This series of articles is an addition to the series of articles entitled “The Ideal Digital Currency”, in whichThe problems of blockchains and cryptocurrencies are considered. Since the publication of the articles, significant progress has been made in working on most of the problems. In the first part of this series, we will consider the role of the cryptocurrency or blockchain management structure, which affects the development, support and final scaling of the blockchain.

</p>Who really owns the money?

The producer of your money provides themsignificant impact. This is most noticeable when the manufacturer suddenly prints and puts into circulation twice the amount of money than before, because of which your money is greatly losing its value.

The same pattern works in less inflationary ones.systems, just her problem is not so obvious. Each year, the non-credit savings of most people, issued by almost all states, are reduced in price. In most cases, the GDP of an entire country can grow, reflecting the general value of economic activity and labor in the state, and the value of the savings of an individual in the state currency decreases, all other things being equal. This was all until the era of cryptocurrencies, to which governments have nothing to do.

Does inflationary currency have positive aspects?

It is possible that inflationary currency haseconomic benefits. Economists argue that deflationary currencies or currencies whose value is ramping up provoke an increase in savings and reduce economic activity. However, the desire for mild inflation does not explain why this process cannot be completely transparent. For example, if it is necessary to achieve an annual inflation rate of 3%, then from a mathematical and financial point of view, this figure can be achieved in a fairly transparent way. The lack of a transparent mechanism for issuing money was the impetus for the creation and subsequent growth of cryptocurrencies, starting with Bitcoin in 2009.

Cryptocurrencies - the answer to an opaque monetary policy?

Bitcoin is very clear, simple andtransparent monetary and equity policies. New bitcoins appear with the creation of each block, and each block contains new transactions that are written to the registry. The amount of new coins is predetermined. It starts with 50 new bitcoins in each block, then every four years this figure is halved until 21 million bitcoins are created. After that, the release of bitcoins will stop.

Such a scheme is very transparent. However, it does have flaws in monetary policy that were described two years ago in this article describing the ideal cryptocurrency policy. Firstly, if the economic system is almost entirely expressed in such a currency, deflation will begin, which will lead to large accumulations and storage of cryptocurrencies, which will reduce costs and economic activity. Secondly, in this scheme there is no means of responding to market changes, which means that there is no control mechanism. A currency with large jumps in prices during the day will not allow companies and individuals to calmly conduct business and daily calculate real income and expenses, as sometimes changes in price can be more than the mark-up of goods and services. The third problem that was not raised in that article is related to those who manage and own cryptocurrency. We will consider this issue in this article.

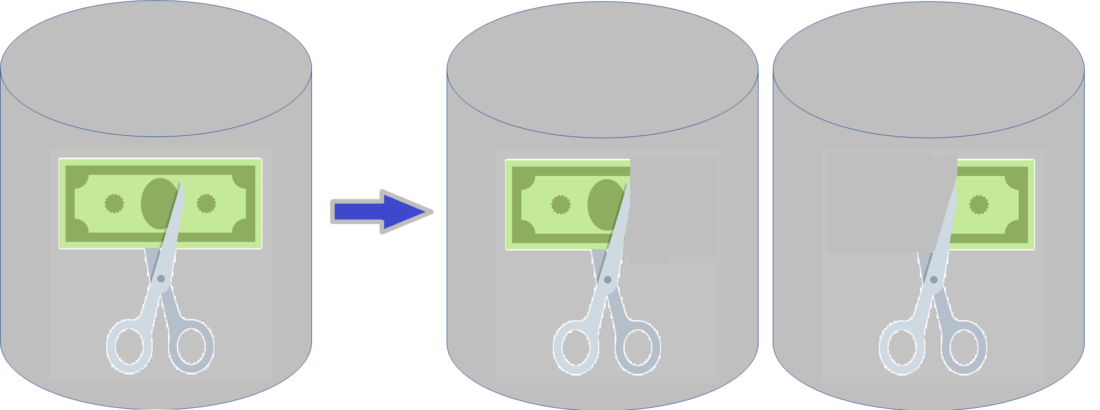

If your currency is clear and transparentemission policy or even if it implies a constant issue, but its governing body allows you to duplicate a currency through arbitrary hard forks, then your currency does not have a fixed and accurate mass.

