Specialists from the research department of the crypto derivatives exchange BitMEX analyzed the impactcoronavirus pandemics to financial markets.

Analysts say the market’s response to the virus "will mark a significant change in the economic structure."

“Ultimately, under this new order there will be one winner:inflation",- says the study.

The collapse of the stock markets in connection with the coronavirus became one of the largest in history, along with the economic crisis of 2008, Black Monday 1987 and the stock market crash of 1929.

“At present, there is practically no doubt that the 2020 financial crisis associated with coronavirus will enter history books.”- noted in BitMEX.

Despite all the efforts of governments to contain the crisis, this is not enough, and central banks have already “reached the limit of their capabilities,” researchers believe.

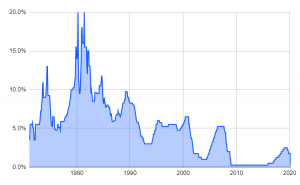

In their opinion, the US Federal Reserve's policies could only contribute to financial crises, since during each of them the solution was to lower interest rates.

So, the reaction to the dot-com bubble in 2000 was a decrease in the interest rate from 6.5% to 1%, and during the financial crisis of 2008, the answer was to reduce the rate from 5.25% to 0.25%, analysts emphasize.

Fed interest rate

“No matter how we relate to monetary policy, now there can be no doubt that the current system cannot survive another crisis.It’s time for change, "- say the researchers.

According to representatives of the Austrian economic school, a deliberate easing of monetary policy delays the onset of the recession, but ultimately significantly exacerbates its consequences.

Business shutdown in coronavirus- not the only problem that will have serious consequences in the future. Growing political populism, largely due to economic inequality, and climate change will also affect the economy, which will result in “shocking inflation,” BitMEX analysts are sure:

“Markets are intolerant of change. Financial markets are very accustomed to the current structure, protected by central bank instruments. Volatile times are coming. ”

Last week's Bitcoin collapse was called expected by BitMEX - against the backdrop of falling stock markets, investors rushed to switch to US dollars.

Nevertheless, the upcoming crisis may be an opportunity for cryptocurrencies:

“In the conditions of the changed economic structure,when the economy and financial markets are shaken and there is no significant anchor, this time may be the biggest opportunity that bitcoin has seen in its short life, ”the researchers concluded.