Cumulative Bitcoin futures trading volume on the Chicago Mercantile Exchange (CME) since product launch inDecember 2017 exceeded $ 100 billion (equivalent to 13.5 million BTC). About this managing director of CME Group Tim McCourt said in a comment Cointelegraph.

The CME Group Exchange launched bitcoin futures trading in December 2017 a week after the Chicago Options Exchange (CBOE) offered the same product.

At the same time, if CBOE withdrew bitcoin futures from trading in March 2019, the CME Group does not plan to refuse them, while simultaneously exploring the possibility of launching a similar product for Ethereum.

“Our Bitcoin futures have evolved over the past two years, and today they are one of the most liquid derivatives on Bitcoin available around the world.”— Tim McCourt said.

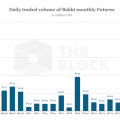

In addition, already in January 2020, the Chicago Mercantile Exchange launched the trading of bitcoin options, thus competing with the Bakkt exchange, the option trading on which started in December 2019.

Earlier, Tim McCourt denied the widespread theory that the launch of regulated bitcoin futures caused a market crash after the 2017 rally.