Article Reading Time:

1 min.

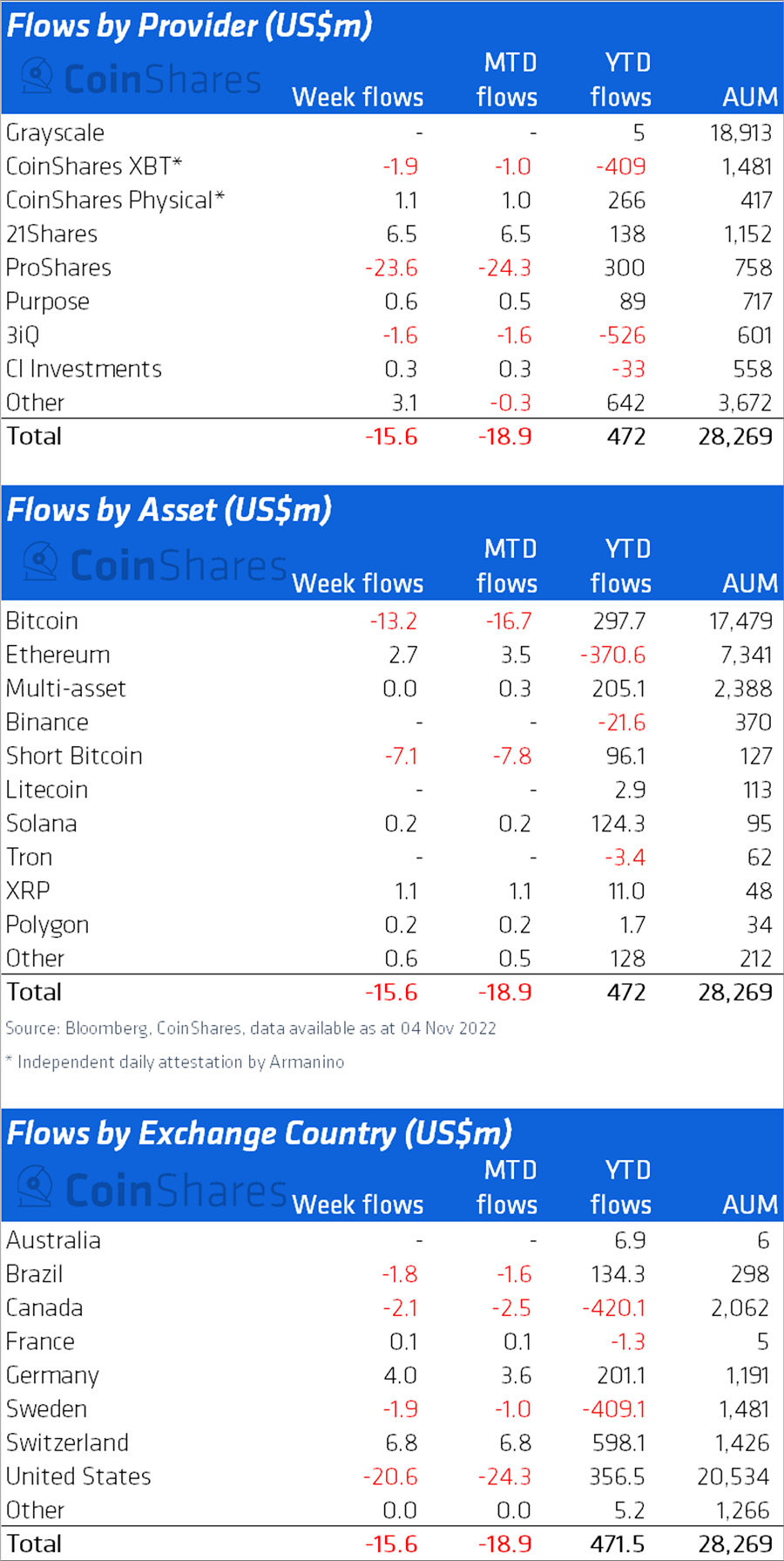

This week, institutional investors actively withdrew funds from investment products to Bitcoin. Prior to this, the funds showed a positive balance for seven weeks in a row.

Last week, from October 31 to November 4,Investors withdrew $13 million from investment trusts for Bitcoin. One of the reasons was the decision of the Federal Open Market Committee of the US Federal Reserve, which increased the base rate by 75 points. If just a few weeks ago funds for short Bitcoin attracted investors, over the past few seven days, 22% of the capitalization was withdrawn from such products.

Overall over the past week, investorsThey withdrew $15.6 million from Bitcoin assets. They withdrew $13.2 million from funds for Bitcoin, and $7.1 million from funds for the fall of Bitcoin. The remaining instruments showed an influx of funds or remained at the same level (multi-currency funds). The leaders were instruments for investing in ETH - they attracted $2.7 million. Instruments on XRP also performed well - investors' faith in the successful resolution of the dispute between Ripple and the SEC regulator added $1.1 million to these funds.

If you look by country, the largest outflowshowed the USA ($20.6 million). Investors from Switzerland continue to invest in cryptocurrency funds - over the week the figure amounted to $6.8 million, and since the beginning of the year the influx of funds has reached $598.1 million, and this is the best result.

Earlier, Messari analysts reported that venture investments in the cryptocurrency sector fell by 74% over the year.