Over the past few weeks, the landscape of the decentralized finance (DeFi) market has changed dramatically.Landing projectCompound, long ranked second to DeFi Pulse, suddenly broke into the lead.

Thanks to the hype surrounding the token distributionCompound is now ahead of Maker DAO by a wide margin in terms of the amount of ETH coins locked in smart contracts. Recently, the capitalization of the DeFi segment has grown significantly, as have the trading volumes of decentralized exchanges (DEX).

We will understand the reasons for the resounding success of Compound and the takeoff of the decentralized finance market as a whole.

Background COMP

Compound was founded in 2018.It operates on the basis of the Ethereum blockchain and representsa money market protocol where interest rates are formed algorithmically based on supply-demand ratios.

In 2019, the San Francisco startup raised $25million in a Series A funding round led by Andreessen Horowitz. Bain Capital Ventures, Polychain Capital and Paradigm also participated in the round.

Even in the early stages of the project life cycle, itfounder Robert Leshner has stated his intention to gradually “decentralize” the protocol by stripping Compound Labs developers of administrative privileges in favor of the community. According to him, the community could change the list of supported coins, influence risk parameters, interest rate curves, etc.

April 16, 2020 management issues atCompound has moved from administrators to holders of COMP tokens. The latter are designed to encourage community participation in the project, acting as a voting mechanism. Therefore, anyone who has a good idea has the opportunity to organize support for changing the protocol.

In total, Compound Labs issued 10 million COMP coins. 55.71% of them are to be distributed among the project team members, founders, investors and partners. The remaining 42.29% will go to users within four years. The pace of the so-called "liquidity mining" will be 2880 COMP coins per day.

Half of the assets will be distributed amongsuppliers of offers on the Compound service, the remaining 50% are among borrowers. The dynamics of coin accrual is dependent on market interest rates. For example, if USDT has the highest rates, then those who deposit and take loans in the Tether stablecoin will receive more COMP tokens.

DeFi landscape changes

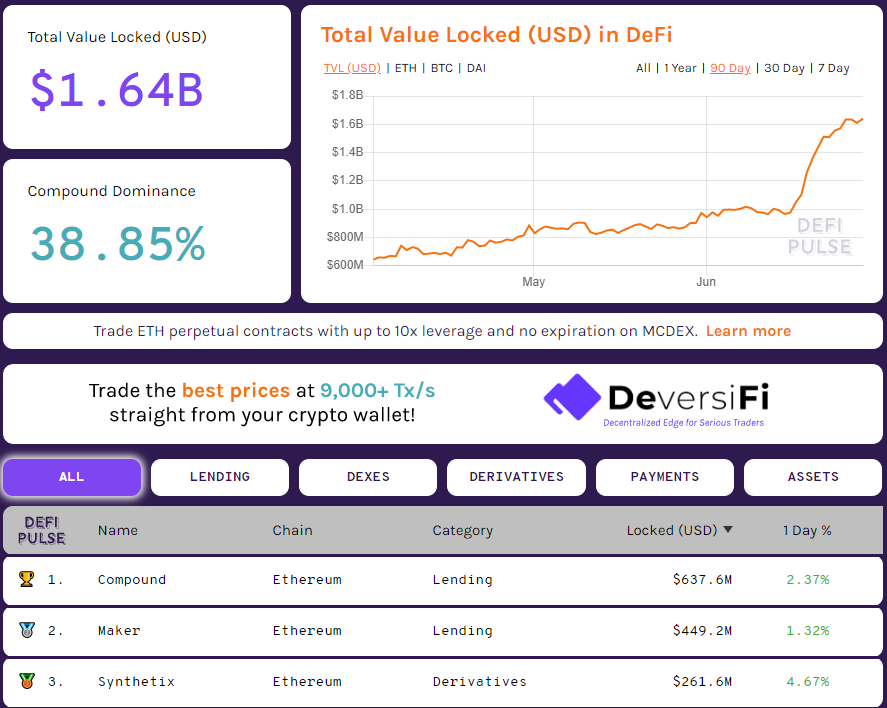

At the beginning of June, the value of blocked fundson smart contracts for DeFi applications was approaching $1 billion. Until recently, the MakerDAO project reigned supreme in this segment, occupying about 55% of the market. It was closely followed by synthetic asset platform Synthetix and Compound.

