This special issue is dedicated to the infection that has spread among the counterparties of the cryptocurrency market, sofactors that contributed to the creation of a finishedliquidation chain, penetrating almost the entire crypto market. We will start the review with a detailed description of the practices and strategies that existed in the crypto market before the current crisis, and also give our assessment of market participants, services and investment mechanisms that ultimately contributed to the formation of the current liquidity/solvency crisis on an industry-wide scale.

Bull Market 2020/2021

After the peak of 2017, in which the price rose by100 times in just 28 months, there was a sharp decline and a period of consolidation that lasted more than two and a half years. In 2018/2019 Bitcoin was trading between $3,000 and $14,000, and then COVID-19 came. The large-scale stimulus measures that countries began to take to support their economies during the period of lockdowns prompted investors everywhere to look for tools to protect against inflation risks, and they turned their attention to the very young, but absolutely scarce Bitcoin.

What followed was a wild bull market,fueled first by natural demand and then by layers of opaque leverage, excess liquidity and arbitrage strategies. In this report, we detail the factors that ignited the fire of a wild bull market and contributed to the crash that followed and the adverse market conditions we are seeing today.

Striving for profitability

The main cause of the crisis that has engulfed, likeepidemic, the cryptocurrency industry in the last 6-7 weeks has been a large-scale deleveraging caused by the desire to “extract profitability” from various platforms and other industry players. This dynamic and the pursuit of "risk-free" returns in an industry built around inherently non-returning bearer assets was doomed from the start. Its ubiquity after the 2020 rally created a systemic risk that few, if any, fully realized. This systemic risk eventually led to a collapse in exchange rates, a liquidity and solvency crisis, and future regulatory intervention.

The concept of "yield extraction" (yield) inthe cryptosphere is completely misunderstood, which has led to a lot of pain for the market, especially in recent weeks. Yield is the return on investment received and realized over a certain period of time, expressed as a percentage. The most common example of such returns in today's investment world is the coupon payment received when buying sovereign bonds.

Example:

You, the investor, provide the state with yourcapital is borrowed for a certain period, and the government agrees to pay you the face value of the loan on a certain date. To compensate for the time value and implied lost profits, the borrower will also pay you periodic interest on the loan. And this “excess” income on capital is defined as yield, profitability.

This is quite different from the schemes"yield generation" in the crypto industry, and this topic needs to be studied in more detail. Below we provide an overview of the most common “yield generation” strategies used in the crypto market since 2020, as well as their current state and the second-order consequences of the spread of these strategies.

Arbitrage on GBTC

GBTC arbitrage was one of the main drivers of Bitcoin's 2020 bull market and, ironically enough, has been one of the biggest bear market drivers ever since. Let me explain.

Grayscale Bitcoin Trust was the first companylaunched a publicly traded over-the-counter bitcoin fund in the United States, and given its first-mover advantage, the fund's visibility and size have grown steadily since its launch in May 2015. The OTC trust shares are fixed BTC (currently 0.00092242 BTC) with an annual fee of 2%.

The trust does not operate as an exchange-traded fund (ETF), securitieswhich investors can exchange for the underlying asset and vice versa. GBTC shares have a unilateral buyback mechanism. The trust converted accredited investors' bitcoins or dollars into GBTC shares, with a sell-off period of 6 months after the shares were created.

Due to the novelty of Bitcoin, OTC tradedmarkets, GBTC shares have long been the only way to access the bitcoin market for investors limited by the opportunities and rules of the traditional financial system. With no other US market options available, GBTC shares have long traded at a premium to the trust's net asset value.

This created an opportunity for arbitrage: investors could transfer dollars or BTC to Grayscale and receive shares (with a prohibition on transactions for six months).

Many funds have invested in the strategy.At the same time, many were simultaneously shorting bitcoin futures or indirect exposure options for it (although there were still very few products available) in order to remain neutral to the market. Some simply used this premium to build up their “paper” balances by the end of 2020: send $100 to Grayscale, get $120 worth of GBTC – yes, locked for six months, but with a 20% premium – is it bad?

