Adamant Research Report.

Introduction

At the end of the 16th century, a motley group of rebel intellectuals andentrepreneurs founded the state in one ofleast adapted for life in Europe. This territory was so often flooded that the settlers had to build hundreds of kilometers of dams. At the same time, the country was waging an 80-year war with the world's largest empire.

Thanks to many years of overcoming difficulties fromThe melting pot of ideas sprang up the golden age of the Netherlands and the United Kingdom and innovative economic institutions that changed the world. One of the most successful socio-economic experiments in America, the city of New York, originates from here.

In this report, we will try to show thatBitcoin, encryption, the Internet and the generation of millennials are not just the trends of the 21st century, but the harbingers of a wave of changes similar to the revolutionary European era of the 16th – 17th centuries.

Here are some conclusions from our work:

- tolerance or intolerance towards Bitcoin will become an important line of political divide;

- Bitcoin's main growth points are value storage, loans, and underwriting;

- collective storage of bitcoins will become an industry standard;

- offshore banks may turn into Bitcoin banks;

- Bitcoin will develop rapidly: bonds, annuities, loans, insurance will appear;

- The practice of initial placement of exchange tokens (IEO, Initial Exchange Offering) will continue and will gainaboutless popular;

- Bitcoin holders can become a catalyst for transforming the worldview.

The past is the key to the present: a remark on the method

My goal as an investor and analyst is to identifysocio-economic trends and anticipate their development. I read, select and distribute materials. I separate the signal from the noise, listening to experts who, it seems to me, are trustworthy. The main difficulty of this work is thatglobal trends are often obvious only in retrospect.

I find a good solution to overcomeof this complexity - drawing historical parallels. In order not to be blind and not to miss modern trends, I study history in the broadest sense. I read historical books and articles and try to find parallels and analogies with today's trends. In the process, I force myself to pay attention to processes that I have not thought of before, and get the opportunity to put forward hypotheses about previously incomprehensible cause-effect relationships. I believe that this helps me more accurately assess the probabilities of various outcomes and, therefore, make more rational decisions on investment strategies and entrepreneurial projects.

"Whoever wants to predict the future mustturn to the past, since modern events associated with people always resemble events of past times. This is a consequence of the fact that all human affairs are carried out by people who have always been and always will be possessed by the same passions, which inevitably leads to the same results,” —Niccolo Machiavelli, 1517

Earlier I drew parallels between Bitcoin andearly oil industry, search engine wars, domain name market, P2P file sharing and Internet protocols. But the feeling that the scale of an era for which Bitcoin could become a catalyst eluded me. It was only after studying the Protestant Reformation that I felt that I had found a prototype of a suitable scale.

I hope that you will read this report with the same pleasure that I worked on it.

Yours sincerely,

Tuur Demester

Four Prerequisites for the Reformation

We believe that the Reformation was ensured by fourthe prerequisites that exist today: the painful status quo, in which services are provided by the monopolist, technology as a catalyst for change, the emergence of a new economic class and workable defense and retreat strategies for rebels.

1. The monopolist in the pursuit of rent

According to the authors of the article “Economic Analysis of the Protestant Reformation”,Catholic Churchwas a monopoly supplier of spiritual services, andpartial control of the legal system allowed it to suppress competitors. For centuries, she performed the most important function - she absolved sins, in fact being the “keeper” of the keys to heaven. This service was usually provided by priests. The authors continue: “If a religious monopoly inflates prices, it risks that (a) ordinary people will choose another religious service provider; b) the government will find another provider of legal services.” This is exactly what happened during the Reformation.

The monopolist whose rent-seeking is questionable today isinternational monetary and financial system. With the Bretton Woods Agreement of 1944, the dollarThe US has an “exorbitant privilege” as a global reserve currency. Like the Catholic Church of the 16th century, financial authorities have partial control over the legal system, which allows them to suppress competitors. Moreover, the fiat banking system controls access to the savings and pensions of citizens around the world. There is reason to believe that in conditions of quantitative easing, negative interest rates and currency wars, the banking monopoly overstates the prices of its services (for which customers pay through inflation). Because of this, she risks facing the fact that a) ordinary citizens and b) civil authorities choose another provider of financial services. In other words, with a wider distribution, bitcoin can be accepted by political players as full-fledged money for all legal purposes.

“Temporary fees have become permanent, andnumerous new taxes were imposed on the richest members of the church. Church documents […] indicate that the sons and grandsons of heretics had to pay for the sins of their fathers. […] The souls of deceased relatives could be released from purgatory for a fee,” —The Marketplace of Christianity, p. 117

