In the market of cryptoassets with a fixed supply volume, there is fierce competition, since all altcoinsexist in the shadow of a dominant reputation,liquidity and with the unconditional market dominance of Bitcoin. The pioneering advantage that Bitcoin has and its tight monetary policy, no doubt, make it the leader of a new era of scarce digital assets. The question that continues to occupy investors' attention is whether altcoins with a fixed issue volume and deterministic supply curves have a chance of successful competition or coexistence with Bitcoin. Can these assets become hard currencies or are they just an example of the irrational distribution of capital?

In this article, I compare observed cashBitcoin, Litecoin, Bitcoin Cash, Dash and Decred bonuses in the context of the ratio of stocks to stock-to-flow, S2F asset development developed by PlanB, based in its research exclusively on Bitcoin historical data. This model showed extremely high (up to 95%) correlation coefficients when checking for many subsets of Bitcoin data, as well as in comparison with uncorrelated precious metals markets.

Scarcity

The stock-to-growth ratio as a measure of scarcity is of great interest to both commodity assets (in particular, precious metals) and cryptocurrency marketsSaifiddin Ammus described this concept in detail in the context of the historical evolution of money in his book«The Bitcoin Standard», where it is shown that scarce assets develop a cash bonus as a result of a high ratio of reserves to growth.

Nick Sabo has perfectly articulated this idea with the concept of "unadulterated value," which describesThe need for unavoidable and substantial production costs for an asset to achieve a monetary premium.

"What do antiques, time and gold have in common?They are expensive, either inherently or because of their incredible history, and this high value is difficult to counterfeit." – Nick Sabo (2008)

"Precious metals and collectibles have an unadulterated scarcity due to the high cost of their creation.The same property was once possessed by money, the value of which, by and large, did not depend onany third parties." – Nick Sabo (2005).

Unfalsifiable value

Unfalsifiable value (value) of an object is rooted in the cost of physical production or in the improbability of its creation.

Here are some noteworthy examples of falsified value:

- "Banksy's shredded 'Girl with a Balloon' has the artist's characteristic narrative, social and contextual capital, and momentHer creation is unique. (Uniqueness)

- The creation and operation of a gold mine requiresSignificant capital investments and operating expenses, as well as large time and human efforts required for exploration and development of the field. Gold as an element is also not very common on the planet due to its atomic properties. (High scarcity)

- Proof-of-work algorithm ensures that bitcoinsit is impossible to release without spending the necessary amount of computing resources and electricity. Satoshi Nakamoto's impeccable concept combines the falsifiable characteristics of a unique history of origin and the high cost of physical extraction, creating an unprecedented digital scarcity. (Extreme scarcity)

Unadulterated value is a prerequisite for the creation of a genuine monetary prize, as it distinguishes"Hard money", which claims to be a store of value, currencies, the volume of the money supply of which can be easily and relatively inexpensively manipulated.Fiat currencies cannot be considered scarce, as they do not haveThere is no real limit to the volume of output, and a centralized authority can control the rate of inflation at almost zero cost.

For crypto-assets, there are several qualities, the presence of which logically excludes the consideration of assets possessing them as scarce due to the open opportunities for falsifying the "high cost" of their production:

- Centralized coins in which a limited number of entities can control the money supply and / or manipulate the rate of inflation.

- Koyn not having at the time of creation hardprescribed in the code of the volume of issue and a determinate schedule for the issuance of new coins, as this transfers the right of monetary regulation to the hands of one entity.

- Coins, in which, due to the issue through premining and sale on the ICO, the cost of creating these coins is almost zero.

- Coins, whose security systems do not require continuous energy consumption and proof-of-work, without which the cost of production is insignificant.

- Insufficient security boilers to protect against unscrupulous actors who can attack the system and issue coins at relatively low cost.

Altcoins Selected for Analysis

The assumption underlying this article islies in the fact that a cryptoactive asset must have an un falsified coin production cost, at least comparable to that of Bitcoin, given the impossibility of reproducing the immaculate concept of Satoshi Nakamoto.