Fig. 1. Splitting the blockchain may lead to cryptocurrency mass inflation

The Importance of Organizational Control of Cryptocurrencies

After almost ten years of existencecryptocurrencies, we saw that a transparent and mathematically based emission policy may not be enough to meet the requirements of a predictable monetary policy. Hard forks or the separation of cryptocurrencies is a huge emission mechanism that does not have the predictability of a clear emission scheme prescribed in the protocol. For example, at the end of 2018, Bitcoin Cash (fork of Bitcoin) was divided into two parts, which led to a serious drop in the price of cryptocurrency, and also, most likely, to a drop in prices for all cryptocurrencies in December 2018. Imagine what it would be like for a 68-year-old person about to retire if all his accumulated savings in such a currency suddenly lose value, as happened in December 2018. He will probably be more upset than if his savings were in fiat currency.

However, the cryptocurrency management structureaffects not only hard forks. It may be responsible for managing the source code and making changes to it, as well as for performing other actions that affect the value of the currency.

Examples of constitutional and code changes that may affect the value of cryptocurrency

Over the past few years, we have seen a number of solutions from cryptocurrency management teams that affected their value or mass. Here are some of them.

- Decisions about the technical functions of cryptocurrencies,for example, block size. Take, for example, the decision to leave the Bitcoin block size at 1 MB, which, according to some, necessitates the introduction of Lightning technology, which increases scalability and makes everyday payments the main function of the cryptocurrency.

- Direct changes in the emission mechanism. For example, EIP-1234 of Ethereum, when programmers decided to reduce the reward for a block from 3 to 2 ETH, postponing a time bomb on the complexity of creating blocks.

- Free decisions to give away free giveawayscryptocurrencies, new coin offerings, team rewards and other policies that increase mass. For example, NPXS decided to create a completely new currency called FX and announced it, which led to a drop in the price of NPXS. From that moment, there are many ICO projects with new currencies, which represent an additional way to earn or finance other side projects, for example, Crypto.com (Monaco) with CRO and Tron with BTT.

Types of Cryptocurrency Management Structures

There are several types of governance structures.fiat currencies. Usually they are managed by some unit created by the central government, or an independent institution appointed by the same central government. Cryptocurrencies do not have a centralized authority, so more options for governance structures appear here, among which:

1. Bitcoin Management Structure

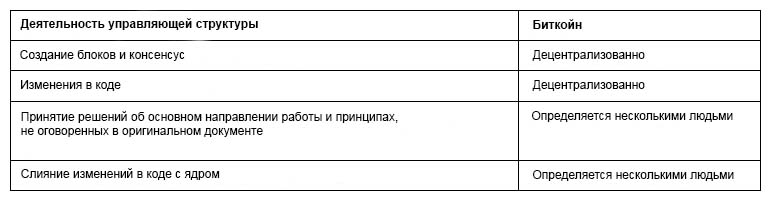

In this type of decision structure regardingquestions that are not clearly expressed in Satoshi’s original document are taken by programmers who develop and maintain code. It turns out that some of these solutions are very consistent and correspond to the general trajectory and value of the cryptocurrency.

Issues such as money issue anddecentralized structure for creating blocks, are written in the original cryptocurrency code. The system for selecting participants who can make changes to the course is also decentralized. Any programmer can think of changes and send them for consideration. Nevertheless, decisions on whether these changes are permissible, who can make them, can be made in a variety of ways, which could determine and determine the cryptocurrency development trajectory. What will be the block size? Do I need to include all transaction signatures in a block?

Learn more about making changes to the codeBitcoin can be learned from the article “Who Controls the BitCoin Core” by Jameson Lopp, the developer of Bitcoin. There are five maintainers who decide what pull requests or changes to the code. Roughly speaking, they make decisions according to the following principle:“The changes should be consistent with the general principles of the project, the minimum standards for inclusion and the general opinion of the developers.”There is also a main maintainer who managesall final versions. From 2011 it was Satoshi Nakamoto, then until 2014 it was Gavin Andersen, and then Vladimir van der Laan. It is worth noting that the article mainly discusses measures to maintain code integrity to ensure the safety of its changes, but does not address the fact that decisions about priority changes remain the privilege of a few specific individuals.

