You've probably heard about the pervasive influence of Bitcoin whales (BTC), but it turns out that in the cryptocurrency seamuch greater species diversity and all inhabitants of the deep sea affect the health of the sector. It's time to find out who you are.

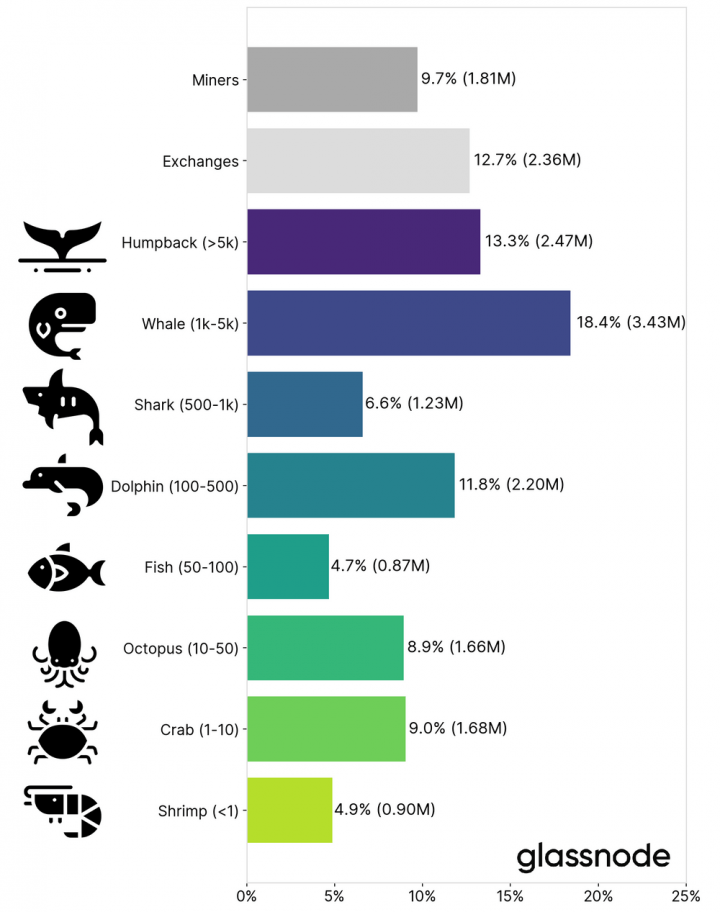

According to the classification of the cryptanalytic company Glassnode, users who own bitcoins can be grouped into several categories:

- If you have less than 1 BTC, sorry, then Glassnode experts say you are at the very bottom of the food chain. You are a humble shrimp.

- If you have between 1 and 10 bitcoins, you get claws and can be classified as a crab.

- The status of an eight-legged octopus gives from 10 to 50 BTC, but if you have 50 to 100 coins, you can consider yourself a fish.

- But to really move up the food chain, you need 100 to 500 bitcoins, and you are already a dolphin.

- Things get serious when you get into the 500-1000 range. This is where you officially become a Bitcoin shark.

- Above - only stars and whale status. But it turns out that even whales have a hierarchy. To truly reign supreme in the sea and consider yourself a humpback whale, you will need over 5,000 bitcoins.

If we talk about the lowest category of shrimp, then thisthe category owns less than 5% of the total share of BTC, while whales have almost a third of all mined coins. The humpback inhabitants of the deep sea control about 40% of this share.

Miners own almost a tenth of the coins, while cryptocurrency exchanges own 12.7%.

Glassnode also made another point - the number of whales has increased, which suggests that institutional investors are coming.

According to researchers, not 2% of accounts own 95% of all BTC in circulation (as is commonly believed), but about 71%. Accordingly, monopolization is high, but not catastrophically critical.

Where is it more profitable to buy bitcoin? TOP-5 crypto-exchanges

For the safe and convenient purchase of cryptocurrencies, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support the deposit and withdrawal of funds in rubles, hryvnias, dollars and euros.

The most reliable sites with the highest turnoverfunds, for several years the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto-exchange in the CIS as well, since it has the maximum trading volumes and supports transfers in rubles from Visa / MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site evaluation |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication