Cryptocurrency market data aggregators are perhaps the most popular tools for everyday analytics.among investors. With their help, you can quickly find out information about the state of the market, prices and capitalization of assets, trading volumes on exchanges, coins and trading pairs represented on them.

The functionality of such services over timethe methodology for calculating various indicators is expanding and improving. Therefore, despite the seemingly identical capabilities, there are significant differences between such analytical resources.

ForkLog magazine compared the market-leading CoinMarketCap service with its main competitor CoinGecko.

Popularity

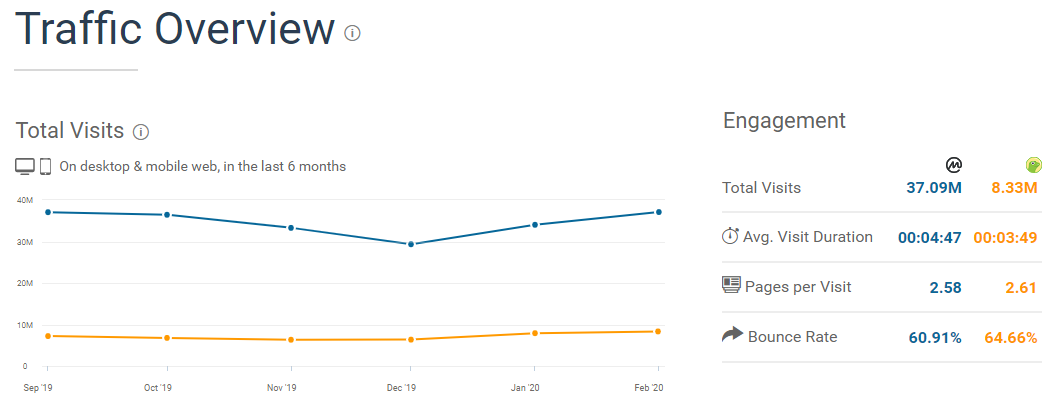

Let's start a comparative analysis of services with theirpopularity among users. According to SimilarWeb, in February, 37 million visits were made at CoinMarketCap (CMC), with CoinGecko this figure is 8.33 million.

Both services have in the last few monthsthere is a tendency to increase traffic. However, CoinGecko this trend is not so pronounced, and the number of visits so far is 4.4 times less than that of the main competitor.

In the comparative report below you can see the dynamics of attendance of CoinGecko and CMC from March 2019 to February 2020 inclusive.

Website Analysis & Insights.april 2020 (1) by ForkLog on Scribd

According to some reports, CoinMarketCap, the largest analytics service in terms of attendance, is about to acquire the most popular Binance exchange today.

If the deal takes place, it will become one oflargest in the industry. It is possible that this takeover will create a powerful synergistic effect and CoinMarketCap traffic will grow even more. Also, perhaps, the development of the service will come to life thanks to the considerable financial resources of Binance.

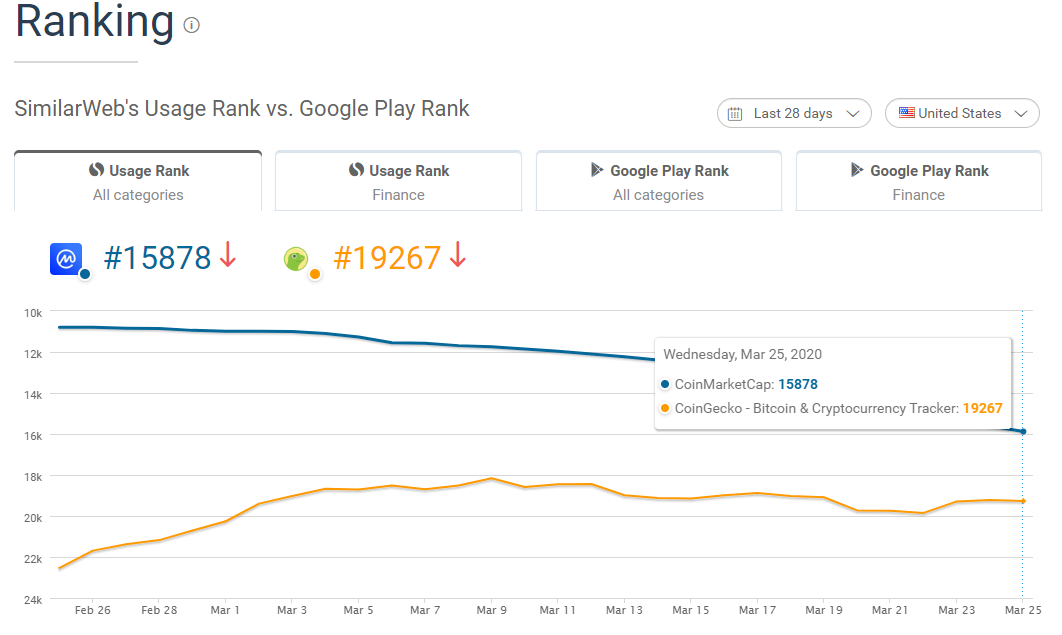

The situation is different with applications - today CMC is slightly inferior to CoinGecko:

Perhaps this is due to the fact that the application from CoinMarketCap appeared relatively recently - in April 2019, and from CoinGecko - almost a year earlier.