And you need to understand that in parallel with the purchase of GBTCfirms could short bitcoin in the futures market to remain (theoretically) neutral to the market in dollar terms, or after a 6-month “quarantine” sell GBTC and buy bitcoin (if the premium was still there), and thus extract the alpha in BTC equivalent.

Three Arrows Capital (3AC) invested heavily in the deal in December 2020, becoming the trust's largest holder with 38,888,888 shares worth approximately 35,871 BTC.

A staggering 394,398 BTC were purchased andlocked into the trust between early 2020 and February 18, when the trust first began trading at a discount to NAV (net asset value). For context, this figure corresponded to 79.26% of the total amount of BTC “mined” during the same period - from just one buyer.

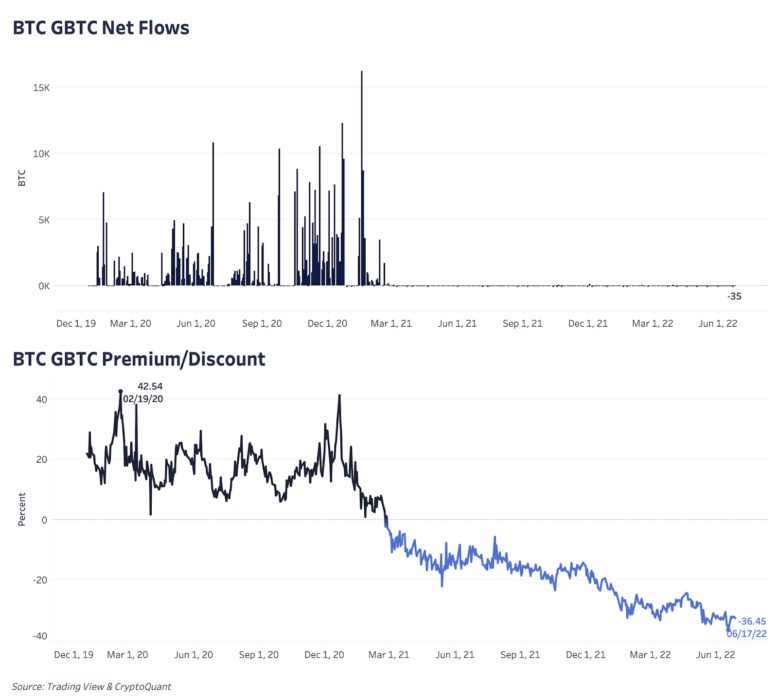

Net capital inflow into GBTC (top); GBTC premium/discount (bottom)

But when the historical premium was replaced by a discount,this became a problem as large volumes of GBTC were unlocked in parallel, flooding the market with available shares. This dynamic, coupled with the lack of redemption capability, has had a major impact on the market:

- One of the biggest buyers in a bullish periodThe market was now out of the game as there was no incentive to create additional GBTC shares, even though they traded on the secondary markets at a discount to NAV.

- Market participants who have purchased largenumber of shares stuck with relatively illiquid GBTC shares in hand compared to Bitcoin itself (average daily trading volume over the past year of GBTC 6.142 million, or $199 million/day).

- Discount to net asset value at thisThe sheer volume of BTC-equivalent exposure scared off institutional investors from spot purchasing Bitcoin itself. And this dynamic still holds true today: with BTC priced at ~$20k, GBTC shares at the time of writing were trading at the equivalent of $14,639 (~30% discount to net asset value).

- One of the main "yield-generating" arbitrage strategies for custodial financial service providers (such as BlockFi) has been rendered unavailable.

- Due to the six-month "quarantine" of shares, many participants who tried to capitalize on "market-neutral" arbitrage suffered large losses when the premium to NAV was replaced by a discount.

The first point is still largely misunderstood and underestimated. Due to the change in the GBTC premium to a discount, the largest non-critical buyer was taken out of the game.

futures premium

Another "yield generation" strategy,emerging in the 2020/2021 bull market was futures premium arbitrage: traders could acquire market-neutral exposure to bitcoin (and other crypto assets) by selling futures contracts while simultaneously holding a spot position.

