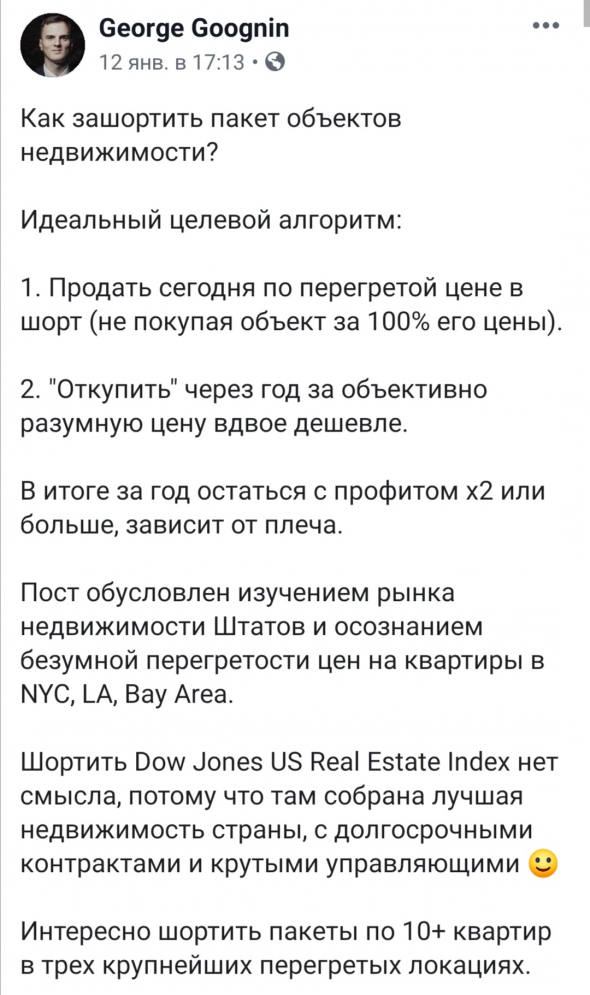

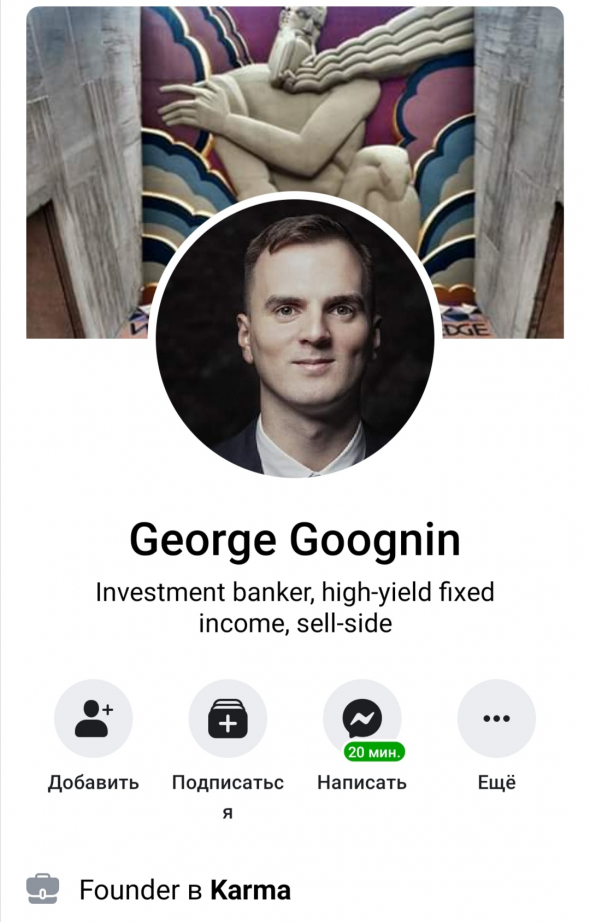

Yes, now the joke is added to the list of heroesYuri Gugnin, who prefers to write himself as George Goognin. There was a marketer and an e-commerce specialist - wow! — with the wave of a drug-crypto wand, he became an investment banker. After all, anything is possible when you're crazy, right? So Yura discovered a superpower.

