Every day, all over the world, people swipe their plastic cards on electronic devices, put them in pilespieces of paper of all sorts of colors and sizes and spendtime and effort, desperate to accumulate "money". How often, during these seemingly mundane operations, the question of what is money comes to mind? Most people will most likely never. For them, paper money is like water for fish: it is everywhere, and it is impossible to live without it, but few can explain what qualities good money should have or why modern civilization needs it so much.

However, perhaps now the question is “what is money?» is more relevant than ever. Why? Consider, for example, the $28 trillion in US government debt, not to mention the $100 trillion in unfunded liabilities, including baby boomer pensions. But don't stop there: Consider also the possibility of the feds passing a "stimulus package" with support from both Democrats and Republicans and printing $3 trillion out of thin air, equal to the annual income of more than 50 million American families. Now, you may have already begun to guess why now is the time to question the meaning of money. To truly understand their properties and purpose, we must first travel back in time to a time when civilization did not yet know money.

</p>Chapter 1. What is money?

Barter

Instead of being used as a medium of exchangeFor money, old civilizations relied on a barter system for trade. Barter can be effective on a small scale, and with the right trading partners, perhaps even more effective than money. Unfortunately, for those of us who enjoy bargaining, bartering has two major drawbacks that limit its scalability and effectiveness. The first significant disadvantage of bartering is the frequent presence of conflicting desires, usually called a problem"Double coincidence of needs"... This can be explained with a simple example.When farmer Fred goes to the blacksmith Bob to get some tools, he should hope that Bob needs milk or vegetables, otherwise he will be out of luck. As you can see, if each side does not want the goods that the other side has in abundance, and does not have a similar value system, the deal will not go through. And, as you might guess, such obstacles seriously hamper the flow of economic goods and interpersonal interaction.

Second major flaw in the barter systemcomes down to a basic fact of human economies known as labor specialization. In short, the theory of specialization of labor says that it is better for the warrior to focus on getting stronger and mastering the best techniques, the blacksmith on swords and armor, and the farmer on increasing the yield. At the level of civilization, it will be less productive if everyone is engaged in many crafts at once. A person who has worked in a particular field for a long time can learn from their own mistakes and learn the best techniques. Lack of intensive specialization in the limited range of economic goods you produce. In a barter system, this can lead to extreme supply / demand volatility and the pricing power of your business. Fortunately, after thousands of years of fighting these problems, humanity has come up with a new solution - money.

Money wasn't always green pieces of paper or numbers on an app. Money took the form of beads, shells, cigarettes(see the classic film The Shawshank Redemption)and rare sparkling rocks. What they all have in common is that they were the most popular(i.e. liquid)goods in one system or another, but evenA huge sequoia grows from a small seed. Beads began to be used as money in Africa because they were rare there and the local population did not know how to produce them. Half of the prisoners arrived at Shawshank as heavy smokers, half of the rest started smoking in prison, and the remaining quarter had 75% of the prisoners to whom they could sell the goods. As for gold, its history is more authentic.

This sparkling, incredibly beautiful rock formationwith fantastic electrical conductivity, it rose in the monetary hierarchy not because of its sophistication, but because of its permanent rarity. Throughout history, we have managed to mine and accumulate less than 4 Olympic gold pools. This includes our grandfathers' golden teeth, so let's round up to 3.5. This extreme and constant rarity, coupled with a long history of accumulation and display of glittering treasures by mankind, has made gold the king of the mountain of money for much of the modern era. You may be wondering: Is there really enough scarcity and liquidity to be good money? No, in fact, everything is more complicated, although not much. Below I will discuss the qualities of good money.

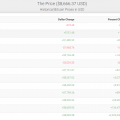

The qualities of good money

(in ascending order of importance in my opinion)

Images: BitNews

7. Protection of confidentiality

In the modern financial world we are dealing withdigital money, saddled with banking customer identification and anti-money laundering laws that treat everyone as a drug lord until they prove otherwise. Regardless of the debate about how well it works(see history of HSBC's drug cartel ties), all participants know how unpleasant it is andpainful for ordinary innocent citizens. Therefore, protecting privacy is a new characteristic of good money, coming to the fore in the digital age. Historically, this characteristic has been overlooked due to the physical nature of gold. In the world of ones and zeros, different systems can be very different in terms of censorship and collection of personal data. For this reason, protecting privacy is the seventh most important quality of good money.