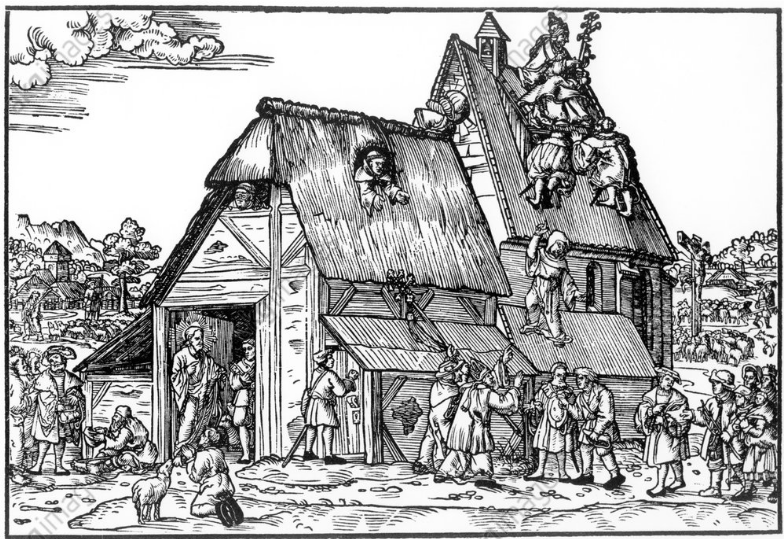

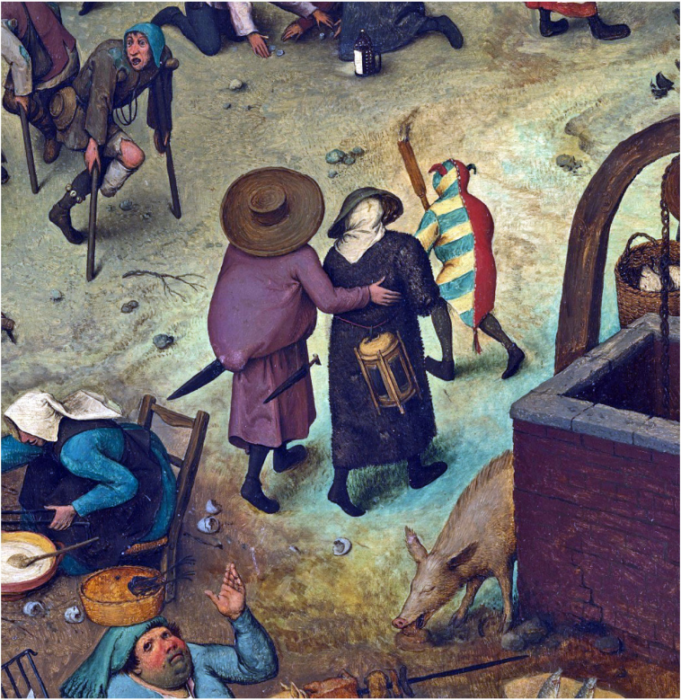

Fragments of the painting “Battle of Shrovetide and Lent”Peter Brueghel the Elder (1559). Bruegel allegorically depicts the conflict of the century: on the left are rebels indulging in pleasures, on the right is the weakened Catholic Church.

2. The technological revolution as a catalyst for change

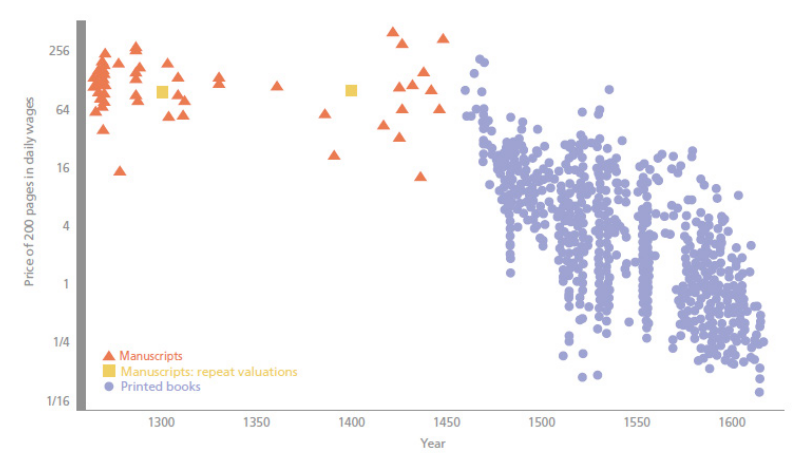

During the 16th century, several world-changing inventions became widespread.Printing pressreduced the price of a book from a year's income to the price of one chicken. DoubleAccountingaccelerated international trade. Improved compass andhourglassallowed to return from uncharted territories (which opened the way to exploring the world). Finally, many other inventions appeared thanks to the boomscientific research.

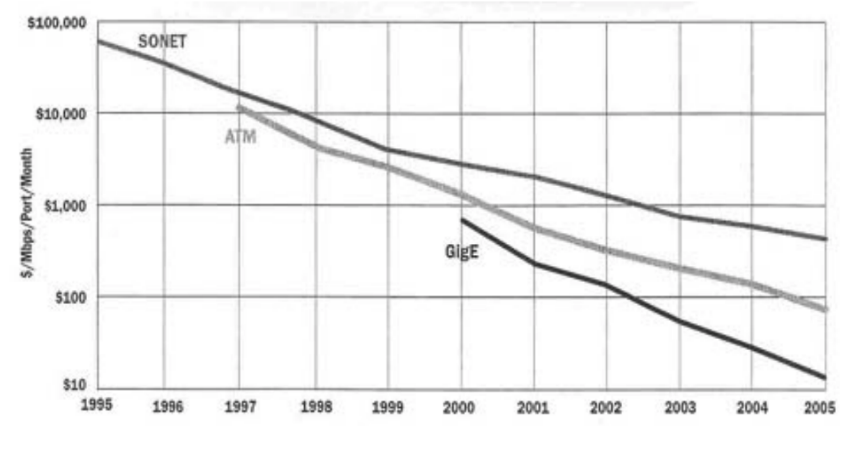

Inventions of the late 20th and early 21st centuries led to the digital revolution.Telecommunicationsand email made it possible to work remotely.Computing resourcesand servicesdata storagebecame a consumer item, which significantly reduced infrastructure costs and, as a result, the cost of launching startups.Open source softwaregave entrepreneurs reliable and free tools. Secure cryptography technologies have found their way into publicly available security solutions.Social networksallowed information to be disseminated quickly and without unnecessary bureaucracy.

