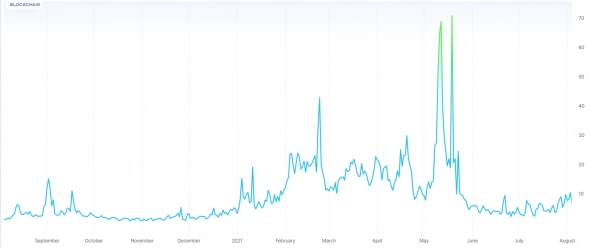

On August 5, there will be a “London” update, which will change the procedure for calculating transaction costs.Now the network uses an auction mechanism:miners include the highest rate transactions in the block first. This leads to an excessive increase in commissions in the event of an increase in turnover and network delays. The size of the commission does not depend on the amount of the transaction, which makes small transfers irrational. Now the average value of the commission is in the region of $ 6, and in May it reached a record $ 69. The hard fork is designed to reduce volatility and cost.

Image source: blockchair.com

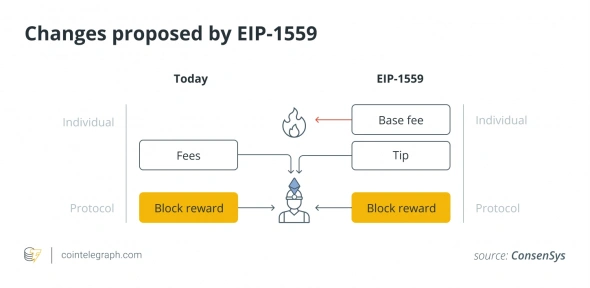

After the upgrade, there will be a base fee fora transaction that will be corrected by the network algorithm depending on the load. Users will be able to pay in excess of the base rate to make their transaction go faster, as well as set a commission limit.

After the block is assembled, a deflationary mechanism is launched - the base rate is burned, and the miner receives income from finding the block and "tips" in excess of the base rate.

Image source: cointelegraph.com

According to various estimates, this circumstance will leadto a drop in mining profitability by 20-50%, which caused discontent among a number of miners. However, the developers reminded them: firstly, on the Bitcoin network, the block reward is halved every four years; and secondly, Ethereum is preparing for the transition to the proof-of-stake protocol and the complete abandonment of mining. In addition, the deflationary mechanism implies an increase in the value of the coin, therefore, a decrease in income from a transaction is offset by an increase in income from finding a block.

Image Source: Cryptocurrency ExchangeStormGain

In fact, it is difficult to assess how muchThe London hard fork will affect the fees as users continue to pay for priority. Consequently, the losses from burning the base rate can be offset by an increase in the tip, then the income from mining will remain at the same level or even exceed the previous one, because the maximum payment for the priority is not spelled out.

The deflationary mechanism also causes massquestions, because if the income from finding blocks exceeds the income from transactions, it turns into inflationary, and mining pools are tempted to assemble empty blocks. Users will be forced to significantly increase their "tip" so that their transactions are still included in the block.

Thus, there is a risk that the hard fork will notwill bring the expected improvements. The situation will radically change only with the transition to Ethereum 2.0, which is promised in early December 2021. At least in this hard fork, the difficulty bomb is carried over to that date. And then miners will have to look for another coin to generate income, and the commissions will become acceptable.

Analytical group StormGain