In the second half of June, the balance of power insegment has changed dramatically. As of June 29, Compound is leading the DeFi Pulse ranking. The value of ETH locked in this application exceeds $600 million.

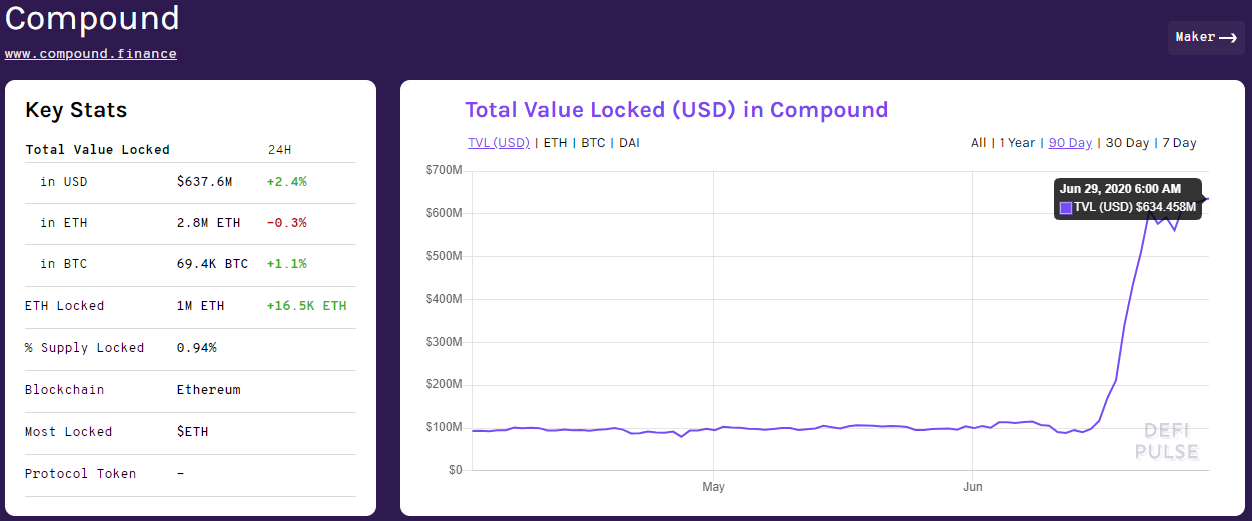

Compound’s massive cash flow started afterstart distribution of tokens COMP. The chart shows a sharp increase in the cost of ETH, which was blocked in the DeFi ecosystem, that began on June 16. We can also note a significant lag behind Maker from the newly minted leader, whose dominance index is 38.85%.

As early as June 15, the volume of assets blocked on the Compound was about $98 million.Now it exceeds $600 million.

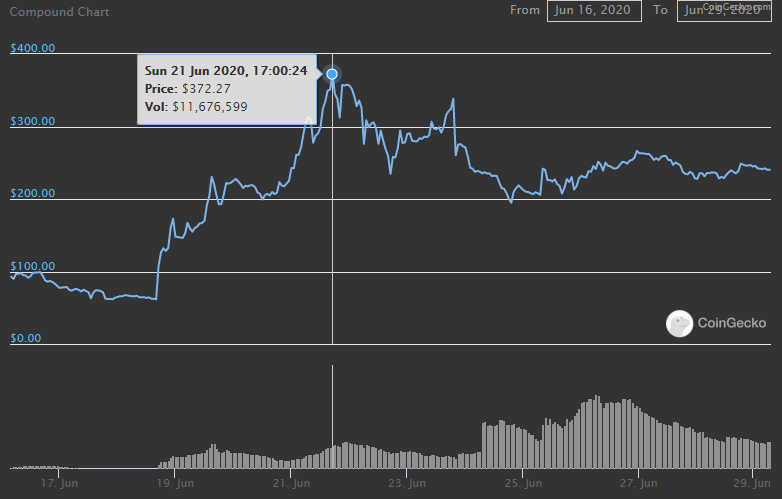

The price of COMP, according to CoinGecko, skyrocketed from $92 (June 16) to $372 (June 21). Subsequently, the token quotes adjusted to $240.

