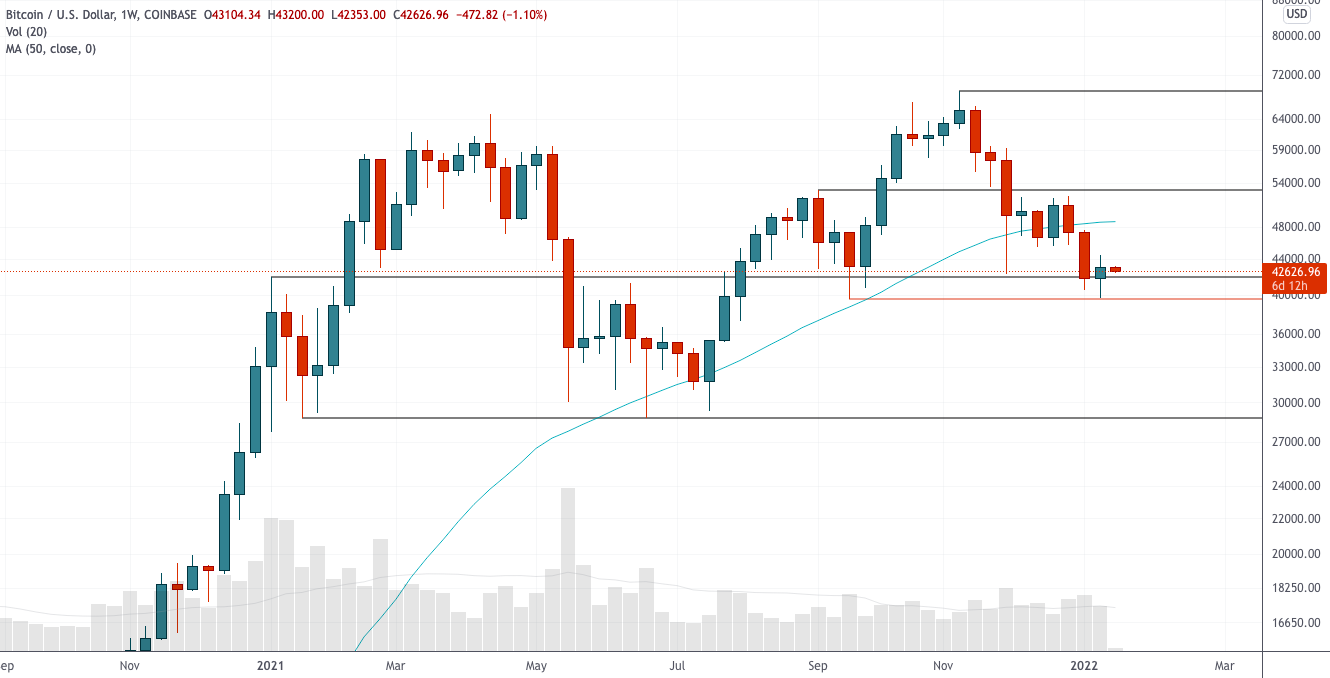

During this entire defining weekend, Bitcoin did virtually nothing. The good news is that it's "nothing"he was making moves above the $42K support rather than below it, which created the conditions for altcoins to move fairly strongly. The most important thing for the bulls is still maintaining the $42 thousand level.

On the lower timeframes, there is absolutely nothing to look at yet: sideways movement and a “haircut” in a narrow range.

Weekly schedule

Nice candle.We need to see if we get confirmation from the results of the new week. Bounce exactly off the $39.6K support and close above the $42K support, long shadow (aka “wick”) and green candle body.

Exactly what the “bulls” wanted to see… for now. There's still a long way to go.

The TD Sequential indicator has officially counted downthe ninth red candle on the weekly timeframe is a rare signal of a reversal to the macro perspective. The weekly chart is rarely so unsightly as to complete this countdown to 9 candles. However, as seen in recent history, the market can take their account to 13 before actually turning around. In addition, history knows many examples when this signal was not followed by the expected market reaction at all, so there are no guarantees, as always.

But for lovers of this indicator, this is, of course, a strong buy signal.

Daily chart

MACD confirmed bullish divergence in both MA andhistogram. The moving averages also formed a bullish cross, and the histogram moved into the green zone. Last time, with this combination of factors, the price went to $52 thousand. Something like this, according to MACD, can happen now.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.