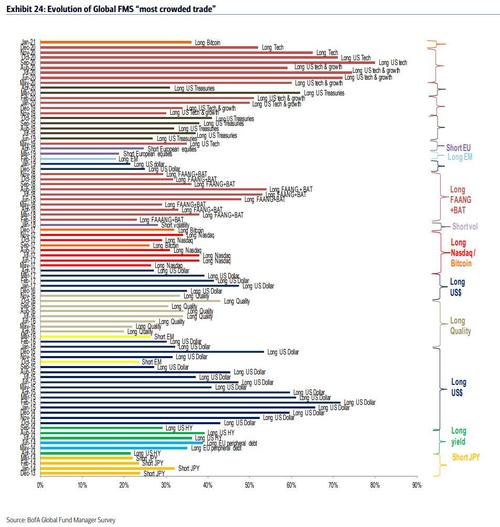

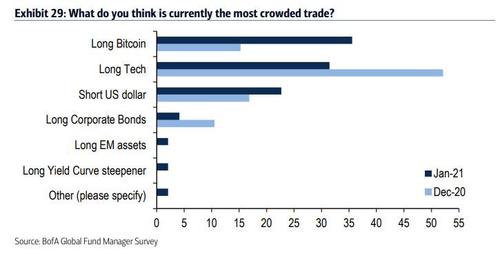

Bank of America's fund manager survey was once a useful indicator of what they were doing and thinkingfinancial specialists.Then, over the years, this evolved into a survey that revealed the prevailing view of consensus—if not what respondents actually did—as survey participants simply answered the question according to what they believed to be the correct answer. Unfortunately, it has since evolved to the point where it is mostly noise with a very weak signal. Take the latest Fund Manager Survey (FMS), released today by BofA's Michael Hartnett, which was conducted from January 8 to 14 and included 194 participants with combined revenue of $561 billion. While we will have a deeper look at the results of the latest version of FMS, one thing remains the same: the question of which deal is the "most crowded" where significant changes have occurred. After 8 months where the predominant answer to this question was “Long Tech Stocks,” for the first time in three years the predominant answer was “Long Bitcoin” …

... with 36% of the responses, while Tech Long fell to second place from 31% (short in the US dollar was in 3rd place with 23%).

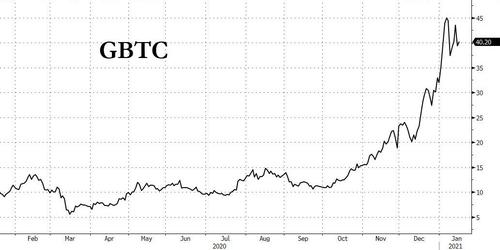

Why was this answer strange?Well, for several reasons: while Wall Street is not restricted in its access to just about any other asset class when it comes to bitcoin, virtually no firm is allowed to directly own bitcoin for regulatory reasons, and although a few specialized firms have long futures on bitcoin - which remain highly illiquid - GBTC or Grayscale Bitcoin Trust (not an ETF, but rather a perpetual trustee trust) is widely regarded and used as the only tool to take a bullish (or bearish) position in bitcoin since the SEC has not yet given the green light to bitcoin- ETF. Well, here's the problem: With bitcoins trading at around $ 37,500, with a market cap of just under $ 700 billion, GBTC's market cap is a tiny $ 26 billion, or less than 4% of the value of the underlying asset.

In other words, Bitcoin can be “the mosta crowded deal "in the imagination of Wall Street professionals - perhaps due to its huge boom, driven in large part by the participation of whales and retail traders - but it's definitely not the most crowded street on Wall Street, where simply as a result of the limited set of assets available Wall Street for long (or short) positions in bitcoin, the real level is a negligible fraction compared to other much busier positions. Just because tech stocks haven't gone away in the past month doesn't mean fewer people are there. In fact, it could be argued that technology is still the busiest deal on Wall Street, and as more traders become unhappy about the lack of a breakout, we are likely to see even more upside potential for Bitcoin as more traders actually will go into bitcoin.

In conclusion, since the BofA survey may havesome significance, the last time traders - again wrongly - viewed Bitcoin as the most crowded trade was back in December 2017. The following month, the cryptocurrency crashed. The only difference this time is that whereas back then the crypto surge was entirely driven by retail traders and Asian hot money, this time we actually have - definitely a small number - of institutions starting to accumulate in crypto, so we're confident that the BofA survey won't mark the top this time, just as it didn't when it named long tech stocks the most crowded trade in May 2020 - tech continued to rise for another 8 months after …

translation from here

Free access to analytics of US markets at elliottwave com

This is why Bitcoin "rejected" the $ 42,000 mark

Crypto Trading Guide: 5 Simple Strategies To Watch Out For New Opportunity

Now the handbook for wave enthusiasts, “The Elliott Wave Principle,” can be found in free access here

And don’t forget to subscribe to my telegram channel and YouTube channel

Free Guide “How to Find High Potential Trading Opportunities Using Moving Averages”

If you find the article interesting, put pluses and add to favorites.