A sharp rise in the market value of COMP, the emergence ofcoins on various trading floors (first of all, on Uniswap and Coinbase Pro) and applications positively influenced the market capitalization of the DeFi market and the turnover of decentralized exchanges (DEX).

</p>Many market participants are likely to havea reasonable question: why is the rise in the DeFi market and the growth in trading volumes on DEX still not particularly reflected in the price of Ethereum? According to the co-founder of Zerion, Vadim Koleoshkin, there is nothing surprising in this, since trading volumes on decentralized exchanges are still much less than on “liquidated” platforms like Bitfinex or Coinbase Pro.

"Also, a large number of Ethereum has not yet been transferred from ICO wallets or stored in castodial services by institutional players.DeFi now has less than 3% of the total volume of ether", - he said.

However, Koleoshkin is sure that gradually capital from centralized services will migrate to decentralized applications and to DEX.

“I think the opportunity to earn and convenienceUses will be the main drivers of DeFi growth in the near future. Thus, the price of Ethereum will be more dependent on the demand for it in the decentralized finance ecosystem. ”

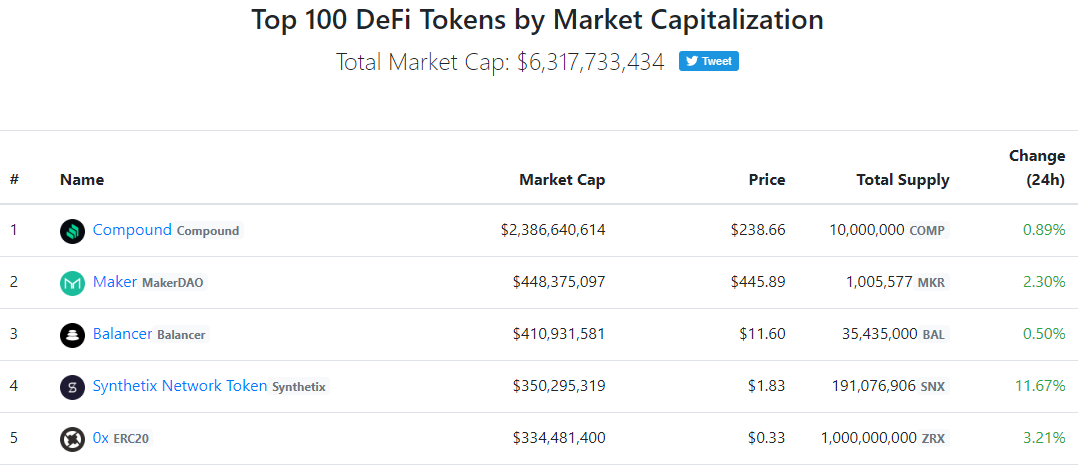

According to DeFi Market Cap, the combined value of DeFi tokens exceeds $6 billion as of June 29. Back in early June, this figure was at $2.1 billion.

The Compound Project Management Token (COMP) leads the way with the Maker DAO (MKR). The market capitalization of the first “DeFi sphere unicorn” exceeds $ 2.3 billion.

In less than a week, the Compound token has almost grown to the capitalization of coins such as Neo, Ethereum Classic, and Dash, and is already ahead of IOTA, Zcash, and VeChain.