Due to the speculative nature of the bull market,where the level of optimism and demand for leverage is extremely high, futures trade at a significant premium to the spot markets during such periods. This happened in both perpetual and quarterly futures markets. Perpetual futures contracts do not have an expiration date and remain linked to the spot markets through a variable funding rate, with payments made periodically directly between long and short positions based on the position of the contract price relative to the index spot price of the underlying asset. When the price of a perpetual futures contract is trading above the spot markets, the value of longs is periodically deducted from the value of shorts, and vice versa.

Similarly, futures contracts with a dateexpiration is essentially just an obligation to buy or sell the underlying asset on a specified date. If the price of the futures contract is trading above the current spot price, the market is in contango and traders/arbitrageurs have the opportunity to capitalize on this spread by selling the futures contract while holding the spot asset in parallel.

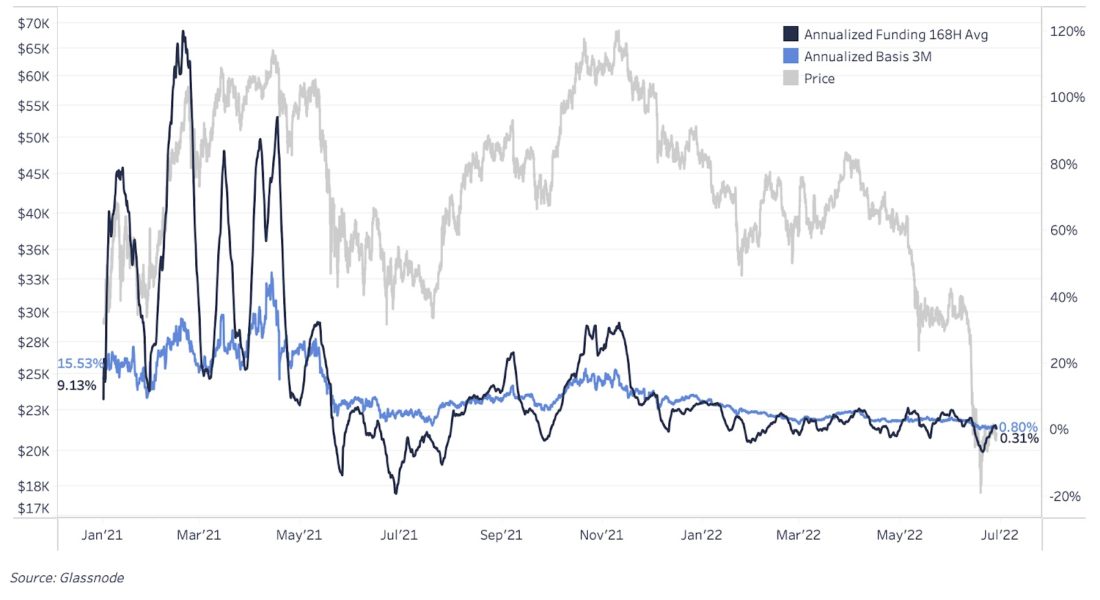

The following shows annualized funding rates for perpetual and quarterly futures during Bitcoin's bull run:

BTC Perpetual Futures Funding Rate (168-hour MA) (black chart) versus quarterly futures annualized basis (blue chart)

In general, the futures basis can collapse for two reasons:

- Arbitrageurs sell futures and buy spot, resulting in a reduction in the spread.

- Spot demand dries up and excessive leverage with a long bias in the market leads to forced selling and cascading liquidations.

Considering that the entire exposureis revalued to the current market price with sufficient collateral, even a rapid fall in exchange rates does not lead to systemic risk. The biggest impact of long liquidations is often the collapse of the futures premium and, as a result, the yield generation strategies associated with it.

Further down the risk curve

When at the end of 2021 this opportunityarbitrage dried up due to the contraction of the futures basis, another opportunity to “generate yield” emerged in the form of UST staking on the Anchor Protocol. The reader is most likely aware of how it ended, but for the sake of completeness, we will briefly summarize this story.

