According to digital asset manager and analyst Charles Edwards, the cryptocurrency industrygrowing up and users need to get used to the correlation of BTC and traditional assets.

Edwards noted that cryptocurrency marketsare becoming more popular among traditional investors. Cryptocurrency users need to act as if the industry is already taken over by traditional investors. The analyst emphasized that cryptocurrency markets will increasingly resemble traditional financial markets:

“You need to get used to the bitcoin world nowwill move according to the will of the managers of traditional funds. Why? Over the past six months, traditional investors have absolutely and ruthlessly flooded the Bitcoin market. Get used to the behavior of cryptocurrency markets, similar to traditional markets. ”

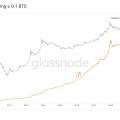

The digital asset manager said thatusually in traditional financial markets, risky assets grow during stability, and defensive ones during instability. The current behavior of the Bitcoin exchange rate is highly correlated with traditional risky assets. Edwards also noted that traditional investors try not to advertise Bitcoin purchases:

“This is called accumulation. The funds try not to make noise when they buy, but the numbers speak for themselves. ”

Recall that in early May, Tudor BVI fund manager Paul Tudor Jones said that the fund was buying Bitcoin as a risk hedge.

</p></p>