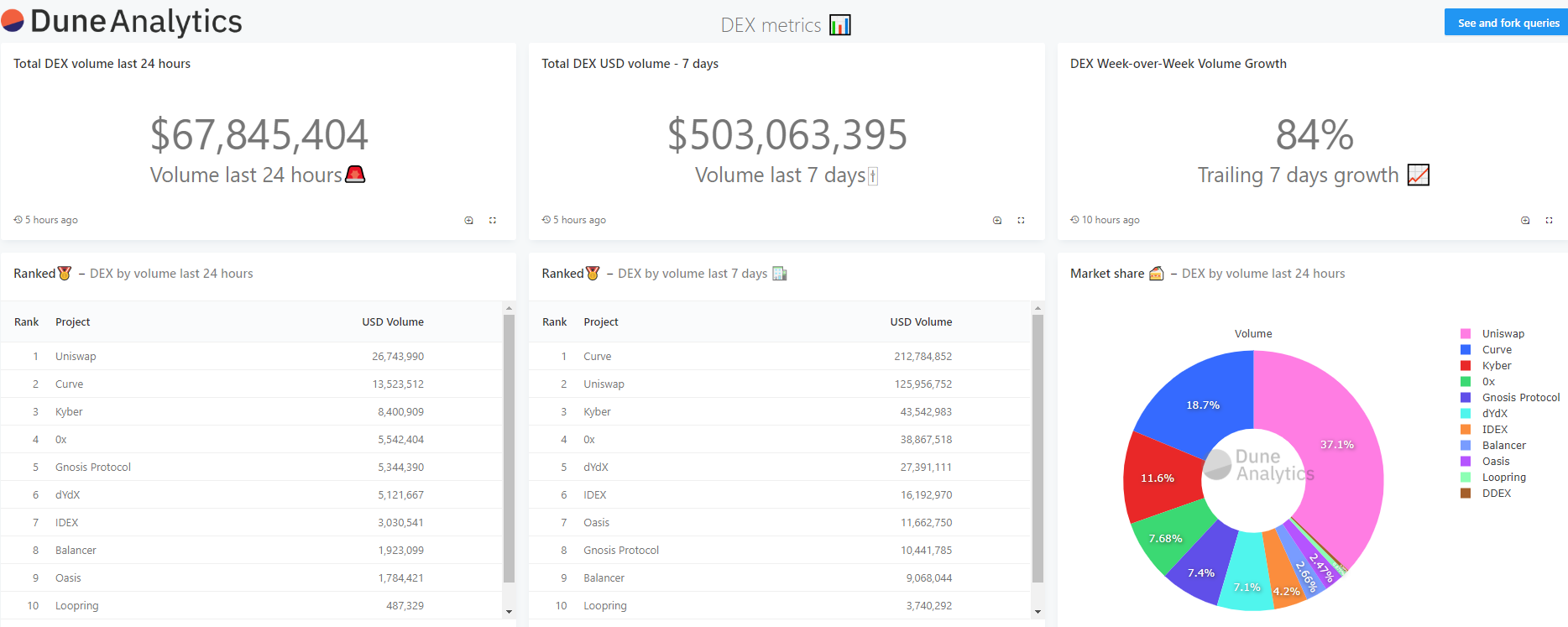

Largely thanks to the hype around COMP volumesDEX trading rose more than 80% in just seven days. Uniswap has further strengthened its position in the segment, it is leading in the sector of non-custodian platforms.

Probably inspired by the success of Compound, itsThe coin was launched by the automated market-making protocol Balancer. On the first day of trading, the token showed significant growth, jumping from $7 to $22. Thanks to this, the project was ranked second in the DeFi Market Cap rating.

Currently, according to DeFi Pulse, Balancer is ranked 4th in value of locked ETH, behind upstart leader Compound, MakerDAO, and Synthetix.

Soon news emerged that an unknown hacker managed to withdraw $500,000 in altcoins from the DeFi project Balancer Labs pool using a smart contract vulnerability.

The “fashion” for governance tokens has not only changed the balance of power in the DeFi segment. but also became one of the reasons for the growth of the median Ethereum commission to the maximum in almost two years.

According to Koleoshkin, many companies are really preparing to launch their tokens. However, the hype around the coins is unlikely to be comparable to what happened during the “ICO fever” in 2017-2018.

