The decentralized finance (DeFi) market has become a perfect storm of innovation. Analysts came to this conclusionGlassnode, examining the development of a new sector of the digital economy.

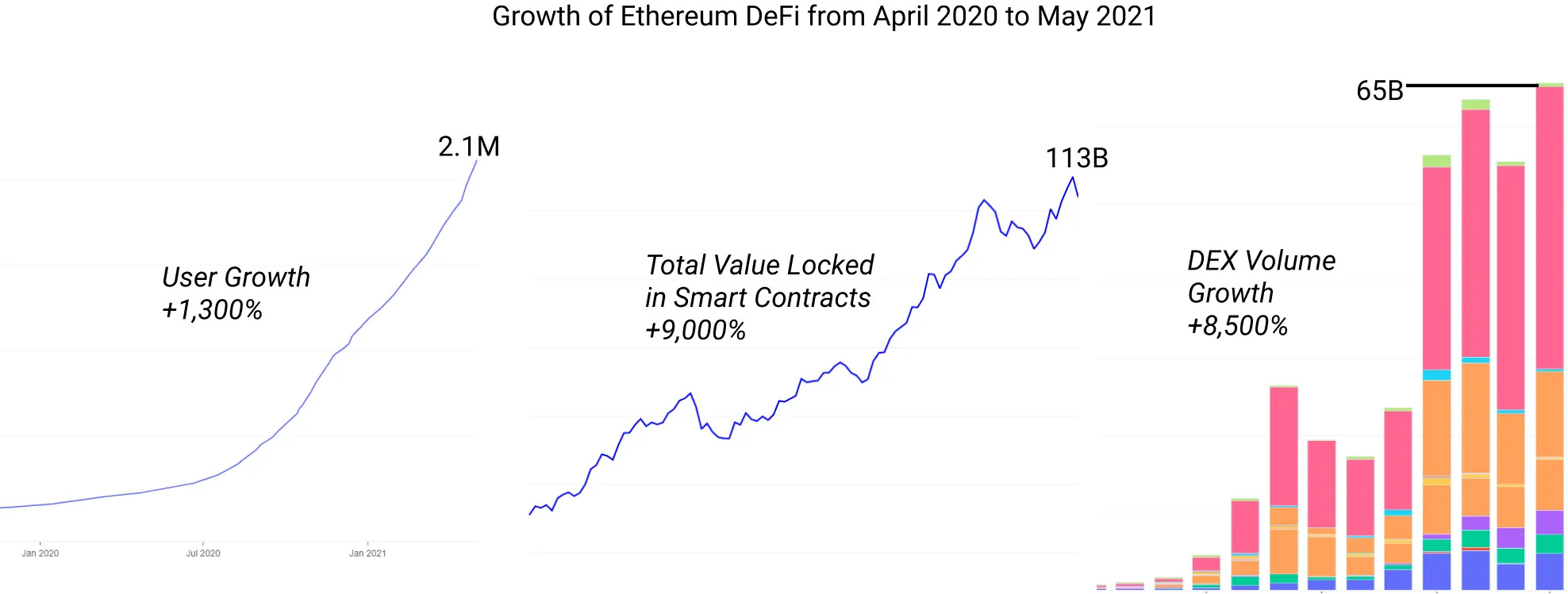

Glassnode experts in their reportanalyzed several market indicators at once, including the user base, capitalization, wallet volumes, as well as activity on decentralized exchanges (DEX). The chart below shows that in just a year, the DeFi industry experienced hyperbolic growth in several ways:

- number of users (+ 1300%);

- capitalization of money in smart contracts (+ 9000%);

- growth in trading volume on decentralized exchanges (+ 8500%).

At the same time, Synthetix conducted one of the firstexperiments in the DeFi sector for liquidity mining back in 2019. Glassnode believes that it was this project that started the hype around liquidity mining in 2020.

Point of no return

Later a key role in the development of miningLiquidity was played by the cryptocurrency lending service Compound Finance. The launch of the protocol with COMP tokens for both lenders and borrowers popularized the service. The capitalization of the smart contract jumped from $100 million to $500 million in just a week.

