Article Reading Time:

2 minutes.

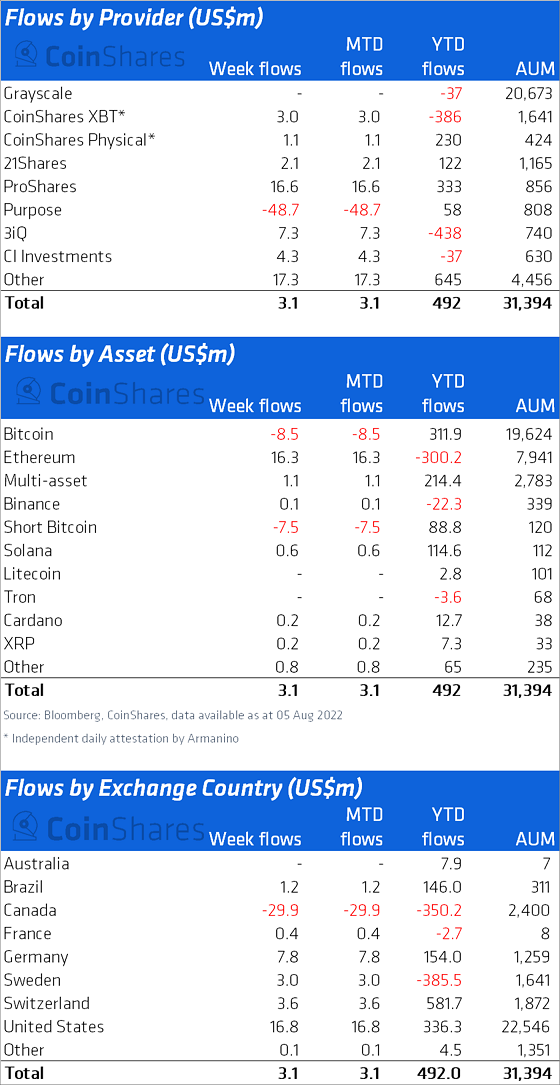

Last week was the sixth week in a rowpositive inflows into cryptocurrency funds for institutional investors, with ETH funds recording their seventh week of positive balances.

As CoinShares analysts noted, interestinstitutional investors' interest in ether is understandable - many expect the growth of the second cryptocurrency before the transition of the Ethereum network to the Proof-of-Stake algorithm. During the week, $16.3 million was invested in ETH products. But $8.5 million was withdrawn from Bitcoin funds, and an outflow was also recorded from BTC fall funds, which lost $7.5 million out of a total capitalization of $128 million.

</p>Trusts for other cryptocurrencies or notrecorded changes or reported a slight increase in capitalization. In general, the week from August 1 to August 5 was not very successful for cryptocurrency funds - the total influx of funds amounted to only $3 million. However, during the six “positive” weeks, the capitalization of such products increased by $529 million.

As for company statistics, outflowOnly Purpose recorded funds, from whose products $48.7 million were withdrawn. The rest reported a positive balance at the end of the week, while the capitalization of ProShares funds increased by $16.6 million. The situation is similar across countries - an outflow of funds was recorded only in Canada.

CoinShares analysts noted that for II32 new investment products were launched in the first quarter of this year. This is the second highest figure after the fourth quarter of 2021, when 33 cryptocurrency funds for institutional investors appeared. At the same time, the trading volume amounted to $1.1 billion, which is significantly lower than the average since the beginning of the year of $2.4 billion. However, analysts believe that this may also be due to the seasonal factor.

Let us recall that last week the influx of funds into cryptocurrency investment products amounted to $81 million.

</p>