Moreover, Comrade Reptiloid and I would not have paid attention to this if Gugnin had not uttered a satanic nonsense about “shorting real estate”, which made our eyes pop out of our heads.

= = = = =

For those who do not know what a “short” (short position) and “short” are, you can familiarize yourself with the essence of the concepts here. Or watch “The Short Game.”

= = = = =

Returning my eyes to their place, I decided to see what was written on Gugnin’s Facebook profile. The eyes moved back to the forehead. Investment banker!

Yura, are you serious there?Are you sure you were sober when you wrote this - if you are offering to “short apartments” with a blue eye? This is purer game than “tokenization of illiquid assets” by Valentin Preobrazhensky from the Latoken scam sect.

However, after the words "investment banker" wesee what? “High-yield fixed income, sell-side.” Thank you, Yura, for your honest confession. Because the first, translated from “smart guy”, means “financial pyramid”, and the second is “a specially hired salesman-pi$$dobol in an investment company / Forex kitchen / bank, focused on selling any junk or outright scam to the client.” I immediately remembered the ever-memorable Zhenya Nazarov.

No, there’s not much that can surprise me anymore.Especially after the sales director at Solid Investment Company 4 years ago showed in all his glory that he doesn’t even know what statements are. But this is a large licensed investment company! But it still became interesting to delve into Gugnin’s biography and understand how you can become an investment banker and not imagine that shorting apartments is technically impossible. If only because they are not commodities.

And as you would expect,Yuri has investment experiencenot traceable. Production Director of the ADV Advertising Group,e-commerce within X5 Retail, courses on digital marketing at a business school, e-commerce again at Hoff, Re:Store, Cupcake Story... And consulting within our own consulting agency “Team A”. I might as well call myself an investment banker, because since 2014 I have been working with traders, financiers and investment bankers.

Well, it’s almost impossible to distinguish me from them - necessaryI know the words, their meaning too (unlike Yuri Gugnin), I have already written a couple of books worth of texts for traders and financiers. All that remains is to invent a company, compose a PowerPoint presentation and print business cards. And I will be like a typical cryptan! What can we say if among the crypto crowd, not so long ago it was fashionable to disguise themselves as Jews (Roman Kaufman-Mikhalev, Vladislav Semenchuk, everywhere else), because Jews have a better chance of collecting money from their mother’s investors. So who would be surprised today by an investment banker who was just yesterday a marketer? They won't check the suckers anyway.

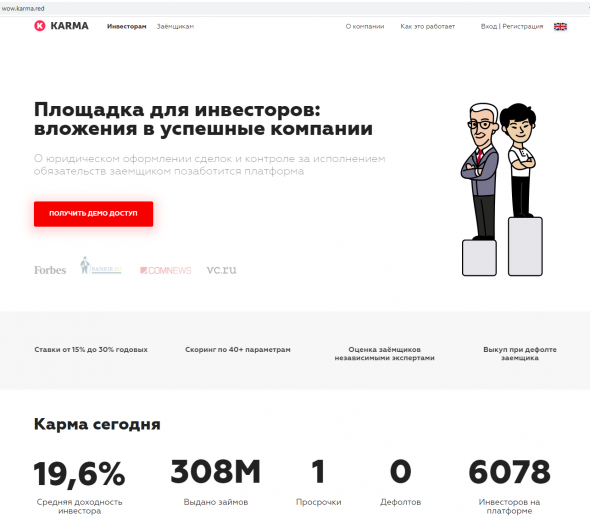

That’s why Gugnin has the Karma project,naturally launched an ICO and collected $10 million from naive hamsters. All due to the fact that once the bank quite logically did not give Gugnin a loan for a private kindergarten. It’s just a matter of crit-hamsters - they are ready to send crypt “to the grandfather’s village” on parole.

