The decentralized finance (DeFi) ecosystem is actively growing and is attractingA lot to yourselfAttention. The most significant events in the sector in recent weeks, especially for ForkLog, were told by co-founder of Zerion Vadim Koleoshkin.

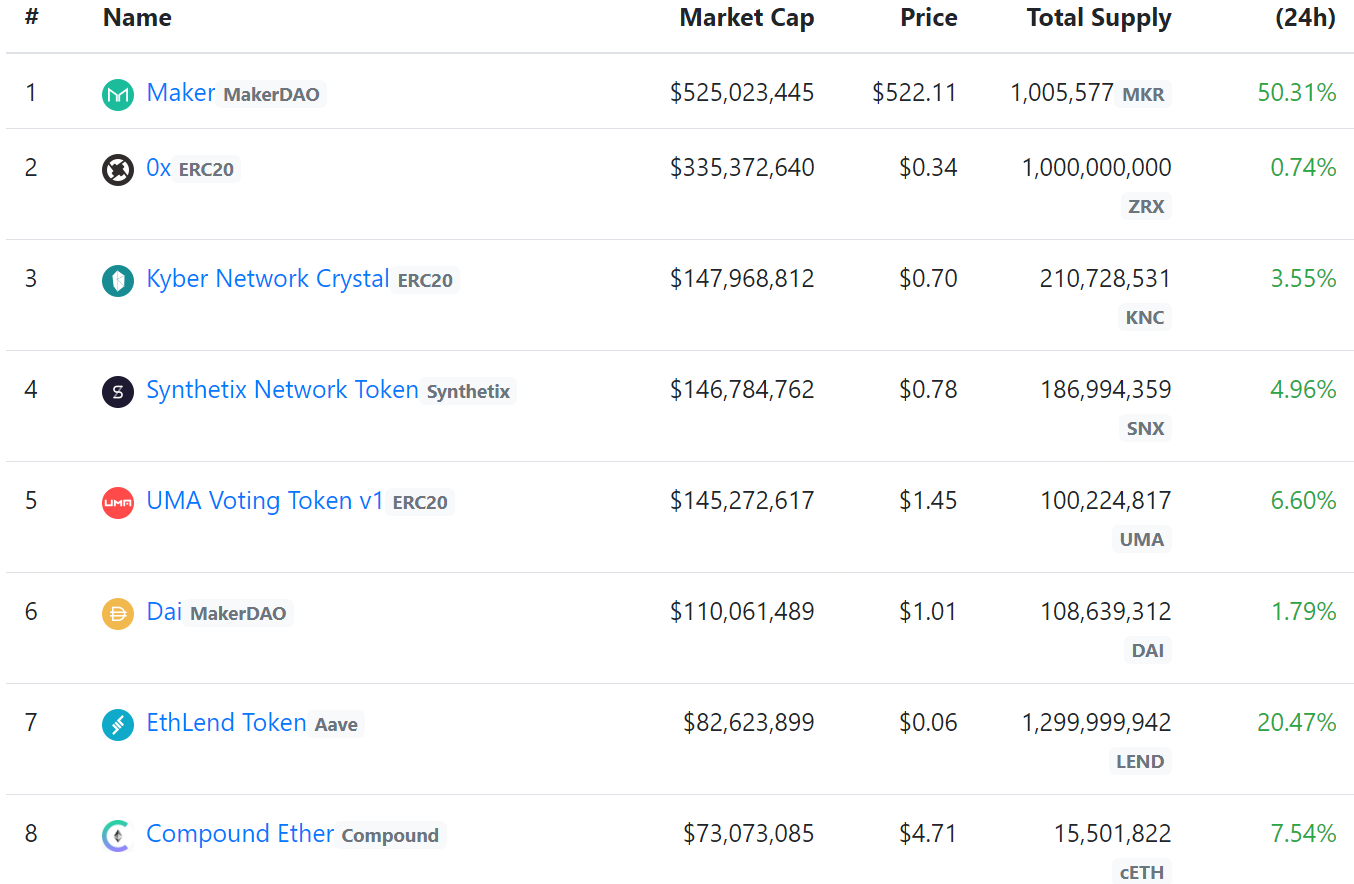

Capitalization, DEX volumes and value of frozen assets

At the time of writing, the capitalization of DeFi tokens was $ 1.907 billion.

