People usually think that one of the best ways to make money with cryptocurrency is to trade it.The fact thatBitcoin value has increased by 10,000% sinceIts creation, makes cryptocurrencies a rather advantageous offer for any person who seeks to earn. The cryptocurrency business is mainly associated with trading exchanges, and it accounts for about 80-90% of the total industry. The rapid growth of cryptocurrencies in 2017 and the volatility in 2018 allowed many investors to earn huge amounts. It can be said without exaggeration that cryptocurrency is slowly penetrating mass transactions. In countries like Australia, Bitcoin is allowed to pay bills, and Malta has become one of the best places to do business in the cryptocurrency industry. Given this evolution, creating a cryptocurrency exchange will be an excellent business solution for an enthusiast.

</p>What is a cryptocurrency exchange? As the name implies, this is a platform on which users can exchange cryptocurrencies for other cryptocurrencies or a specified currency at a predetermined value, which[official]determined by the dynamics of the market.

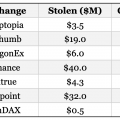

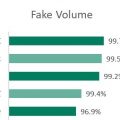

(Translator's comment. Recent studies clearly show how a number of cryptocurrency exchanges can effectively manage the "market dynamics")

What do cryptocurrency exchanges earn?

Types of cryptocurrency exchanges

Not all crypto exchanges are equally designed. There are various types of exchanges on the cryptocurrency market.

Centralized cryptocurrency exchanges

(comment translator. Both the technical structure and the exchange technique are centralized)

This type of exchange is suitable for users who do not haveIt has a simple interface with user-friendly features and navigation.The exchange is instantaneous between the user and the administrator[exchange].

The profit of the exchange is due to the exchange margin. If the current Bitcoin price is $10,000, you can sell it for $10,500 if you bought it for $9,500 from another user.

(translator's note. Or at another exchange. This is called arbitration, which is an extremely common and completely normal, legal practice).

A thousand dollars difference is your profit. As a rule, the spread varies from three to five percent of the current market rate.

Peer-to-Peer exchanges [p2p]

This type of exchange is very similar to the previous oneoption, but at the same time works with the blockchain directly. An additional difference is that there is no point of control. Transactions occur between users - for this, the exchange connects them directly. The profit comes from a percentage exchange fee for each transaction. Binance and Poloniex[in some cases]practice like that.

Decentralized Cryptocurrency Exchanges

Decentralized cryptocurrency exchanges in fullfunction on the blockchain. As the name implies, they do not have a centralized management of exchange operations. There are various types of decentralized exchanges, such as on-chain, off-chain and cross-chain.

Such exchanges can be decentralized orcompletely or only partially. They have some blockchain functionality. The wallet and registration modules are generally decentralized. Decentralization provides a higher degree of security since funds are not held by an exchange. However, the functionality offered by such an exchange[relatively]very limited.

Proof of Keys: prove what you own

Cryptocurrency exchanges with margin trading and leverage

This is new[not new at all]a trend that is gaining popularity and appeal amongsomeusers. Cryptocurrency exchanges with margin trading help the trader “create contracts in monetary terms.” This increases the return in proportion to the risk.

(translator's note.In Russian, leverage allows a trader to trade using borrowed funds from the exchange. Those. the transaction amount may significantly exceed the amount of funds on the trading account. Margin is the trader’s pledge to secure a margin transaction. At the slightest fluctuation in the value of an asset in the opposite direction from the position set by the trader, the transaction is automatically closed, and part of the margin is “burned out”. The higher the leverage, the greater the chance for a trader to suffer losses. There are other meanings of the term "margin", such as the difference between the actual price and the cost.)

There are not many players in this field and the target audience is also small.(comment translator. Approval without proofs)

***

Also, there are a few more points that need to be taken into account before choosing options for creating a cryptocurrency exchange.

Legal aspects

Following all legal rules for a cryptocurrency exchange[on practice]not necessary, but it gives an advantage[doubtful]before other companies.

(translator's note.As an example, the BitLicense is a set of rules put forward by the New York State Department of Financial Services for Bitcoin companies serving New York residents. Many well-known cryptocurrency exchanges openly gave up on it and simply left this state)

It will be good practice for any exchange to follow the rules of KYC (Know Your Client) and AML (Anti-Money Laundering). Legal requirements may vary by country.

