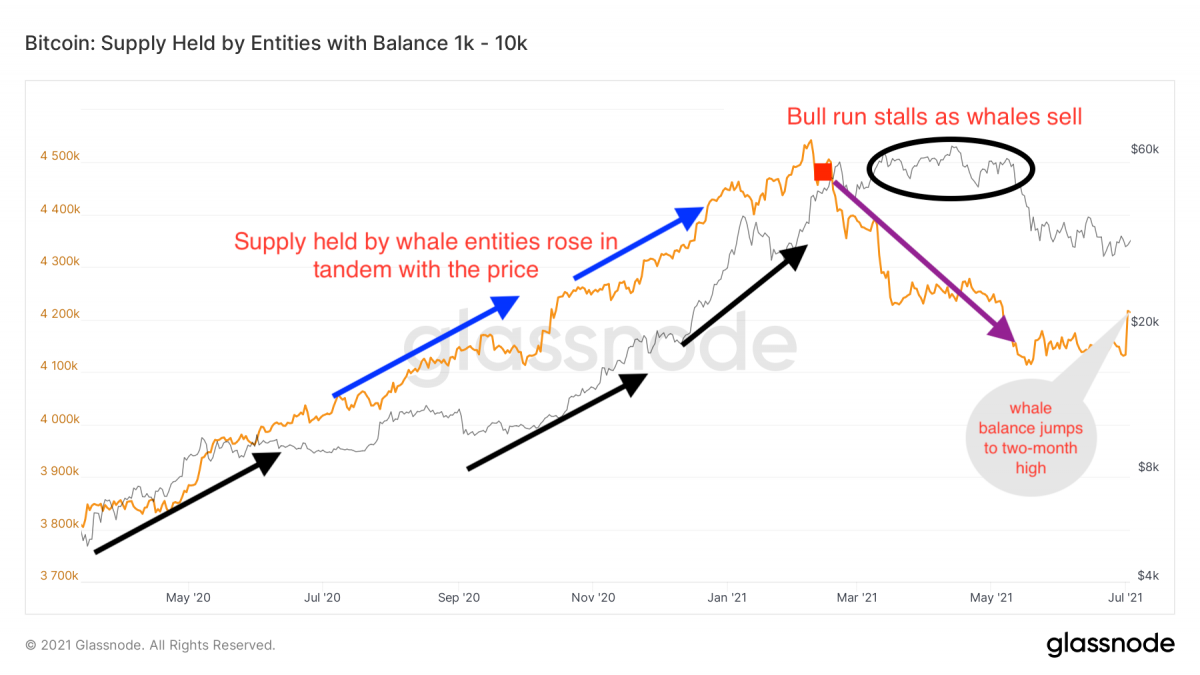

Large investors are again increasing their assets in Bitcoin after getting rid of them along with the declinecourse over the previous months, according to the Glassnode analytical platform.

In June, large Bitcoin holders predominantlysold cryptocurrency, which provoked a drop in its value. In total, since the middle of last month, «whales» sold 60,000 BTC. The sales were carried out by investors whose wallets control from 100 to 10,000 bitcoins.

However, already in July the trend changed, and«whales» went on the offensive again. According to Glassnode, addresses containing between 1,000 and 10,000 coins bought more than 80,000 BTC. The volume of cryptocurrency held in «whales» wallets, rose to its highest level since May 2021.

Researchers have found that major players now control 4.216 million BTC. Number of «whales» reached a three-week high in early July (1,922 addresses).

Many analysts rate positivelyprospects for bitcoin amid the activation of large cryptocurrency holders. It was this trend that provoked the rise in the value of BTC, which began in the second half of last year.

As CoinDesk analyst Omkar Godbole notes,The resumption of bitcoin accumulation by whales should be positive news for the market, as these same investors played a significant role in the cryptocurrency's rise from $10,000 to nearly $60,000 in the five months to February 2021. During this period, the balance of such wallets grew along with the rate until it reached a record high of 4.542 million BTC on February 8.

The head of the Celsius Network gives an optimistic forecast,assuming that there will be a period of calm after the July sell, and bitcoin will begin to move towards current highs and eventually reach the $ 140,000 - 160,000 range, before adjusting to $ 90,000 by the end of the year.

At the same time, among bitcoin investors there is nounanimous point of view as to how the unlocking of Grayscale shares will affect the BTC market. According to popular belief, their holders will sell to compensate for the loss from the discount to the price of bitcoin.

Amber Group, however, notes that investorsborrowed bitcoins to deposit into Grayscale (GBTC) and will now have to buy cryptocurrency on the market in order to pay off creditors. In other scenarios, they won't have to do any spot market trading at all to close the deal. Ultimately, Bitcoin's behavior will depend on the balance of different investors in the trust and the expectations of outside market participants.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)