Related Reading: Why worry about privacy if you have nothing to hide?

Hardware crypto wallet Ledger

6. Portability

Living in a highly globalized and interconnectedworld, it's easy to see why being able to transfer funds faster, further and cheaper is useful. This key property of money led to the decline of gold and the era of paper money representing gold, and then to paper notes backed by nothing except government fiat.(fiat money)... With the advent of digital money, fiat currenciesthe first were able to move almost at the speed of light, unless, of course, all the control and regulation mechanisms in the financial system are considered. Now people expect this property from money, so it seems to be indispensable. Consequently, portability is the sixth most important quality of good money.

5. Severability

Ability to divide each unit into many partsincreases the utility of money for different types of economic interaction. This is where precious metals, among other things, have excelled, and now Bitcoin is doing even better. Since gold and silver are elements of the periodic table, they are theoretically divisible down to the atomic level. In practice, they can be reliably measured to the nearest gram or fraction of a gram. The first cryptocurrency took this to a whole new level, as one Bitcoin is divided into 100 million subunits known as satoshis. That is, only 2,100,000,000,000,000 (2.1 quadrillion) satoshis will exist. Luckily, Bitcoin is just information, so if that's not enough, we can always split it into even smaller shares. Thus, divisibility is the fifth most important quality of good money.

4. Interchangeability

Interchangeability is, in a simple way, whenthere is a group of products whose comparative characteristics are similar enough to call them roughly “the same”. Since gold is just an element of the periodic table, it is ideally interchangeable. Diamonds, on the other hand, are not interchangeable due to differences in quality, and also because the atoms they are made of (carbon) are not rare in themselves, but the way these atoms are structured makes them rare and unique.

Products of varying quality cannotfreely circulate as money, since the assessment of their "purity" and, therefore, their value is subjective. This can be seen in the example of dollar bills obtained illegally (money laundering), and even bitcoins that went through the wrong hands are considered by some to be “tainted”. With the advent of new technologies that protect privacy, this problem in the case of bitcoin should become less significant over time. In the Bitcoin network itself, coins are completely fungible, but have different ownership histories, which should guarantee auditability for all 21 million units. Thus, fungibility is the fourth most important quality of money.

3. Verifiability

The Bitcoin world is taken seriously for a reasonto the saying "do not trust - check." When you receive a five dollar bill, how often do you check if it is real? It may seem like a joke now, but jump back 500 years in the past. How do you know the weight and fineness of gold are correct when someone pays you for a leg of lamb in a crowded market? Modern technology makes it easy to measure weight, but the fineness of gold is a completely different story. You need expensive equipment, time and a certain level of trust (unless you try every ounce when buying several tons). The ability to check in general, and even more so to check cheaply the amount and purity of money, is very important. It simplifies money circulation and reduces the necessary level of trust between two trading partners. For example, if the payment in bitcoins that you promised me appeared in my wallet, then it has already been checked for purity and quantity up to one hundred millionth of a coin. Thus, verifiability is the third prize among the most important qualities of good money.

2. Durability

The above properties mainly covermoving value through space, and I believe this is one of the two main uses for hard money. The second application that distinguishes excellent money from just decent money is the ability to retain value over time. And it is precisely the two most important qualities of money - durability and scarcity - that allow it to stand the test of time. Durability can be described as the ability not to rust, rot or deteriorate at all under the influence of time and various conditions. According to this property, gold has historically held the leading position.

Gold has virtually no equal in monetary termsthe world in its ability to pass the test of time. Having started life in a collision of neutron stars or in a supernova explosion, each gold atom went through a crazy journey before reaching our blue planet, while maintaining the same number of electrons orbiting its core. Bitcoin can only dream of such longevity and thousand-year history. Since bitcoin (an asset) is just information, it is also immortal in some ways, but fragile in others. If there is a nuclear war, gold will still have the same number of electrons, while the Bitcoin network could theoretically disappear from the face of the earth. However, Bitcoin is antifragile at the system level (relative to events that do not destroy the world). He is able to grow stronger after major attacks. Or, in other words, every time he suffers an attack, the very fact that he survived gives people more confidence to invest in different aspects of the project, from the actual coins to the mining hardware that powers the network. This is known as the Lindy effect: the longer something exists, the longer it can still exist. Early on, many critics cited various reasons why Bitcoin will soon die, from stopping mining to government bans, but it is still alive and well. He pays no attention to criticism and grows stronger over time. Thus, longevity is the second most important quality of good money.