CoinGecko app rating on Google Play - 4.7; CoinMarketCap has 4.3.

Note that there are other services, in many respectssimilar to CoinGecko and CMC. These are, for example, Coincap.io, Coinpaprika.com, Cryptocompare.com and Livecoinwatch.com. However, their attendance and, therefore, popularity is several times lower than among the leaders of the segment.

Crypto Asset Ratings

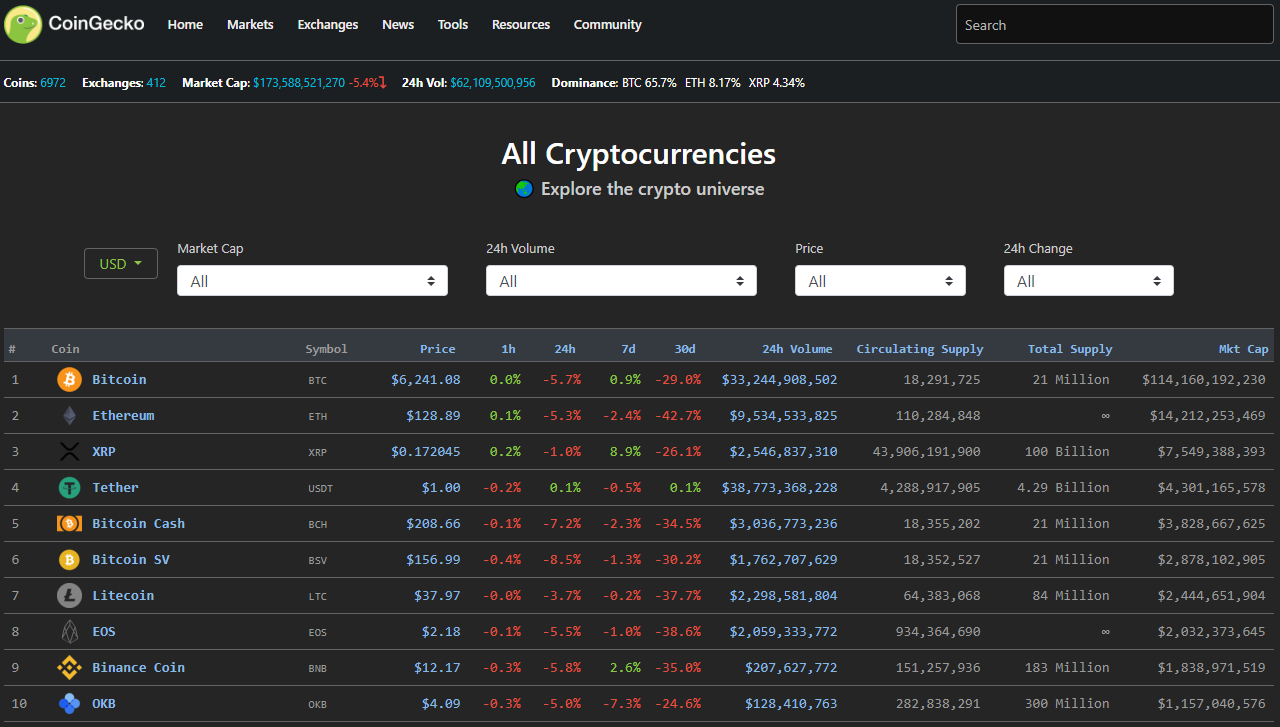

The page with the crypto assets rating by market capitalization at CoinGecko looks like this:

The top ten top assets on the CoinGecko service with the “night mode” turned on. Data as of 03/28/2020.

As you can see in the screenshot, there are filters on the pageto sort assets by various criteria. Conveniently, a stock ticker is displayed opposite each asset and the trading volume is shown not only for the last day, but also for an hour, 7 and 30 days. There is also a Total Supply column - the total supply volume (not to be confused with Circulating Supply, which means the number of coins already released on the market).

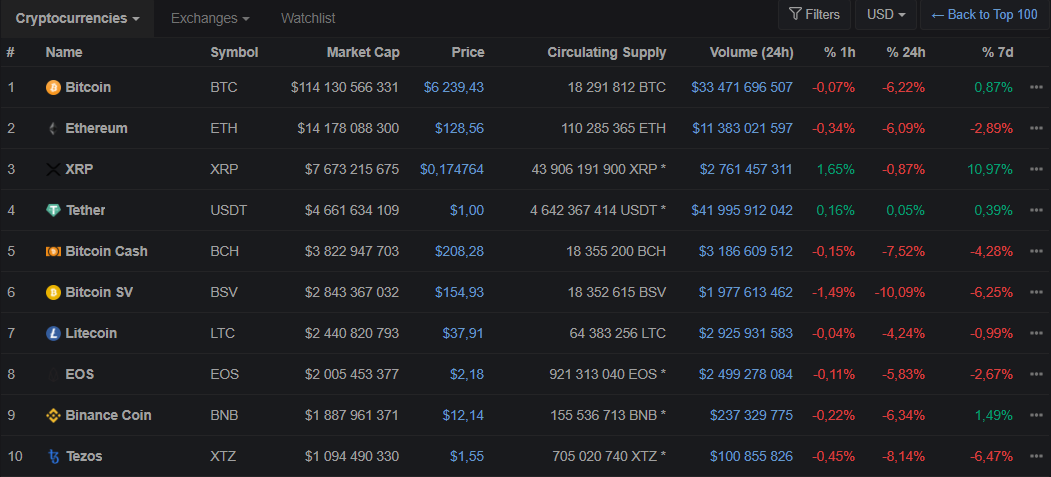

At CoinMarketCap this section looks a little different - by default the trading volume is shown only for the last 24 hours. However, this and other fields open in Full List mode.

