What is a card for cryptocurrencies?

A debit card for cryptocurrencies and other cryptocurrencies is not much different from conventional cards linked to fiat currencies.

You canpay with this card at the cash desk in the Russian Federation or in the United States, withdraw cash from it via an ATM, or use it to make online purchases.

Usually, all transactions with cryptocurrenciesare converted to fiat currency, ideally at the most favorable rate and without any additional fees. The idea is to simplify the process of using cryptocurrencies as much as possible, even if the seller does not accept them for payment.

Features of crypto cards

Before you start using crypto cards, you need to familiarize yourself with their features:

These cards work in tandem with MasterCard and Visa payment systems. Simply put, the owner of such a card can pay with it anywhere and at any time.

The card will be linked to the account opened in a particular service. Thanks to this, you will be able to get fiat money quite quickly.

The card provides round-the-clock access to funds in both crypt and fiat.

There are no intermediaries, which simplifies and reduces the cost of operations with cryptocurrency.

How to use a crypto card?

If you have registered at least once in an online bank or on a bitcoin exchange, the process will always be exactly the same.

Now let's get to the main point: how to “withdraw” the crypt with such a card. Well, in general, maybe it's the time when I finally buy sausages for bitcoin.

Currently, the services of cryptocurrency cards offer three main options. They depend on how the issuer's system works.

Option 1

Option 1 includes the principle of operation ofthe Coinbase card, Crypto.com et al. The card is linked to the exchange account the user orders the card, and when he receives it, he can link it to his exchange account through the app. After registration and linking, the user can start performing operations with the card.

But if you look deeper, purchases are still paidin fiat currencies, and the cryptocurrency goes to the exchange, which acts as a kind of online exchanger. This is, without a doubt, a compromise solution, because stores around the world are not ready to accept bitcoin and other coins.

However, this option has two obvious drawbacks.The user needs to switch the wallets from which he receives funds: BTC, LTC, XRP, ETH, etc. And also track the exchange rate so that the conversion is not unprofitable.

Option 2

This can include the work of AdvCash.At the user's disposal are the accounts and the card. The owner of the cryptocurrency can choose which currency account he wants to use for the transfer of the cryptocurrency: dollar, euro — or any other account. To do this, the user is provided with a key that is linked to his account. By inserting this key in the withdrawal window in the wallet or on the exchange, the cryptocurrency is transferred to the selected fiat currency.

Once the cryptocurrency is converted to a fiat currency, it can be sent to the crypto card.

An important caveat: Now in the Russian Federation, AdvCash cards are not available.

Option 3

This is how Betconix, CryptoPay works. Here, the user has a bitcoin wallet, a fiat account, and a crypto card; and all this is stored in one place - the application.

This option should be considered as a mobile bank, where your credit and debit cards are connected and can be managed through the app.

This is the most convenient solution of allcrypto cards, because everything you need is available in one place. A person can store cryptocurrency and fiat currency together. You can also check the amount of transaction fees using the card when converting cryptocurrency into fiat money, i.e. dollars, euros, rubles, etc.

However, as a rule, such cards have certainrestrictions on the maximum amount that can be held on such a card and the maximum withdrawals per day. This may raise questions from the "anti-washing" services. But the limit on the maximum amount makes it less risky.

Today, in 2021, there are a huge number of cardsfor cryptocurrencies: AdvCash, Revolut, Betconix, SpectroCoin, Uquid, Coinbase, Crypto.com, Amon, Bitwa.la, Bitpay, Xapo, Bitnovo, Bitcard, TTM ... But we are interested in maps that we can use in Russia and the CIS ... As well as those cards where there are adequate commissions. And there is the possibility of additional income.

But I want to immediately draw your attention to some cards at the moment being in the Russian Federation will have to wait a little.

Cards for cryptocurrencies.

1. The largest.

The largest cryptocurrency exchangeBinance hasannounced the launch of its debit crypto card. It will be possible to replenish it with bitcoins or internal tokens of the BNB exchange, and in the future it will be possible to pay with it as a regular card. For now, the map is only available in Malaysia, but later it will appear in other countries in Asia, and then in the rest of the world. However, you can subscribe to the newsletter on the Binance website if you want to be notified when the Binance card will be available in your region. Your humble servant is already in the list of the first "zhdunov" that I recommend you to do.

Initially, you can only get a virtual card worth $ 15, and physical cards will be issued later.

For virtual cards, there is no charge for card or account maintenance. The Binance card can be linked to an account on the exchange and, if desired, topped up from any crypto-and your BNB-wallet.

