Until recently, crypto exchanges provided their users with a so-called “fiat gateway” -Possibility of replenishing your balance usingtraditional bank account or card. But at the end of March, crypto exchange Binance announced the launch of its own debit card that supports crypto payments. This will provide its holders with the opportunity not only to trade cryptocurrencies, but also, with some reservations, to pay with digital assets for goods and services in the same way as with ordinary money.

Cryptocurrency Wallets Cardschannel, also offered some popular payment systems available to residents of Russia. However, now the situation is changing, and not in favor of our country.

What foreign financial services do Russians offer cryptocurrencies and why can the situation on our market change dramatically in the near future?

Binance card

At the end of March, the largest cryptocurrency exchangeBinance announced the launch of its own debit card. It can be replenished with bitcoins or internal tokens of the BNB exchange, and in the future it will be possible to pay with it like a regular card at about 46 million merchants in more than 200 regions and countries.

For now the card is only available in Malaysia, but latershould appear in other Asian countries, and then in other countries of the world. However, already now you can leave your email address on a special project page - they promise to send a letter to it notifying you when the Binance Card will be available in the sender’s country.

At first, you can get only a virtual cardcosting $ 15, and physical cards will be issued later. In this case, there will be no commissions for servicing the card or account. The Binance Card can be linked to the balance on the exchange, and, if desired, topped up from any BTC and BNB wallet.

Also, the Binance Card team has already releasedAn application on Google Play that allows you to conduct operations with the card. However, it has a minimum of functions: a map page (does not work yet), a built-in crypto wallet and settings for personal data, notifications and security. No history of operations, statements and other options familiar to online banking has yet been provided.

Most likely, when paying with a cryptocurrency card onthe account will be converted into local currency, but Binance did not provide any details on this topic. It is also unknown which bank issues the card and on the basis of which payment system it will work.

The cryptocurrency exchange Binance originally announcedlaunch of the Binance Card in collaboration with the payment giant Visa. However, a few days after the release, the exchange administration deleted all the payment system data: the logo from the cover of the press release, as well as the mention of Visa in the text of the announcement and in posts on Binance social networks. What was the reason for this decision - neither Binance nor Visa reported. Note that Visa was the first payment system with whose cards it became possible to replenish an account on the Binance exchange.

Provide an opportunity to earn money not only onTrading, but also paying with cryptocurrencies, is a logical goal for Binance. But while the cryptocurrency debit card market is in its infancy. Nevertheless, the Binance Card has several competitors in this field, many of which have already provided ready-made products. Among such projects is the Coinbase Card from the eponymous American regulated crypto-exchange.

Below we will talk about crypto cards that can be obtained by representatives of the crypto community in Russia.

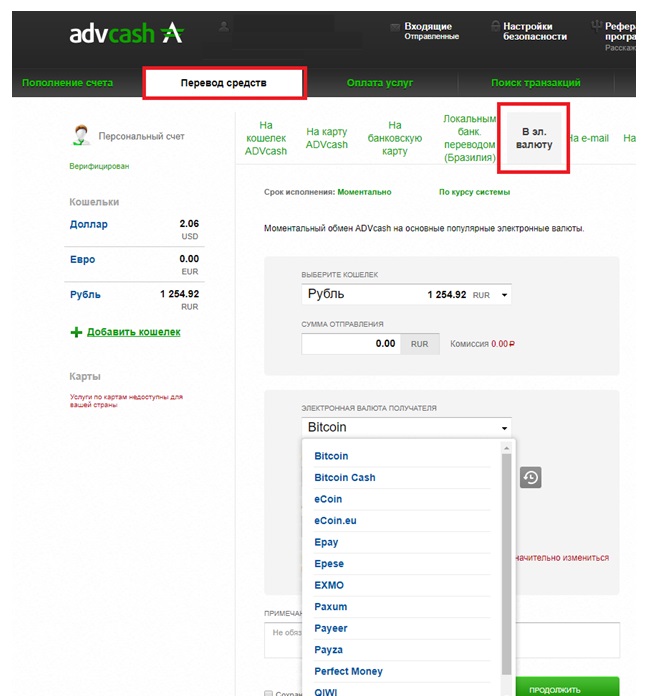

AdvCash

AdvCash is perhaps one of the most famousfinancial services for freelancers, presented in the form of a payment system and a digital wallet. The AdvCash crypto card is supported in almost all countries except the sanctions states and the “bear corners”. When registering, you can add several purses of fiat currencies, including the ruble.

Last year, the service launched its ownCryptocards - both physical and virtual. The main difference between the first and second types is in the cost of production. In addition, you will have to pay a small commission for replenishment from the AdvCash virtual wallet in case of cash withdrawal in a currency other than the currency of the card account.

As such, store cryptocurrencies in the serviceYou can’t, but you can replenish the fiat account with several coins - BTC, ETH, LTC, BCH, XRP, ZEC, TRX and USDT. The transfer will be converted into the currency of the account to which funds are received. The same scheme works for withdrawing money.

The conversion rate is set by AdvCash, and whenIf you wish, you can buy cryptocurrency directly in the service application. It should be noted that in November, AdvCash became a partner of Binance for ruble transactions (a few months later, the exchange introduced the function of transfers from Visa cards).