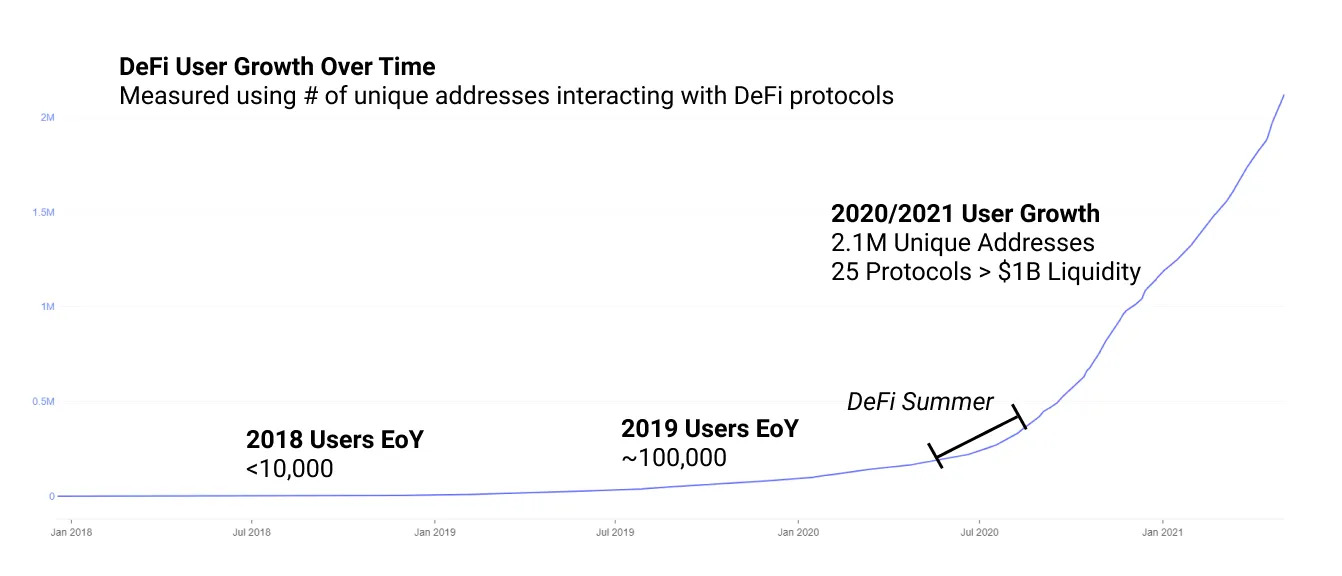

That 2020 was the decisive year forThe DeFi market also signals the number of wallets that have contacted DeFi protocols. Since the summer of 2020, the number of wallets has exceeded the 2.1 million mark.At the same time, from 2018 to the beginning of 2020, the volume barely exceeded 100 thousand.

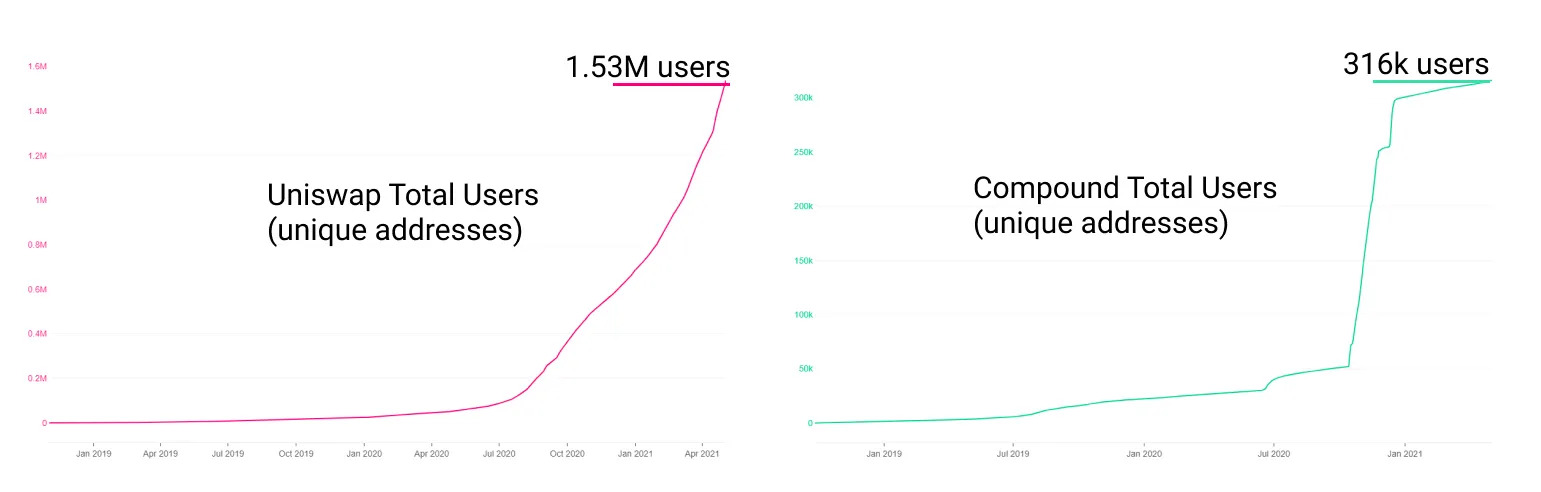

As the DeFi market has grown, so has activity.decentralized exchanges (DEX). Of the 2.1 million wallets that interacted with DeFi, 1.53 million interacted with Uniswap (~73%). The hype around Compound at one time accounted for 316 thousand wallets (~15%).