DeFiMarketCap Data

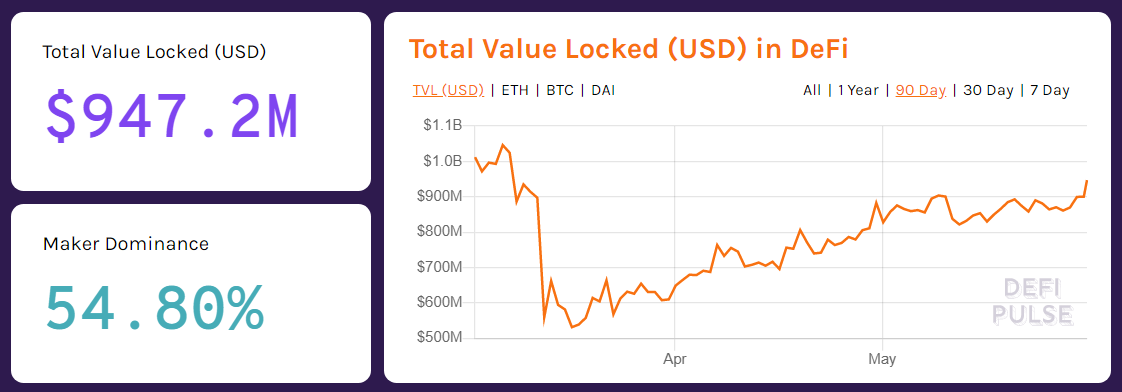

Funds worth $ 947.2 million were frozen in DeFi services. According to DeFi Pulse, the Maker dominance index is 54.8%.

DeFi Pulse Data

ETH Price: $ 235 (+ 14% in the last 7 days)

Average best 30-day landing rates:

DAI 3.12% on Aave

USDT 6.13% on Aave

USDC 3.84% on Aave

ETH 0.3% on dYdX

Before investing, study the risks of each platform. A good tool is Defiscore.

Breaking News Over the Past Two Weeks

Uniswap v2

Token Decentralized Exchange ProtocolUniswap launched the second version of the protocol. Its development was conducted from June to November 2019. Over the past four months, the project team conducted security audits and formal protocol verification.

The first version of the protocol was created in 2017 and became the first experience in programming smart contracts for the creator of the protocol, Hayden Adams.

New Uniswap Protocol Targetedsolving two problems. The first is to provide liquidity providers with the ability to add arbitrary pairs of tokens, and not just the token together with ETH. Thus, liquidity providers, if they wish, can exclude ether from their portfolio. For example, putting assets in USDT-DAI, DAI-USDC or USDT-USDC pools, almost completely eliminating the risks of volatility. You can read more about the mechanism of operation of liquidity pools in this article.

The second task was the ability to useUniswap v2 as a reliable source of price for assets trading on it for other smart contracts. In February of this year, hackers who stole funds from the bZx protocol used the opportunity of short-term price manipulation for Uniswap for hacking. In the new version, for such manipulation it will be necessary to attack the protocol within 24 hours, which makes the attack economically inefficient.

Other innovations are related to safety and usability. A detailed description of the update is available on the project blog.

At this point on the new version of the protocolabout $ 17 million was transferred, which is about a third of the total liquidity. The project team plans to complete a full transfer of liquidity within a few months. Popular liquidity aggregators, such as 0x and 1inch, have already released or are working on Uniswap v2 support. Detailed information on moving can be obtained on the project website.

Aave adds Uniswap tokens as collateral

Continuing the Uniswap theme, highlight the additionUniswap v1 liquidity tokens as a possible collateral with the Aave landing protocol. The protocol is the fourth largest project in the DeFi ecosystem with $ 63.5 million of locked-up liquidity.

This is the first attempt to use derivatives as collateral. Prior to this, protocols like Compound and MakerDAO only added basic protocol assets or stablecoins as collaterals.

This solution has two sides. On the one hand, the ability to take out a loan secured by liquidity makes the possibility of providing it to decentralized exchanges more attractive. Providers can use the money received from the loan as a leverage to provide even greater liquidity, which will positively affect its quality and reduce the spread between buying and selling tokens. Or use these funds for other purposes, while leaving liquidity on the exchange.

On the other hand, such tools increase the average level of risk in the system.If someone uses the DAI stablecoin as a tool for the operation described earlier, it automatically acceptsthe technical risks of the three protocols and the price risks of at least three assets, as well as the governance risks of two systems – MakerDAO and Aave.

In the near future, the Aave protocol also plansAdd TokenSets programmable strategies as collateral. It will be interesting to see what rates on loans and deposits the market will determine for these assets, taking into account all the risks and a potential return on investment.

The number of bitcoins in DeFi exceeded their volume in the Lightning system

Over the past two weeks, there have been two pieces of news related to BTC on Ether.The first is the postponement of the launch of tBTC for 10 days due to a last-minuteThe reason was a combination of factors, including the high cost of transactions due to the congestion of the Ethereum network.The project team took the opportunity to turn off the system to accept new deposits and bought all tokens from investors who managed to bring their BTC to the ether network.In the coming week, they will restart the system with the new parameters.This case shows that despite the tremendous work done to check the health of the system, there are stillsituations that developers can't predict in advance.