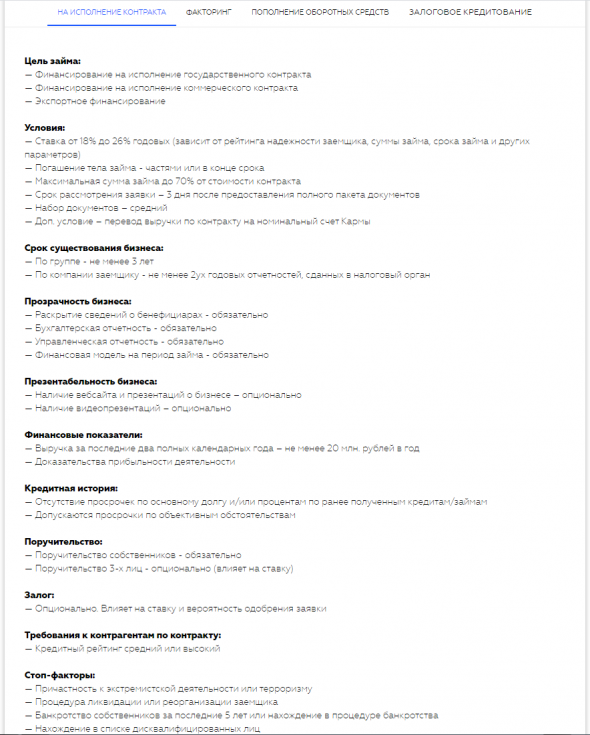

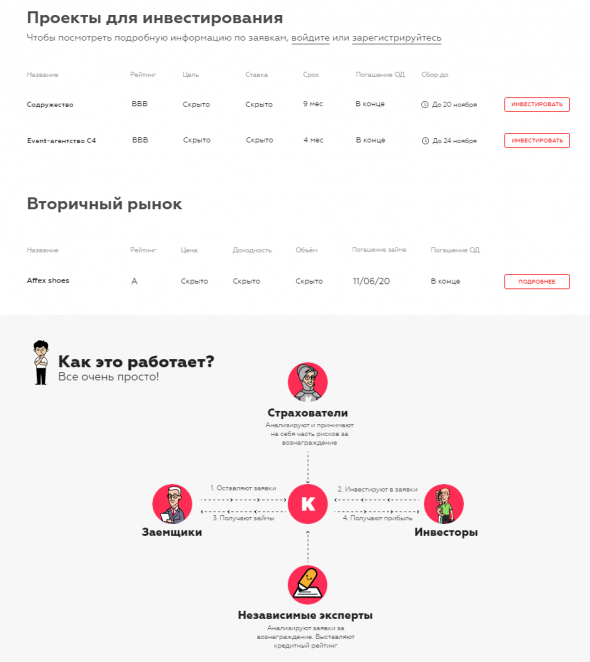

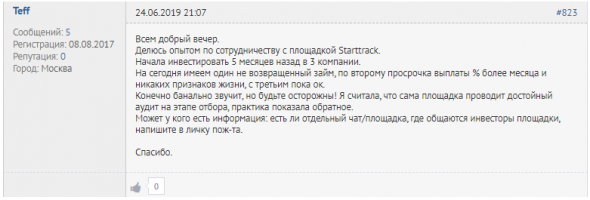

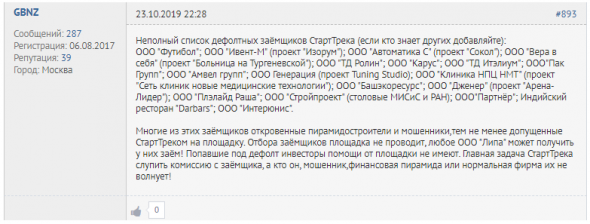

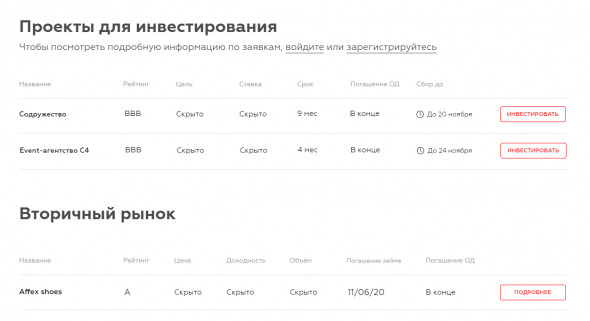

Congratulations, Yura!You and your partner not only followed the crap road of “P2P something” (see examples of Zaimoteka or Teambrella), but actually created a copy of the IIDF StartTrack. Which, as you remember, significantly disgraced the football school Footyball (a criminal case was opened). And all investments made through StartTrack solemnly “burned out.” Moreover, StartTrack, as Ivan Alekhin from Startup Show stated at the end of July 2019, has stupidly run out of funds. Not the best object to copy, don't you think?

= = = = =

Waiting andreality:

Waiting andreality - 2:

As you can see, StartTrack (IIDF) is an extremely “successful” investment platform. Surprisingly, they have not yet been dragged through the courts.

= = = = =

Well, in general, the P2P/P2B lending market itself RoemIt was not without reason that he was buried back in 2016. Moreover, you can now read about how fintech companies in the United States specializing in consumer lending and loans for SMEs have significantly lost in capitalization and could collapse at any moment in Forbes. There you can also read about the actual collapse of projects similar to Karma - LendingClub and Funding Circle. So far no one has managed to pull the banks on their main field.

In principle, the entire logic of such P2P/P2B projects (including Karma and StartTrack) is well described here.

"The problem with all these sites is that theyplus or minus clone the predecessors: give small businesses without collateral, get default 20-30%, and then tell investors why they earn so little (or even in the minuses)."

However, this didn’t stop anyone in Karma -they just added blockchain on top. Therefore, with the blockchain on board, then they gave money, and without it, no. Lochchain itself, of course, was not needed at all in the project.