Therefore, to study this problem, I selectedThe following altcoins with significant capitalization and a fixed volume of issue and having a deterministic release schedule to assess whether unfalsified value is a sufficient condition for creating a competitive cash bonus. The table below provides information on the falsified value required for the extraction of each block (and, therefore, for the creation of coins).

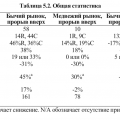

PlanB recently held some greatstudies on the relationship between the ratio of reserves to growth for Bitcoin and the value (market capitalization) of its network. These studies have shown that there is a power-law relationship between cryptocurrencies and precious metals markets with a correlation coefficient of 95%. Further analysis showed that the correspondence of the model was reliable enough so that the substitution of many subsets of Bitcoin data (taking into account lost coins, different time scales, etc.) yielded a comparable distribution in accordance with the law of power dependence.

The results of these studies allowit is certain to assert that scarcity (measured through the ratio of stocks to growth) has a great impact on the human perception of value, which subsequently is reflected in the price of the asset.

Power dependency cases are rare, butThese are important relationships that often describe natural phenomena, such as the relationship between the distribution of earthquake magnitude and the frequency of their occurrence or changes in the planet's orbital velocity with distance and distribution of biological diversity. Power dependence is also traced in many observed distributions of human behavior, in population and demographic density, and even in the distribution of financial well-being.

Power-law relationship between the ratio of stocks to growth and the market value of Bitcoin, PlanB model

Natural phenomenon

Bitcoin is one of the most organic assets.free market as the world has seen. In less than 10 years, it has grown from a cipherpunk party and zero capitalization to an asset worth more than $ 320 billion. Bitcoin has gained value by providing people with a useful service, given its reliability as money, the value of which is supported by an ever-growing deficit (a growing S2F ratio).

Its adoption is not mandatory; users make this choice voluntarily.

In the age of accessible information, Bitcoin has managed to attract the attention and investment of millions of people.It seems reasonable to assume that Bitcoin has become a kind of "gravity center" for the relationship between scarcity and the human perception of value.Bitcoin can be called a natural phenomenon with which other scarce assets can be compared.

Altcoins and cash bonuses

The mania phase in the cryptocurrency market in 2017 was largely the embodiment of an unrealistic desire to create the "next Bitcoin" that apparently influenced (through hype, liquidity events, etc.) the market valuation of these assets, decoupling it from theIn addition, many of these coins do not have intrinsic value.data for a sufficiently long period to adequately assess the dynamics of changes in indicators based on altcoin data alone.

Therefore, I do not consider that reasonable orthe organic relationship between S2F and market value can be determined for each altcoin individually, using only its data. PlanB in a discussion with Stefan Liver, in which attempts to establish a relationship between the S2F coefficient and capitalization using data from individual altcoins, do not look very confident, defines this as a low correlation.

However, the position I find more compelling is based on a comparison between the raw S2F ratio data, the market cap data for each altcoin, and Bitcoin's "center of gravity."The altcoin with the best performance in relation to Bitcoin's power law could well be seen as having a tangible cash premium.Conversely, low-performing coins, I believe, do not enjoy support in the free market, and their unadulterated value canbe insufficient to sustain sustained demand growth.

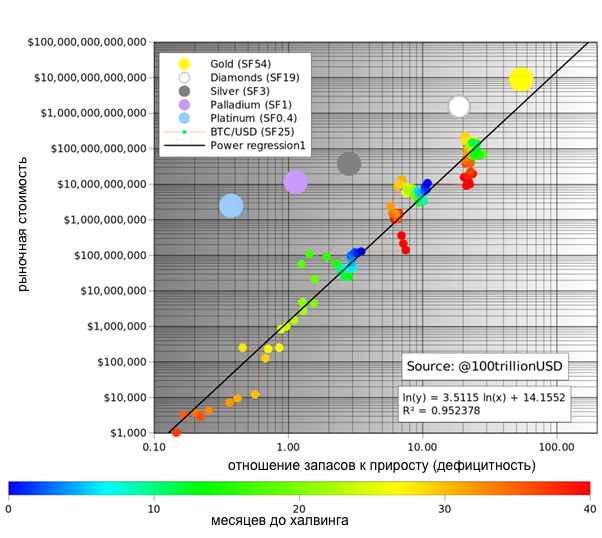

For this group of altcoins with a fixedby the volume of emissions, I calculated the ratio of stocks to growth over time based on measured data on the volume of emissions, as well as on market capitalization according to Coinmetrics.io. Taking into account the difference in hashing speed and other natural deviations, I used 28-day averages to calculate the ratio of stocks to growth, in order to get a clearer visualization (which as a result has a slight distortion with respect to the resulting observations and horizontal zones of the data points with halving )

