Against the backdrop of the volatility of many cryptocurrencies, crypto enthusiasts are wondering whether it is still possible to getCryptocurrency mining profit.

Most profitable mining mechanisms involve enormous costs, including wholesale purchases of equipment and electricity, maintaining the operation of the cooling system and ASIC devices.

The best option for mining cryptocurrency on2019 is a cloud mining year, as it provides maximum profitability at any level of starting investments and does not require any technical knowledge from the user.

For ratings of reliable cloud mining services, see this review. In this material we will look at cryptocurrency mining exclusively using our own equipment.

How are things going with mining on your equipment in the fall of 2019?

Now for many, the principle of making profit from cryptocurrency mining on their equipment is this phrase: spend money to earn (a little) money.

To improve the situation and increase interestminers, new competitors to ASIC devices are being released onto the market. In particular, Samsung, BitFury and ASICminer are creating their own ASICs, along with the famous technology giant Bitmain.

Much easier to mine using graphicalthe processor. ASIC-resistant coins are more accessible to conventional amateur miners, but they are extremely vulnerable. Hash rental services such as NiceHash allow 51% attack without having your own equipment. A network with a low hash rate and mining using a GPU can hardly withstand such vulnerabilities.

It is also worth noting that most altcoins are not the same as before. Depending on the cost of electricity, many of them are useless to mine.

In the US, miners using the GeForce 2080Ti canget just a couple of dollars a day or even less. But even in this situation, it will take a couple of years or more to cover the cost of video cards. This low yield issue could ultimately lead to the demise of many GPU-mined altcoins if current hashrates are not sufficient to secure the networks.

Profitability of mining on ASIC devices

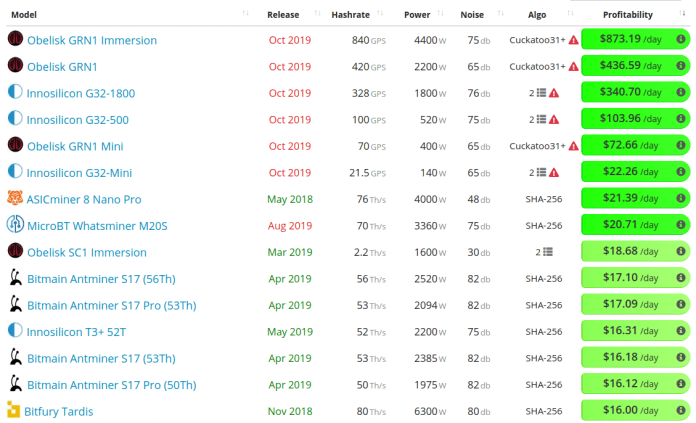

To estimate what your dailyprofitability you can use profitability calculators, take a look at the popular ASIC miners that will soon hit the market (production of some Obelisk miners, such as the Obelisk GRN1 are in question):

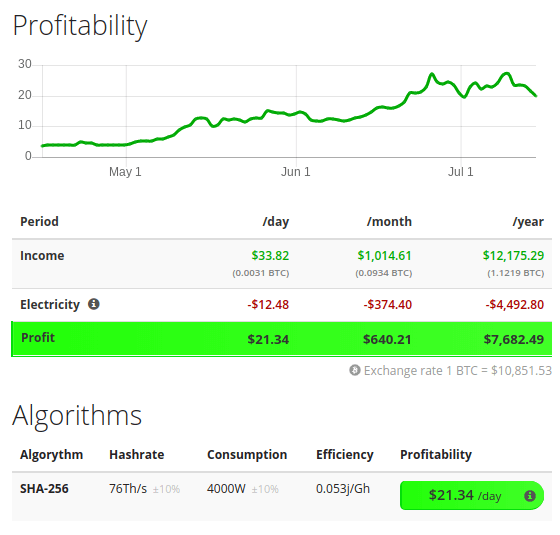

Consider one of the most efficient ASICminer 8Nano Pro, which is currently available. It can make a profit of about $ 21.00 per day for each miner if you pay $ 0.13 per kilowatt / hour. Not bad, right?

But there is one problem — this devicenot designed for beginners (at least financially). To buy this machine from ASICminer, you'll have to shell out over $9,000 per device, and you'll need a minimum of 50 to run.

Believe it or not, the 8 Nano Pro is already sold out. You can now choose a newer model — ASICminer Zeon Turbo with $9500 discount and daily profit of about $25.