Rating of largest assets by market capitalization from CoinMarketCap in Full List mode. Data as of 03/28/2020.

You can see that CoinGecko has the top tencloses the OKB token of the OKEx exchange. In this case, CoinMarketCap in 10th place - Tezos. Probably, on one of the services the Circulating Supply parameter is incorrectly set.

Exchange ratings on trading volumes and liquidity

The problem of reliable display of exchange trading volumes has not yet been 100% solved, despite the efforts made by many services.

Data from various resources is often very different. For example, little-known exchanges may appear in the top ratings, the traffic on which is completely incomparable with the daily turnover.

CoinMarketCap has a section with a rating of exchanges in three versions:

- Top 100 By Adjusted Volume - Spot Volumesexchanges where there is no commission-free trading and the trans-fee (Trade-to-Mine) mining model, which involves the issuance of its own token to reward traders for activity;

- Top 100 By Reported Volume - volumes from all spot exchanges, regardless of the trading models used;

- By Liquidity - rating of exchanges by their liquidity.

The Top 100 By Adjusted Volume section as of March 28 looks like this:

As you can see, the top are mostly little-known trading floors. The popular Binance exchange in this section is on the 16th line.

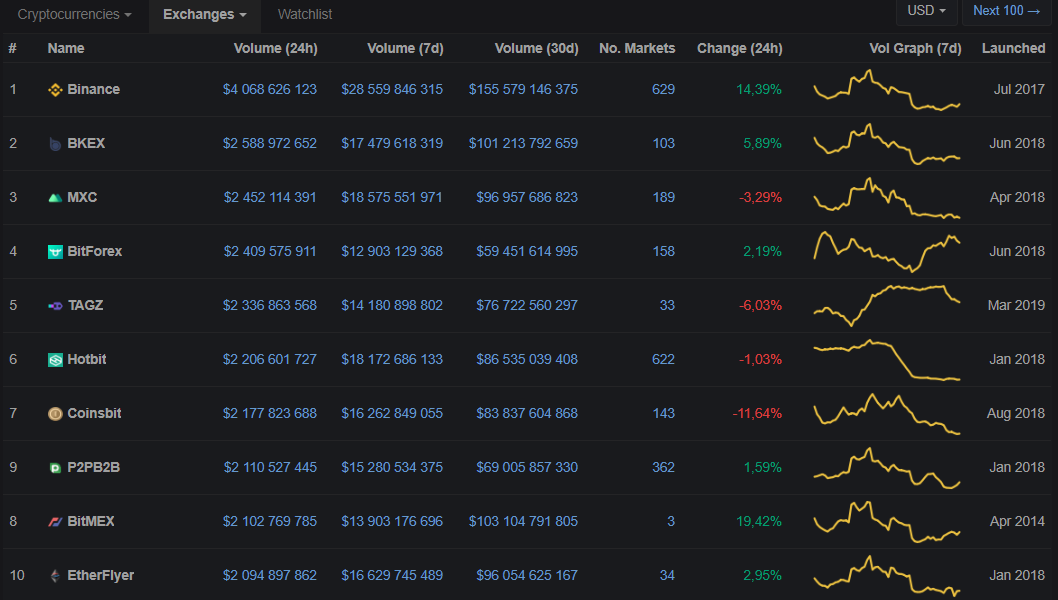

A slightly different picture in the Top 100 By Reported Volume section:

Binance, although at the head of the list, however, unknown to most market participants BKEX and MXC are fighting for the next two lines.

Liquidity rating of exchanges takes into accounta range of factors, such as the size of orders and the ratio to the average price of an asset. The price is fixed for each market pair at random intervals during the day, after which the average result is calculated in dollar terms.

According to Carilin Chan, CoinMarketCap Strategy Director, the liquidity parameter is most important for investors and traders. In the service support section, this metric is briefly characterized as follows:

- the more liquid the market, the easier it is to buy and sell an asset;

— trading volume itself is an ineffective indicator of market liquidity due to the inflated trading volumes of some exchanges;

- Liquidity is a more suitable metric for identifying the most liquid markets for the assets that the user wishes to trade.

As of 03/28/2020, the rating of exchanges in this section of the CMC service looks like this:

As you can see, this list is already presented muchmore well-known exchanges operating on the market for several years. Therefore, it is possible that the liquidity section better reflects the true state of things than the above-mentioned indicators of trading volumes.