2. Developing or less decentralized versions of the Bitcoin management structure

Other cryptocurrencies use morecentralized governance structure than Bitcoin. If the initial goal of the project is the transition to a more decentralized structure, then at the development stage it can be more centralized. Use the following table for clarity. It reflects the level of centralization of different parts of a decentralized cryptocurrency management structure using the example of Bitcoin. According to this scheme, you can analyze many other cryptocurrencies.

3. Decentralized management structure with delegation

These include cryptocurrencies that workabout the same as representative democracy. There is a fixed number of decentralized miners. These miners are chosen in a free, decentralized way by all network participants. Such cryptocurrencies include EOS, Steem, and TRON. However, as in the first two management structures, only a few people make decisions about who can make changes to the code.

4. Representative decentralized governance structure with a choice of proof of ownership

In this transaction processing management frameworkand a small network segment deals with decision-making through voting. One of the types of such structures is networks with main nodes, in which a participant must own a certain share in order to be able to make decisions or become the main node processing blocks. This includes Dash and PivX. The handler segment can also be selected using the Proof of Stake (POS) algorithm. Now there are no popular cryptocurrencies with widespread use that would be based on the POS algorithm, but Peercoin is based on POS, and Decred cryptocurrency uses a hybrid algorithm of proof of work (POW - Proof of Work) and POS.

5. Management structure with exclusive access right

There are many different types of exclusivepublic processing networks, but their main point is that the central authority appoints transaction handlers on the network. The same authority governs code development and changes. Among these networks are Ripple and Stellar.

Many members of the cryptocurrency communitybelieve that a centralized public blockchain makes no sense. However, some of the advantages of the blockchain, such as the immutability of transactions, are still very useful, even if the network is controlled by a central, selected, but independent group of transaction handlers. This is due to the fact that transactions created by voting within the framework of solving the Byzantine generals task, which is carried out by several separate institutions, for example, different banks, are much more difficult to cancel than transactions in the register located in only one of the banks. Proponents of impeccable decentralization of cryptocurrencies ignore this small but powerful advantage, which will surprise them in the future, because exclusive public networks are likely to only gain popularity.

Remaining Problems of Cryptocurrency Management Structures

From the previous part of the article it became clear thatPower is concentrated in the hands of several participants who control and manage the source code, or the principles that will be encrypted in almost all cryptocurrencies to varying degrees. Usually special attention is paid to how decentralized the process of creating blocks is, but how rules are interpreted and implemented is also very important, because this aspect is usually less decentralized.

How to reduce the likelihood of forks and the separation of cryptocurrencies?

In his article “Who Controls Bitcoin Core,” Jameson Lopp wrote:

“This is open source freedom - anyanyone dissatisfied with the efforts of the Bitcoin Core project can start their own project. They can do it from scratch or fork the Core software. ”

It seems like there is practically no wayprevent the fork of public decentralized cryptocurrency. However, we have already seen several forks of Bitcoin, and the most recent of them - Bitcoin Cash - caused a serious drop in the price of both chains. Forks affect the value of cash savings in cryptocurrency. Cryptocurrencies of the second and third generation with delegated structures appeared recently and showed great resistance to forks and partitions. It is worth noting that measures to reduce the risk of open source cryptocurrency forks may include legal and government tools, which also contradicts the principle of cryptocurrencies - censorship resistance.

Blockchain fully decentralized transaction processing cannot be scaled

Fully Decentralized Transaction Processingimpossible to carry out on a large scale without a governance structure. In other words, no existing decentralized cryptocurrency can process a large number of transactions for mass use. Neither Bitcoin, nor Ethereum, nor any other deployed or proven decentralized cryptocurrency system.

Bitcoin can process seven transactions insecond, Ethereum is fifteen, and the Visa network is about 24,000. On the other hand, a system based on a centralized group of trusted processors or a delegated decentralized structure with a small limited number of processors can process millions of transactions at a fairly high speed close to the speed of the Visa network. Significant progress has been made in second-level networks, for example, in the Lightning network and in such technological developments as sharding, which is planned to be introduced in Ethereum, and which, in a special form, has recently been introduced into a relatively new cryptocurrency called Zilliqa.

