Bitcoin rally in 2020-21 led to a significant influx of investment into the cryptocurrency environment. Publicmining companies actively attracted funds,promising to become the biggest Bitcoin miner. In the pursuit of an investor, they painted themselves into a corner, as the complexity of computing continued to grow, despite the price correction that came and the fall in mining profitability.

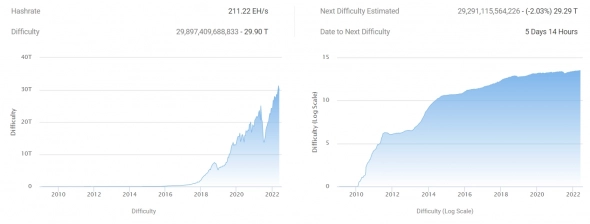

Image source: btc.com

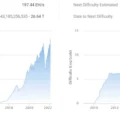

The complexity of the network is adjusted every two weeks independing on the number of connected devices so that it takes about 10 minutes to find the block. Public mining companies tried so hard to succeed in the arms race that the queue at the leading ASIC supplier Bitmain stretched for more than six months. As a result, new devices continued to be put into operation at half the profitability included in the investment plan.

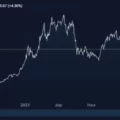

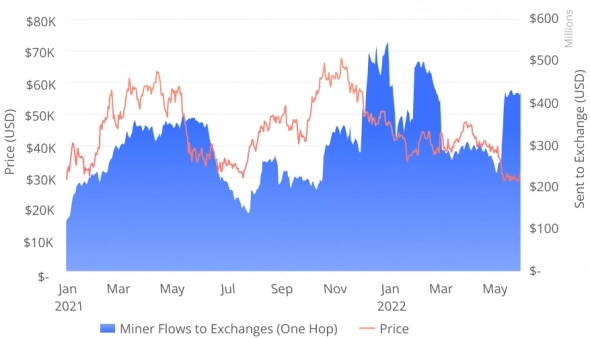

The need to repay loans and otherobligations leads to the fact that public miners have less and less opportunity to hold Bitcoin in the hope of a price recovery. In an analytical report, Compass Mining notes that the influx of coins from miners has reached its highest level since January of this year.

Image Source:compassmining.io

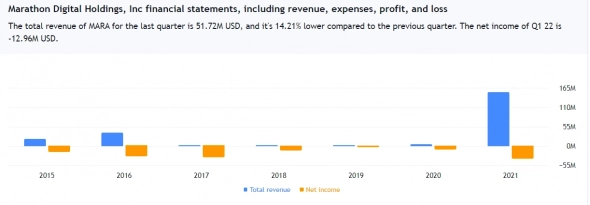

On the need for an additional sale of Bitcointo maintain operations among publicly traded miners have already announced: Core Scientific, Argo Blockchain, Riot Blockchain and Cathedra Bitcoin. Even Marathon Digital, which has remained an ardent hodler since October 2020, does not exclude the sale of coins in the near future. According to the investment program, the company needs to raise about $0.5 billion before the end of the year in order to move in accordance with plans. Marathon Digital, like most of its peers, has been losing money for a long time.

Image Source:tradingview.com

Another problem for public mining companies is the inability to actively dump mined coins to receive funding.

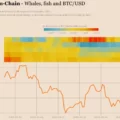

Image Source: Cryptocurrency ExchangeStormGain

Marathon Digital alone owns 10,000 BTC worth $300 million. If the mining companies start a massive sell-off, it will increase the supply and lead to an even bigger Bitcoin correction.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)