In 15th-century Europe, “the price of books fell by 2.4% per year for over a hundred years,” while the proportion of university courses devoted to science rose from 25% to 40%. (Dittmar & Seabold)

The price of an Internet connection at a speed of 1 Mbps has fallen by 99% over 20 years: from $ 100,000 to less than $ 10 (99.99% - approx. Per.)

“As a rule, people from Antwerp are brilliant merchants, very rich, [...] strive to imitate strangers, [...] determined and able to trade anywhere in the world,” Gvichchardini, 1612

3. The new economic class: people who have something to fight for

Throughout the 16th and 17th centuries, maritime trade inEurope has grown and improved significantly. The Rhine, flowing from Switzerland to the English Channel, was the most important trade artery, and the cities of the Low Countries located at its mouth benefited. The volume of goods transported by sea grew rapidly, especially the import of spices from Asia to Europe. Under these conditions, the influence of technological progress grew stronger. In port cities where the rule of law was respected, specialized industries such as dye and textile production, printing, gunsmithing, tapestry weaving, education, and medicine flourished. Craftsmen who mastered these professions attracted clients from all over Europe.As a result of trade growth, technological innovationAndintensive specializationgeneral welfare increased and the role of agriculture in the Dutch economy declined. This weakened the position of landowners and the church in favor ofnew class of merchants.

These days, classes in the West are less pronounced. However, we believe that certain parts of the population are much quicker to embrace change than others. In particular,millennials generationvery skeptical about traditionalfinance and is enthusiastic about digital innovation. A 2016 Facebook survey found that only 8% of millennials “trust the advice of financial institutions” and that 45% “would be willing to give up their bank, brokerage or credit card account for a better alternative.” Moreover, a survey by the Transamerica Center for Retirement Services found that 76% of millennials believe it will be “much more difficult for them to achieve social security” than their parents’ generation, and 79% are concerned that by the time they retire, they will will be left without the support of the social protection system. Millennials, the most invested generation in the Bitcoin economy, are expected to control the majority of disposable income in the US by 2029.

"A new definition of millennials - people before 1996Year of birth is important, as it indicates a generation that managed to understand and remember September 11 and met the 2008 crisis by young people, ”- Pew Research, 2018

4. Reliable defense and retreat strategies

Even with economic superiority and considerable wealth, a person is not inclined to resist the prevailing state of things without having reliable strategies for defending and retreating.

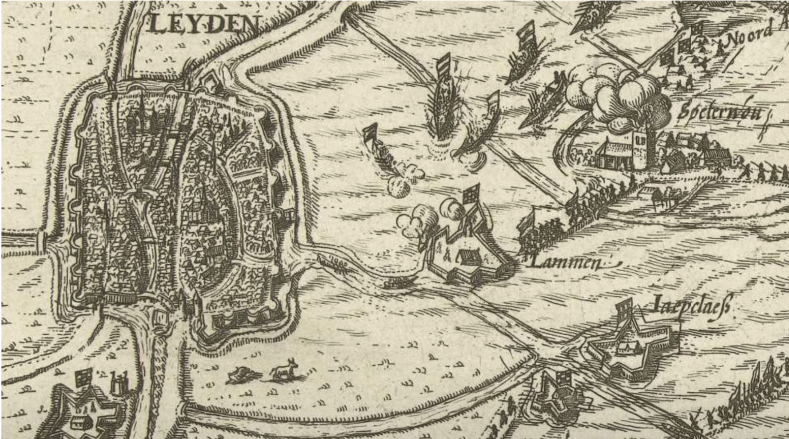

It is not surprising that the Dutch Revolutionlasted 80 years - longer than any other uprising at that time. Sea gueuzes were indestructible on the water. In 1573, the Dutch successfully defended Alkmaar from siege.floodingnearby fields and cutting off a critical supply line for the Spanish. A year later, the same tactics saved the center of education, the city of Leiden. Dutch water line - chainfortified villages, located in direct visibility from each other- protected the cultural and economic center of the country located in the west of the Netherlands: the surrounding fields could be flooded in a few hours. And due to access to the North Sea and a developed fleet, there was always a backup option -emigrationto the British Isles or, already in the 17th century, to the New World.

"The Removal of the Siege of Leiden", 1574 (fragment). The flooding of the fields through the destruction of the dams caused great damage, but weakened the Spanish army and allowed the Dutch flotilla to reach the city.

In the 21st century, the safety of people who question the economic status quo is the responsibility ofcryptography. Cryptographic technologies provideprivacy and protect against confiscation of assets. Encryption is common today. For example, HTTPS usage on the World Wide Web has grown from 13% in 2014 to 77% in 2018. But this is not enough if the service provider can be compromised. Therefore, we are seeing an increase in interest in digital sovereignty: millennials use Bitcoin and are interested in projects such as VPN, Blockstack, peer-to-peer WiFi networks, Tor, Signal, Purism, U2F, PGP and so on.

