In less than a decade, Bitcoin has gone from being a small club of geeks sending each other “magicinternet money ", into a truly globala monetary phenomenon that attracts both ordinary people and foundations and even public companies. Like it or not, Bitcoin is almost certainly with us for a long time.

Of course, everything comes first almost alwaysfocus on price, but it is often just a product of market forces rather than a true indicator of what is really going on. To find out, one has to look behind the scenes, and in the case of Bitcoin, that means looking at its network.

And just as hashrate and difficulty often correlate with upcoming fiat price changes, the network can paint a clear picture of a possible future.

And this is a very interesting story.

First, basic concepts

If you are not familiar with what is happening under the hood of Bitcoin, I can say that this is all very exciting.

I do not pretend to be an expert inprogramming, but as an experienced miner, I understand a lot about how blocks are processed, what equipment is needed and why electricity at a good price is important, preferably from an environmentally friendly and renewable source.

However, for the purposes of this article, it is sufficient to understand the aspect of the Bitcoin network such as computing power - or so-called hashrate.

When you and I send bitcoins to each other,this transaction is combined with transactions of other users into a "block" and sent to the global network of machines for verification and confirmation. These machines are essentially competing with each other to process these transactions first, and the winners receive new bitcoins AND fees included in the block as a reward for their contributions to the network.

These machines are called "miners" and, in short,The more of these machines you have, the more power—or “hashrate”—you can provide to the network. To simplify it a little more, more hashrate = more bitcoins. This is a simplification as there are other factors involved, but it is enough to get the point across.

The result was an industry worth billions.dollars, producing mining equipment that is better, faster and more efficient than its predecessors. Miners, either alone or in groups, try to achieve as much hashrate as possible while consuming as little electricity as possible and spending as little money on it as possible. It's that simple.

Russia's largest mining farm Bitriver, located in the city of Bratsk. : Bloomberg

Because anyone can join at any timeto the network or leave it, large businesses have emerged with hundreds, sometimes thousands of machines generating enormous computing power in order to get their hands on precious bitcoins. All of these companies appear, at least on the surface, to be in the private sector, which is not surprising since they approach business entirely from a commercial point of view.

However, lately I've been wondering ifwhether the line between private-sector and government-sponsored computing power has begun to blur. In other words, will we soon see not just companies, but entire countries entering hash wars?

Some facts indicate that this is already happening, and if so, we will see a battle for a hash rate of such proportions that the space race just fades.

Hashrate envy

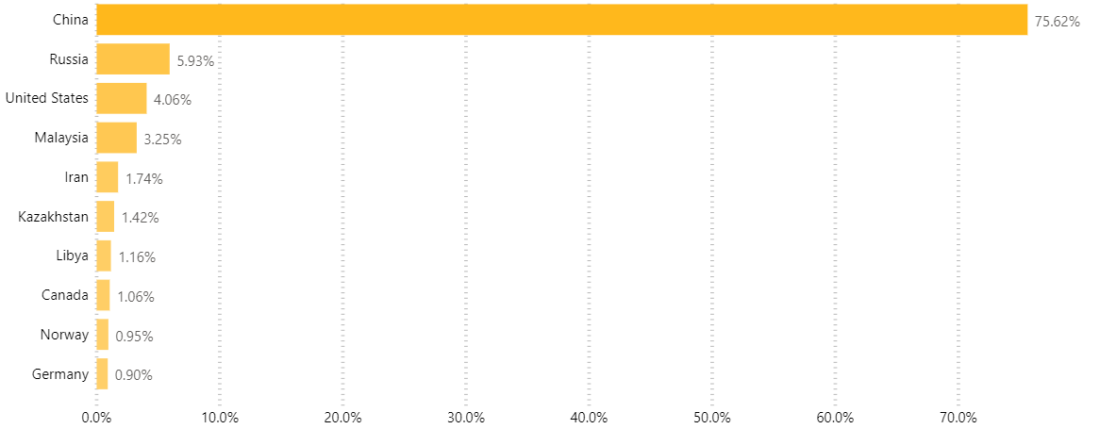

The University of Cambridge website cbeci.org has a little-known but very interesting graph showing how hash rates change over time by country.

Although these data have a number of caveats - in particular,only about 37% of the total hash rate is included - they still paint a consistent picture of where the hash rate is currently coming from and which countries are working to increase their contribution.

Average monthly hashrate by country. Chart as of September 2019. : cbeci.org

For example, in September 2019, China was the largest player, which is not surprising given the availability of cheap electricity and the ability to easily and quickly obtain mining equipment.

