Early adopters, geeks and growing mainstream interest. With these words you cancharacterize Bitcoin today, just likeThe Internet back in 1995. Having rummaged through Youtube, you can find some pretty interesting videos from those times when people were just beginning to get acquainted with the meager, relative to today’s, possibilities of the Internet. For example, here is an old video that explains the concept of email and the concept of «downloading a file». Reminds us of today's situation with numerous videos explaining how Bitcoin works, doesn't it?

Today's Bitcoin proponents explain concepts like wallets, cold stores, and private keys to ordinary consumers who are less knowledgeable in the technical details.

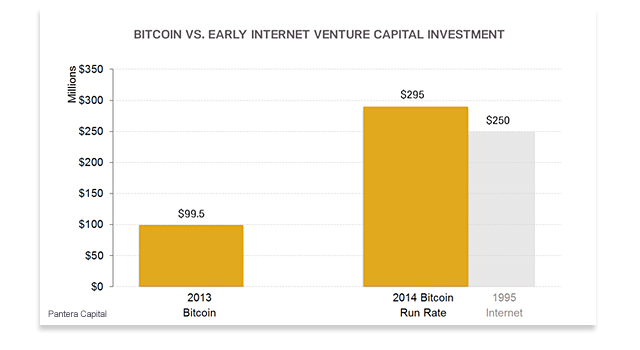

Let's now take a look at the situationWhere Bitcoin stands today relative to the Internet in 1995, in terms of venture capital investment. Ron Glantz, director of research at the Pantera Capital investment fund, and Dan Morehead, executive director, tried to address this topic in their newsletter to investors:

The dynamics of venture capital investment in Bitcoin is outpacing investment in Internet companies in 1995. Purely for information… In 1995, companies such as Yahoo!, Amazon and eBay were founded.

We are confident that funding Bitcoin startupswill have positive consequences for the future of the industry. Well-funded startups will create innovative, more efficient and interesting ways to use Bitcoin, which will accelerate widespread adoption of Bitcoin in the medium term.

Few innovative technologies reachmaturity by avoiding mass criticism. And Bitcoin is no exception. Bitcoin skeptics today are reminiscent of the people who were skeptical of the Internet in the early 90s.

Further, Pantera Capital analysts draw analogies on the technical side:

In the early years of its existence, the Internet wasslow, and there were almost no programs with a consumer-friendly interface. Dial-up modem with speed 14400— this is the current state of Bitcoin. But in the end, developers built applications that were unimaginable at that time based on the TCP/IP protocol. The same thing will most likely happen with the Bitcoin protocol. We are confident that new applications will make it as useful as other technological innovations become over time.

The authors of the report indicate the fact that the numberBitcoin-related venture projects have grown at least 3 times over the past year. In their opinion, this occurs as a result of the combination of many factors:

- Bitcoin is built on top of the Internet. If Bitcoin already existed in the 90s, we are sure that it would already be a built-in standard for paying for goods and services online

- Innovation spreads faster than in the 90s due to the global penetration of Internet accessibility: ideas spread almost instantly

- Bitcoin directly hits in areas thatnow monopolized. Just as once online brokers with low commissions supplanted telephone brokerage services, Bitcoin will supplant monopolists in many other areas.

- Banking and financial system that is familiarfor Americans and Europeans, inaccessible to 6 billion people around the world. Bitcoin gives these people an elegant financial instrument, moreover, for almost nothing

- Bitcoin is very attractive as a tool forstoring value for people in countries with high inflation and risks of devaluation — such as Argentina, Venezuela and Zimbabwe. Wherever inflation destroys the value of money and the government prevents the population from buying more stable currencies.

In the inflation race of 2014, so far Venezuela leads by a wide margin. Http://t.co/6aMasTH4sT pic.twitter.com/557y9jwr9k

— BitNovosti.com⚡️ (@bit_novosti) November 3, 2014

Fund analysts believe that the future of Bitcoin will become as significant as the future that awaited the huge clumsy computers of the 90s:

We believe that developers will create applications that we cannot even imagine now.

For reference to our readers:

Pantera Capital is a subsidiary of onefrom large Wall Street algorithmic funds Fortress. You can read about its history and the people behind its origins in the entertaining book by Scott Patterson «Quantums: how math wizards earned billions and nearly brought down the stock market«.

Based on materials: insidebitcoins, panteracapital