Jake Chervinsky, a lawyer specializing in the cryptocurrency industry, reminded his Twitter followers thatUS Securities and Exchange Commission (SEC)less than a week is left to make a decision on Wilshire Phoenix's application for the launch of a Bitcoin-linked exchange-traded fund (ETF). The decision should be made by Wednesday, February 26th.

“Despite the crazy overpayment by GBTC, the refusal is inevitable”, he wrote.

The SEC outlined doubts about the cryptocurrency market in January 2018, which had prevented the approval of a Bitcoin ETF until then and thereafter:

- Rating– SEC wants ETF to track Bitcoin priceon several exchanges, which would ensure fair pricing. However, the regulator is still not confident in the reliability of the data on the cryptocurrency spot market itself;

- Liquidity– Although daily Bitcoin trading volumes are measured in billions of dollars, the SEC is still not confident in the liquidity of the market;

- Storage– Since the beginning of 2018, the custodial side of the cryptocurrency business has undergone qualitative transformations, due to which this aspect can influence the regulator’s opinion to a lesser extent;

- Arbitration– There are many crypto exchanges, but only about 10 are trusted. Closing one of them should not affect the arbitrage opportunities or the price;

- Market manipulation– The SEC is confident that Bitcoin is subject to significant risks of manipulation.

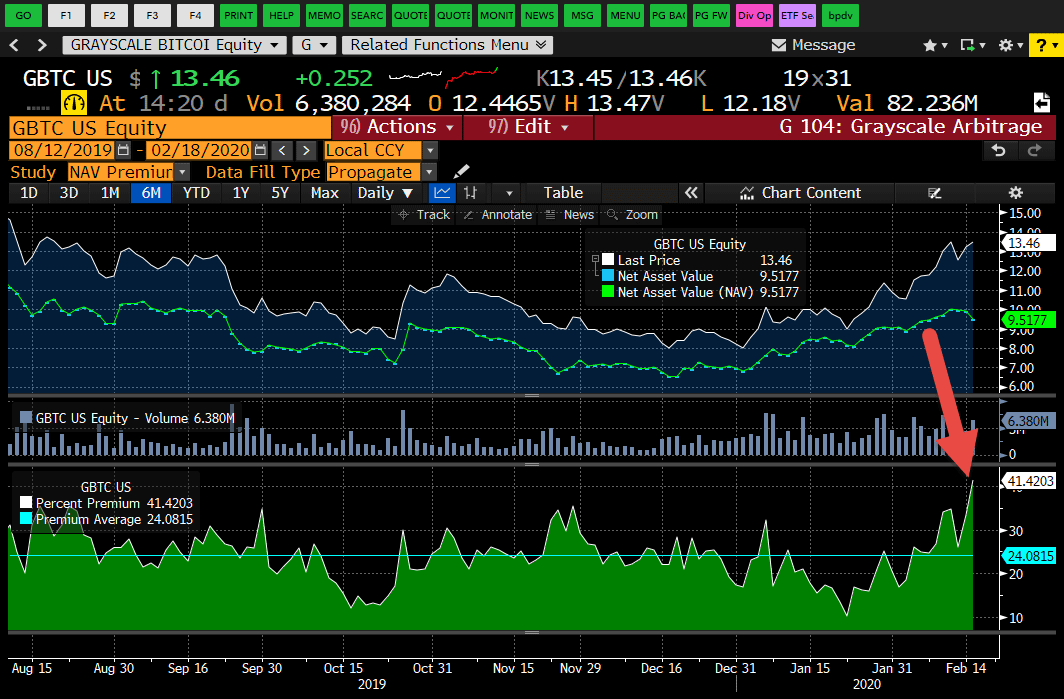

Thus, Chervinsky’s doubts are quiteunderstandable, because Wilshire Phoenix did little to address the issues the SEC has. He left his comment to the message of Blockforce Capital CEO Eric Erwin, who drew attention to the emergence of an overpayment on securities of the Grayscale Bitcoin Trust relative to the cryptocurrency spot market in 41% and, relying on this observation, urged the SEC to approve the ETF.

Chervinsky notes that the more likely candidates Bitwise and VanEck so far decided to take a break.

“I think no ETF in 2020”- he added.

Rate this publication