“If it takes so much to conquer other citiesthe same time as the ones that we have already conquered, we have neither the time nor the money to crush the remaining 24 rioting cities in Holland, ”- Spanish commander Don Luis de Recensence, 1574

“Cryptology is the future of privacy, andhence the future of money, banks and finance. Choosing between interaction with a monetary system that preserves a detailed digital trace of all financial activity and an alternative system that guarantees anonymity and privacy, people will choose the second. Moreover, they will demand it ”, - Orlin Grabbe, 1995

Doctrines of the Past and Present

The intuitive parallel between the Reformation and modernity are doctrines that reflect the essence of the rebellion and proclaim unity and conviction. We see such unifying appeals today.

In the 16th century, the central doctrine of the Lutheran Reformation was the wordsSola fide, which translates to “by faith alone.”This phrase expresses the idea that believers no longer need a priest to go to heaven. Only faith and devotion are enough. Another popular appeal of the Reformation isSola scriptura, or “Scripture alone,” rejects any authority other than the Bible.

In the Bitcoin world today there are several "battle cries", often disparagingly called memes. In our opinion, they reflect a rebellious spirit and proclaim a modern reformation. Firstly,Vires in numeris- “strength in numbers.”The essence of this mantra is summed up in a popular quote from Tyler Winklevoss: “We have chosen to entrust our money to a mathematical system free from politics and human error.” Another motto of Bitcoiners is “Don’t trust, verify.” The phrase has been around since the 1990s and likely originated as an inversion of Ronald Reagan's "Trust but verify" quote. It encourages users to independently verify the integrity of open source software and, in the case of Bitcoin, the validity of transactions on the blockchain. A 2013 forum post gave birth to the wordHodlwhich means a firm intention to keep theirstocks of bitcoins, despite the volatility. Finally, the mantra “Not your keys - not your bitcoins”, emphasizes the distrust of third-party services that take bitcoins for storage.

Christ and the Shepherd, 1524, Nuremberg. This popular engraving shows how Christ welcomes true believers while the Catholic Church plunders a shed and enriches itself on indulgences.

“The very idea of an independent currency, not justapplying private and censorship-resistant payment methods to existing currencies did not appear among early cipher banks or academic cryptographers until it was proposed by futuristic libertarians, ”- Nick Szabo, 2019

Finance during the Reformation

As we have seen, the Reformation saw the emergence of a new cultural and economic class that attempted to defend itself in a dynamic, unstable, and hostile environment. It wasa network of independent, unique economic players ready to defend their views, cut off from traditional ways of doing things, but have powerful tools. Thanks to the acuteneed to improve financial securitya number of innovations and long-termtrends. In the following sections, we will discuss the characteristics of the 16th-17th century Dutch financial sector and extrapolate some parallel trends that are likely to take hold in the Bitcoin world.

Marinus van Reimerswale, The Tax Collector, 1542

Deposit banks: full reservation, strict rules

In 1609, the Netherlands merchants and urbanThe authorities jointly founded the Amsterdam Wisselbank (AWB), which performed two main functions. Firstly, it kept reserves of gold and silver brought by merchants - refugees from the South Netherlands and other territories. Secondly, the bank issued bank notes recognized outside the country, denominated in florins, and bills of exchange.

“No wonder the Dutch come toprosperity before us. All their statesmen are merchants. They traveled to foreign countries, they understand how to trade, and do everything in its interests ”, - Petition to Oliver Cromwell, XVII century

The level of security in the Amsterdam Bank is nothad analogues in the world. It was located in Amsterdam - a city protected by the Dutch water line - a moat 80 kilometers long. The office and storage facilities are located in the very center of the city, in front of everyone, in the town hall. The organizational structure itself reflected the bank's firm intention to fulfill its fiduciary duties. Four commissioners worked in it, and at least two employees should always have watched the premises. The Commissioners supervised four accountants, four auditors, three administrators, and a precious metals tester. To prevent fraud, each accountant performed a predetermined task. The Dutch East India Company (Verenigde Oostindische Compagnie, VOC) - probably the most powerful economic organization of its time - kept an account with the Amsterdam Bank and paid only through it.

Despite a somewhat spoiled track recordListed as a fully reserve bank, AWB's reputation was second to none in the 17th century. Reliability and stability of the bank played a key role in the prosperity of the Republic of the United Provinces. Already in 1776, Adam Smith praised the money of the Bank of Amsterdam for "the inherent advantages over currencies." AWB services were not cheap: the bank charged a fee for opening an account and took 1% per year for storing gold coins and 1.5% for withdrawing funds. But in general, the advantages of AWB money were so obvious that his banknotes had agio, that is, they traded more than gold and the coins with which they were secured.

Trolley for transporting gold coins in the Amsterdam Bank

In the Bitcoin community in response to rejectiontrusted third parties, the high risk of loss and theft and long-term regulatory uncertainty, we expect the emergence of similar highly reliable and requiring minimal trust banking systems and storage of bitcoins.

Minimum trust solutions are designed to make theft and fraud much more difficult. Usagedelay mechanismstransactions andprogrammable multilevel signature rightsindicates the emergence of reliable methodsBitcoin storage, which can raise security to previously unattainable levels. We appreciate the promise of smart contract solutions proposed by people like Bob McErlath, Bryan Bishop and Pieter Wuille. In this sense, the rise in popularity of multisig wallets is likely the promising start of a much larger trend. As of October 2019, 32% of bitcoins in circulation are held in P2SH addresses, which provide better privacy, and 12% are held in addresses that can clearly be classified as multi-signature wallets (compared to 0% in 2014).