A more practical option — Bitmain AntminerS17. It's still quite expensive— a few thousand dollars (and makes a noise like an air raid siren), but it can be purchased at retail and is much more suitable for beginners. Taking into account electricity costs, you can make a profit of about $17 per day.

However, to cover the cost of the purchase, it will take more than 500 days of mining at the current price of bitcoin. This is a fairly serious investment with deferred interest.

It is easy to assume that such prices mayscare off an ordinary crypto enthusiast who just wants to try his hand at mining. This “price wall” is detrimental to decentralization, as fewer people or companies have the means to secure the network.

Mining pools

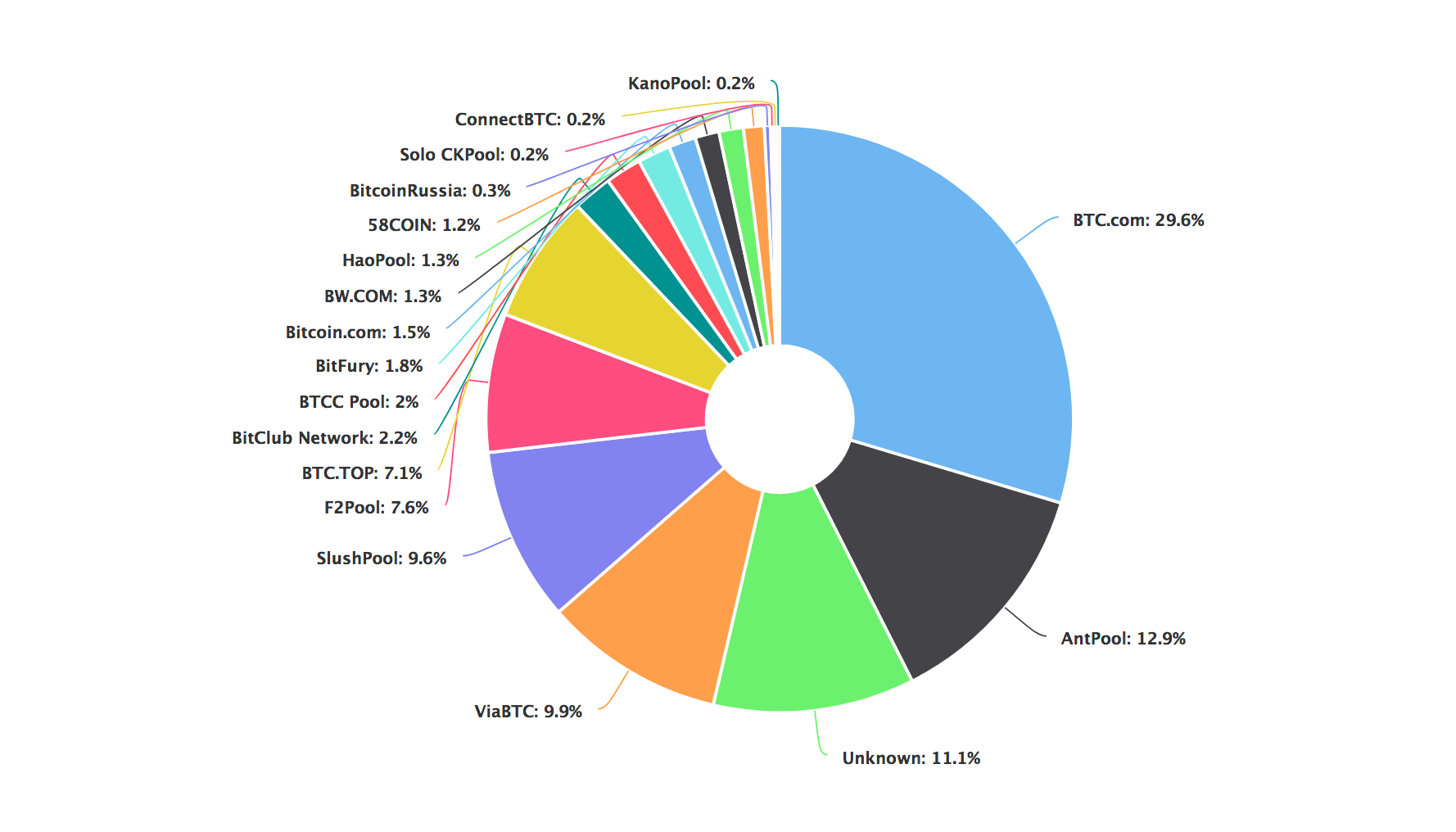

One of the most important steps in the mining processbecomes the choice of a mining pool. Pools often have many parameters that affect your profit — from pool participation fees to transaction fees.