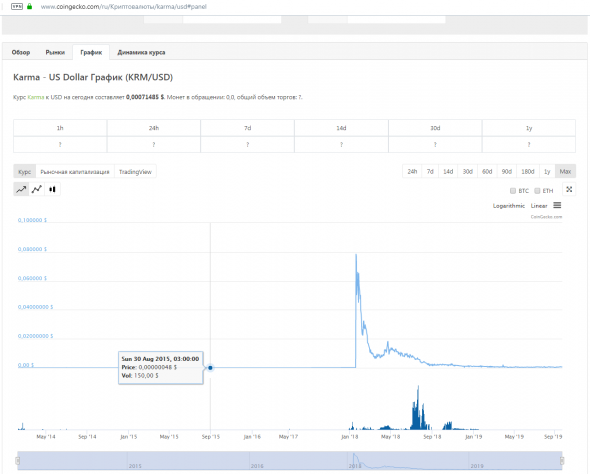

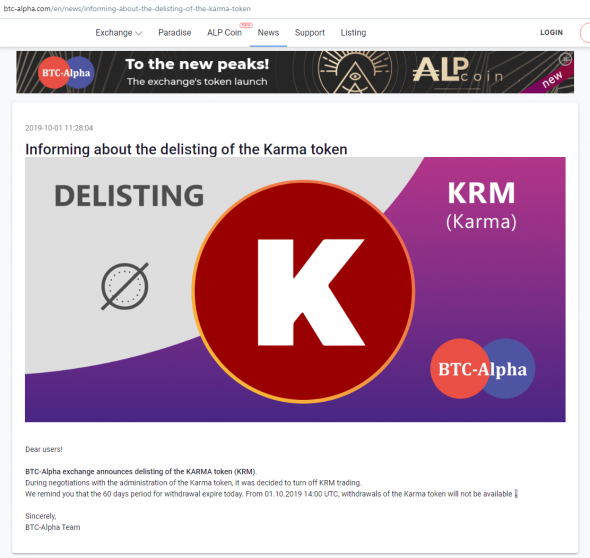

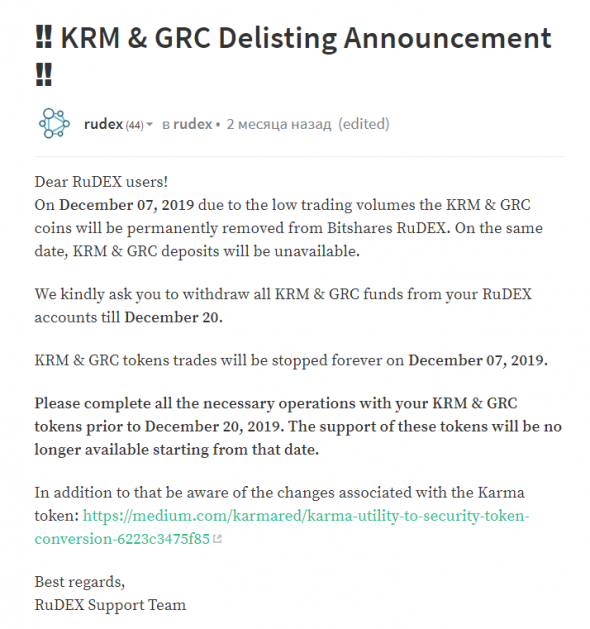

With KRM tokens after the ICO, everything was also extremely predictable. Price and volume drop to zero, delisting even from such garbage exchanges as RuDex and BTC-Alpha (one, two).

What kind of investment banker is Jura, who allows his project to be so shamefully managed? Although wait, Gugnin is not a real investment banker ... He probably found a business card at a construction site.

Nevertheless, with or without a business card, Yuri tries to put on a good face when the game is bad and announces the conversion of tokens into security tokens. That is, not just electric wrappers, but almost like shares.

There are only a number of small problems:How will this fit with Art. 185 of the Criminal Code of the Russian Federation, Art. 15.18 Code of Administrative Offenses of the Russian Federation or Art. 226 of the Criminal Code of the Republic of Belarus? Or with SEC / MAS / FCA requirements and beyond? It is also interesting how payments will be made. Based on what? Fiat or crypto? How will