The pages of news sites are full of statements about the green light for the cryptocurrency market in China, the new “to themoon ”on Asian traction and Xi Jinping's“ revolutionary ”speech.

Are the gates of the Celestial Empire really now open to Bitcoin and what could a change in the direction of regulation entail for cryptocurrencies and the entire industry?

Chinese crypto-week

Over the past week in the Middle Kingdom there has been a wholea series of events that alarmed the cryptocommunity is no less than a ban on ICOs and the dispersal of Chinese exchanges in 2017. If until this moment you did not have the desire or time to study the news feed, then this is what happened:

- October 25 Xi Jinping (President of the People's Republic of China)officially spoke before the Politburo Committee, noting among other things that blockchain could provide an economic breakthrough in the country. The head of China called for identifying priority areas for the use of technology and allocating resources for the necessary research.

- On October 26, the government of the Celestial Empire accepts"Cryptography Law". The document is notable for the fact that it regulates not the economic, but the technical component of tokens and cryptocurrencies. In particular, it sets standards for hashing and access key management. It is interesting that the Law has been hanging at the National Assembly since May, and the fact that it was adopted the day after Jinping’s speech was a pure coincidence.

- October 28 Lu Lei - Deputy DirectorThe State Administration of Foreign Currency of the People's Republic of China made a statement that China intends to use blockchain to create a single channel for foreign investment and apply this technology in international payments.

- On October 30, the Central Bank issued certification standardshardware and software. Among other things, it mentions the Trusted Execution Environment technology used to create blockchains. The presence of standards allows the regulator to check the development of digital products (including those based on blockchain), at least in the financial industry. Developers must obtain a “Certification of Fintech Product” license and renew it every three years to operate legally.

In addition, on October 30, Guangzhou authorities approvedcreating a 1 billion yuan blockchain fund to support companies developing public and federal blockchains. Similar projects already exist in Shanghai and Beijing, major Chinese metropolitan areas.

The most interesting thing is that in developments supported by the fund, companies should not use cryptocurrencies.

Against this background, it is worth recalling the statementsThe Central Bank on the completion of work on the national cryptocurrency - the so-called. "crypto-yuan", which, according to experts, should appear in the near future. Apparently, the development of the currency is coming to an end, and the regulator has approved the legal framework for its development.

This explains the ban on usingcryptocurrencies in local projects and an unchanged position in relation to Bitcoin (the ban on trading and ICOs is still in effect). The place of these decentralized assets should be taken by a national controlled two-tier payment system “crypto-yuan”.

Hold the bulls

The reaction to Xi Jinping's speech was intense and almost immediate. On the day of the speech, the number of mentions of blockchain on WeChat increased by 329%, and the number of similar queries on Baidu increased by 1,382%.

Traders and investors also seem to have decidedthat the call for work on blockchain projects predicts a green light for cryptocurrencies in China in the near future. First, Bitcoin, and then a number of altcoins, showed growth.