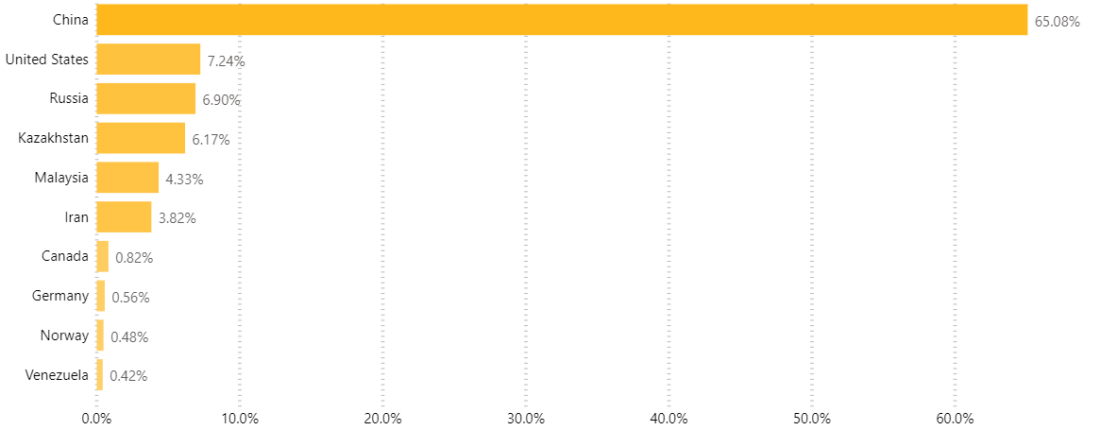

Six months later, in April 2020.(last month for which data was available at the time of writing), the situation began to change significantly, although this may not be immediately obvious.

Average monthly hashrate by country. As of April 2020.: cbeci.org

China’s share has decreased noticeably over the past six months – ifto be precise, by 10.58 percentage points. At the same time, the share of the USA, Russia, Kazakhstan, Malaysia and Iran increased. It is also worth noting the appearance of Venezuela in the top ten. It would be logical to conclude that these countries have increased the amount of mining equipment, but if you consider the global picture, everything can be much more impressive.

Over the same period, according to data taken directly from the blockchain, Bitcoin's hashrate increased from 86 Ehash/s(exahesh per second = quintln hash / s)up to 110 Ekhesh/s.This means that in order to simply remain at the same level, countries needed to proportionally increase their share of hashrate over this period. Achieving this means significant investment, and four countries stand out:

- Venezuelain six months, almost from scratch, it reached 0.42% of the global hashrate.

- USAincreased their share in the global hashrate by 78.33%.

- Iranincreased its hashrate by 119.54%.

- Kazakhstanincreased its hashrate share by 334.51%.

However, if we consider each of these countries byqueue, you can see unexpected differences in approach and possible motives, which may indicate the next stage in the war of hash supremacy.

USA

On this list, the US is the only one that most people would call a "first world" country, and while they are not entirely against Bitcoin, they are not very supportive at the federal level.

However, some states, such as Georgia,Kentucky, North Carolina and New York welcome large-scale mining activity. Companies such as Core Scientific, Northern Data AG, and Blockstream have mining farms out there or nearby, and more are being built.

However, all these companies are fully fundedinvestors and are unlikely to benefit from any significant government assistance, with the possible exception of local authorities setting electricity tariffs. However, in other countries, a similar statement cannot be made with the same certainty.

Iran

illustrations: BitNews

Iran is a country under sanctionsdirectly affecting its economy, so it is logical that it is looking for any opportunity to make a profit. Interestingly, mining in the country was largely an underground activity until August 2019, when the Ministry of Industry, Mines and Trade finally saw the opportunity it presented.

This ministry not only created the channelgenerating revenue through licenses (more than 1,000 have already been issued, according to Amir Hossein Saidi Naeini, a union representative for Iran's information and communications technology sector), but has also realized how profitable selling electricity within the country can be. Consequently, miners have easier access to Iranian electricity, which facilitates the flow of external capital into the country through channels not subject to sanctions.

Then in September 2020, The Tehran Times reported that three power plants had received licenses allowing them to directly mine Bitcoin using the energy they generate.

Licenses have certain conditions - such asthe use of special equipment that is not connected to the national power grid - and, of course, there will be some state fee from this, but such a step shows how much the government's position has changed in just a couple of years.

This was succinctly explained by the same representative of the Iranian trade union at the end of 2019:

"Our research shows that the cryptocurrency mining industry has the potential to generate an additional $ 8.5 billion a year for the economy."

I find it interesting that the country is "chasingdollar,” rather than hoarding Bitcoin itself, at least for now and according to public statements. However, this is not necessarily the case for other countries that are now directly competing with Iran for such important hashrate.

Venezuela

illustrations: BitNews

The Venezuelan economy is in disarrayfor a variety of reasons related to high-level corruption and sanctions, but the country is now actively making efforts to increase its presence on the global mining scene. However, as in Iran, until recently mining here was a largely underground and unregulated activity, meaning that the figures provided by the University of Cambridge include mining that falls under this category.

However, on September 21, 2020The government agency responsible for regulating cryptocurrencies has unexpectedly legalized the mining industry through a decree published in the official gazette. The decree was issued by Joselit Ramirez, head of the National Directorate of Crypto-Assets and Related Activities (SUNACRIP). By the way, this is the same Joselit Ramirez who is wanted by the United States on charges related to corruption and drugs.