taxes be withheld from payments? How will this be recorded in the company's reporting? Etc. etc. Which seems to hint that this move is more like stalling for time and reducing tension among investors. As in the training manual for pyramid makers. "Take time, promise that everything will be fine, do the conversion to the edge in a new project - and then the hamsters will calm". Because the hamsters saw the token price at ZERO and two delistings from garbage exchanges - which means obvious and very unpleasant questions have accumulated for Gugnin and his partner Laptev.

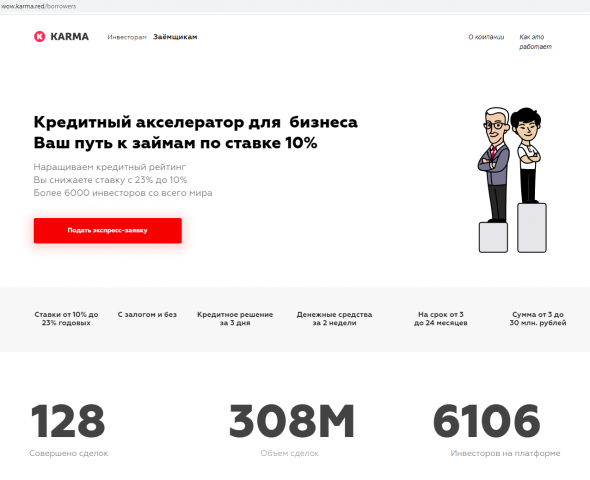

There are also questions for the numbers on the site, which should symbolize the successful success of Karma.

Firstly, in the sections “borrowers” and “investors”The numbers for the number of investors on the platform did not match. The screenshots were taken less than a minute apart. A trifle, but already with a smell. It is also interesting why the number of investors in the article on Forklog (7000+) is noticeably higher than what is indicated on the site. The smell has gotten worse, Yuri, ventilate the room.

Secondly, if we roughly take the number of investors to be6100 people, how did they make only 128 transactions? So inactive core? Moreover, the figure of 308M (apparently millions of rubles) raises some questions. I remember how the StartTrack office jumped with joy, having reached 1 billion rubles of capital in work - and this was much more than just one year. Let’s assume that Start Trek is staffed by stupid and self-confident people (which is not too far from the truth), and we can attract capital much more actively. I know well how - but this “how” is not visible from Karma. And it seems to me that those same 308M... well... about the same as the trading volumes of crypto exchanges, hehe.

Moreover, the average volume of one transaction (issuedloan) is equal to 2+ million (rubles, presumably). How to tell you friends. To attract a hamster with an average check of 2+ million is a radically different task than to attract a bunch of small hamsters with an average check of 50+ thousand (if 308 million is divided by 6100). Different input threshold, different expectations, different strategy in work. This requires not an impersonal service-remake, but very active marketing with an emphasis on the identity of managers and building the brand of the company. Karma does not observe either.

But what’s even more interesting is where they could technicallytake on these volumes if... in August 2019 there were as many as FOUR companies ready to take out loans. Each of them had a very finite capacity of dough, which they could take and return on time with interest. Yes, from user reviews it is clear that there were more companies - but there were no more than 10 of them! And now on the Karma website you can see... AS MUCH TWO!

Yes, Yura, think about it,in a typical fintech startup, that is, an intermediary shop, the problem is not only to attract the hamster with the dough, but also to find sane objects, where to loot the lootto take your commission.

This is where StartTrack burned out.They collected all the slag for the sake of quantity - they received a FootyBall and the mark of swindlers for many years to come. Yes, the drug addict brothers were in the project itself, and not in the IIDF division - but who cares about that? He brought the IIDF by the hand and slipped it to investors as a sure thing. Therefore, now IIDF/StartTrack is smoothly transforming into a classic gathering of infogypsies from venture. How once Xelius from an investment office became ordinary information businessmen from trading - just one time they screwed up big time in money management.

The ridiculous number of borrowers results in 0 defaults and 1 delay. What will happen, Yura, if you have more borrowers? Let me guess... Probablyyour scoring will come down no worse than starttrackers, and you will receive a delay noticeably worse thanTinkoff Bank. And for them it is clearly more than one percent, if you look at the corporate reporting for holders of depository receipts. Note that we are talking about a leading usurious shop... oh, sorry, MFO... sorry, a leading Russian bank. Moreover, a bank with significant equity capital, which Gugnin and Laptev do not have. From whose money will you cover losses in case of non-returns? Very interesting to listen to.

Moreover, despite the slogans “Economy Of Trust. Worldwide cross-border p2p loans ecosystem" and claims to globality, indicated before the ICO and on the current version of the site,Karma is barely trying to master the Russian market.

We need to remind you where the Russian economy is headingsince 2014 and what is happening to the solvency of the population of the Russian Federation and Russian business? Mister supposedly investment banker, explain how you will deal with the inevitable increase in loan arrears? Or the main thing is to master the 10 lyams of green collected from the ICO and live well personally, as was the case with the patients from Mark.Space?

At the same time, the “business plan” dated September 4, 2018year implies entry into foreign markets - that is, a full-fledged launch in three countries, except for the Russian Federation. If in the familiar and understandable market of the Russian Federation 10 business borrowers could not scrape together, then why will you fail somewhere else? Questions, questions…

And if we are talking about questions, then why is the news aboutpartnership with Thomson Reuters is visible in searches exclusively as a news story on Karma's blog on Medium. Am I doing a bad Google search? Or are you going the Mark.Space route with non-existent partnerships?

Moreover, external experts are present in the scheme.

Who are these people? What is their qualifications? How many of them? How were they recruited? Are they in the state? Or are these dudes from a construction site, plumbing and plasterers, as was done as part of a mortgage startup abroad? Well, cho, the builder can estimate the value of the house and its liquidity in the market - isn’t it?