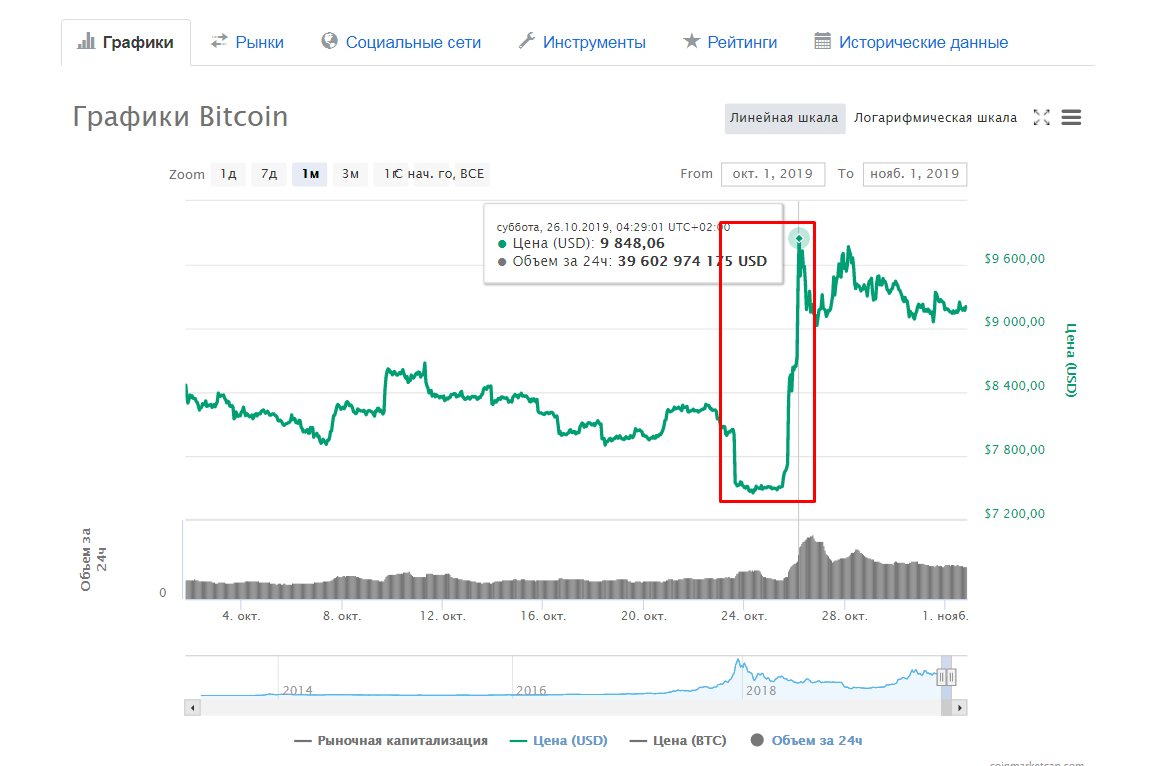

True, only coins grew among altos, soor otherwise associated with Chinese companies - NEO, TRON, Qtum, Ontology and several others. The first cryptocurrency, it generally demonstrated a rally of the scale of December 17th - for a day it grew by $ 2000:

Noticing such an active response from the market, the authoritiesThe Celestial Empire decided to hint to traders that they should not wait for a new “crypto paradise”. The local People’s Daily published a publication stating that government support for blockchain does not mean support for cryptocurrencies.

“The growth of the blockchain was accompanied by the development of cryptocurrencies, but technological innovations do not mean that we should speculate on virtual currencies,” the article says, among other things.

And everything would be fine, you never know what journalists write,But the People’s Daily is controlled by the Chinese Socialist Party, so the article can be considered, albeit indirectly, but a warning that no one is going to allow Bitcoin and other currencies into the already regulated Celestial Empire.

In addition, the country has enough of its own innovators.On October 27, the China Information Technology Development Center published a report according to which 700 companies operate in the Middle Kingdom, including 83 research organizations. These enterprises have introduced 151 blockchain solutions in 28 industries, including logistics, healthcare and financial services, in the last year alone.

The new legal framework does not open China up tointernational projects or cryptocurrencies, it should rather intensify, simplify (and bring under government control) the activities of Chinese companies.

Implications for Bitcoin and the industry

Although China does not approve of volatileand unregulated Bitcoin in their own country, no one prohibits mining it. Moreover, cheap electricity from the Sichuan hydroelectric power station creates favorable conditions for locating mining farms in this region.

So, on October 28, the local cell of the Socialist Party of the People's Republic of Chinaheld a meeting on the further development of the province, where it was noted that 70% of bitcoins are mined in Sichuan. If we add to this a Coinshare study, according to which more than half of the network’s mining capacity is located in the region, a disappointing conclusion emerges - the first cryptocurrency remains only formally decentralized. And if the Sichuan authorities continue to develop a mining-loyal policy, this trend will only intensify.

Yes, mining is a technical process and with its helpIt is difficult to control the spread of Bitcoin, but if the PRC feels a threat to the “crypto-Yuan” in Bitcoin, then it will be enough to issue one resolution for giant farms to repeat the fate of the exchanges of 2017. In this case, the network will normalize transaction processing by recalculating the hashrate complexity, but this will take about two weeks. If during this time BTC holders begin to panic and “dump” their coins, then the Bitcoin rate may drop significantly.

While the US and the EU are jointly putting underthreat of the launch of Libra, China is beginning to fully exploit the potential of the blockchain, creating its own global payment network and, at the same time, thinking through a plan to eliminate its main competitors - decentralized cryptocurrencies. And it remains to be seen what threatens the dollar more, Zuckerberg’s idea or Xi Jinping’s speech.

</p> 4.6

/

5

(

42

votes

)