The ratio of stocks to growth (28-day averages) and market capitalization for selected altcoins with a fixed issue volume. (data: coinmetrics.io)

This dataset is interesting in that it is basedexclusively at the registered market capitalization and the estimated daily emission rate (projected for 365 days as a constant value) to determine the S2F coefficient. No additional assumptions.

Several observations can be made from this study by comparing each coin's data points and fractals in relation to the "center of gravity":

- Bitcoin's "gravity center" does indeed appear to be the center of gravity to which almost all assets converge, or at least tend to be, throughout their life cycle.

- Bitcoin oscillates around the "center of gravity" in every market cycle and comesThe data points are quite organic, and their fluctuations haveRounded appearance, which indicates the natural nature of price determination.

- Litecoin is also fluctuating around this line (albeit less confidently) and, like Bitcoin, is coming closeIt's worth noting that Litecoin's behavior appears to be much less organic, with more discrete "events" having an impact on the price, leading toto abrupt changes in values, instead of Bitcoin's rounded fluctuations.

- Bitcoin Cash seems to have undergone the mosta significant decrease in any cash bonus that it could achieve, and a spread in the values of the S2F coefficient indicates the instability of the hashrate, which results in an irregular issue of coins.

- Dash has a relatively weak cash bonus,market valuation values touched the line at only a few points. Due to approximately monthly masternode payout blocks, the Dash data also has visual outliers, also smoothed by using 28-day averages. The flow of data points looks more consistent compared to BTC, LTC and BCH due to a smoother emission schedule and lack of halving.

- Decred's cash premium remains above the "center of gravity" to a greater extent and for a longer time (relative to its lifetime) than for any other coin studied, not even Bitcoin.Thanks to the smooth release curve, the data appears to be more coherent during 2019, when Decred settled just below the midline.This may be due to the constant demand for PoS tickets, which ensure the right to participate in the Decred governance system, as well as receive rewards for PoS mining.

