We need to move NFTs onto the layer 2 ecosystem to cut fees. However, doing that *right* requires good cross-rollup portability standards, so the ecosystem can avoid getting locked into oneparticular L2.

I make a cross-rollup portability proposal here: https: //t.co/eKRQFSjjUh

— vitalik.eth (@VitalikButerin) September 8, 2021

@VitalikButerin:We need to migrate NFT to a second tier ecosystem to lower fees on the main blockchain. To do this * correctly *, however, requires good cross-accumulation portability standards so that the ecosystem can avoid blocking in one particular L2.

Many are familiar with the recent rise in popularity of NFT, with digital images of rocks and pixelated characters selling for millions of dollars. A bubble, a quirk, or the start of something much bigger?

We cannot know this, how we are not going toto discuss the validity of NFT as an investment (read: speculation), rather, we are going to dive into the comparison of Bitcoin and Ether as a money settlement network, as Ethereum proponents increasingly tried to represent it as "ultrasonic money".

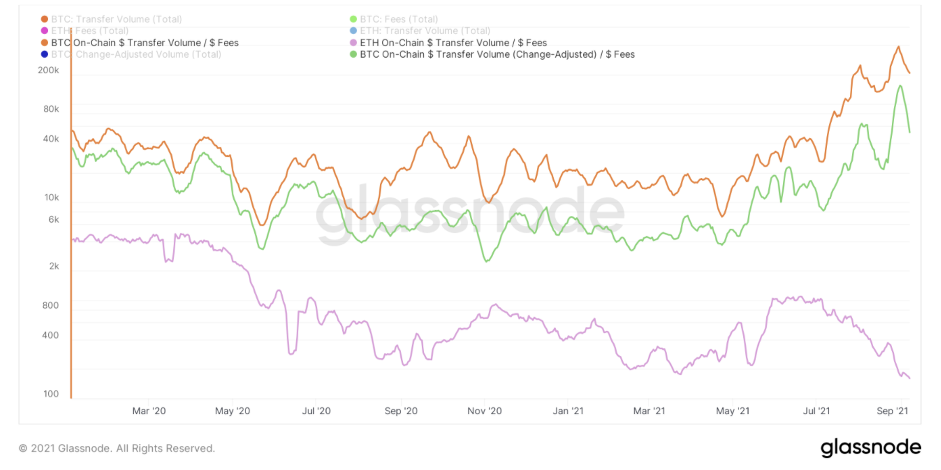

Let's take a look at various metrics comparing the volume and efficiency of calculations at the base level of the Bitcoin and Ethereum networks.

The first thing to distinguish is the difference between the volume of transfers and the volume of transfers adjusted for change.

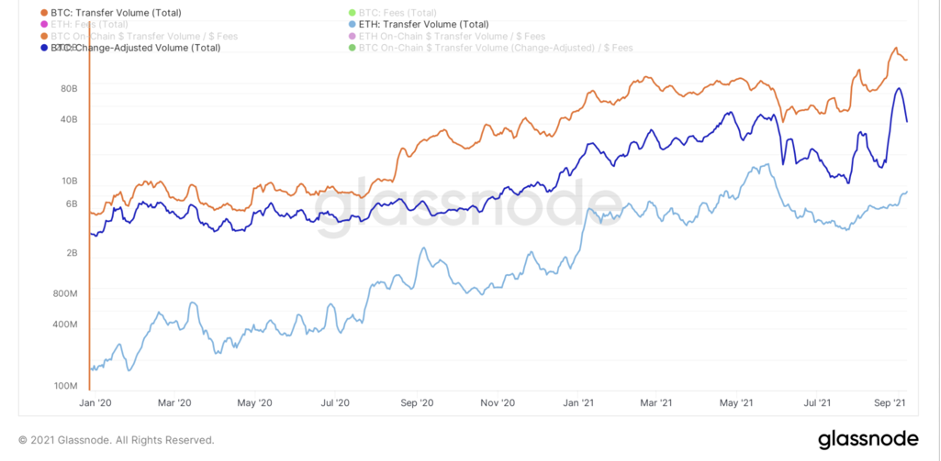

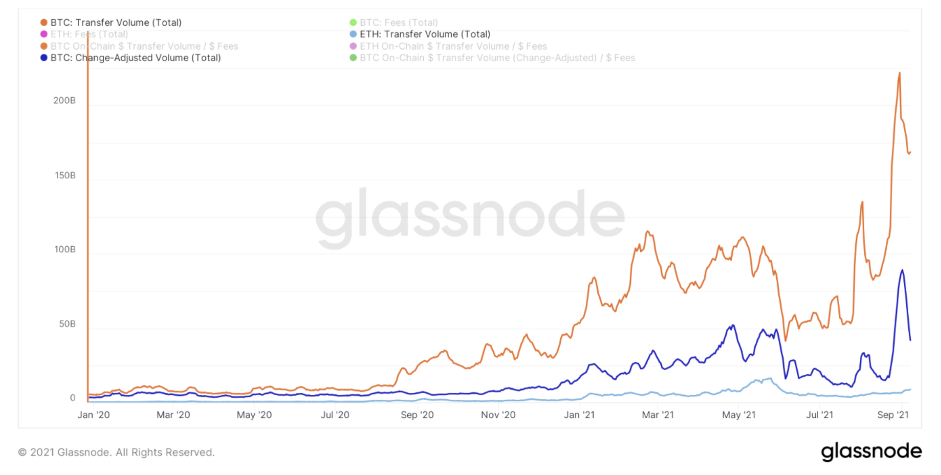

If we look at the total volume of transfers in the basic layer of the Bitcoin and Ethereum networks, then the average weekly transfer volumes are as follows:

- BTC: $ 168.5 billion

- BTC (adjusted for change): $ 41.8 billion

- ETH: $ 8.7 billion

Below are the graphs in both linear and logarithmic scales:

Total volume of transfers BTC vs ETH, $

Total volume of transfers BTC vs ETH, $

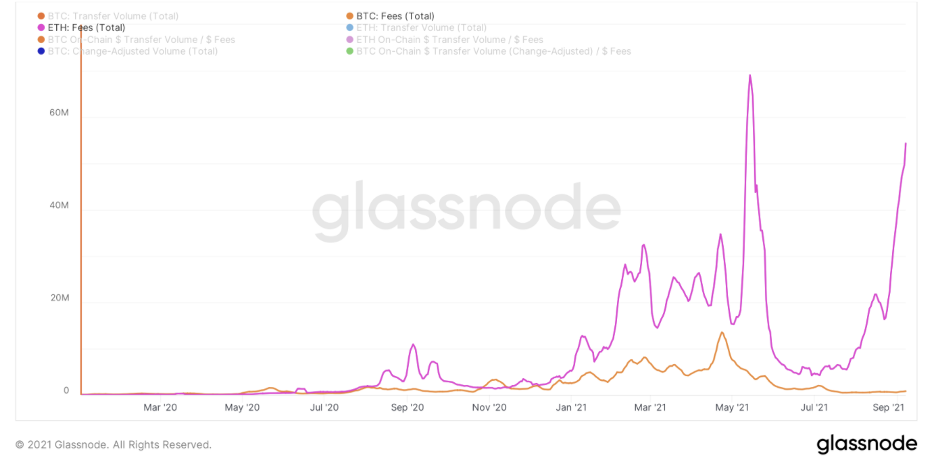

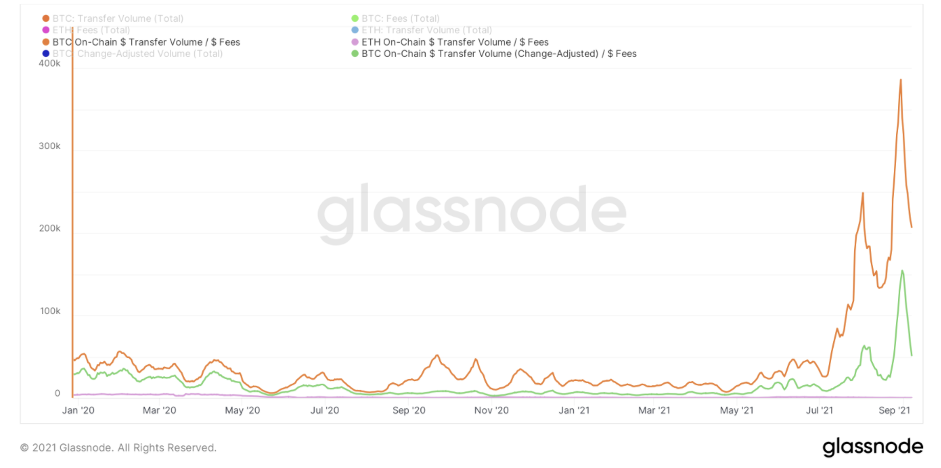

Here's a comparison of the baseline average daily fees of both blockchains over the past week:

- BTC: $ 0.8 million

- ETH: $ 54.3 million

Total daily commissions BTC vs ETH

Total daily commissions BTC vs ETH

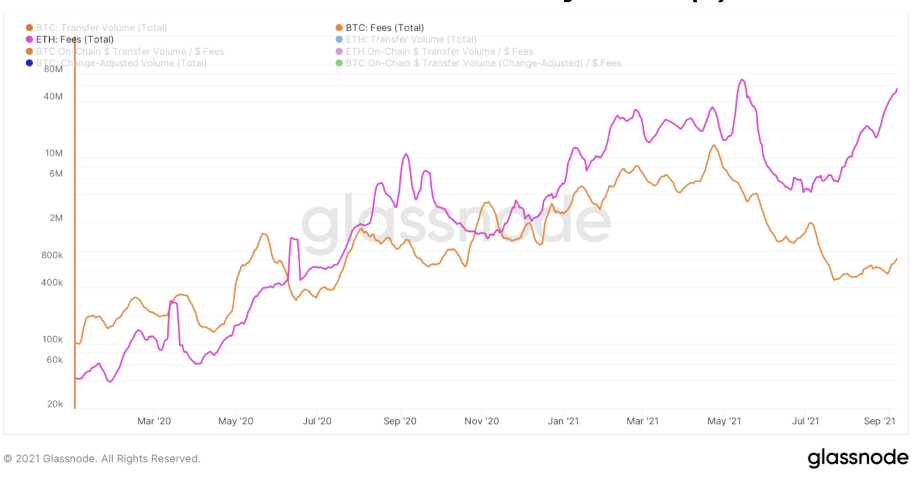

When comparing the settlement efficiency (total daily cost of transfers divided by daily fees) of the two blockchains, the comparison couldn't be clearer.