Here are the countries most loyal to cryptocurrencies:

- Estonia

- Switzerland

- Australia

- Singapore

- Seychelles

Staff

Gone are the days when revenue and turnovercompanies were proportional to the number of employees. Often in companies with a turnover of more than a million dollars, 10 to 100 employees work. However, when it comes to cryptocurrency exchanges, there are only a few key skills that are needed.

It should be noted that, in fact, the number of these skills is not proportional to the number of employees.

(translator’s note. That is, one person can perform different duties or, conversely, several employees will be required for something)

- Managing Director to monitor all work and ensure optimal performance of duties by employees.

- Marketing Manager, respectively, responsible for marketing and PR activities.It is marketing[in the current system]distinguishes a successful project from a failed one.

- Partnership Director, who will be tasked with finding partners and contractors.

- Support Manager who will checkIncoming tickets and answering support questions. Prompt response to customer requests is what helps to justify the superiority of your cryptocurrency exchange over competitors.

- When creating a cryptocurrency exchange, technical work can be transferred to trusted companies[if you trust them].

It is clear that you do not need more than three people to launch a cryptocurrency exchange.

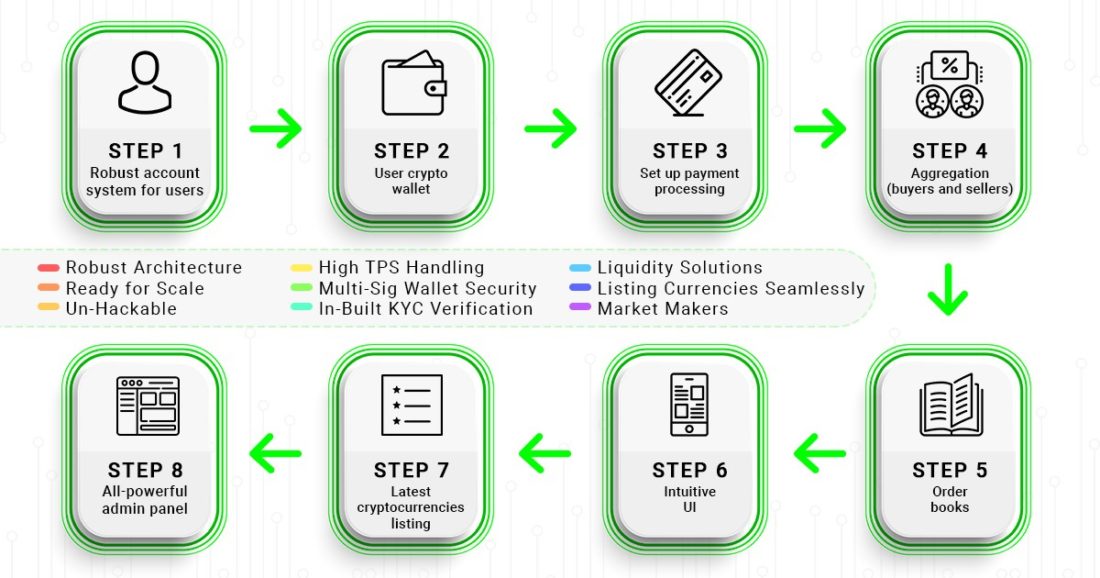

Cryptocurrency Exchange Architecture

Functionally, a cryptocurrency exchange is expected to do nothing more than connect buyers and sellers. This can be achieved using different architectures.

- Monolith is a universal architecture in which wallets, payments, bills and the administrative part are located on one server. Not suitable for working with a large number of users.

- Modular - contains easily manageable modules for each function, usually located on separate servers.

- Distributed - has independent modules,consisting of different submodules. The database can be hosted on multiple servers. Performance is proportional to quality and maintenance efforts.

It should be noted that any cryptocurrency exchange should be easily scalable. This can be achieved by increasing the capacity of the server, optimizing scripts or transcoding modules.

Key features of the cryptocurrency exchange

The work of any cryptocurrency exchange includes the following aspects:

- Graphical user interface

- Wallets

- Liquidity

- Trading engine

- [Server architecture]

- [Admin panel]

Backend architecture

Each architecture has its own advantages andweaknesses, and it is important to determine your goal before setting about creating a cryptocurrency exchange. The principle of operation for different models is usually similar. Today, the most efficient data transfer API is in JSON format.