Monetary volatility

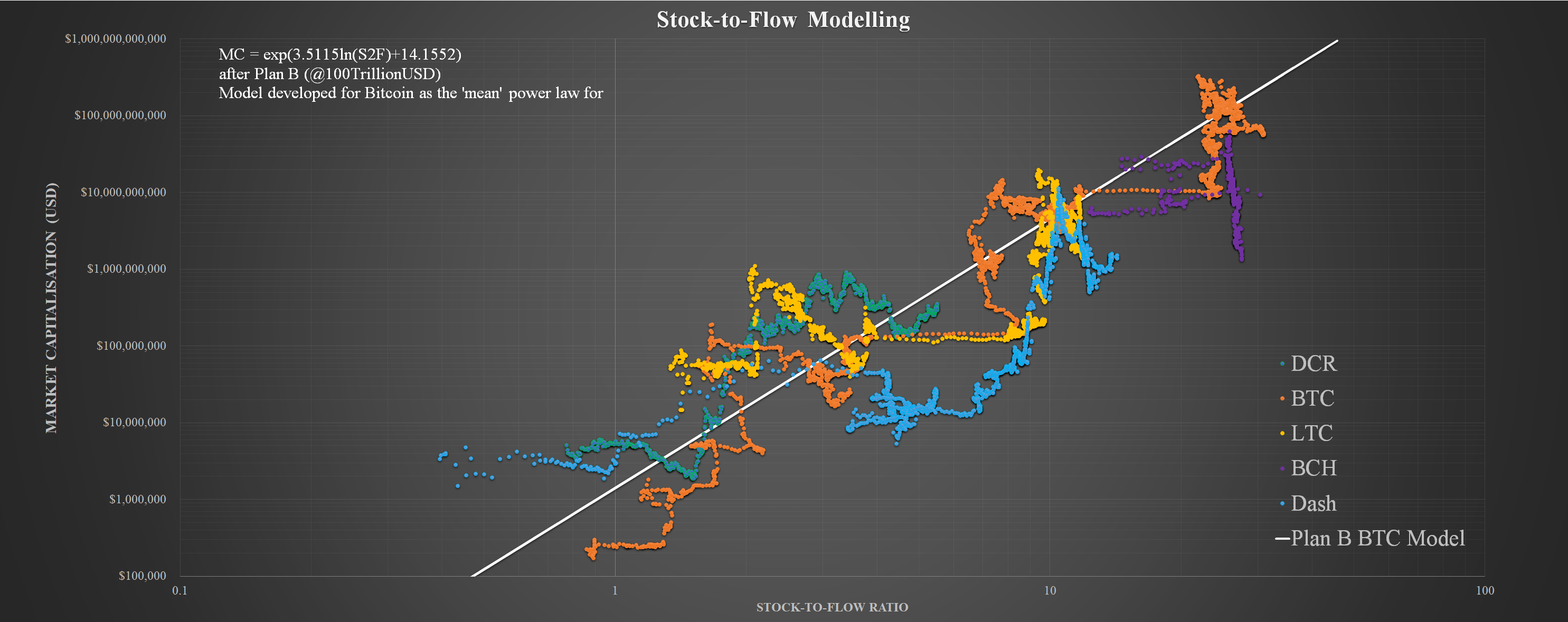

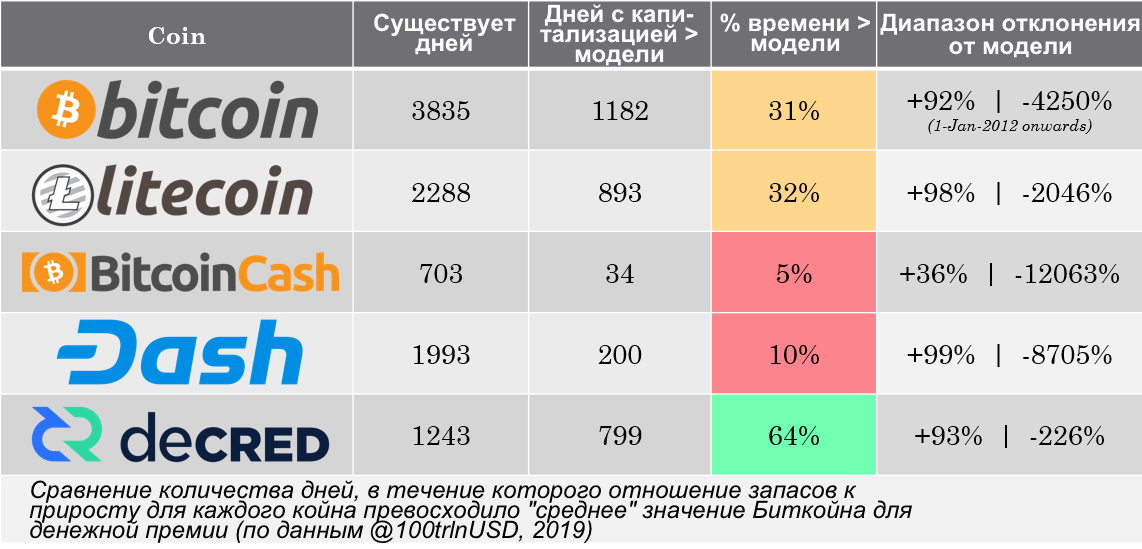

To further formalize these observations, I calculated the number of days that the market value of each coin was above the "center of gravity" to establish for what fraction of theI also paid attention to the maximum and minimum deviations from theof this line as a measure of "monetary volatility," or the ability of each coin to maintain its monetary premium over time.This study is similar to the S2F ratio presented by PlanB.

