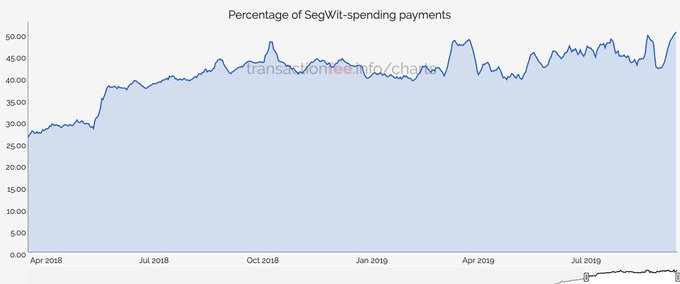

The number of transactions using Segregated Witness (SegWit) technology has exceeded the critical threshold of 50%. More than halfAll network activity now uses a software update that helps reduce transaction fees and block congestion.

Previously we wrote thatBitcoin's hashrate is growing rapidly. The growth in the volume of SegWit transactions is another fundamental indicator demonstrating stable positive dynamics. In July, the figure peaked at 48%.

50% of all #Bitcoin transactions are now #segwit

Recall that SegWit technology appeared in August 2017, but cryptocurrency wallets and exchanges were in no hurry to implement it. Two years later, the technology utilization rate overcame the 50% barrier.

SegWit update was supposed to implement softwarefork on the network, making the blocks more efficient. In the initial stages, she helped slightly lower commissions. It is believed that the transition to SegWit is more active when commissions in the Bitcoin network grow. For example, in May the transaction fee jumped from $ 0.54 to $ 2.36, the share of payments made using SegWit literally in two weeks increased from 40.4% to 45.8%.

Combined with SegWit transaction packagingallowed to reduce transaction costs by 60% compared to December 2017 levels. This is good for bitcoin. Moreover, commissions will continue to decline as the share of SegWit transactions grows. It is possible with a certain degree of probability to assume that the indicator stabilizes at around 50% and in 2020, before halving it will reach 75%.

Bitcoin is currently in perfect conditionstorms ahead of upcoming mining fee cuts Hashrate has reached an all-time high and the cryptocurrency has proven resilient during the 2018 bear market. Moreover, Bitcoin is gradually gaining the status of a hedging tool against a variety of macroeconomic and geopolitical risks.

Source