It remains to be verified whether it is possible to scale the fully decentralized structure of transaction processing in terms of transaction number and speed.

Is a fully decentralized governance structure possible?

Imagine if for all the proposals aboutChanges or interpretations of fundamental provisions are voted on by all currency holders, not just transaction processors. Then, for every correctly implemented change in the code, its developers would vote. Is such a utopia possible? Will change requests that need to be voted on cause system overload? What if the majority of developers vote for a malicious change — unconsciously or intentionally? In the long run, majority voting looks good enough, but just one mistake by the majority can destroy the system in a way that is not so critical to political democratic governance structures.

[editor's note: Here the author obviously does not understand the difference between democracy — «majority vote», and consensus—«acceptance by all».in the absence of consensus, and not “acceptance by the majority,” forks are generated. But, as practice shows, forks do not harm the underlying crypto. At least Bitcoin will be filled with forks from 2014 to 2017 — failed].

In fact, the search for the perfectThe organizational structure for managing cryptocurrencies is not much different from finding the best way to manage society. The best existing systems are based on representative democracy, where many people choose several representatives of their interests. A completely decentralized approach, where everyone votes for every nuance of the system, may be ideal, but only if the majority really understands these nuances, gets the appropriate education, and therefore can do without a smaller representative group. In societies with a high level of population, such a successful working system does not yet exist. I won’t be surprised if, in the long run, systems based on a changing group of decision-makers and transaction processors that all currency holders periodically choose using a decentralized and honest way will become successful and dominant. Decision making is as important as transaction processing.

References

Jameson Lopp, “Who Controls Bitcoin Core?”

Ken Alabs “An Ideal Digital Currency Needs Scaling Methods”

Brief conclusion (main idea)

- The level of decentralization of the cryptocurrency management structure is as important as the decentralization of transaction processing.

- There are four governance structures:

- Completely open management structure, inwhich everyone participates in making decisions, in code changes, and in adding code to the repository. This is an ideal system that is only partially used by networks that decide to act in this direction.

- Completely open management structure, inwhich everyone participates in making decisions and processing blocks, but those who make the final decision about the changes, and the block handlers are selected based on what share in the network they have. Such a scheme is similar to a network with main nodes, in which a certain amount of a share gives any participant the opportunity to make decisions and / or process blocks. Or it can be a system with an algorithm for proof of ownership, which determines the main participants by the size of their share in the network.

- A decentralized structure and registry, while decision-making and transaction processing is carried out by a separate segment of network users, which is selected in some way by network participants.

- An exclusive network in which transaction processing participants are selected or appointed by the central authority. Examples are Ripple and Stellar.

- Some new networks based on structures 2, 3 and 4types turned out to be more scalable with respect to speed and throughput, but less resilient to failures and partitions. They also typically consume less power and offer cheaper transaction processing methods. However, they are more likely to create a system in which several influential people make decisions and control the network in a centralized way.

- At an early stage of the development of type 1 structureseveral powerful leaders can turn it into a system with a centralized decision-making body. In the long run, this can steer development in the right direction. There is no doubt that in the early days of Bitcoin and until the network got stronger, Satoshi Nakamoto had a huge influence on the course of its development. Vitalik Buterin is doing the same for Ethereum. [editor's note: unless, of course, one does not take into account that Satoshi Navomoto was never a public figure and, in general, a person embodied in the real world, i.e. accessible to outside influence]

- Separation of the cryptocurrency network, especially if itimplies the separation of the main participants in the decision, can have a significant impact on the price of cryptocurrency. In November 2018, Bitcoin Cash split into two parts, all of them fell significantly in price compared to the price before the split.

- Watching the latest disagreements in the communityEthereum, the holders of this cryptocurrency, and the entire cryptocurrency community, may be worried, because the history of the separation of Bitcoin Cash affected the value of all currencies at the end of 2018.

Author's note:This article should not be construed as financial advice. The information in this article and accompanying material are published for informational and educational purposes only.

Editor's note:The author’s opinion on the issues covered in the article(especially regarding the fundamental need to manage — and, thus, be controlled by someone, — a decentralized open blockchain) may contradict the editorial point of view.

</p>