Deviation from the "center of gravity" in the graph of the ratio of reserves to the increase in the quantity of the asset

Dash and Bitcoin Cash were subject to significantdecreases from average values, which indicates an inability to maintain a solid cash bonus for a long time. To date, Bitcoin Cash has shown itself to be the weakest, reaching only 36% growth in relation to average values, and then only once. It would be reasonable to expect that Bitcoin Cash should be traded at a discount as an asset that does not have a cash bonus and, therefore, lacks attractiveness as a form of scarce money with a fixed issue volume.

Bitcoin and Litecoin showed normaldeviations from the average values in the range from 1000% to 2000% during the periods of the bear market and, like other coins (except for Bitcoin Cash), the periods of premium growth were 90% higher than the average values. Given the expected volatility of assets with a fixed issue volume, I consider this a reasonable guideline, especially given the dominance of Bitcoin.

In this study, Decred stands out sharply froma number of other coins. He not only kept his cash bonus more than twice as long (relative to his life) as Bitcoin, but he also kept this bonus for most of the 2018 bear market with a remarkable maximum negative deviation of only -226%. This is 10 times smaller than Bitcoin, with its typical deviation size of -2000%.

This suggests that Decred managed to attractthe strongest cash bonus of all investigated assets. This, apparently, is the result of demand for proof-of-stake tickets and participation in the Decred management system, which will soon be 50% of the available DCR offer. This further confirms that demand for tickets (and, therefore, ownership and participation in the protocol) is a reliable source of demand for purchases and has a great influence on the perceived scarcity of DCR.

This contrasts interestingly with Dash, withits management system through masternodes, which requires masternode owners to lock 1000 DASH on the account (~ $ 81,500 at the time of writing). This can be a significant obstacle to entry into the system of representatives of the widest sections of society, especially in comparison with the system of tickets used in Decred, which requires 120–130 DCR ($ 3600–3900), with the additional possibility of sharing tickets between multiple owners. Further study of this mechanism as a driver of demand for coin and its perceived scarcity may shed more light on such a difference in performance.

Concluding observations

This study is based on the assumption that organic growthBitcoin and the high degree of trust in this asset have created a kind of "hub"gravity" for the relationship between the ratio of inventory to gain (scarcity) and the human perception of value as expressed in price.Therefore, Bitcoin should be considered the benchmark by which all crypto assets competing for a monetary premium should be judged.

Altcoin mania 2017 and relatively smallthe life of altcoins, apparently, to some extent distort the data, and, therefore, it is likely that the study of the ratio of reserves to growth for each coin individually is not representative. This assumption should be reviewed periodically as new market cycles pass.

By comparing data from the five major fixed-supply crypto assets – Bitcoin, Litecoin, Bitcoin Cash, Dash, and Decred – we can see how the altcoin's cash premium is evolving relative to Bitcoin's "center of gravity."

It can be concluded that Bitcoin today has perhaps the most organic and undeniably important cash bonus of all financial assets.

According to this study, Litecoindemonstrated a dynamics comparable to Bitcoin, but less confidently, and we still have to see if it will be able to maintain this premium in the future. Based on this, there is no advantage in holding Litecoin instead of bitcoins for any purpose other than speculative.

Similarly, I feel insecure aboutDash as a candidate for the role of a means of preserving value, taking into account episodes of a strong decline and the general position on the chart below average values for a power law dependence. Further study of the mechanics of the emission schedule and the structure of Dash stimuli as a deficiency driver can shed more light on the dynamics of changes in this coin.

Bitcoin Cash is clearly not able to hold a cash bonus and, based on this data set and the results of its analysis, can safely be ignored as a monetary asset.

Decred today has demonstratedthe most interesting and promising indicators, coupled with the remarkable ability to keep their cash bonus over time. Most importantly, in all metrics evaluated in this study (duration of staying above average values and monetary volatility), Decred's results significantly exceeded Bitcoin, which, apparently, can be of great interest in assessing potential candidates for the role of a means of preserving value.

Observed High Decredtestify that DCR can develop a convincing cash bonus and I believe that this moment is underestimated by the market today. However, given that the fundamental properties of Decred are extremely close to those of Bitcoin, albeit with noticeable differences, it is likely that DCR will subsequently attract significant interest, provided that the indicators under study do not fall, liquidity increases and the market expects to respond to growth factors .

Disclaimer: Nothing in this article should be construed as investment or trading advice.

</p>