“[Here, storage is defined as] a circuitcreating a transaction that obliges both the user and the attacker to always observe the public blockchain. A weakly protected hot key can be used to send coins to an arbitrary address only after a certain time. During this delay, it is possible to initiate the return process, which can either cause the colder storage parameters, or [...] restart the delay period, ”Bryan Bishop describes a proposal for a pre-signed multi-signature repository, 2019

Business Insurance: Carefully Weaving a Trust Network

Along with the boommaritime tradein the 16th century, there was a need for financial technologies that would take into account the associated risks. Interest rates «marine loans»- an early form of insurance for ship owners- were forcedly high: the loan was repaid only when the ship returned safely to the port. Such contracts were especially convenient if the investor did not have reliable information about the profitability of the expedition. The alternative was the contract "the command"(Comenda), which gave the investor the right to a share inarrived on a successful flight. Both options, however, were not complete prototypes of modern marine insurance. The first insurance contracts appeared in Italy, where merchants themselves acted as insurers, which subsequently laid the foundation for mutual insurance. By the sixteenth century, insurance reached the shores of Britain, France, Holland and Spain.

Image of a Dutch merchant ship (fragment), Willem van de Velde, 1650

One of the main problems for merchants wasreceipt of insurance payments. Not all financial centers were equally reliable.Having made a mistake in choosing an insurer, the merchant could say goodbye to his money. Obtaining reliable information in the immature shipping market was difficult, so insurers faced highoperational risks. Sometimes sailors specifically insured theira ship for a significant amount, to then sink it, or buy insurance for a ship already sunken. Due to the high risks, merchants paid increased premiums to reliable insurers, while insurers often dealt only with those merchants they could trust. Other factors, such as the financial stability of insurers and the rule of law in the city, also influenced the cost of insurance. The governments of Amsterdam and Venice repeatedly tried to introduce licensing of insurance brokers and guilds, but this measure did not find support.

Merchant of the Dutch East India Company with his wife, Albert Kuyp, 1640–1660

Insurance in the EcosystemBitcoinis still at a very early stage.Since the advent of the mining industry in 2013, we have seen many examples of proto-insurance. Investors pre-order mining devices from startup manufacturers. They, in turn, use the collected funds to produce chips and equipment and, as in 16th-century maritime trade, claim a share of the profits if the enterprise is successful. Additionally, several custodial services offer different forms of insurance. However, the fine print usually states that only “hot” wallets that store no more than 10% of the bitcoins under management are insured. As in 16th-century trading, insurance in the crypto business depends on many unknown factors, such as price volatility and risks associated with regulation, information security, service providers, etc. Given the global liquidity of Bitcoin, even attacks from states cannot be ruled out. Insurance companies wishing to succeed in the industry must have deep theoretical and practical knowledge, as well as a clear set of standards outlining the responsibilities of the parties and their long-term obligations. It is no coincidence that self-insurance in the form of a reserve fund has become the de facto standard in the Bitcoin custodial industry.

“While in the traditional market there areinsurance programs with coverage of up to $ 2 billion, programs for crypto assets are available only up to $ 500 million. ”- Jeff Hanson, Director of AON, June 2019

Liquid collateral asset as the basis of loans and derivatives

In 1602, Dutch merchants united six small companies and collected 64 tons of gold to foundDutch East India Company(VOC).She owned her own fleet of ships for trade with Asia, for which the Dutch government gave her a monopoly. Thanks to this monopoly, the East India Company's fleet played an important role in the ongoing war with Spain. In 1604, the company went public, conducting the first public offering of shares in its modern form. Anyone could buy a share in it. The placement was successful: more than 2% of the population of Amsterdam became VOC shareholders. The deliberate absence of bearer shares and clear rules for the ownership and transfer of securities met key requirements for a transparent market. In 1610, investors received their first dividends.

“Falling interest rates show successAmsterdam secondary market. He channeled capital into productive uses, particularly short-term borrowing, through active securities trading and related lending facilities." - Gelderblom & Jonker

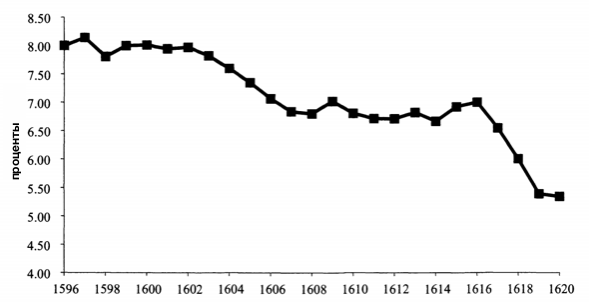

East India Shares Have Been Extremelyliquid. They were willingly taken as collateral: a few months after the company was founded, shares with a total value of 27,600 guilders were used as a guarantee in the exchange of prisoners. Already in 1607, one aristocrat took 2,000 guilders at 8%, laying shares with a market price of 3,000 guilders (collateral ratio 66%). The VOC equity market grew rapidly, but left little evidence of itself, as the transactions took place privately. In 1623, the government formally approved the procedure for the liquidation of shares of the East India Company in the event of default by their holder. By the 1640s, the Amsterdam Exchange had regular repo transactions on the company's shares. Market interest rates in Amsterdam for (secured) loans fell from 8% in 1596 to less than 6% in 1620. The high liquidity of the VOC stock market made them an ideal underlying asset for the thriving 17th century derivatives market in Amsterdam, which offered forward contracts (including with the possibility of opening short positions) and repo transactions. In his dissertation on the East India Company, the historian L.O. Petram concludes that "after the 1630s and 1950s, investors were mainly interested in financial services provided by the secondary market, and not in trade with the East Indies themselves."