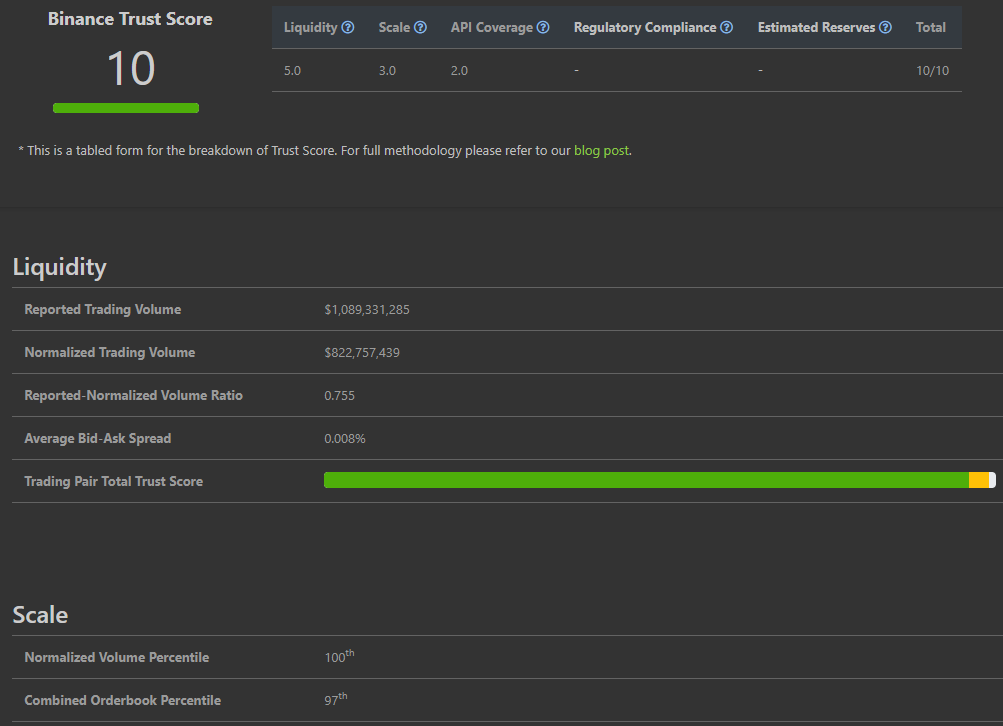

As for CoinGecko, in May 2019, the service introduced the so-called “Trust Score”, which shows the normalized trading volumes of cryptocurrency exchanges.

Trust score methodology involves comprehensivethe use of various techniques, including analysis of web traffic and order logs (spread between Bid and Ask prices, estimation of the volume of an order required for price movement by 2%), as well as Bitwise data on ten reliable exchanges.

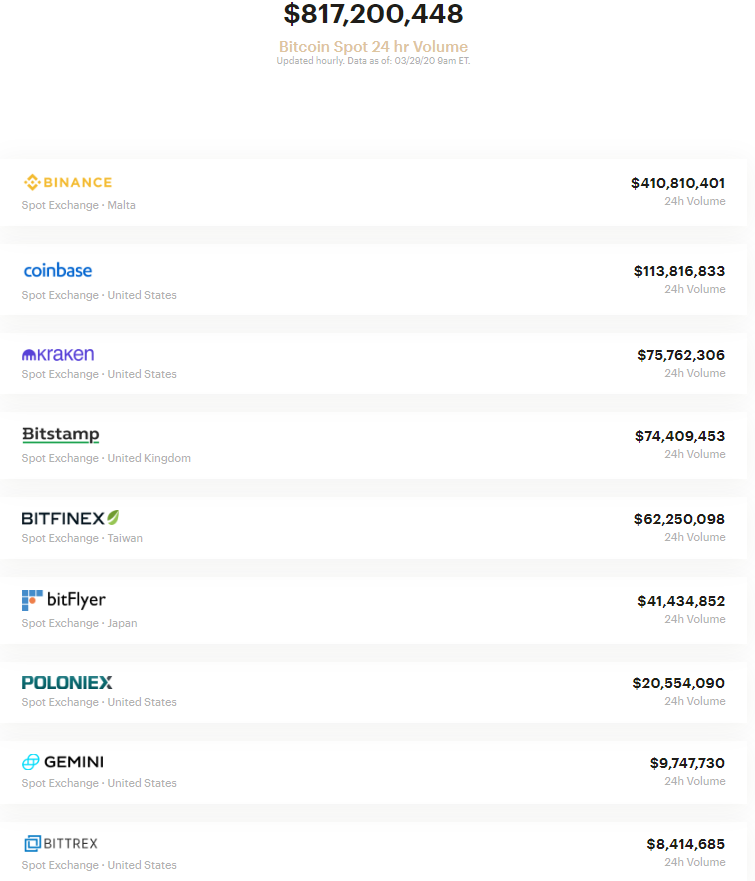

The rating of spot exchanges according to the Trust Score is as follows:

The top ten top exchanges according to CoinGecko. Data as of 03/29/2020.

As you can see, CoinGecko data is fundamentallydiffer from those presented on CoinMarketCap. The latter, by the way, is also trying to deal with fake trading volumes. For example, in May last year, CMC launched the “Accountability and Data Transparency Alliance” initiative, and in the fall introduced a new rating system for cryptocurrencies.