1. Rarity

So, we come to the main secret of any goodmoney that can stand the test of time: a rarity. In short, scarcity includes how much of something exists today, how much is created each year, how much can be created each year with appropriate incentives, and, finally, how much is available for sale at any given moment (less important). There are many different interpretations of how the scarcity of a good in an economy can be measured. I prefer to look at the ratio of stocks to inflows. Stocks are the entire supply of the commodity in existence, so for gold this would be the 4 Olympic pools mentioned above. The influx represents new gold mined each year. Historically, this number has been in the order of 2%. That is, 2% of all gold reserves in the world are mined and processed annually. The ratio of stocks to the inflow of a particular commodity is the inverse of these percentages. Thus, for gold, the ratio of reserves to inflow is 50. This is a very high value, which is mainly due to the complexity of finding and producing new gold. In addition, most gold is used for monetary or jewelry purposes rather than being consumed like aluminum or steel. Consequently, the money supply is only growing. However, Bitcoin is taking the stock-to-inflow ratio to a new level.

Bitcoin supply, like gold, over timeonly grows because it is not consumed. We can assume that coins disappear when the keys to access them are lost, but we will ignore this for now. Unlike gold, Bitcoin has a distinct property known as halving. This is a once every 4 year event where the total number of Bitcoins mined each day(more on mining will be below), is reduced by 50%. We have already seen three halvings.At the start, 50 BTC were created in the system every 10 minutes, then 25, then 12.5, and since May 11, 2020, 6.25 BTC are created every 10 minutes. Since the last halving, Bitcoin's stock-to-flow ratio is almost the same as gold. In 2024, humanity will finally have money that is more rare than gold (twice). It is impossible to know for sure how the market will react to this event in the coming months. If Bitcoin manages to equal gold in value(which seems somewhat pessimistic, as it outperforms gold in almost every quality of good money), then each coin will cost more than $ 400 thousand ...

“It makes sense to get some coins in case they become fashionable. If enough people think the same way, it will become a self-fulfilling prophecy. " - Satoshi Nakamoto

Ultimately, money can have the highestscore on all other criteria, but if they don't pass the rarity test, they won't last long. This includes long-term scales where engineering or technological breakthroughs can make available in abundance much of what we now consider rare. A simple example is beads in Africa, and if you want to learn more about technological deflation(when technology advances lower prices)– read Jeff Booth's book"The price of tomorrow"... Thus, scarcity ranks first among the most important qualities of good money.

Chapter 2. What is Bitcoin?

It was January 3, 2009.The world has just begun to realize the scale of the financial ruin awaiting it. Ahead were unthinkably large stimulus packages, the monetization of government debt, and central bank buyouts of toxic bonds. Bureaucrats in Washington, Brussels and Beijing have tried to find a way out of this chaos. In the end, they came up with a plan to save people, like firefighters entering a burning building, only people did not know that these same firefighters, together with the Federal Reserve System, lit the fire - but that's a completely different story.

And while the world was mired in political and financial crisis, a block of organized data began to spread on the Internet, in which a bold statement was forever imprinted:"[UK Treasury] Chancellor Considers Second Bank Bailout Program". Thus began the journey of Bitcoin, whichHe then took his streamlined data sets from the natural gas-rich plains of Texas to remote water-powered mining farms in the mountains of China. Since then, Bitcoin has continued to create new blocks approximately every 10 minutes. At the moment, there are already more than 660,000 blocks in the Bitcoin blockchain, with an uptime of 99.98%, which is much more than any website. The Bitcoin blockchain has become an encrypted, unstoppable and distributed power that spans the globe.

And you may be wondering:what is blockchain? Why is Bitcoin good money? Who created it? Why did Satoshi Nakamoto create it? Why can't you copy it? Finally, what is the difference between Bitcoin as a digital asset and the Bitcoin network? (Let's assume that all of these questions came to you in that order.)