UST was a stablecoin that was being triedalgorithmically bind to $1. In theory, the peg was maintained since UST could always be exchanged for the equivalent of $1 in LUNA, the cryptocurrency that powers the Terra blockchain system. Users could mint UST by burning LUNA by $1, thus reducing LUNA's circulating supply. In the event that the UST exchange rate falls below $1, the LUNA supply is algorithmically increased to fulfill the obligation to peg to $1.

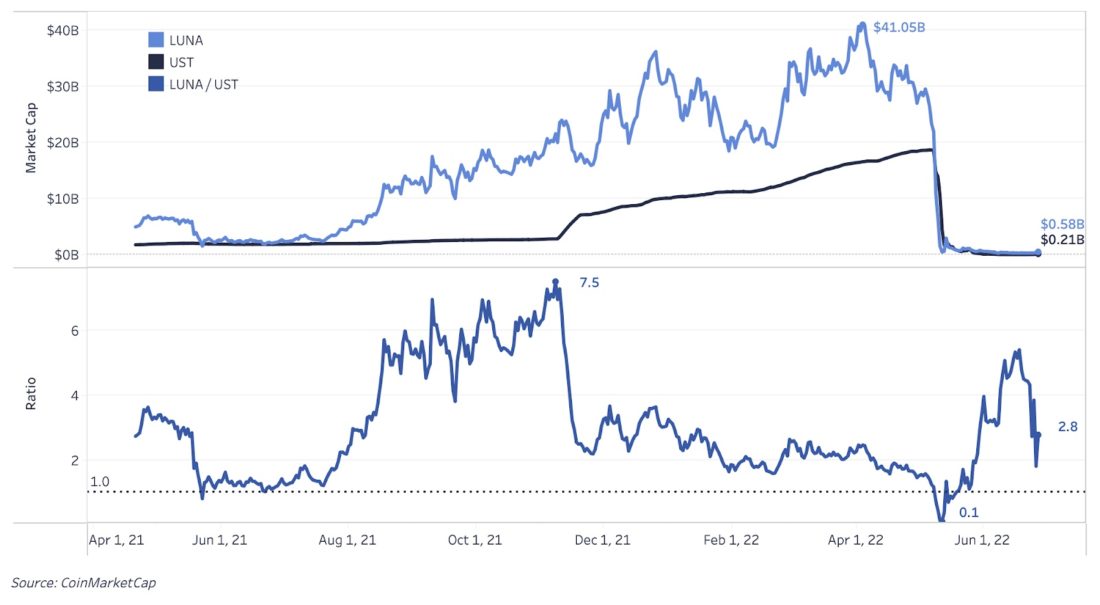

Both UST and LUNA have seen impressive growth in 2021, with the combined capitalization of UST and LUNA rising from ~8 billion in May 2021 to $59 billion just a year later.

Growing interest in UST and, as a result, in LUNA(required to purchase UST) was largely provided by Anchor Protocol, a DeFi platform that paid UST depositors a sky-high rate of 20% per annum. In part, this rate was paid for by deposits from those who borrowed UST against crypto-currency assets such as ETH and LUNA. However, it was subsidized by Terraform Labs, the creators of the LUNA blockchain.

This subsidy from the funds that Terraform Labs allocated to itself on the LUNA premine encouraged market players to use the protocol for yield generation strategies.

What went wrong with UST and LUNA?

Ratio of market capitalizations of LUNA and USTcan be considered as an indicator of the solvency of the system. Because LUNA's supply increased when UST was redeemed, it was critical to the solvency of the system that LUNA's market capitalization remained higher than that of UST.

When UST capitalization exceeded capitalizationLUNA, the system became functionally insolvent, and as investors ran out of the asset, dumping their UST, LUNA's supply began to skyrocket in an attempt to maintain the peg, bringing the token's exchange rate down to $0.

This chart shows the ratio of market capitalizations of two assets:

Ratio of market capitalizations of LUNA and UST

When LUNA and UST rushed towards deathspiral to $0, it was revealed that many industry players suffered significant losses not only due to falling exchange rates of crypto assets, but also due to the almost instantaneous collapse of the $18 billion “stablecoin”, which was widely viewed as a risk-free asset.