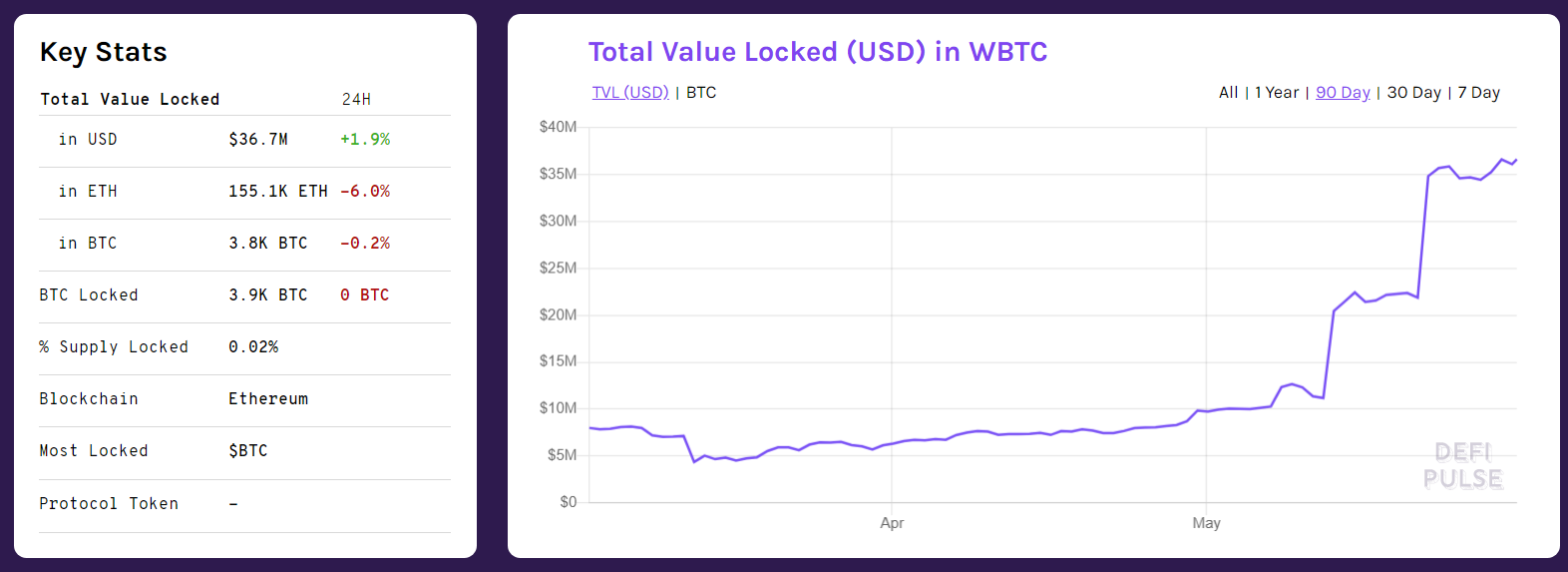

The second piece of news is that there are now more than 3900 WBTC on the Ethereum network.That's more than three times the amount of BTC locked on the Lightning Network.For example, 9.5 million DAI (about 10% of the total) have already been created with its help.This shows the interest of large BTC holders in using DeFi tools.

DeFi Pulse Data

UMA launched the first synthetic asset

The first synthetic asset launched whenThe UMA protocol has become a token representing the ratio of the price of ETH to BTC. This token is provided by DAI as a pledge of the token provided by sponsors.

Token Sponsor Challenge That May Becomeany players on the market, is bringing the price of the synthetic token to its real price and providing it with a pledge by trading on decentralized and centralized exchanges. The know-how of the project is the architecture of smart contracts, in which you do not need to rely on a source of prices outside the system until the asset is liquidated. Thus, any investor has the opportunity to speculate on the price ratio of ETHBTC without the need to open positions on centralized exchanges.

In the very first days, the price of this asset broke away from its original towards ETH, which provided food for reasoning on crypto-twitter:

</p>Synthetic tokens that do not require constantaccess to information about a real asset, creates a lot of opportunities for future financial instruments. In addition to creating assets that are tied to the price of real assets (gold or oil), you can create volatility indices and other instruments that are not currently available in DeFi. To ensure the security of the system, UMA tokens are used, which allow owners to earn money on punishing dishonest players in the market.

The project invites you to actively participate in the discussion of the correct method of distribution of tokens among the community:

</p>New assets appear in the DeFi family

ForFoundation company founded by formerDharma’s designer and Harbor tokenization service engineer launched the unique goods exchange. The idea of the project is to produce tokenized variants of limited edition items and trade them on the open market. Each token can be exchanged at any time for the real thing or left in tokenized form for trading.

The Uniswap project used similar mechanics to sell its UniSocks merchandise. For all the time, 153 pairs of socks were sold, and the price rose from a few dollars to 143 dollars.

The first project for WithFoundation was the tokenization of NeuGoods items. Brand lovers or investors can buy items for later delivery or sale on the open market.

Compound continues to transfer service management to the community

Earlier, ForkLog already wrote that the startup Compound, which developed the DeFi protocol of the same name, will transfer control over management from administrators to holders of COMP voting tokens.

This week, project representatives announced new details of the process.

We also wrote:

- Trading volume for perpetual Bitcoin swaps on the dYdX DeFi platform exceeded $ 22 million

- Startup Ren introduced a protocol for connecting Bitcoin, Ethereum, Bitcoin Cash and Zcash

- New DeFi Project from AVA Labs Launches Final Test Network with Rewards