Over the year, the cryptocurrency market shrank more than threefold, displacing weak players.It's hard to believestudying the Bitcoin hash tape: the total computing power of the network has jumped by 65% in the same time.

Image source: btc.com

From month to month, miners added new equipment, despite the deteriorating macroeconomic environment and the fall of Bitcoin to new local lows.

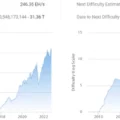

Image Source: Cryptocurrency ExchangeStormGain

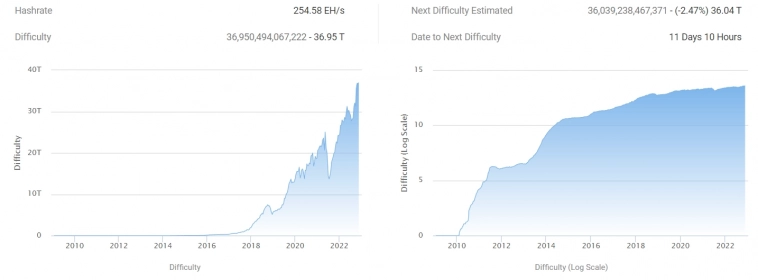

Complexity increased due to the introduction of new equipmentcalculations, which, coupled with the fall of Bitcoin, led to a decrease in mining profitability to new anti-records. On average, miners are already working in the red: according to the MacroMicro portal, the cost of mining is in the region of $20 thousand per coin (these estimates will always be approximate, since electricity tariffs, equipment used and the cost of investments vary greatly from company to company).

Image Source: macromicro.me

Since Bitcoin mining is mainly representedlarge companies with long planning horizons, some of them are ready to use the equipment at full capacity and at a negative profitability to squeeze out competitors with the subsequent purchase of ASICs at the lowest prices.

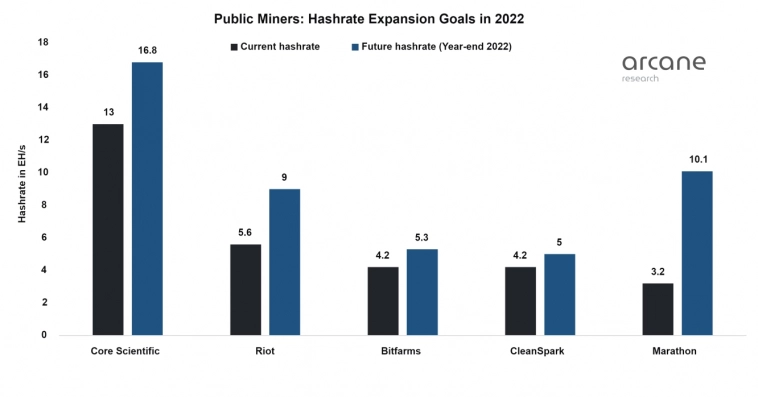

The redistribution of the mining market is in full swing.The industry leader in terms of power and once coin reserves, Core Scientific, reached a total loss of $1.7 billion in 2022 and warned investors about the risk of bankruptcy, while in the middle of the year it published plans to deploy additional ASICs.

Image Source:arcane.no

Iris Energy took out a $100 million loan in September,including the purchase of new equipment. On November 21, the company notified the SEC that it had shut off the machines due to low profitability and was at risk of not meeting its financial obligations.

In November, Argo Blockchain sold for $5.6 millionjust received 3,843 ASIC S19J Pro from Bitmain and warned investors about the risk of suspension. At the beginning of the year, the company was among the TOP 10 miners in terms of reserves, but just like Core Scientific, it was forced to sell all its coins.

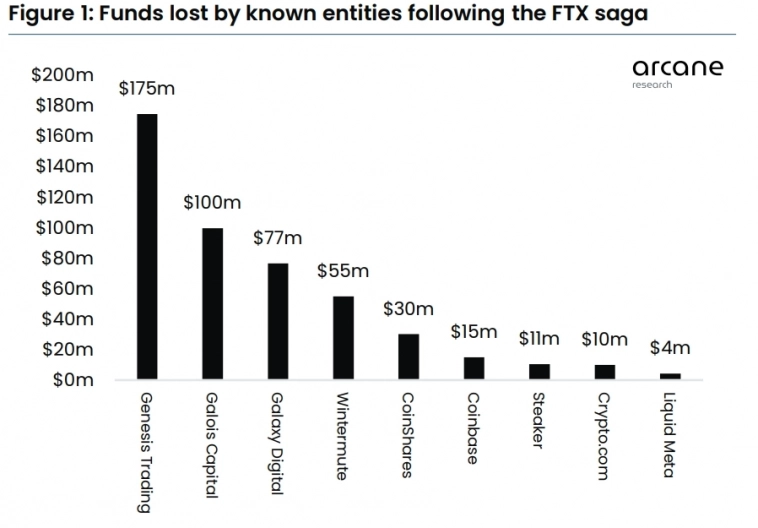

Foundry operating the world's largestmining pool Foundry USA, recently announced the purchase of a business from the bankrupt Compute North. Foundry is a subsidiary of the Digital Currency Group, which itself is experiencing serious difficulties due to the investment of another subsidiary (Genesis Trading) in the collapsed FTX.

Image Source:arcane.no

Companies that have retained capital buy outequipment from bankrupt colleagues, along the way ordering ASICs from manufacturers at “unprecedented discounts,” as CleanSpark boasted in early autumn. However, there is less and less room for maneuver, and more and more new companies report the impossibility of continuing to work under the current conditions. The founder of the Capriole fund, Charles Edwards, called what is happening "a bloodbath for Bitcoin miners", promising a series of bankruptcies ahead.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)