What is blockchain?

At its simplest level, a blockchain is a ledgertracking digital asset owners. Bitcoin, for example, processes a new block of transactions approximately every 10 minutes, updating the ledger according to the movement of coins on the network. This block of transactions is added to the previous one, forming a chain of blocks - blockchain. When miners process a block of transactions following the rules of the protocol, new coins are created. Bitcoin uses a proof-of-work algorithm that forces miners to allocate computing power, and therefore consume electricity, in order to receive a reward. Miners provide cryptographic security proportional to the work performed. That is, a twofold increase in hashrate(a typical indicator of computer work spent on mining)Provides twice as much network security. Reward in the form of new coins(+ transaction fees; more details below)motivates miners to tell the truth and follow the rules of the protocol. In the early days of Bitcoin, this reward was negligible(if valued in dollars)so the network defense relied on altruismcypherpunks, people who thought cryptocurrency was a fun collectible toy, and the few who were inspired by its potential. At current market prices, this altruism, frivolous collecting and insane faith is worth more than $ 2 million ... every 10 minutes ... on electricity costs less than 5 cents. Quite good profitability in just over 10 years.

Today the situation is completely different. Only 6.25 Bitcoins are created every 10 minutes(12.5% of the initial block reward), but the Bitcoin network consumes more electricity than the whole of Switzerland. Cryptocurrency has become a mainstream product and it is impractical for the average person to start mining today.(We return again to the theory of labor specialization)... Outpacing attacks from championsecology, it is important to note that most of the energy that Bitcoin uses is renewable or that would otherwise be wasted, as miners are very mobile and are looking for the cheapest energy on the planet. Coming back to our topic, since the block reward is halving every 4 years, the last bitcoin will be created in the first decades of the XXII century. This begs the question: when all the bitcoins will be mined, how will the network be maintained, consuming so much electricity?

Although about long-term viability in advanceIt is impossible to know, Bitcoin has reached a position where it has a full-fledged second source of income for miners - transaction fees. At the initial stage, they were negligible. Since almost no one was using the network, the block reward was 50 bitcoins, and the market price of bitcoin was practically zero, miners did not pay much attention to fees. But with each halving, commissions accounted for an increasing percentage of the total income of miners. Since there is a limited number of transactions in one block, space goes to the one who offers the highest commission. This source of income has grown to nearly $ 1 million a day. Since all fees are calculated in bitcoins, this figure can easily grow 10 times or more as the price of the cryptocurrency and its use increase.

This has the disadvantage of short term spikes.the cost of moving your coins online. But we must be willing to pay that price, given the antifragility and resilience that this brings to the network. Just as the internet has scaled, people around the world are working on tier 2 and tier 3 solutions to make the use of Bitcoin economically viable for all sorts of types of transactions. Using such scaling solutions to avoid sacrificing transaction fees is essential for the blockchain to keep creating new blocks until bitcoiners can send away chancellors and central bankers who themselves need to be bailed out.

Why is Bitcoin good money?

Bitcoin is a digital asset, tool, invention, commodity, network, etc.(choose what you like best), the closest thing to perfect money.Historically, gold was the king of the mountain of money. Coming back to the list of qualities of good money, it matches most of them very or relatively well. By and large, its ascent to the top of the money mountain, it owes a very high ratio of reserves to inflow. This quality has allowed him to save value and therefore be good money for millennia. A high reserves-to-inflow ratio can be otherwise described as resistance to depreciation. Gold miners act as depreciation agents in the gold economy, lumberjacks in the timber industry, and miners in the Bitcoin network. But Bitcoin differs from all other commodities in human history in its ultimate rarity. That is, only 21 million bitcoins will be created ... And no more ... no matter how many people try to create them. For the first time, humanity has met with a real, uncompromising, ultimate rarity. We are still at a very early stage, because in one or two average human lives, bitcoins will no longer be created.

Briefly summarizing how BTC matches the key qualities of money

7. Privacy protection:This new characteristic of money, unique todigital age can be divided into two main components: how the network views addresses and what data can be extracted from the public ledger that is the blockchain. Bitcoin's public address system, similar to bank accounts, does not require a name, date of birth, or social security number. The user only needs to keep a unique set of 12 or 24 words secret. In this sense, the Bitcoin network provides excellent privacy protection and freedom.