Side effects

Rumors began swirling that major players in the crypto market such as 3AC had large exposure to LUNA and UST, with 3AC specifically locking up $500 million in LUNA tokens just three days before the crash.

Blockchain analysis in April also revealed that Celsius, a large crypto-lending company, was pouring hundreds of millions of dollars into Anchor Protocol in the weeks leading up to the collapse.

When arbitrage on GBTC and futures premiums becameinaccessible and after the collapse of LUNA/UST, which severely undercut the balance sheets of the largest players in the market, many realized that the risk / return ratio for placing funds in centralized platforms for “yield generation” was becoming increasingly unfavorable.

As this understanding spreads amongmarket participants, the volume of capital withdrawal from such products increased, which further exacerbated the liquidity / solvency problems that any credit institution that practices partial financing and re-pledge is at risk to some extent. This became an increasingly significant risk factor for institutional managers, whose capital was locked in long-term "yield generation" strategies.

Unsecured lending, recollateral and leverage levels

What led to the collapse of the UST and the flight of capital fromcentralized crypto lending institutions like Celsius is the huge volumes of unsecured loans handed out by firms, especially those with 3ACs. From what we now know about 3AC, the firm has been involved in the following transactions and practices:

- Due to its reputation, it took out unsecured loans from many counterparties, including $350 million in USDC and 15,250 BTC from Voyager.

- Derivatives/options trading on Deribit (portfolio company) without any collateral.

- Promising portfolio companies/protocols with8-10% "yield" on bonds used this circumstance to increase assets in management by re-pledge. And they probably used the Anchor Protocol to pay out the yield and capture the spread.

- The “opportunity” offered to investors during the recession to buy BTC and receive 15% per annum on them was an attempt to attract liquidity due to the illiquid holdings of GBTC on the fund’s balance sheet.

- Secured lending (full or not yet unknown) to numerous firms such as Genesis and BlockFi.

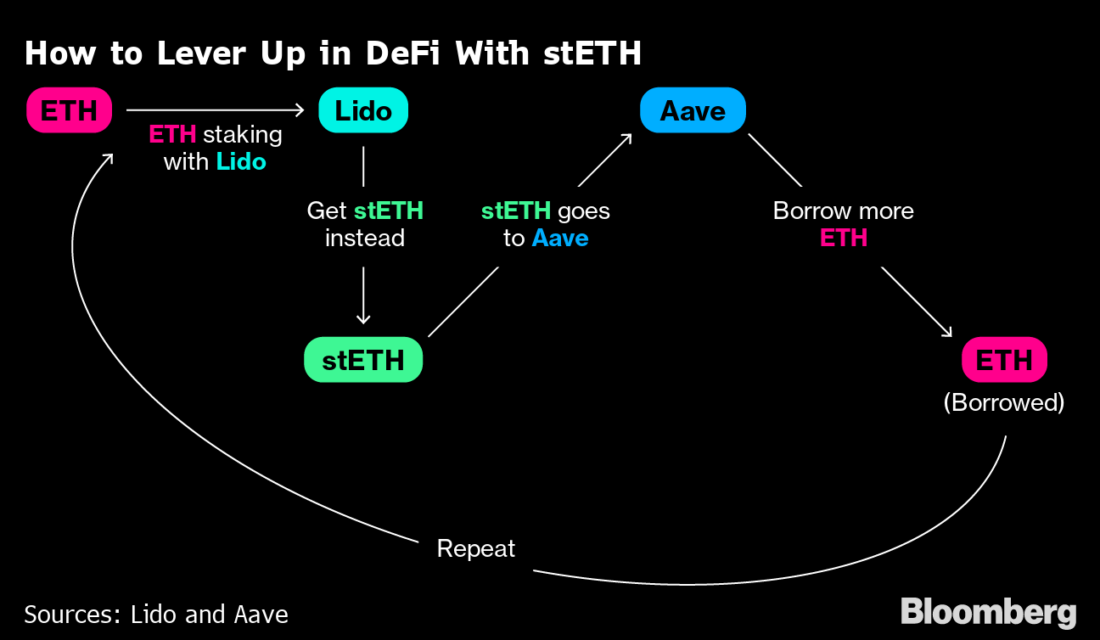

- Buying ETH, staking ETH in Lido to receive stETH, collateralizing stETH in DeFi to generate income, borrowing ETH against stETH, and so on (see diagram below).