For ample opportunities for currency exchangeyou have to pay a considerable price - AdvCash has commissions on almost all transactions. For replenishment you will have to pay from 2.7% to 6%, depending on the chosen method. For withdrawal there is a fixed commission or percentage. The list of fees is very long and detailed. There are no commissions for cryptocurrencies, but most likely they are included in the conversion rate.

Note, due to the situation with the coronavirus pandemic, AdvCash temporarily stopped issuing new cards, but promises to return this opportunity soon.

Wirex

Wirex - a British startup with founders fromOf Russia. This financial service allows you to buy and sell cryptocurrencies for fiat money. The initial goal of Wirex was to issue its own crypto card in addition to the electronic account.

Despite using cryptocurrencies, Wirex was able toget the first e-money license in the UK, and subsequently in some other European countries. Therefore, after registering, a new client will have to go through the verification process and confirm his identity and payment details for using the service.

Wirex is a multi-currency account, withone main fiat currency and several cryptocurrencies, namely: BTC, ETH, LTC, XRP, XLM, DAI, NANO, WLO, WAVES. Wirex also provides the ability to convert fiat and digital currencies within the application. In addition, the service has its own WXT token, which gives a discount on commissions. The account balance is tied to a Visa physical card. Transfers are available both between cryptocurrency addresses and between other banks and cards.

Formally, Wirex is present in many countries,including regions of the European Economic Area (EU countries plus Norway and the UK), Asia-Pacific and the CIS. However, the card itself is only available to residents of European countries. And although the service recently officially announced its launch in the Asia-Pacific region, so far only account registration and identity verification are available to users from this region. The same applies to Russia and other post-Soviet states. In an AMA session at the end of last year, Wirex co-founder Georgy Sokolov said that the service was ready to launch in Russia, but was prevented, among other things, by “the ambiguity of the regulation of the crypto market.”

As for Wirex tariffs, users are chargedThere is a small monthly card maintenance fee. When transferring funds from a cryptocurrency account to another card, you will also have to pay a 1% commission (not counting conversion to fiat). There is also a fee for converting cryptocurrencies and withdrawing cash from ATMs (the daily limit is only $250). In addition to fees, there is also a cashback program (in cryptocurrency).

ePayments

ePayments is another payment system with a cryptocurrency gateway and a plastic card, which until recently was available to Russians.

However, at the end of February 2020the service suspended operations at the request of the British financial regulator FCA (ePayments has a license in the UK). The reason, according to the ePayments administration, was the regulator’s claims regarding insufficient control over the issue of anti-money laundering legislation. At the same time, the service is not going to close, and the frozen funds of users are promised to be unblocked in full. However, when this will happen is unknown.

As for commissions, the service takes money forissue and reissue of cards, as well as for delivery. Mail delivery is free, but it will have to wait a few weeks. Express shipping costs $ 45. In addition, you will have to pay a fixed fee when issuing cash at ATMs. Transfers to and from the card to ePayments accounts are free. For all other transfers from the wallet (for example, to Qiwi or Yandex Money) you will have to pay a percentage. In addition, there is a conversion fee for purchases not in the card currency.

Are service problems related to support?cryptocurrency transfers are unclear. There was such a function in the service. The service is affiliated with the British crypto exchange DSX, and 20% of all transactions in ePayments included digital assets. But, on the other hand, now the list of prohibited activities that ePayments does not work with officially includes “cryptocurrency exchange.” It is also curious that DSX suspended bank transfers at the same time that problems with ePayments began. However, just a couple of days later this feature was restored.

Why can cards of foreign payment systems disappear from Russia?

Cryptocurrency-enabled plastic cardstransfers are mainly concentrated in international fintech services. However, it is likely that such financial instruments will become inaccessible to Russian citizens. In particular, we are talking about plastic cards of payment services that are not registered in Russia. And the "culprit" is by no means cryptocurrency.

Thus, at the end of March, the popular financial service Payoneer stopped issuing cards for Russian users. The letter that customers in Russia received said:

“Russian regulators have notified Mastercard thatforeign card issuers can no longer provide cards to customers in the Russian Federation. Unfortunately, this means that from May 27, 2020 we must stop our work with cards for all users whose billing address or delivery address is in Russia. ”

Then a short message about the upcomingchanges have also appeared on the Payoneer website. According to the company, these steps are related to changes in the law “On the National Payment System” adopted in 2019, which relate to payment systems, as well as suppliers of foreign payment services.

According to the amendments, any payment system andservice providers in this area are required to register in a special registry of the Central Bank of the Russian Federation, be a member of the National Payment Card System (NSPK) and conduct transactions through the domestic infrastructure. These measures take effect in the summer of 2020.

Chairman of the State Duma Committee on FinancialAnatoly Aksakov explained the adoption of the amendments to the markets by the fact that Russian regulators cannot control the work of payment services, since they work in foreign jurisdictions.

At the same time, it is likely that not all foreignpayment services are ready to comply with the requirements of the new law. At the same time, in February of this year, the Bank of Russia, in instructions for commercial banks, defined transactions with cryptocurrencies as a sign of money laundering. That is, direct transfer from a crypto exchange to a Russian bank account may now be unavailable.

Meanwhile, the Russian Ministry of Finance is still inJanuary 2019 emphasized that the use of cryptocurrency debit cards to pay for goods and services does not contradict Russian legislation, however, the use of a foreign account for these purposes may raise questions from the tax service.

</p>Rate this publication