Well, let me remind you that "carefully selected" expertsStartTrack "carefully selected" Footyball and other investment shit, which, I recall, ended in a criminal case under Art. 159 of the Criminal Code. And it is strange that only one criminal case. Jura, didn’t it occur to you that scoring and expert evaluation at banks is a rather complicated thing? Much more complicated than hanging noodles for investors before an ICO. And that is why so far in the credit sector banks are more alive than all living ones, despite sweeps and falls, but your “typical startup” and Laptev have every chance of dying in the very foreseeable future.

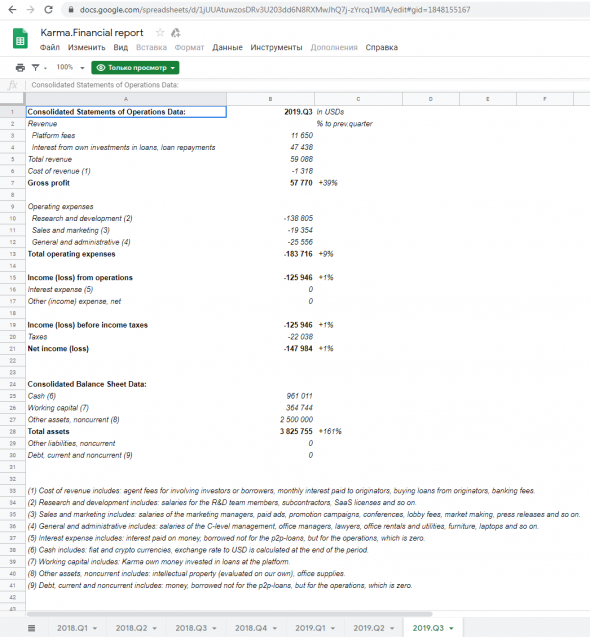

Nevertheless, Mr. Gugnin, in his Medium blog, paints us with a picture of a sucessful business. That is, the crypto collapsed, the token is exactly zero, two delisting from the trash - but the business is cutting!

"As you can see, Karma business is growing 40% each month for 10 months in a row".

How a business can grow proportionally by 40%every month? Only based solely on the effect of a very low base. Or with some very breakthrough product or breakthrough sales technique. I don’t see either one in Karma. However, if you add an old picture with the Google team, then investors will be distracted by it and will not ask questions.

Because they will be interested if you havefunds for 2 years of existence under favorable conditions, then what will happen to the repayment of loans if something happens? And at the same time, they will wonder why the “Platform fees” column gives such insignificant numbers. And how is the platform actually going to earn and recoup the $10 million invested in it?

What we saw leads to one simple thought.Karma is a “typical startup” that will successfully die on its own without new investments from investors. How recently GoLama kicked its hooves without investment. Gugnin and Laptev are engaged in classic self-employment at the expense of investors - I believe they did not deprive themselves of a salary. Yuri Gugnin himself as an “investment banker” is a classic charlatan with a business card. If you invested in Karma at the ICO, you are out of luck in life. You are stupid. If you invested in a certain SME through Karma, God grant that your investments are recovered and you are able to withdraw them. But overall, fellow investor, there is no good news for you. Hang in there and have fun.

With you was Alexey Gryatskikh, previously a marketer, andnow an investment banker and money management expert. Bring me the money, I know how to properly manage it and where to invest it. In the end, cryptans and marketers can - and I can’t chtol?

= = = = =

Original post: https://zen.yandex.ru/media/id/592d3ad87ddde88dbd5af2da/besedy-s-reptilovichem-ch32-ugolovka-dlia-pavla-durova-raketa-ot-sec-i-intellektualnaia-nisceta-nikity-kolmogorova-5e22cdf6c05c7100ae87fd63

Main blog: https://zen.yandex.ru/media/id/592d3ad87ddde88dbd5af2da

Telegram channel "Cryptocriticism": https: //t.me/cryptocritique

Telegram channel “Marketing Huyarketing”: https://t.me/marketinghuyarketing