In addition, the Binance Card team has alreadyuploaded an app to Google Play that allows you to make transactions on the card. However, this app still has very limited functionality: a card page (currently not working), a built-in crypto wallet, as well as personal data, notifications, and security settings. Transaction history, statements, and other options available in the bank online are not yet available.

Most likely, when paying with a card, thecryptocurrencies on the account will be converted to the local currency, but Binance is refraining from providing any details on this topic. It is also unknown which bank will issue the card and on the basis of which payment system it will work.

2. The oldest crypto card.

AdvCash is one of the oldest payment services, I personally got acquainted with the service around the time when with the crypt back in 2012.

The AdvCash crypto card is supported in almost all countries, with the exception of sanctioned states and completely remote places. When registering, you can add several fiat currency wallets at once.

The service released its crypto cards (both plastic and virtual) last year. The main difference between the first type and the second is the cost of the product.

You can’t store cryptocurrencies in theservice as such, but you can top up your fiat account with several coins - BTC, ETH, LTC, BCH, XRP, ZEC, TRX, and USDT. The transfer will be converted to the currency of the account to which the funds were received. The same scheme works for withdrawals.

Note that AdvCash-temporarily suspended the release but I’m sure (however, they say so) that in the very near future, will restore the issue of cards.

3. The most innovative card for cryptocurrencies in 2021.

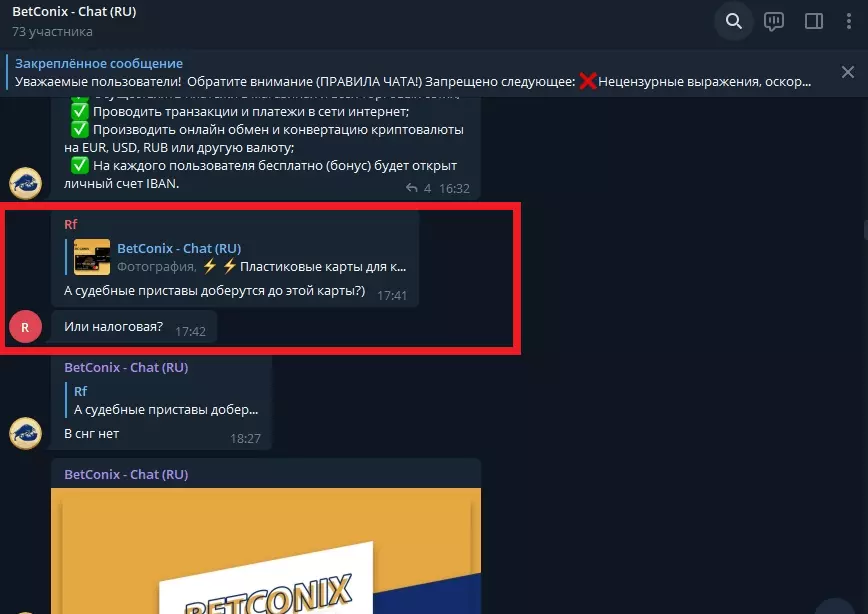

Betconix cryptocurrencycard just recently announced the release oftheir own cards, according to the service for the first 5 days, more than 1000 cards have already been ordered, and the first users, judging by the reviews, have already received.

Master Card cards.On the card, in principle, all currencies are available that are on the exchange about 80 currencies today, the standard scheme of online conversion, only a personal account in the partner service for security. But I am glad that there are no restrictions on currencies, which means that they will be added to the exchange, and as a result, to the card.

Among the features, it seems that the card willalso be linked to the market place platform for NFT tokens and the P2P platform that are planned to be launched on the exchange. Perhaps only an interesting system, the expectations of the map, deserves attention. There is an option not just to get a free card, but also the opportunity to earn extra money in the process of waiting for the card and get interest just for waiting for the card more details here.

4. The most bank card.

TTM Bank has made a big breakthrough by making its crypto cards available in almost all countries, with the exception of those countries that have been sanctioned by regulators around the world.

Crypto card holders can top up their TTM Bank card directly from any wallet.

The TTM Bank's crypto card supports only 5 digital currencies: USDT, BNB, BTC, TRX, ETH. TTM operates under EU jurisdiction.

Recommendations for selection

This issue should be approached with fullresponsibility, so as not to lose your savings. There are several main factors that affect the choice of the company that provides the opportunity to order a card.

There are already a large number of companies onthe market that provide services for issuing a debit plastic card for cryptocurrency. There are also constantly new startups that want to work in this segment. However, we recommend that you pay attention to the following factors.

On the availability of a license from a crypto exchange or payment service.

Availability of additional options.

The possibility of developing the system.

Availability in your country, as well as in the countries where you go, for example, on vacation. Good luck to everyone soon the fairy tale will become true, soon shopping w