Article Reading Time:

2 minutes.

Forming a response to the experts' requestcrypto industry about the possible movement of the value of Bitcoin at the time of the next halving, the popular chatbot ChatGPT predicted that this event will become a catalyst for “massive bull runs.”

ChatGPT, built on the principlesartificial intelligence, announced that the cost of a limited resource with constant or growing demand increases. This means that after the completion of the halving the price of BTC should increase, since this means that Bitcoin has become an even more scarce asset.

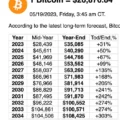

The first cryptocurrency by capitalizationsurvived three halvings. The first event occurred on November 28, 2012, the second on July 9, 2016, and the third on May 11, 2020. In the first case, the reward dropped from 50 BTC to 25 BTC per block, in the second to 12.5 BTC, in the third to 6.25 BTC per block.

ChatGPT recalled that all three cases of halvingwere accompanied by a multiple increase in the value of the crypto asset. Therefore, based on historical data, the information and reference system does not see any prerequisites for a possible fall in the bitcoin rate as a result of the 2024 halving.

ChatGPT notes:The BTC price forecast is influenced by many explicit and implicit factors, which may not be predictable due to their dynamic change over time. That is “past performance cannot assure investors of their future performance.”

In particular, the price of Bitcoin may be affected by market demand, investor sentiment, adoption rates, regulatory environment, technological advancements and macroeconomic conditions.

This is not the first attempt to predict behaviorBTC prices at the 2024 halving stage. Earlier, analysts from Germany's oldest bank, Berenberg Bank, said that the future halving, as well as a combination of circumstances, evolution and time, will become a springboard for the growth of Bitcoin's value.