If you pay attention to the rating of trusted exchanges from Bitwise, it turns out that its data largely agree with the information on CoinGecko, significantly differing from CoinMarketCap:

CoinGecko does not have a separate section with the liquidity rating of exchanges, like CoinMarketCap. However, this metric can be viewed on each of the trading floors separately.

The screenshot below shows Binance liquidity data as of 03/29/2020:

On the same page you can also see how much the trading volume declared by the exchange differs from the normalized by the Trust Score methodology, as well as the average spread between Bid and Ask prices.

Data for individual coins

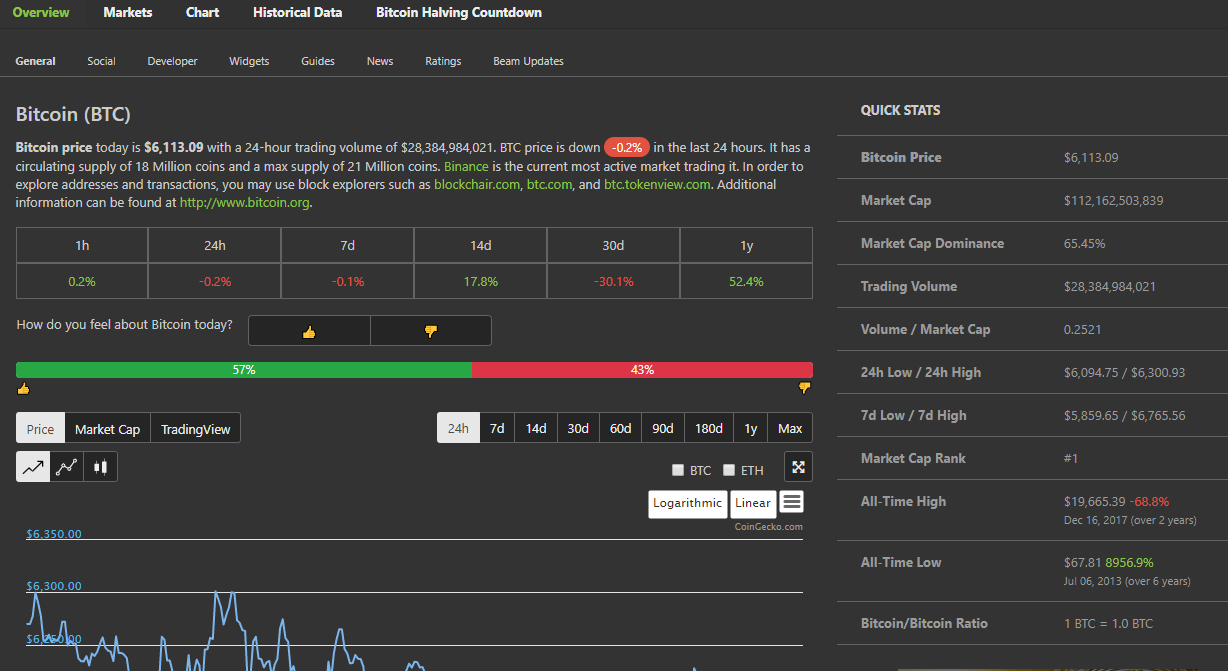

In the context of individual coins, the sets of these services also differ significantly. For example, this is how the Bitcoin details page on CoinMarketCap looks like:

Information about Bitcoin as of 03/20/2020

In addition to general information about the coin, trading volume andmarket offer, links to block browsers, source code, technical documentation, as well as graphics, you can see a list of trading pairs with BTC on various exchanges and historical data on price and capitalization.

For proponents of fundamental analysis, there is a section with on-chain indicators from IntoTheBlock and data from the rating system Fundamental Crypto Asset Score (FCAS) from startup Flipside Crypto.

The corresponding page of CoinGecko service is no less saturated with information.

In particular, there are:

- a general overview of the coin: basic information about the technology, market data, capitalization, dominance index, trading volume, price lows and highs over the past 24 hours;

— indicator of the ratio of trading volume and market capitalization;

— price dynamics over different periods of time;

— the opportunity to vote in which direction the price will go;

— the ability to select a candlestick chart from TradingView;

— on-chain indicators from IntoTheBlock;

— data on activity in social networks (on the Social tab);

— data on developer activity on GitHub (Developer tab);

— codes for widgets embedded on the site, links to reference materials, news aggregator;

— exchanges and trading pairs with this coin (Markets tab);

— timer until the next block reward halving.

The range of data provided by CoinGeckoslightly wider than on CMC. For example, there is a statistic of developer activity missing from the “older” service, data from social networks, a news aggregator and links to training materials.