Unfortunately, the combination of the Bitcoin blockchain withfiat financial systems that use customer identification and anti-money laundering protection make it possible to identify the owner of the coins. However, most Bitcoins were created during the Wild West days.(when the block reward was 50 and 25 BTC), and all coins come from decentralized miners outside the financial system. This, coupled with technological developments(Layer 2 scaling, Lightning Network, CoinJoin, etc.), means that future protectionprivacy will only get better. Hence, Bitcoin can be rated 4+ for privacy protection, with a likely rise to 5 or 5+ in the coming decades.

6. Portability: “As a thought experiment, imaginethat there is a base metal, as rare as gold, but with the following properties: a dull gray; poor electrical conductivity; weak hardness, but also poor ductility and malleability; lack of practical or decorative utility; but with one special, magical property: the ability to navigate communication channels. " - Satoshi Nakamoto

Solving the problem of double spending and the problemByzantine generals for distributed databases, Satoshi Nakamoto created the most portable free-market money in history. This magical ability to send funds through communication channels without anyone's interference can open up a completely new topology of economic interactions at the level of civilization. Citizens no longer need to get government approval to move funds domestically and internationally.

Honestly, at the moment, Bitcoin cannotgive the maximum rating for portability. In certain types of transactions - take the classic example of coffee - using bitcoin at a basic level is not always economically feasible. And this is without taking into account taxes in the fiat system on the one hand and 10-minute intervals between blocks on the other. Fortunately, open-source second-tier scaling solutions and corporate innovations are being developed and improved on a daily basis that will make Bitcoin more accessible and portable for all types of economic interactions and participants. So I give Bitcoin a 5 for portability with a 5+ perspective.

Each block contains a print of the previous one. : binance.com

5. Severability:This point will be short and clear.Currently, Bitcoin is divided into one hundred millionth part, known as a Satoshi. Because Bitcoin is information that represents a finite space on a digital ledger, it can be divided into even smaller pieces if desired. This shouldn't be a problem until Bitcoin accounts for a much larger share of the global economy. Therefore Bitcoin scores 5++ in divisibility and is the most divisible(in a practical sense)money in human history.

4. Interchangeability:As already discussed, at the network level, eachBitcoin is treated the same, apart from different ownership histories and different current owners. “Stained coins” that have passed through the hands of drug traffickers or dictators are only possible from a human point of view. To the network, each Bitcoin is as “pure” as any other. Because I'm human, my assessment of fungibility is inevitably biased. At the network level it is 5 or 5+. From a human perspective, the assessment can range from failure to complete success. I prefer to ignore human error and stick to what the code says: all satoshis are equally pure.

3. Verifiability:Fork wars 2017(a kind of bitcoin civil war or blockchain split)ended with a landslide victory for Bitcoin.In addition, the network has proven perhaps its most important property at the moment: the rules of consensus control the nodes. Never before has this been proven on a large scale in this way. Nodes are computers scattered around the world that in real time CHECK each block added to the blockchain for compliance with consensus rules. If a miner tries to add an invalid entry to the ledger, nodes will reject the block. The miner will then lose the bitcoins earned from the proof of work and the associated transaction fees. At today's prices, that would mean a loss of more than $150,000 for 10 minutes of work. In turn, this makes Bitcoin's scattered nodes the quality testers for the entire network. These nodes ensure that every Bitcoin on the network is pure and accurate to the satoshi level. Thus, Bitcoin receives a 5++ as the most easily and cheaply verifiable hard money humanity has ever encountered.

2. Durability:Since Bitcoin is just information,it is not subject to the forces that destroy most physical goods. The survival of the Bitcoin network is ensured by all the nodes scattered around the world and the data they store. Barring cataclysms like an asteroid impact or a full-scale nuclear war that would destroy us all, Bitcoin will continue to create new blocks every 10 minutes. While this is not quite comparable to gold's ability to survive a global catastrophe and retain the same number of electrons orbiting the core, Bitcoin could very well be given a 5 or 5+ in durability due to the immortal and immaterial nature of information.

