Article Reading Time:

2 minutes.

Management company analystsCoinShares states that the withdrawal of funds from financial products by institutional investors is associated with the “expectation of dire monetary policy” from the US Federal Reserve.

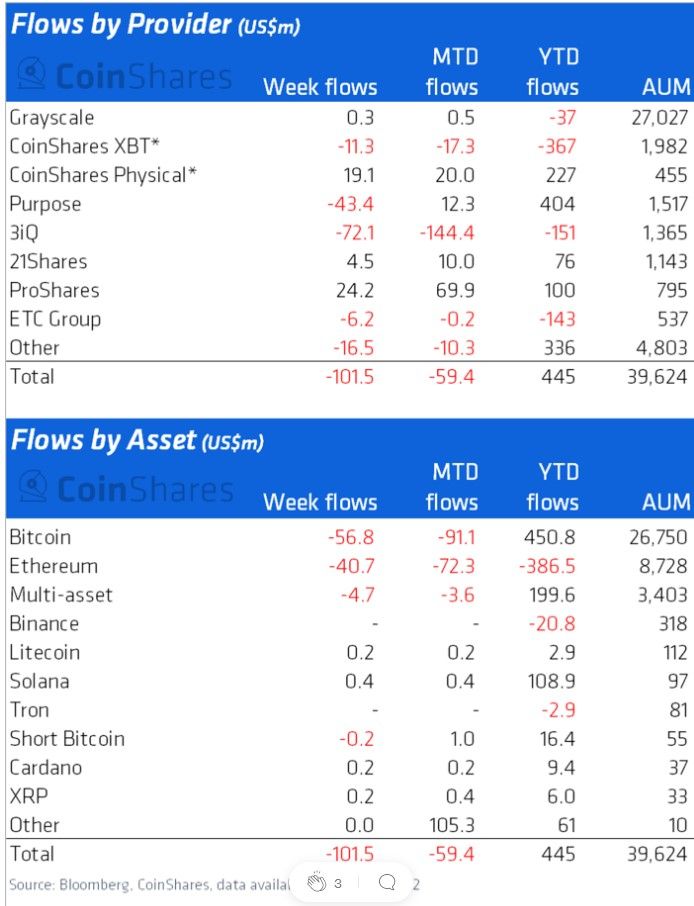

In the week from June 6 to June 10, institutional investors withdrew $101.5 million from cryptocurrency funds, they reported

CoinShares analysts.

Inflation in the US has reached 8.6% per year, such an indicator has not been recorded since 1981. Therefore, most financial experts expect base rates to increase. Against this background, investors are withdrawing funds from risky assets.

According to CoinShares from investment$56.8 million of products were transferred to Bitcoin. Ether was in second place in terms of outflow - $40.7 million from funds. An outflow was also recorded in multi-currency funds, which lost $4.7 million. Other investment products showed a positive balance at the end of the week, but the inflow of funds was very small.

The company that lost the most was 3iQ - from itsfunds withdrew $72.1 million, which is about 5% of the total investment. Also, $43.4 million was withdrawn from the Purpose Bitcoin futures ETF. Funds were lost from ETC and CoinShares XBT products. And Grayscale reported an influx of $300 000. ProShares funds received the most funds ($24.2 million).

“Bitcoin’s rate has declined over the past sixmonths, in fact, means a new crypto winter, which can be explained as a direct consequence of the increasingly hawkish rhetoric of representatives of the US Federal Reserve System,” according to CoinShares analysts.

A week earlier, the total inflow of funds into cryptocurrency investment funds amounted to $100 million.