In the next reviewCredAnd DonAlt, mailing list authors Technical Roundup, discussing a breakout of the trading range inthe bitcoin / dollar pair on a weekly timeframe andpotential daily setup, of which the following. The authors also discuss a breakout in ETH / USD and argue that Bitcoin / USD is a more attractive trade at the moment.

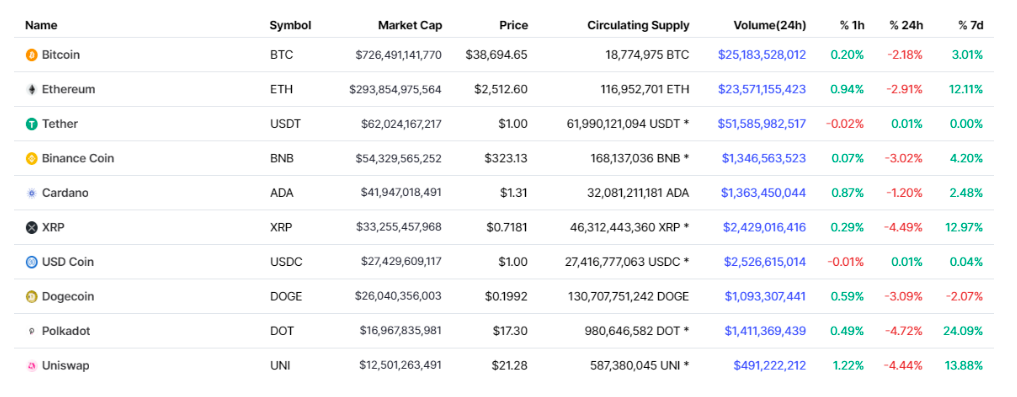

https://coinmarketcap.com/coins/views/all/

Bitcoin: Breakout of Resistance on a Weekly Timeframe

Chart executed in TradingView

Chart executed in TradingView

BTC/USD closed above $38.2 thousand on the weekly timeframe. This means a breakout of the weekly range.

Assuming the breakout continues, the target level for this move on higher timeframes is resistance at $45K.

While BTC/USD formed a successful resistance breakout on the weekly timeframe (closing above $38.2K), this did not happen on the daily chart (below $40.6K).

When the picture in different timeframes does not match,a good tactic is usually to target the close on the higher timeframe and use the lower timeframe to choose when to enter the position. In this case, this implies the expectation of further growth and the interpretation of the price pullback on the daily chart as a potential "wick" of the forming weekly candle.

Regarding the weekly trend continuation setupTwo reasonable options are visible. First, a price recovery above daily resistance at $40.6K would likely signal continued growth. This would indicate that the daily chart is coming into line with the bullish close on the weekly timeframe. Second: a price rollback to $37.4 thousand (at least to $34.6 thousand) and a strong rebound from this support at the close of the week will also be a good sign of a continuation of the trend.

Regarding the invalidation of the bullish thesis, anyoptimism in the current situation is based on the fact that we are dealing with a real breakout on the weekly chart. Accordingly, a weekly close below $38.2K would invalidate this thesis and signal a return to the crab-like movement in the previous range. The loss of the $34.6K level on the daily chart also refutes the bullish thesis, since a strong weekly close in this case would be extremely unlikely.

The last thing worth noting is that togetherwith bitcoin a lot of junk bounces off. As we've discussed in previous installments, a recovery led by bitcoin tends to be more resilient than a recovery driven by more speculative parts of the market.

Ethereum is forming a breakout; activation of EIP-1559 is imminent

Chart executed in TradingView

Chart executed in TradingView

ETH / USD formed a larger high as a result of a break above $ 2300. The pair to BTC is trading neutral.

From the TA point of view, the situation in Ethereum/dollar is nottoo different from BTC/USD. Essentially, this is a high timeframe breakout and the market is now closer to resistance than support. Perhaps the clearest options for entry are to trade either on a rollback of the rate with the formation of a larger low, or on a breakout of resistance.

In this case, the upper limit of the range andThe immediate resistance remains the daily structure at $2,750–$2,890. The nearest support in case of a pullback is the break level of the market structure, i.e. the previous local high of $2300.

As far as setups are concerned, betting on ETH on a pullback to the $ 2300 region may well make sense. The idea of opening a position in the area of resistance looks much less convincing.

The condition for refuting the thesis is quite simple. A drop in bitcoin against the dollar and / or a daily close below $ 2300 are likely bearish factors.

In general, considering the sideways movement in ETH / BTC,The picture in BTC / USD seems to us clearer and more convincing, and although the likelihood of a price reaction of ETH to the early activation of EIP-1559 is high, we prefer to focus on the bitcoin / dollar pair.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>