Derivatives

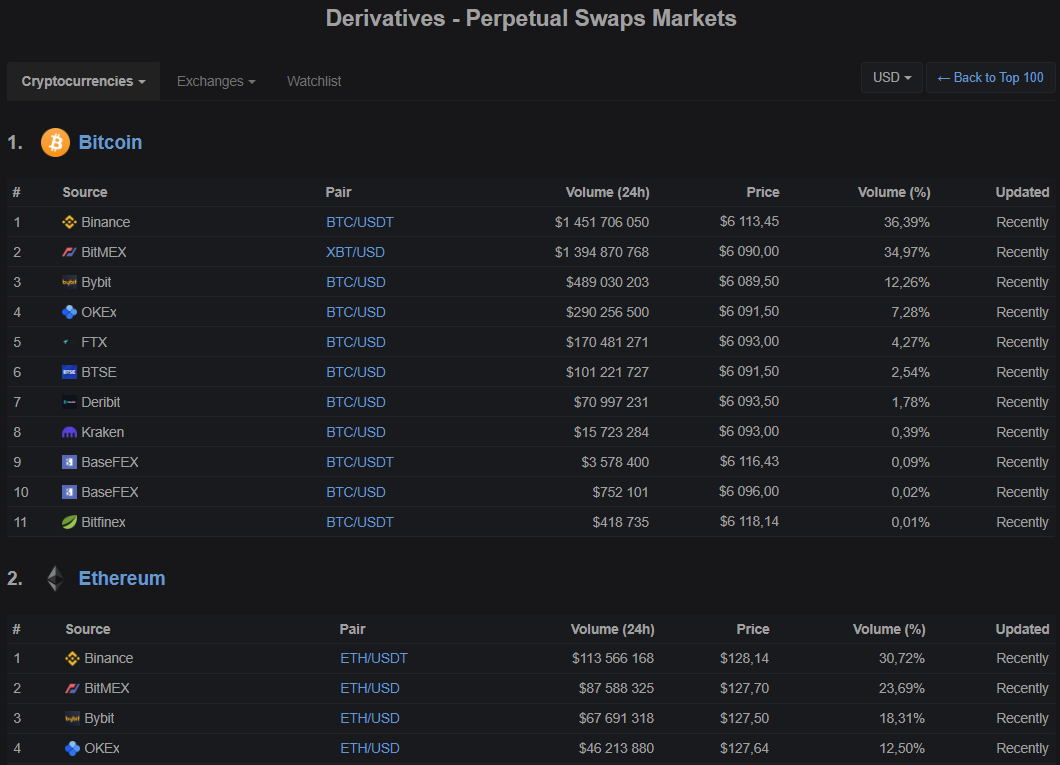

For CoinMarketCap, the corresponding page looks like this:

Data as of 03/29/2020

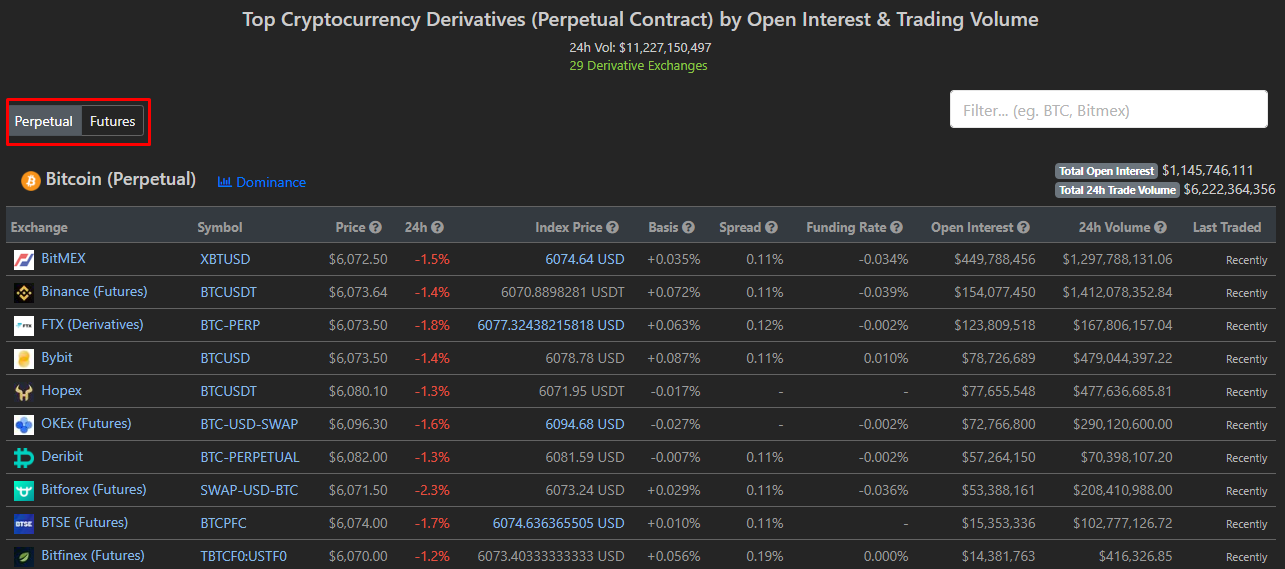

At CoinGecko this section is divided into two subsections - Products and Exchanges.

Products statistics on perpetual swaps and futures are presented, for each category separately:

On CoinGecko, you can switch between Perpetual (perpetual swap) and Futures (futures) modes.

In addition to standard metrics such as trading volume and price, the following indicators are presented in this section:

- change in the price of the contract for the last 24 hours;

— index price (based on data from several spot exchanges);

— basis (the difference between the spot price of the underlying asset and the futures price);

— spread between Bid and Ask prices;

— contract financing rate;

- open interest.