The server side of the cryptocurrency exchange isone of the most important aspects. This is the heart of the whole system, where operations and calculations are carried out through basic scripts. In developing the architecture of the project, this part should be focused on, while other aspects of the exchange may be secondary.

Graphical user interface

It should be recognized that the end user is notcoding details taken into account when creating the kernel are very concerned. For them, a pleasant and intuitive interface is important. This user interface is the first thing that strikes the user. At the same time, a growing number of smartphone users are requiring the website to be compatible with mobile device screens. Perhaps, at the very beginning, it is not necessary to create mobile applications, but over time, it would be nice to make them available on two main mobile OS - iOS and Android.

Purse

The wallet consists of two parts: a cryptocurrency wallet and a fiat wallet. This allows you to connect the blockchain with the functions of replenishing and withdrawing traded currencies.

There are different ways to integrate yourwallet with the main banking system. In manual mode, these can be direct bank transfers, and in automatic mode, you can use Visa or MasterCard services. Money is credited directly to your bank account.

(translator's note.Banking services are the weakest part of any cryptocurrency exchange. Often, exchange offices resort to various, sometimes hardcore, tricks in order to continue working, which in the end is also fraught with consequences. As an example -Crypto Capital)

Liquidity

Liquidity is one of the most important aspects.any exchange, including in relation to traditional exchanges. The order book shows how popular the stock exchange is. Therefore, a cryptocurrency exchange must also display order books in order to display liquidity.

You can choose a liquidity provider orsimulate trading activity inside the exchange using bots.The first option will increase the cost of business, which will negatively affect the interests of clients.

Trading engine

The trading engine is the core of your exchange, whichconnects buyers and sellers. The speed and performance of the exchange are directly dependent on the trading mechanism. Most p2p cryptocurrency platforms use limit and market orders to ensure that performance does not suffer.

Some systems allow you to place stop-limit and stop-loss orders. They are preferred by experienced traders.

(comment translator. Experienced traders know that stop loss can sometimes do more harm than good)

Admin panel

Admin Panel is the control centerexchange. The owner or administrator should have access to all important functions and be able to perform key actions, including user management, wallet and transaction management, including additional actions such as controlling KYC and AML. If necessary, and depending on the size of the exchange, you can even delegate roles to other users with limited authority.

Cryptocurrency Exchange Security

For any system that deals with a hugevolume of funds - safety is of utmost importance. Most hackers try to use several methods at once to violate the ecosystem’s security.

“White hackers” from March 28 earned $ 32,000 for detecting 30 vulnerabilities in cryptocurrency projects

Here are some of them:

Hacking the admin panel– the attacker gains full access to the system.However, this can be avoided by using two-factor authentication. Another way to secure your funds is to combine both cold and hot storage wallets.

Hacking a specific user– this will damage the exchange in a different way than if it were hackedadmin panel, but, nevertheless, this is a vulnerability. As in the first case, it will be useful for users to use two-factor authentication. It is well known that hackers are targeting users who have shown in some way that they have a lot of money in their crypto wallet, and this is a growing concern.

Social engineering- this is one of the most primitive and, at the same time,time, the most inevitable methods one has to face. The system itself won't be of much help if you knowingly or unknowingly reveal your wallet credentials. The best way to protect yourself from these attacks is to understand that even the smallest information can provide access to your wallet.

Server hacking- for a hacker this is one of the most profitableways to access huge amounts. The best way to avoid such attacks is to invest in a good supplier. Providers such as Amazon Web Services or Microsoft Azure are known to provide security by protecting your data from denial of service attacks.

(comment translator. It is worth thinking carefully before stopping the choice on the servers of these companies)

Conclusion from the translator

This article is presented more thanfact-finding information, and cannot [of itself] be a complete instruction for launching your own cryptocurrency exchange. And what's more, in the current competition and the monopoly of large well-known cryptocurrency exchanges, the cost of launching another office for exchanging cryptocurrencies is more likely to not pay off. But, everything can be - let the daring dare!

It is worth paying attention to decentralized exchange methods, where, at the moment, competition is relatively low:

</p>