this weekCredAnd DonAlt, mailing list authors Technical Roundup, discussing the correction of the crypto market to levelssupport for Bitcoin and Ethereum.There will not be an abundance of altcoins this time, given the volatility in major cryptocurrencies and the level of leverage ahead of the correction in the altcoin market. And there is also an update on DonAlt's rate on ChainLink frompast review.

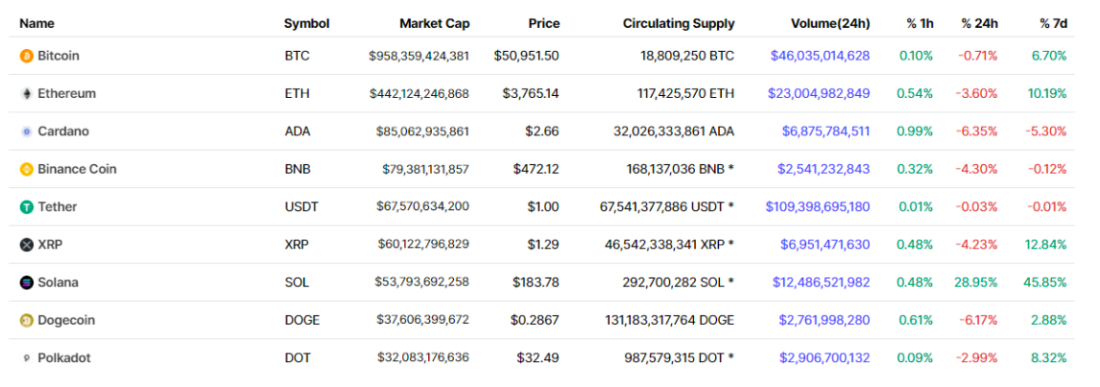

https://coinmarketcap.com/coins/views/all/

BTC: significant correction through immediate support

Chart executed in TradingView

Chart executed in TradingView

A healthy red candle has formed in the bitcoin / dollar pair. We have already begun to forget how it happens.

The BTC / USD rate aggressively broke through the immediate potential support, however, it is still above several important structure-forming levels.

Level $49.1 thousand.— the previous resistance on the weekly chart has been broken down at the time of writing, but technically the weekly candle has not yet been closed. On smaller timeframes, if one is looking to catch the wicks as part of a larger move, the daily chart suggests support is around $44K.

Technically, while these structures are seniortimeframes are preserved, we proceed from the expectation of a bullish continuation. If they fall through, it would probably make sense to look for buying opportunities at the structurally important $38-40k level, or wait until the dust settles and the price recovers above ~$45k.

Buying altcoins essentially means shorting bitcoin (and ether) volatility. Such a deal does not appeal to us at the moment.

Moreover, if this downward impulse receivescontinuation, then altcoins will fall more than Bitcoin. If we somehow still get a quick recovery with bullish engulfing on the weekly chart and the price accelerating towards $60k, then there is a good chance that altcoins will start to lag behind the leader that got so close to their all-time highs.

To summarize, we note a correction.The nearest weekly structure in the area of $49.1 thousand has been confidently broken today, but quick “wicks” in the area of $43.8–44.6 thousand within the week are quite acceptable. If these levels are not held, we will look for long opportunities around the structurally important $38-40k level.

ETH: correction to multi-week support

Chart executed in TradingView

Chart executed in TradingView

ETH / USD is correcting from the $ 4000 level and at the time of writing is at the important support for many timeframes in the $ 3240-3430 area.

The price traded in a range of about $ 3000several weeks before breaking through higher. This range is now a support. On the chart, we have so far identified it using the old daily cluster $ 3240-3430.

More broadly, as long as the $ 3000 level is held, technically our expectations regarding the outlook for this market remain positive.

If the situation turns out to be an unpleasant unfortunate exit from the two-week range, we will still have time to discuss it. Today our attention is focused on the level of $ 3240-3430.

ETH / BTC is still largely sideways trading. There is a larger high on the daily chart, but we are waiting for confirmation on the weekly.

Altcoin analysis

The bitcoin / dollar is trading in the red, so so are the altcoins.

As we have said more than once, some of the bestmoments to buy altcoins are when the largest cryptocurrencies (bitcoin and ether) are at support levels on higher timeframes. Now we have reached them in one day's candle, and, of course, it makes sense to watch how the price behaves in them.

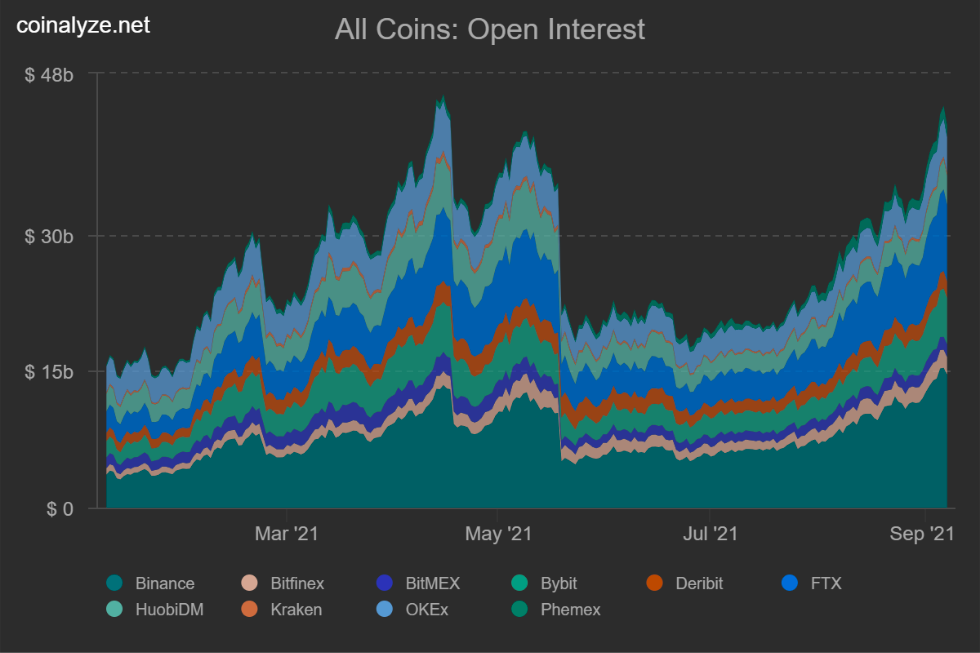

But another point that can be noted isa fairly high level of leverage in the altcoin market before the start of the correction. The total open interest in the crypto market was close to record highs and most of this leverage was in altcoins.

Altcoin futures positioning is aggressively bullish, as evidenced by the high funding rates for so many pairs.

High Futures Funding - Not Alwaysis a bearish factor. Basically, it just means that holding longs becomes expensive. Your profit is supposed to offset these costs. However, a high funding rate becomes bearish if the market does not rise (which means holding a long eats up the collateral for your position) or if the market moves sharply in the opposite direction to the positioning of most of the futures market.

So, before the correction in the altcoin marketthere was a high level of use of leverage. And even a moderate pullback in major cryptocurrencies is likely to lead to a significant decline. If so, deep wicks and discounts can be expected to form among the altos, and then we will share a few graphs in the next issue.

Oh, and DonAlt sold their ChainLinks. The price went up and DonAlt came out at the resistance. Not a bad deal.

https://coinalyze.net/

https://app.laevitas.ch/dashboard/derivs/bybit

BitNewsdisclaim liability for anyinvestment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

</p>