In this section, the data spectrum is much wider with CoinGecko.

Cryptocredit and decentralized finance

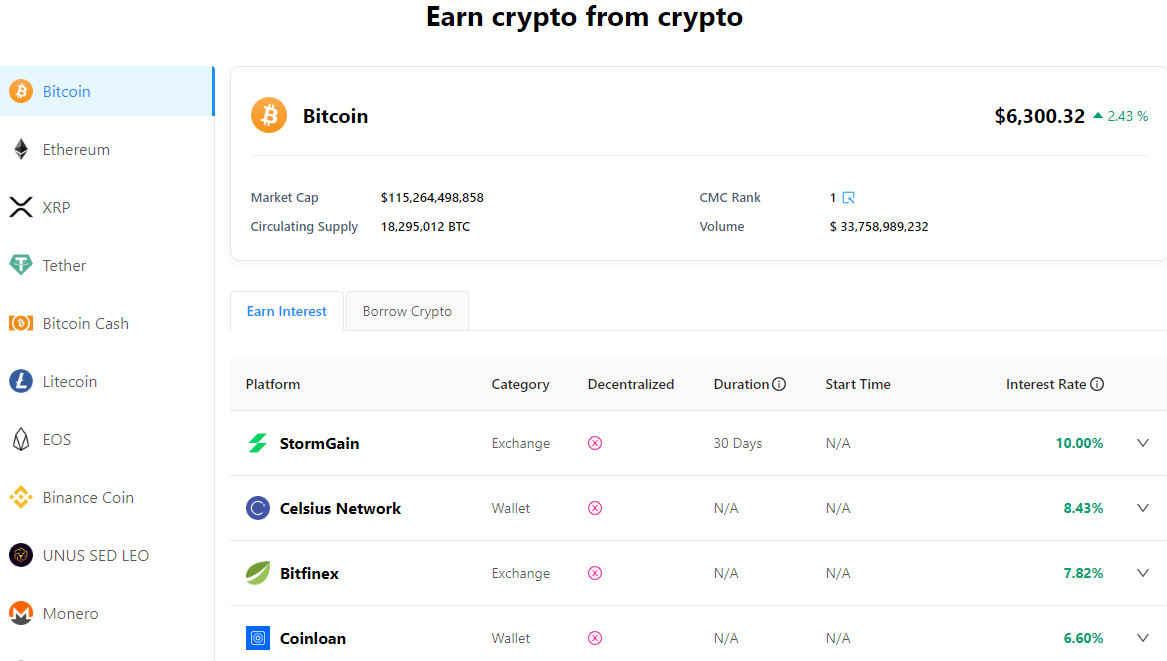

On CoinMarketCap you can see deposit and loan rates for various coins and services, both centralized and DeFi.

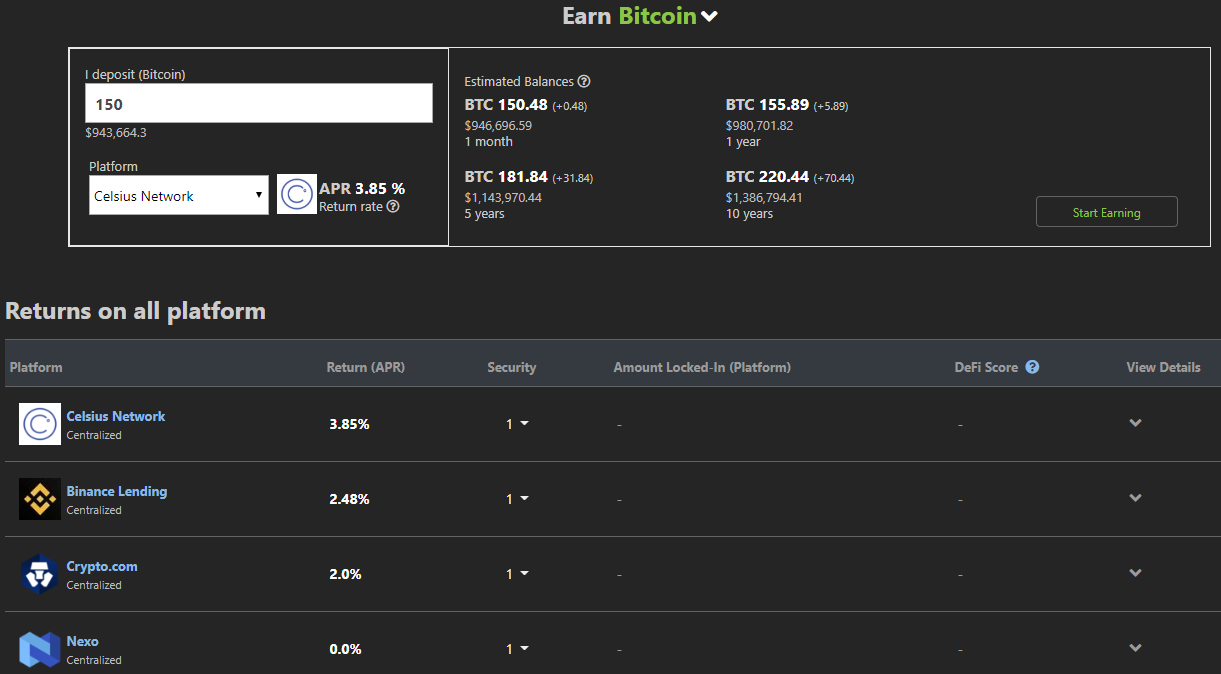

CoinGecko in the Earn section shows only deposit rates:

But there is a simple calculator showing the growth of the deposit for a month, a year, 5 and 10 years.