Investments and profitability of trading companies until the founding of the East India Company

Access to loans secured by shares of the East India Company led to a sharp drop in interest rates in Amsterdam

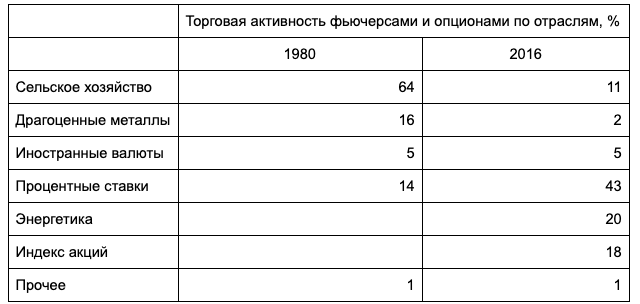

Returning to today, we see thatbitcoin holdersmuch like VOC shareholders.They tend to invest for the long term, keep a significant amount of capital in this asset and are reluctant to sell it in order to avoid paying capital gains taxes. As millennials, they are full of ambition to invest further. We expect Bitcoin to grow in popularity ascollateralfor loans. We are also optimistic about the marketsderivativesenabling businesses to pinpoint theira risk management strategy, thereby ensuring the sustainable growth of the Bitcoin industry. Our hypothesis is that the largest derivatives markets emerge in sectors of the economy with the highest price volatility: shares of the East India Company in Amsterdam of the 16th century, agriculture and precious metals in the 1980s, interest rates today, and tomorrow, probably Bitcoin.

Trading activity in the financial sector grew by 45%, while in agriculture fell by 53%. : CFTC, Commission in brief, 2016.

“According to our hypothesis, derivatives marketsgrow around the sectors that are most responsible for assessing risks in the economy (that is, economic products that companies must hedge against), ”- US Commodity Futures Trading Commission (CFTC), Commission in brief, 2016

Access to capital in a deflationary world

Lifeannuityis sold at a fixed priceA contract that gives the owner the right to receive annual payments for the rest of his life. Such contracts were widely used since the 14th century as debt substitutes, since they did not violate the Catholic Church's ban on usury. (Beginning in the 16th century, the law generally guaranteed that perpetual annuities could be repaid by paying off the body of the debt.) Perpetual annuities were often used to finance capital-intensive, low-risk enterprises: businesses, farms, and local governments. There were two common economic scenarios in the Low Countries in the 14th century. Coastal regions with sandy soils suffered from frequent flooding, and many landowners there fell into debt and lost their properties. In the more stable interior states of Flanders, annuity-based loans were used to stimulate business development (often for the purpose of property investment), while older residents bought life annuity contracts as a pension. Annuities were transferable to third parties and therefore became a popular financial instrument among urban populations. As the Dutch Revolution gained momentum and revenues from maritime trade increased, so did the importance of protecting cities and their populations. Cities began raising capital by issuing annuities.

"By the 1580s, annuities were quitedeveloped to serve as a reliable tool for the general public, including merchants, widows, orphans and charities." - Gelderblom & Jonker

Annuities gained popularity much earlierthan mutual life insurance (which appeared only in the 18th century in England), since they required trust to the issuer of the insurance policy to a much lesser extent. The insurance payment would have to be claimed literally from the other world, without the possibility of taking the security deposit. Perhaps the cultural component also played a role: it was more comfortable for clients to put on a long life (annuities) than on a short one (life insurance).

“Annuities could be used for a variety ofpurposes, in particular as a way of paying off the debts of heirs […] The remarkable growth of Antwerp has greatly influenced both the land and credit markets in its surroundings due to the massive participation of citizens,” Limberger & De Vijlder

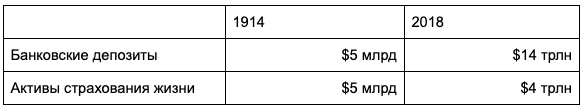

Bitcoin Nominated Lendingis alive and well, although the currency itself is onlyrecently celebrated its 10th anniversary. Genesis Capital has reportedly written over $2 billion in Bitcoin-denominated debt contracts since it began operations in March 2018. Demand from hedge funds, businesses with Bitcoin holdings, and individual traders is evident. We see parallels between the annuities that Dutch cities issued and the IEO tokens that exchanges issue today (Initial Exchange Offering, or IEO, is the initial placement of exchange tokens). For example, Bitfinex created the IEO token LEO to attract market liquidity during a legally challenging time, as well as reduce the liquidity risk associated with Tether. The exchange's perpetual commitment to repurchase LEO at market price makes this token similar to annuities. Other offshore exchanges followed suit: Binance released Binance Coin, Huobi launched Huobi Token, and FTX launched FTX Token. Bitcoin exchanges have a loyal audience that is somewhat dependent on their services, and tokens allow exchanges to leverage the trust of users by essentially borrowing money from them. Building on the analogy of beleaguered Dutch cities and profit-hungry merchants, we expect annuity-like offerings to continue to be popular with offshore Bitcoin exchanges and millennial crypto traders. In fact, these are the first examples of proto-life insurance in the Bitcoin market. Over time, we expect mutual companies to emergelife insurancethat may well breathe new life into thisextremely weakened traditional industry. Numerous studies have shown that inflation dampens the demand for life insurance, so the spread of bitcoin as hard money can return the popularity of this service.