In just one year, the amount of liquidity in the DEX marketamounted to $420 billion. The monthly volume increased to $67 billion, and the daily volume peaked in April above $3 billion. The leader is still Uniswap, where at the time of writing more than $8 billion is pledged. It is followed by SushiSwap, whose volume of pledged assets is approaching to $4.8 billion. In third place is Curve with liquidity at $6 billion.

Income farming

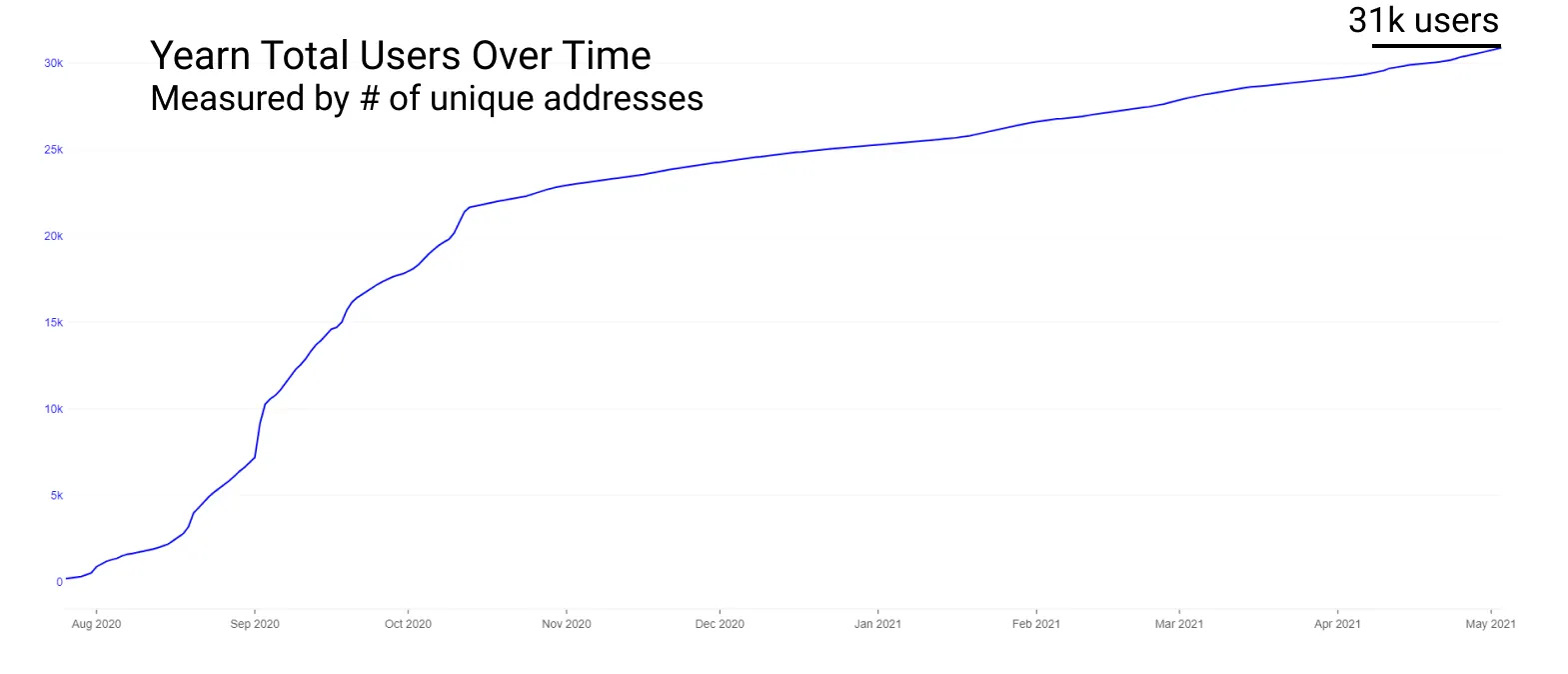

However, the most high-profile innovation onThe DeFi market has become yield farming. The most striking project in this sector was the Yearn Finance aggregator. The project distributes user assets across different DeFi protocols in search of the greatest profit.

The users liked the idea so much thatthat the native token of the YFI project became the first altcoin that managed to overtake Bitcoin in price per unit. YFI's all-time high at the time of writing is $88,287.

Glassnode analysts believe that specialYearn Finance achieved popularity due to the small number of exploits. Taking into account the constant attacks and hacking of smart contracts, the Yearn Finance protocol still maintains the level of user trust, Glassnode notes.

Where is it more profitable to buy DeFi project tokens? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)