Other functions

An interesting CMC option is the ability to see the ratings of the top assets of past years. For example, on May 4, 2013, the first ten of the most capitalized crypto assets looked like this:

As you can see, a lot has changed since then. Only the leadership of Bitcoin remained unchanged.

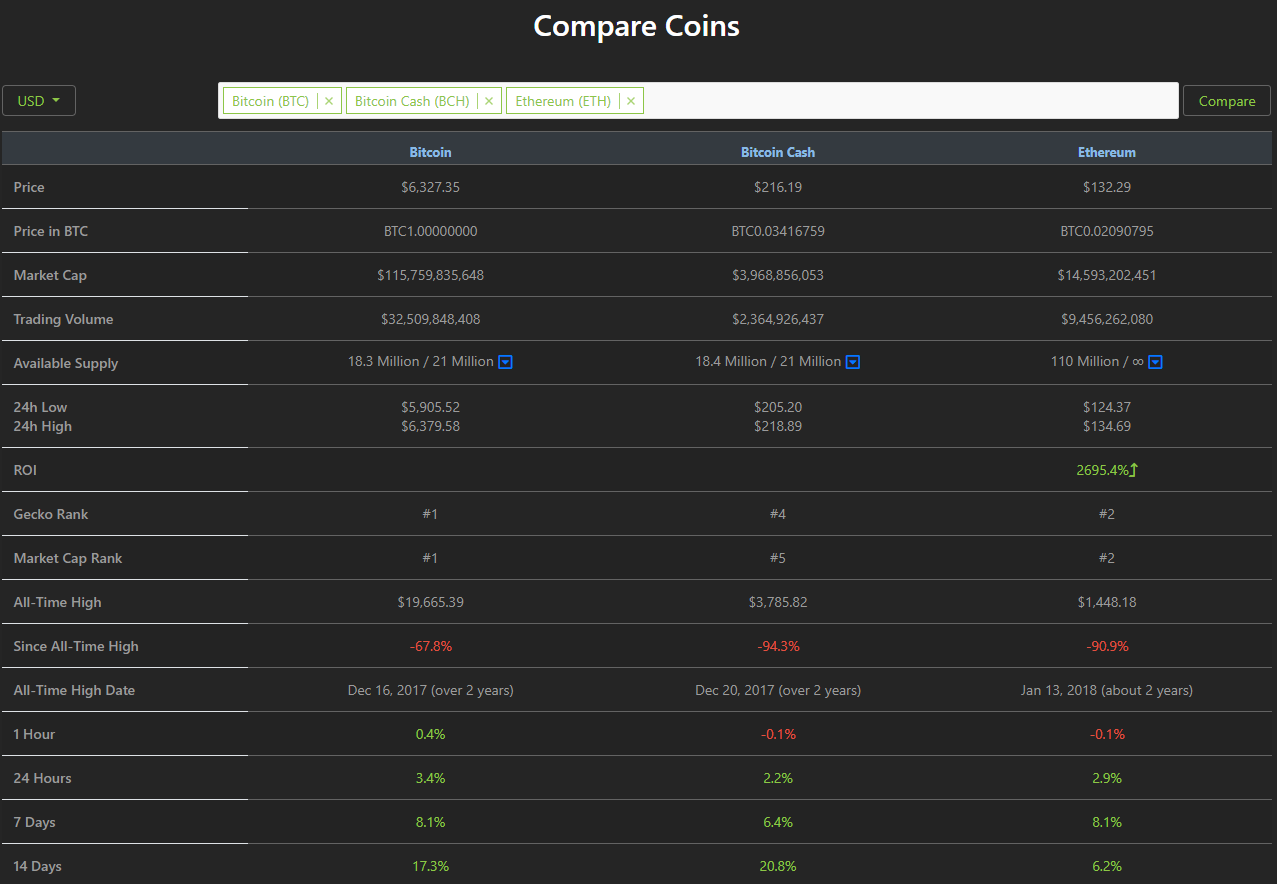

CoinGecko has a Compare section for comparing different coins.

For example, you can compare the prices of Bitcoin, Bitcoin Cash and Ethereum, their capitalization, the volume of the market supply of coins, the depth of the drawdown of asset prices in relation to the historical maximum, etc.

findings

Both services are good in their own way, each has advantages and disadvantages.

CoinMarketCap features a more minimalistic interface, but not so extensive functionality.

CoinGecko has more different sections and metrics, although it does not have, for example, a subsection with a list of lending rates and its analogue of Historical Snapshot, like CMC.

Nevertheless, both services deserve attention and can perfectly complement each other, benefiting investors.

Alexander Kondratyuk