“IEO is an explosive mixture of Goldman Sachs and Nasdaq. This is a new type of fundraising that can change the financial industry [...], but first you need to deal with its regulation ”, - Steven Nerayoff, CEO Alchemist, June 2019

US data. : Sixth Annual Presidential Meeting of Life Insurance Companies, iii.org, ycharts

“1% inflation growth is expected to bebe accompanied by a decrease in the total amount of existing life insurance contracts per capita by 1.2%, ”- David Babbel, Professor, University of California, Berkeley, 1981

findings

Venture Capitalist Eric Weinstein (EricWeinstein) recently suggested that the common phrase “good ideas conquer bad” is incorrect and that the more correct wording is “suitable ideas conquer inappropriate”. Paraphrasing Darwin's theory of the survival of animal species, he argues: an idea blooms only when it is most consistent with historical circumstances.

Indeed, history shows thatthe quality of an idea is not enough for its dissemination in society. A working steam engine was described by Heron of Alexandria in the 1st century BC. e., but this technology received commercial application only after 1600 years. A manual printing press existed in Korea in the 14th century, before the Gutenberg machine, but did not lead to a revolution there. The Vikings reached America several hundred years earlier than Columbus and the Hudson. In other words, due to external circumstances, even ideas with great potential are often not widely disseminated.

But from time to time circumstances developin a special way: on fertile soil many ideas take root at once, and this triggers an incredible chain reaction that radically changes society. An example of this is the Protestant Reformation: ideas arose, rebellions broke out, wounds were healed, and a new generation of radical entrepreneurs created an unprecedented series of fundamental economic and financial innovations. Five hundred years later, the situation may recur.

“If startup potential is proportional to sizeIts competitors, multiplied by their incompetence, the most promising startup is one that competes with national governments. This is not impossible: this is what cryptocurrencies do. ”

- Paul Graham, Founder of Y Combinator, August 2019

Today we see that the general population,especially millennials, express strong disagreement with the interventionist policies of central banks. Meanwhile, technicians are increasingly developing tools that can undermine the economic status quo. According to forecasts, in ten years millennials will earn more than all other generations. They are technically well-versed, grew up after September 11, and they have a security technology - encryption. Meanwhile, the Bitcoin ecosystem is becoming increasingly developed in all economic aspects, especially in terms of bank deposits, insurance, loans and derivatives, as well as early forms of life insurance. If this process continues, the multilayer set of Bitcoin protocols can become a global driving force and a potential alternative to the global monetary system.

Are you ready for the Bitcoin Reformation?

application

A Brief History of the Protestant Reformation with a Focus on the Lower Lands

1. The first dissent

IN1511In 1960, Erasmus of Rotterdam published In Praise of Folly, a popular satirical work aimed at the Catholic Church. Six years later, in1517year, Martin Luther gains famethanks to his "95 Theses" - a caustic criticism of the Catholic Church and its pursuit of rent. Within months, thousands of copies of this document were circulating throughout Europe. In response to this in1521The Catholic Church declares his works heresy and burns them. IN1522In the year 1960, King Charles V established the Inquisition in the Low Countries to suppress heretics. IN1523year the first burnings of heretics take place. IN1535in the year Charles V sentences all heretics to death, and in1539suppresses an uprising directed against him in Ghent, provoked by an increase in taxes.

During this period, all social strata were subject to political persecution. Under investigation in1543even the devout Flemish Catholic Gerard Mercator (cartographer famous for his world map) turns out to be1569of the year).He spends seven months in prison, from where he is released due to lack of evidence. That same year, Copernicus published a book on the heliocentric model of the world, and the Flemish anatomist Vesalius expressed fundamental disagreement with Galen's anatomical model for the first time in a millennium and a half.

The main characters of the painting "The ship of fools"Jerome Bosch became the representatives of the clergy. The work was probably inspired by the satirical poem of the same name in 1494, the preface to which contains the lines: "Who takes his place on the ship of fools, with laughter and songs, goes to hell."

IN1548The humanist Christopher Plantin moved to Antwerp - his publishing house soon became the most prestigious in Western Europe. IN1555The first underground Protestant city parish appears in Antwerp.

2. Open resistance

IN1559year, the king from the Habsburg dynasty (Philip II - Approx. Trans.) leaves Brussels for Spain, after which his half-sister Margaret of Parma becomes Stadtholder of the Netherlands.1566The year goes down in history as the “year of miracles.”At the beginning of it, the Flemish nobility publishes a petition to the Stadtholder of the Netherlands asking him to stop the persecution, which causes a surprisingly mild reaction. Having gained courage, groups of Protestants begin to preach in Catholic churches, which is accompanied by vandalism, which later becomes known as iconoclasm, or iconoclasm. At the local level, without the consent of the governor, a truce is concluded with them, and Protestants are allowed to preach in six churches inside the city walls of Antwerp. Later that year, the defeat of the Protestant (Gueuze) army tips the balance of power back in favor of the royalists.