For mining bitcoins, some minersprefer to use larger pools such as Slushpool, which is one of the oldest and most trusted pools among miners. There are other large pools such as Antpool and BTC.com.

Payout mechanisms can be complex and somewhatconfusing. For example, in Slush, the pool fee is 2%, which is slightly higher than in Antpool. But Antpool does not always pay transaction fees, while Slush does it regularly.

Smaller pools may have lowercommission, but the miner may have to wait longer for the payment per block due to the lower technical capabilities of the pool. This is why small pools more often suffer from downtime, during which the miner does not receive any profit.

However, in the long run, dimensionsrewards are equalized, of course, provided that the pool remains stable. For those who want stable and frequent payouts, larger pools look more reliable, but given the increased commission, with patience, small pools may seem more attractive.

When it comes to altcoins, there is politicsmining pools are more flexible and diverse. Each PoW altcoin has multiple pools with different payout schemes, some with minimum payment thresholds, some — with a higher or lower commission for the pool, some without commissions at all.

For novice miners, applications such asVertcoin One-Click Miner, — A great place to experiment with GPU mining. The application guides the user through each step of the process, helping in the selection of pools based on statistics on pool fees and uptime, which are clearly displayed in the interface.

If you are not ready to dive into complextechnical calculations, even using practical tips, but want to mine cryptocurrency on your own equipment, NiceHash service will become an easier choice. It allows you to mine coins through leased equipment.

Your computer provides a hashrate thanks towhy payments are made to your bitcoin wallet. This eases the difficulty in choosing a cryptocurrency and eliminates the need to find the best mining pools.

NiceHash also takes a part of the profit, but one way or another it is more profitable than a single mining.

The struggle for decentralization

Let's see what a number of developers are doing.cryptocurrencies to solve the problem of centralization. Since along with a huge variety of PoW mining algorithms there are more than 1000 different cryptocurrencies, we will mention only a few illustrative examples.

Monero community was alarmed last yearmining using ASIC in your network. Bitmain “broke the code” by developing an ASIC for the Cryptonight XMR algorithm. The all-new Antminer X3 brings huge profits over the modest GPU capabilities. Having received a "discount" of $ 3,000, newcomers were given the opportunity to make good profits.

The reaction of the Monero developers was extremelyunderstandable. They suspected that Bitmain was secretly mining Monero with ASICs, as evidenced by the surge in hashrate willing to ship used ASICs to unsuspecting buyers. Meanwhile, Monero was ready to fight back:

“We will conduct an emergency hard fork tolimit any potential threat from ASIC. Additionally, to maintain decentralization and remove the incentive for ASIC production, we propose to modify Cryptonight PoW by forking twice a year.

Finally, we will continue to explore alternative Proof-of-Work features that can provide increased ASIC resistance than Cryptonight. ” (source)

In response to the Monero fork announced, the price of the X3 fell to a sale price of $ 1,000, but still remained relatively high. It is important to note that the hard fork did not solve all the problems.

Thus, the developers of Monero repelled the attackBitmain's ASIC, presumably retaining a high degree of decentralization. At the same time, they continue to work on implementing additional ASIC resistance using the RandomX solution, which randomly alternates between different algorithms to block ASICs.

Siacoin — another example of a project that abandoned monopolies by deliberately blocking ASICs from Bitmain and Innosilicon. As a result, the Obelisk SC1 miner began to successfully mine Siacoin.

Other open-source currency developers have joined the anti-ASIC movement called #FairMining. This includes Digibyte, Vertcoin and others.

Another way of fighting can be consideredmulti-algorithm design, which is based on running a random sequence of algorithms, significantly complicating the operation of the ASIC. Whattomine.com lists Ravencoin as the most profitable currencies with a multi-algorithm design, and Digibyte is generally considered a pioneer of this technology.

As you already understood, this is a constant pullRope requires ASIC developers and manufacturers to continue the technology arms race. This will contribute to the decentralization of mining and the ecosystem of electric currencies.

</p>