1. Rarity:No matter how incredible it may seem to someone,Bitcoin is the first case of a finitely rare commodity that also has the other important qualities of money. For example, the Mona Lisa is extremely rare, since there is only one original. Along with other factors, this is the reason why her captivating eyes are so expensive, but since she lacks most of the important qualities of money, she would be a terrible choice as a base world money tier.

In 2100about 1 new bitcoin will be created ... PER YEAR. In comparison, the current 6.25 BTC block reward seems like a cornucopia, and the original 50 BTC per block is a digital Eldorado that will never be again. The ratio of stocks to bitcoin inflow grows over time, doubling every 4 years, and will eventually approach infinity when humanity finally reaches the event horizon in the form of 21 million coins. After that, new Satoshi will no longer be created. For the reasons listed above, Bitcoin gets 5 ++ on rarity - the most important quality of good money. Together with its excellent performance for the rest of the quality of money, this makes Bitcoin a clear candidate for the title of digital gold if you are a bear / pessimist, and a new monetary standard if you are a bull, an optimist, or a bitcoiner.

Who Created Bitcoin?

Images: BitNews

In 2020the world's largest bank is just 11 years old - a real success. Would you believe if I said that no one knows who its creator is and that it has no CEO? Before our very eyes, a decentralized protocol, which is not managed by any one person or group, was able to surpass all banks in the world in market capitalization.(JP Morgan has approximately $350 billion)... This begs the question ... Does it matter who created Bitcoin? I have mixed feelings about this, of course, a subjective issue. Therefore, I will give both sides of my opinion on this topic.

First of all, I do not want the legend ofBitcoin's immaculate conception is dead or lost in history, so it really matters who Satoshi is. His engineering achievement deserves accolades, awards and, ultimately, the Nobel Prize in several areas at once. Humanity has never encountered an instrument with such a concentrated monetary power, let alone a non-physical, confiscation-resistant form. In addition, it was a perfect miracle that it managed to take off and not burn up in the atmosphere, thanks in large part to adjusting the complexity and incorporating game theory and human psychology. Since many of the key technologies have existed for decades, was it mere luck that humankind received this tool just when it needed it most? I prefer to rely not on luck, but on human ingenuity and freedom to help us get through difficult times. In this regard, I am grateful to a group of people who were closely associated with Satoshi when he presented his invention - the cypherpunk mailing list.

This group of technolibertarians was far ahead ofthe surrounding civilization on the money path. Many early e-money creators and other famous names were on this mailing list: Adam Back (creator of Hashcash), Hal Finney (eternal optimist), Julian Assange (founder of WikiLeaks), Nick Szabo (eminent cryptographer), Wei Dai (creator of b-money ) and Satoshi Nakamoto himself. On Halloween 2008, Satoshi sent this group of prominent eccentrics a letter, accompanied by a white paper, describing a new version of electronic money called Bitcoin. This group had no idea what kind of money black hole would appear later. Thus, anyone on this mailing list could have been involved in the creation of Bitcoin. Whoever it is, THANKS from all civilization.

Interesting fact:Hal Finney Receives First Bitcoin Transaction From Satoshi; Hal lived a few blocks from a real person named Satoshi Nakamoto, and he predicted the price of $ 1 + million for Bitcoin before he crowded out the dollar. A true legend; rest in peace, Hal.

And this brings us to the other side of my opinion:IT DOES NOT MATTER!Unlike traditional corporations withCEOs in suits, no one controls Bitcoin: it has an army of peers from Singapore to Texas that enforce the rules of the protocol. The decentralized, cryptography-enhanced wall protecting Bitcoin is now higher than ever. With millions of custom-built computers, Bitcoin is now as antifragile and decentralized as it has ever been. Even if Satoshi had some bad intentions, it wouldn't matter at this point. The system is completely decentralized and this is intended as its main engineering advantage. In this sense, we are all Satoshi. Anyone who holds a node, provides energy for mining, or simply breathes the air on planet Earth is welcomed into the Bitcoin network.

Интересно по теме: От фиатных денег к криптовалютам

Why did Satoshi create Bitcoin?

