Article Reading Time:

2 minutes.

Specialists from the research agency CoinShares note that against the backdrop of capital outflow from Bitcoin funds, the influx of money into Ethereum has been growing for the third week.

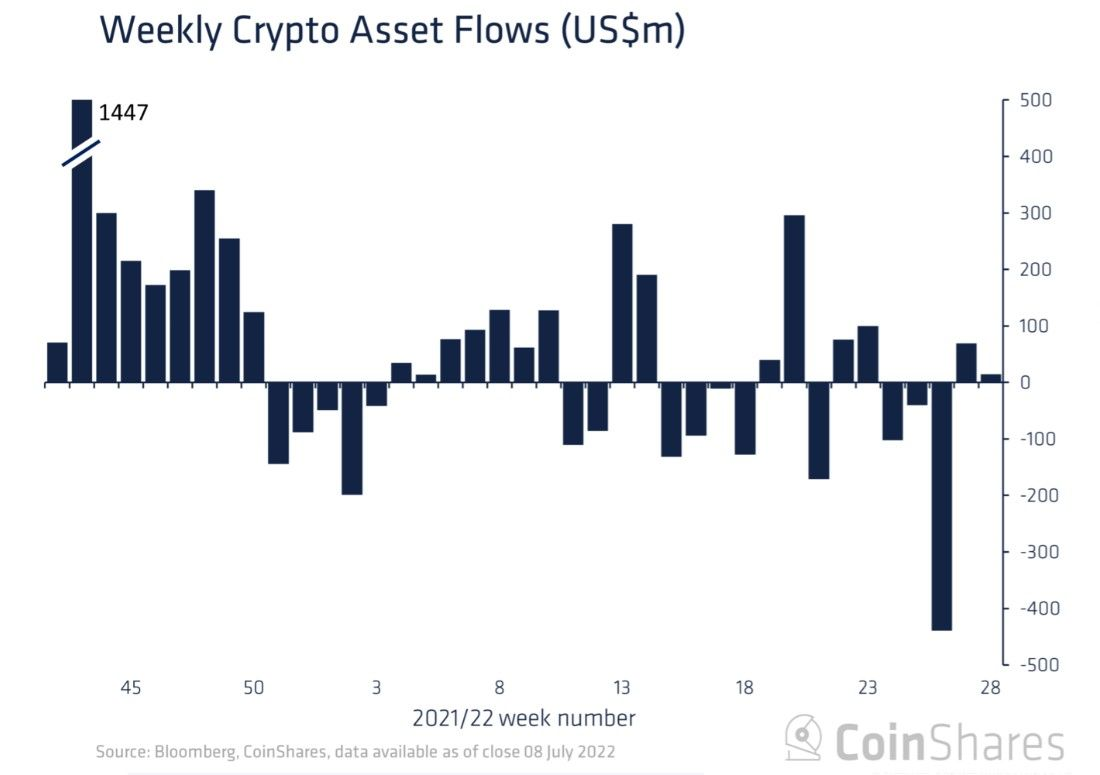

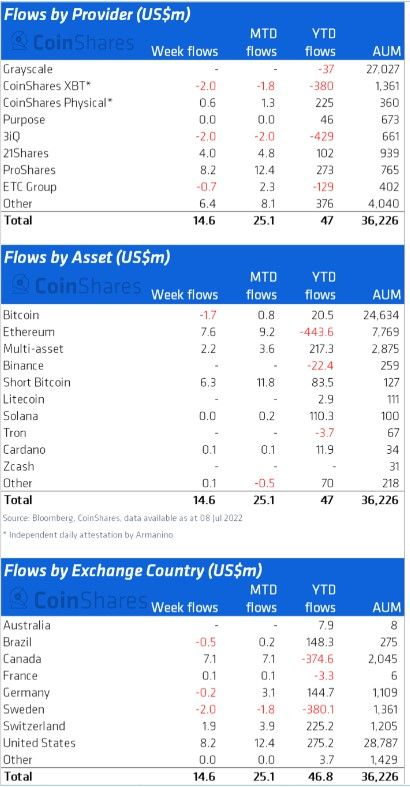

The CoinShares report states thatThe crypto market has seen an influx of investment in digital assets of $15 million over the past week. Total assets under management (AuM) have recovered from a year and a half low to $36.2 billion. US exchanges received an influx of $8.2 million, with 76% being short positions. In Canada, the inflow amounted to $7.1 million, and in Switzerland – $1.9 million.

The report's authors note that Bitcoin has collidedwith minor capital outflows totaling $1.7 million, while BTC short inflows totaled $6.3 million. However, short inflows are beginning to cool, while the recent rise in Bitcoin prices has seen AuM decline from its peak level of $140 million to 127 million.

Experts note that this is already the thirdThere has been an influx into Ethereum funds for a week in a row. Capital invested in ETH funds totaled $7.6 million last week. The report notes a moderate turnaround in sentiment after 11 straight weeks of outflows that saw ETH outflows peak at $460 million in 2022. The current improvement in sentiment may be due to the increasing likelihood of Ethereum switching from proof of work (PoW) to proof of ownership (PoS), which should occur before the end of this year.

The report states that investmentmulti-asset products saw minor inflows totaling $2.2 million, while the broader altcoin market has remained surprisingly inactive this month with minor outflows totaling $0.3 million.

MicroStrategy CEO MichaelMichael Saylor recently stated that having a cryptocurrency issuer makes it possible to change the blockchain, so Ethereum cannot be considered a commodity - unlike Bitcoin, which cannot be changed. This means that ether is a security that in the future will be strictly regulated by supervisory authorities.