“Unlike the wave of ICOs, projects are likely tothey will need to show what they did before raising money. At the moment, this can be compared to raising funds from a round of venture financing.

The big plus for these projects is thatThe infrastructure for trading and use is ready. You don’t have to pay big money for listing on exchanges - just create a Balancer or Uniswap pool for the token ”- co-founder of Zerion shared his thoughts.

According to him, the development of the decentralized finance market is proceeding rapidly:

“Over the past two years, DeFi has gone fromconcepts and the first working examples of smart contracts to one of the industry's most talked about trends and billions of dollars of capital, every day turning around in the open market. If a year ago it was used only by enthusiasts who were interested in the very concept of programmable finance, now thousands of people from all over the world manage their capital and savings using new services. ”

The expert emphasized that much remains to be done in the area of decentralized finance. The main upcoming challenge is the launch of the second version of Ethereum.

“Industry will face a lot of migration, I would evensaid the evolution from DeFi to DeFi 2.0. In ETH 2.0, developers will have new opportunities, but there will be many limitations. Projects will need to take all the accumulated experience and recreate their products in new conditions. I think DeFi and DeFi 2.0 will exist side by side, as there are Bitcoin and Ethereum now, and the transition will take years ”- concluded Koleoshkin.

Controversial Coinbase Effect

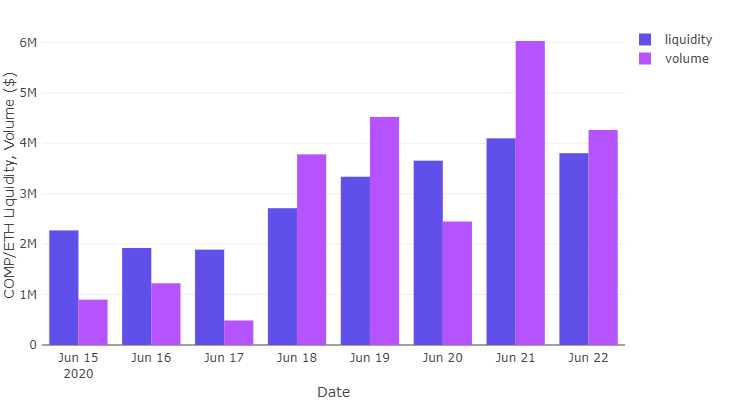

On June 15, COMP debuted paired with Ethereum onleading non-custodial exchange Uniswap (v2). 25,000 COMP and 2,000 ETH were deposited into the platform pool. The price of the token was initially approximately $18.50 or 0.08 ETH, but in just three days it reached $145 and continued to rise amid the news of its upcoming listing on Coinbase on June 22.

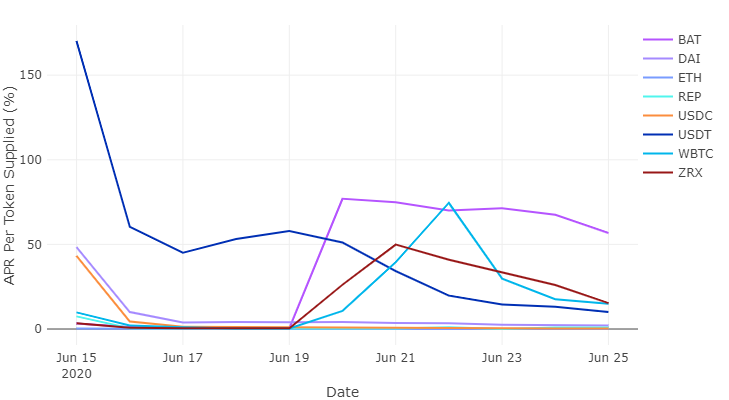

The following chart shows that at first most of the COMP coins were distributed among users of the Tether USDT stablecoin, and then among Dai holders.