While this question cannot be answered from my point of view, the following quote from Satoshi's whitepaper sheds light on possible true motives:

“The main problem with traditional currency isthe trust you need to make it work. It is necessary to trust that the central bank will not devalue the currency, but the history of fiat currencies is full of examples of violation of this trust. We need to trust the banks that store our money and send it electronically, but they lend it, creating one credit bubble after another, keeping only a small fraction of the reserves. "

History textbooks are littered with tales ofempires collapsed under their own weight due to excessive greed and lust for control and power. Oftentimes, innocent citizens suffer from this, losing their purchasing power due to currency depreciation and becoming victims of wars. After the creation of Bitcoin, a monetary power finally emerged that could store value in a decentralized, unlimited, and non-physical way. This should be the most liberating technology in human history. Never before has an individual been able to memorize 12 or 24 words, escape from an authoritarian nightmare, and still retain most of their savings and the flame of hope in difficult times. In this sense, Satoshi created one of the most powerful forces to generate and maintain hope this world has ever seen, graciously gifting it to humanity without any conditions. There are many different additional reasons why Satoshi might have decided to create Bitcoin, but I'll leave them to you to study.

Why is Bitcoin impossible to copy?

Since Bitcoin is just code,running on computers around the world, it would seem easy to copy and thus create your own “Bitcoin.” While it is indeed possible to create your own “Bitcoin” with very similar properties and even improvements from your point of view, Bitcoin cannot be copied. Unfortunately for all those who would like to have their own printing press like Uncle Sam, what makes Bitcoin valuable cannot be copied. It is impossible to simply copy network security, which is provided by special computers scattered around the world. There is some truth to the idea of a “better version” of Bitcoin that could theoretically emerge and take away the security from the original blockchain.(computing power). But in practice the free market has made it clearBitcoin supremacy. The amount of computing power that goes into securing the Bitcoin network is more than 100 times that of its nearest competitor. In addition, it is impossible to create money that is rarer than the first cryptocurrency. As discussed above, resulting inflation is 0%(after the creation of 21 million coins)means no amount of money can beatBTC is rare - the most important quality of good money. Even deflationary currencies will not be able to become more rare due to the policies that are involved in destroying coins at the protocol level.

Even if we neglect physical and engineeringaspects of Bitcoin, its social side is even more difficult to copy. As you can see in the 2017 Bitcoin Cash fork, most of the die-hard, long-term supporters of Bitcoin did not fall for the illusion of grandeur and advantages then promised by the big block charlatans. As a result, the dilutive hard fork ended with an unexpected profit in the form of 1 free BTC for every 5-20 that the hodlers had, who decided to escape from the sinking Bitcoin Cash ship before it even had time to leave the harbor. Bitcoin's superiority after this hard fork only strengthened its potential as a store of value, proved that hard forks would not destroy its rarity, and demonstrated why "slightly decentralized PayPal" is not its future.

What is the difference between bitcoin as an asset and the bitcoin network?

Not everyone understands what the difference is and why it is notsame. The Bitcoin network physically encompasses all miners and all nodes that provide security, validate the blockchain, and maintain its existence, ensuring that the rules of the protocol are followed. The Bitcoin network socially includes all the developers, bitcoiners, and companies built around Bitcoin. Bitcoin as an asset is a reward paid to miners to keep the network secure. Issuing new bitcoins from day one supports the game-theoretic aspects of the network, and the incentives only get stronger over time. Not because of the increasing printing of currency, as in the fiat world, but because of the increasing value of each coin due to the rarity. Ultimately, the issue rate will drop to zero and the network will be supported solely by fees.

As impressive as Bitcoin's physical network andBitcoin as a digital asset, the social network of the first cryptocurrency is incredibly rich in talent, knowledge and hope. There is a lot to learn from what bitcoiners share on Twitter. With insightful insights into money history from Robert Breedlove, macro strategies from Michael "Giga Chad" Saylor, uplifting speeches from Max Kaiser, TFTC posts turning you into a true bitcoiner, insightful explanations from John Wallis, bullish arguments from Vijay Boiyapati and Swonapati's podcast on the way to work, it is simply impossible not to dive headlong into the bitcoin rabbit hole.

</p>You can always thank the translator for the work done:BTC:3ECjCH5tPoyDCqHGCXfiiiLZQ3tVGzCSxBETH:0xf45a9988c71363b717E48645A412D1eDa0342e7E