The purpose of Bitcoin is to preserve capital andensuring mutual settlements. It is the world's first and only advanced cash settlement network and is actively expanding to serve the entire globe.

Below is a comparison of the mutual settlement efficiency (total daily cost of transfers divided by daily fees) between the two blockchains:

- BTC: 206.989;

- BTC (adjusted for change): 51.428;

- ETH: 160.

Comparison of the efficiency of mutual settlements BTC and ETH

Comparison of the efficiency of mutual settlements BTC and ETH

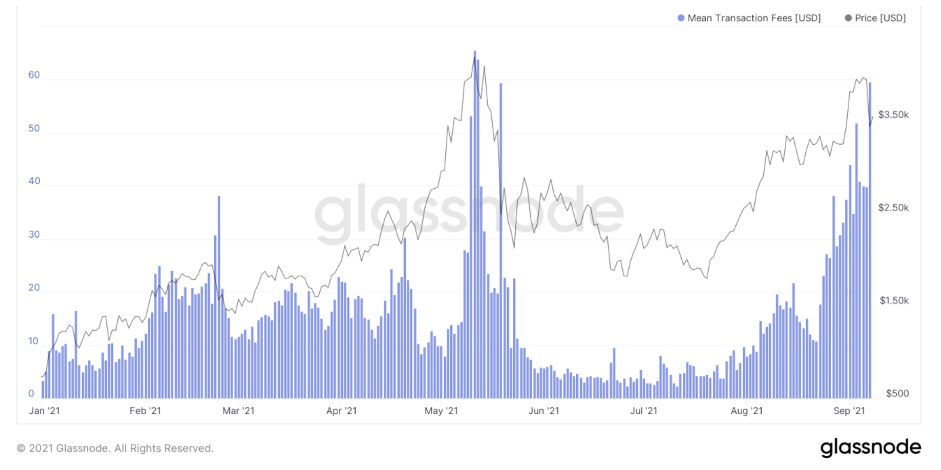

The gist of this argument is that,when someone tries to claim that Ethereum is "ultrasonic" money, they in fact lose sight of the fact that with ETH, which by its very nature can do so many different things at the basic level of the protocol (ICO, DAAP, DeFi, NFT, etc. etc.), transactions on the network become extremely costly, which ultimately leads to a decrease in the cost of less profitable use cases of the protocol.

Given the fact that the most valuable use of blockchain is money, you find yourself in a highly inefficient money network that is trying to be used for other purposes.

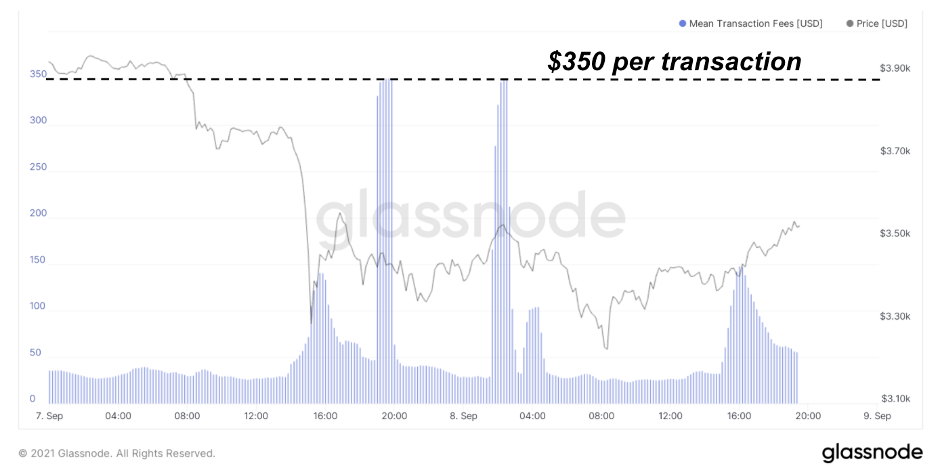

As an example, let's look at the fees fortransactions on the Ethereum network during the recent market decline. In the midst of the decline, the average transaction fees on the Ethereum network reached $ 350 per transaction as demand for the blockchain skyrocketed. This means that during a peak market crisis, if for any reason you need to change the value (i.e., to provide a higher level or enter / exit from this market), you will have to pay an average of $ 350 for this.

Average transaction fee on the ETH network

Average transaction fee on the ETH network

BitNewsdisclaim liability for anyinvestment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

</p>