Dynamics of changes in annual interest rates forvarious DeFi tokens for the period from June 15 to 25. At first, the ultrahigh USDT indicator fell significantly, but still remains at double-digit levels:

One of the reasons for the subsequent declineThe popularity and therefore the USDT rate could be due to the approved proposal of COMP holders to redirect 10% of the interest income generated by this stablecoin to a reserve fund.

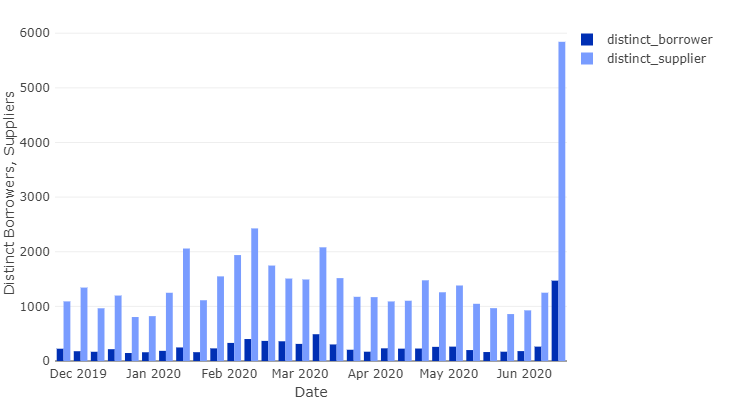

The revival of activity in the DeFi market was reflected in the number of its participants. The number of liquidity providers on the Compound service jumped by 200%, the number of borrowers by 238%.

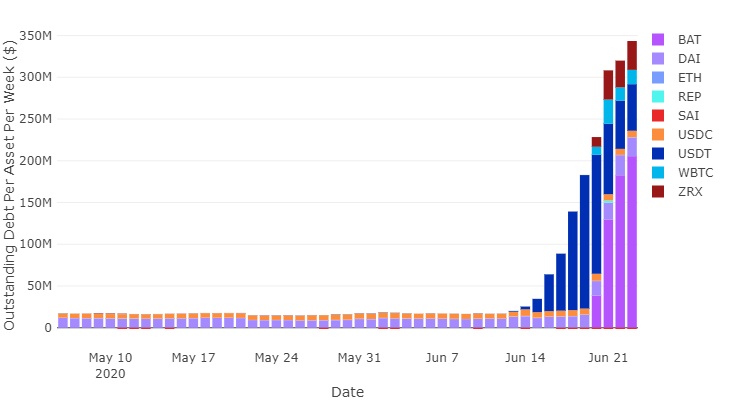

Compound's total outstanding debt since June 15 has grown by 470%, to $ 137 million. USDT accounts for over 80% of this indicator.

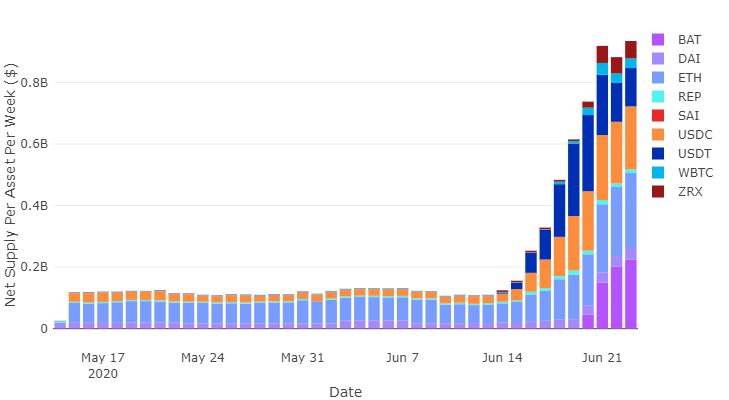

The volume of liquidity supply has grown along a similar trajectory:

Note that the shares of USDT, USDC and ETH in depositsusers are comparable among themselves - 35%, 26% and 28% respectively. Such a uniform distribution in this case is due to several factors: the USDT rate is the most attractive, ETH is the most popular asset among DeFi platforms. In turn, USDC stablecoin may be the preferred security for risk-averse investors. So, by borrowing USDT against USDC security you can avoid the risk of liquidation.