Be that as it may, this decree is very interestingformulated. In addition to going through a complicated license application process, being listed in the government register, keeping archives for 10 years, and importing hardware only with government approval, all mining activity must go through the government-controlled National Digital Mining Pool.

Apart from the obvious control, this last detailcreates the intriguing possibility that a country's government may seek to hoard bitcoins directly, presumably through pool fees or some other similar fee.

Given the level of sanctions imposed on the country,unsuccessful attempts to return their gold from the Bank of England and the need for hard assets to support a ruinous budget balance, this is quite logical. However, although Venezuela may well have such intentions, for now this is purely my guess.

Be that as it may, I expect that with formal andWith legalized infrastructure for mining and clear incentives, Venezuela's hashrate will continue to grow in absolute terms in the near future, although its global share is unlikely to increase further due to the speed of progress in other countries.

Kazakhstan

illustrations: BitNews

As in other countries, Kazakhstan's legal position on mining has only recently been clarified, and again, almost certainly only because of the very attractive dollar earnings.

In recent years the situation has changed noticeably.In 2018, the National Bank of Kazakhstan proposed banning cryptocurrencies altogether, but a few months later the government came out in favor of regulating them. However, it was not until June 2020 that mining became fully legal, which again suggests that the data collected by the University of Cambridge covers underground or unregulated mining.

After this, the Minister of Digital Development of KazakhstanBagdat Musin announced an investment of $715 million in the cryptocurrency mining sector to strengthen the country’s economy. This is not surprising, since in Kazakhstan electricity is almost the cheapest in the world thanks to the abundance of coal. While this arguably makes the country's contribution to Bitcoin's hashrate one of the dirtiest in the world, miners receive an attractive price of $0.04 per kilowatt-hour.

But, again, the actual mining takes place inthe private sector, and the government only provides incentives and conditions in order to receive dollar income. It is unclear if the country plans to hoard bitcoins in the process.

The rest of the world

Mining, of course, happens everywhere, in different ways.rules and with different incentives and goals, but in almost all states it is growing. Even in countries under heavy sanctions, such as North Korea, where access to the necessary equipment for Bitcoin mining is very limited, the state has recognized that this is a way to circumvent these very sanctions.

For example, in February 2020.American cybersecurity firm Recorded Future reported that Monero mining (XMR) network traffic originating from the North Korean IP address range has increased "at least tenfold" since May 2019.

Monero is not only mineable on standardcomputer hardware, but this cryptocurrency is also anonymous, allowing the secretive state to conduct global transactions without being detected. The benefits for the rogue state are clear.

Of course, many other examples can be given,to show that the mining industry is increasingly recognized and encouraged by central authorities, but at this stage this is secondary to the more important issue:what's next?

Superiority in hashrate

Although it may not be so obvious(especially if you work in this field and constantly deal with Bitcoin)mining on a large scale is, by definition, a very young industry.

Cryptocurrency appeared 11 years ago, and the presentreceived international recognition only in recent years. We are only seeing the earliest days, as can be seen from how the aforementioned countries have recently set about formalizing their operations.

But, in my opinion, they will not be the last.I fully expect that other countries will also expand and clarify the legality of mining as it becomes clear to them that it is an effective way to increase their GDP. Better yet, for those countries still unsure what to do with Bitcoin, this is a way to generate income in the traditional sense without directly participating in the cryptocurrency space.

However, the more countries becomemore investor-friendly, the more choice mining companies will have where to place their capital and equipment. This will inevitably lead to incentives being offered by countries that want to win them over. Then the next stage of development will come, and today's pioneers will have an advantage. But this will not be the last step on the way.

As far as we know, no country hasdoes not officially hoard bitcoins as part of its national reserves. Of course, some countries unintentionally acquired cryptocurrency, usually as a result of the confiscation of criminal assets, but this is not quite the same thing.

When is the real value of bitcoin as realinternational asset and store of value will be recognized at the government level, the situation will change again. Then the real race for hashrate supremacy will begin. When this happens, no country will want to be left behind - it would be like not hoarding gold and allowing competing economies to do so.

In addition, developing and undercountries are more motivated to get into the game early by sanctions, since no other global asset allows them to be placed on a level playing field with others.

Governments will rush to authorizestate-sponsored mining complexes, even redirecting funds and resources from other projects when necessary. Private complexes will either be acquired by the state or work for it on favorable terms. “National hashrate” will be a source of pride and an indicator of economic success, which will be cited on economic websites next to gold reserves.

And as the title of this article reads, the coming hashrate wars are likely to resemble the space race that took place decades ago.

After all, isn't it so implausible thatthere will be official government agencies whose task will be to support and increase hashrate through the development of new technologies and attracting personnel from the private sector?

Of course not. I believe it's only a matter of time.

</p>You can always thank the translator for the work done:BTC:3ECjCH5tPoyDCqHGCXfiiiLZQ3tVGzCSxBETH:0xf45a9988c71363b717E48645A412D1eDa0342e7E