Losing more than $20 billion in asset capitalization in less than 30 days will not suit any potentialinvestor. Bitcoin recently faced another such situation.

November was extremely bearish for the largestin the digital asset world since BTC registered a six-month low this month. However, after the fall of November 22 and 25, signs of recovery appeared in the industry.

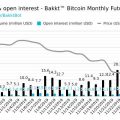

According to Skew analytics, despite falling prices, the Bitcoin derivatives market was on the rise last week, showing huge trading activity on the CME and Bakkt exchanges.

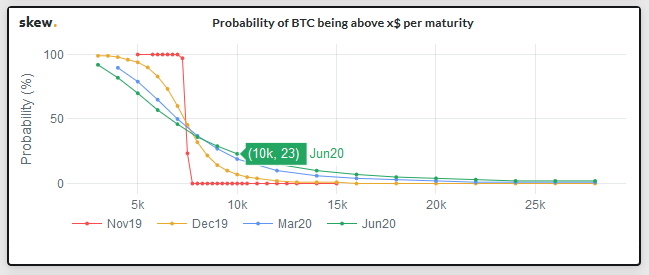

Due to increased trading activity in the marketThe Bitcoin Probability Index soared and recorded a 23% probability of crossing the level of $ 10,000 by June 2020. For comparison, last week the probability was only 15%. At the time of publication, the same indicator by March also improved and reached 19%, previously it was approximately 11%.

The PlanB crypto trader has already shared his calculations regarding the fact that according to the “Stock / Flow” theory, in December, bitcoin can cross the $ 10,000 mark.

Call me crazy, but it wouldn't surprise meif BTC closes 2019 at $10k+ .. opportunities like this (#bitcoin below S2F model value, 6 months before the halving) are rare. pic.twitter.com/ADwqixd9EF

- PlanB (@ 100trillionUSD) November 25, 2019

The upcoming launch of Bakkt's cash-settled BTC futures contracts, scheduled for December 9 in Singapore, could also push the price of Bitcoin upward.

</p>