It is possible that one of the token growth driversCompound could serve as the so-called “Coinbase effect”. The fact that the “hot” asset will appear on the leading American stock exchange became known almost immediately after the issue of COMP.

On June 23, immediately after the token began trading on Coinbase, a serious and unexpected price dump occurred for many.

COMP trades opened above $ 400, but soon the price was below $ 200. As of June 29, the coin is trading at $ 240.

Galois Capital experts suggested that one of the early investors could take advantage of the hype around COMP, which was growing rapidly in anticipation of the listing on Coinbase.

Analysts recorded 25 translations for 2000 COMPon exchange wallets against the background of the opening of trading. The company does not exclude that Bain Capital or Coinbase Ventures could be behind them. Coins could be transferred for subsequent sale at a relatively high price.

Messari experts are confident that the effect of the listingdigital assets on Coinbase Pro are significantly overvalued. The company claims that news of listing on the exchange does not have a significant impact on the overall market trends of the selected cryptocurrencies.

According to observations by CoinMetrics researchers,many assets exhibit negative changes in market value within ten days of listing. Only a few coins rise in price by more than 5% over this period. The average effect is estimated by analysts at + 4% to the price.

Will COMP Hold Leadership?

The rapid rise of COMP is still presentedone of the brightest episodes of the still short history of decentralized finance. The success of the experiment is confirmed by the rapid growth of unique users, the dynamics of outstanding debt, interest rates and other key metrics.

The sharp growth of COMP’s capitalization is also impressive, which in a short time exceeded the figure of the Maker DAO project by almost five times. The latter reigned supreme in the DeFi market until recently.

It’s difficult to outline future medium- andlong-term prospects of Compound. For the further development of the project, not only the growth of outstanding debt is required, but also a more or less equitable distribution of COMP. The decentralized nature of project management, potentially reducing regulatory and other risks, depends on the last factor.

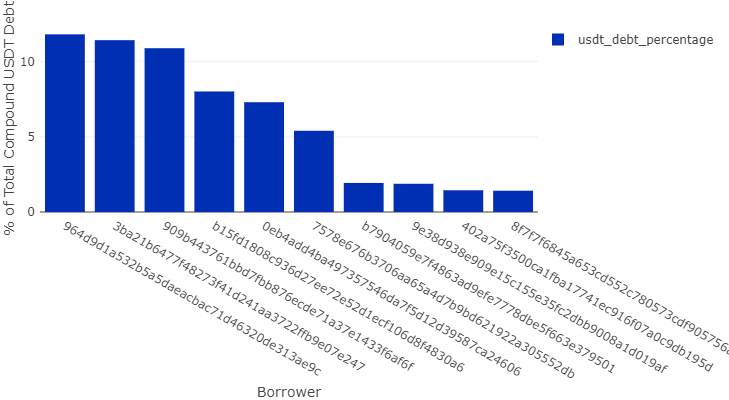

Equal distribution of “digital wealth” has never been the industry’s strength. Compound is no exception: the top 10 borrowers in the USDT market account for more than 60% of the debt in this stablecoin.

It can be assumed that competition between the protocols will increase, as Curve, Ren, Synthetix, Balancer, FutureSwap and other DeFi-projects implement similar Compound initiatives.

it means that liquidity will be smoothflow between different protocols, affecting interest rates. Consequently, the effect of the huge funds spent by Compound on attracting customers may soon be offset by arbitrage operations.

Liquidity inflow to the protocol to a large extentDepends on the market value of the COMP token. The higher the price of a coin, the more profitable it is for a user to interact with Compound, and vice versa. In other words, a change in market value is reflected in interest rates and the attractiveness of the service as a whole.

Nevertheless, the distribution of COMP tokens is a striking, exciting experiment. It can serve as a sort of standard for the distribution of DeFi governance tokens.

The successful implementation of such programs by various projects can attract funds from traditional market participants who are unfamiliar with cryptocurrencies and are “tired” of low interest rates.

</p>Rate this publication