(: Bloomberg)

Leverage levels, especiallyunsecured, contributed to the creation of a ready-made liquidation chain, penetrating almost the entire crypto market. In such a chain, assets on the balance sheet of creditors, secured only by IOUs, dissolve in an instant.

Do not trust. check

The unique circumstances that accompanied thisbitcoin's bull cycle has led to a boom in volatile arbitrage strategies, opaque systemic leverage, and unsecured lending that is in the process of phasing out after November 2021.

Consumer financial products such asBlockFi, Celsius, etc., which offered attractive returns, were not sustainable in either their past or current form, due to the no-return and absolute scarcity nature of Bitcoin, as well as the fact that many of the risks taken by the projects were opaque and/or not amenable to quantification (DeFi cracks and drops, counterparty risk, and liquidity and duration, as with GBTC and stETH).

Distribution on the crypto market of unsecured andUndersecured lending should serve as a stark lesson to industry participants about the challenges that counterparty risk and leverage can bring in the system. And to fix these problems, Bitcoin was literally invented.

“Users are forced to trust banks inissues of storage and electronic transfer of their money, but they use the money of users to issue loans, leaving only a small part of them in their accounts and provoking waves of credit bubbles”,— Satoshi Nakamoto.

Lessons learned

“Your profitability is not profitability” — Do ̶Kwon authors of this article.

The first:

Financial products for yield generation inBTC terms are volatile. There is no way to generate additional returns on your bitcoins without putting them at risk. Thus, the term "yield" (yield) is used rather incorrectly here. It would be more correct to speak of a "risk premium", which is defined as a return in excess of the risk-free rate of return that an investment is expected to generate.

Given that the risk-free rate of return forBitcoin in BTC is 0%, any platform or service that offers any kind of return in BTC is, by definition, taking on excess risk.

Second:

Bitcoin is not going anywhere, and despite the developmentsituation in the crypto market, it is one of the best forms of collateral the world has ever seen. Transparent global ledger ownership, 24/7/365 liquidity in most jurisdictions around the world, and fungibility.

Continuing to strengthen and integrate intoexisting financial system, bitcoin will increasingly be used as financial collateral, similar to how it has been in the last couple of years in the cryptocurrency ecosystem.

And this is a completely normal development of events, but only when used correctly.

- Bitcoin is known for its volatility.Overcollateral with confirmed reserves should become the standard in the future. Given the transparency of the Bitcoin UTXO set, this seems like a trivial task for any lenders. Firms such as Unchained Capital have already implemented strategies where users receive one of three keys to a multisig quorum and can transparently verify that their collateral is idle.

- Similarproof-of-reservesshould become the standard for every crypto/bitcoin exchange with custodial functionality.

Finally

The events of recent weeks and months have shakencryptomarket. It may take many months, quarters and even years to work through all the second and third order implications, with future regulatory standards being the most obvious.

It is also unlikely, even today, that the entirelosses - direct and indirect - on the crypto market has already been disclosed and calculated. For these reasons, our short-to-medium term market outlook remains fairly cautious as general risk-reducing conditions in global markets have led to a sell-off in risky assets across the board, with bitcoin and the crypto market as a whole being among the most risky in terms of volatility. and regulation.

However, our long-term outlook for Bitcoinremains very optimistic, and the liquidations and general deleveraging of the market recently have created extremely favorable conditions for long-term value investors looking to acquire a stake in the world's largest and most secure decentralized monetary network.

Over time, the current difficulties will also pass, and bitcoin will continue its ascent as an unstoppable global money built on a system of rules, not rulers.

“Many automatically write off electroniccurrency from accounts as a lost cause because of all the companies that have failed since the 1990s. I hope, obviously, that only a centralized control system doomed them to death. I think this is the first time we are trying to create a completely decentralized and non-trust based system.”— Satoshi Nakamoto.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.