"The courage of the Calvinist preachers in thisthe area of [Flanders] has grown so much that in their sermons they instruct people that it is not enough to eradicate idolatry in the hearts - it is necessary to completely remove it from sight. Apparently, they little by little affirm their flock in the thought of the need to plunder the church and get rid of all the images, ”- Servant of the Spanish Government, 1566

3. Suppression

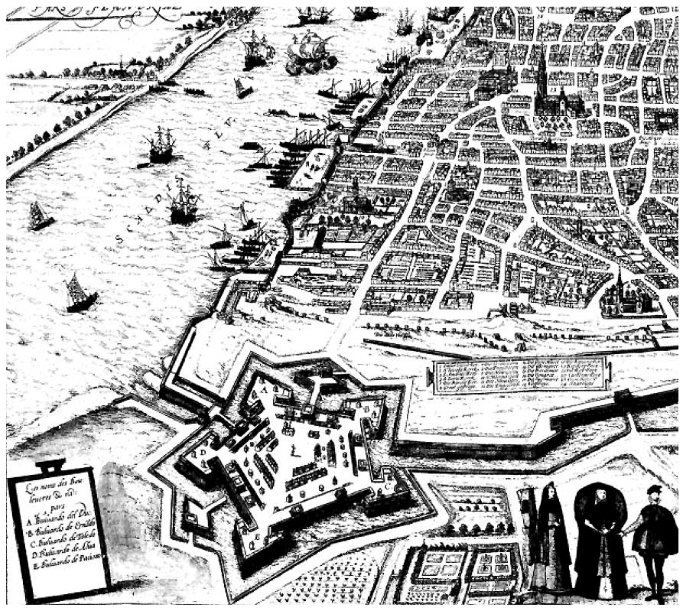

IN1567year the Spanish Duke of Alba arrives inThe Netherlands, with ten thousand experienced fighters, establishes a “court of blood.” His six-year reign as Stadtholder of the Netherlands is, according to some estimates, responsible for the deaths of more than eighteen thousand people. Upon arrival, Alba raises taxes and begins construction of a huge fortress on the city's borders, which will be completed in1572year.This citadel-pentagon becomes "one of the most significant urban structures of the 16th century." Three years later, the Spanish crown faces financial difficulties and stops paying its mercenaries in the Netherlands, who, under the command of the commandant of the Antwerp citadel, Sancho D'Avila, sack the city in1576year. The "Spanish Fury" becomes one of the largest atrocities in many centuries: in three days, 7–10% of the city's population is killed, thousands of houses are destroyed.

Allegory of the Dutch nation attacked by the Spaniards. Johannes Gacyus, 1616

Aerial view of Antwerp, the citadel of Alba in the foreground. : Civitates Orbis Terrarum I

An engraving from 1580 shows how the Dutch were frightened by a Spanish invasion depicted as an invasion of pigs. Lion is a symbol of the Netherlands

Despite desperate resistance, which included the partial destruction of the Spanish citadel,1585Antwerp surrenders to Spain and everyoneProtestant residents are given four years to complete their affairs and leave the city. The same thing happens in Ghent and Brussels. Within twenty years of the sack of Antwerp, almost 50% of the townspeople emigrated. Europe's strongest economy is experiencing a heart attack: for the next century, wages in Antwerp will remain 35% lower than in Leiden, a city just 140 kilometers away, in the Protestant-friendly region of the Northern Netherlands.

4. Netherlands, New Amsterdam, New York

The fall of Antwerp, and then the southern Netherlandsas a whole, makes a great contribution to the establishment of the Golden Age of the Republic of the United Provinces, where 50-100 thousand Flemings are resettled. At the same time, relatively tolerant England is building up its human capital through an influx of immigrants. After decades of wars and conquests, the Spanish Empire is weakening from the inside out (partly due to the damage to health from close marriages), and its rigid, hierarchical rule does not withstand competition from the flexible, dynamic and commercially oriented economies of the Netherlands and Britain. The combination, on the one hand, of religious and commercial tolerance, and, on the other hand, territory protected by water, becomes a recipe for success. Over the next 200 years, the Netherlands and England are at the forefront of economic innovation and growth.

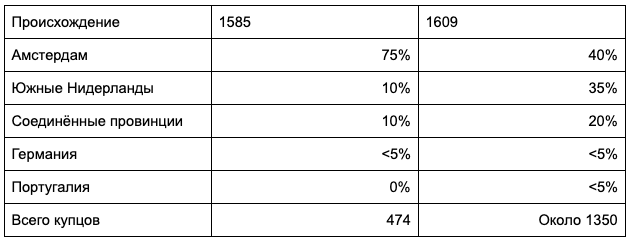

The approximate distribution of the merchants of Amsterdam by origin in 1585 and 1609. “More than half of the merchants with property of 100 thousand florins and more in 1631 were from the Southern Netherlands”

"Events in Holland after 1600 contradictThe common belief is that secondary markets originate from publicly traded government debt. East India Company shares, not government bonds, were the key turning point." - Gelderblom & Jonker

IN1579year the provinces of the Northern Netherlands gather,to sign the Union of Utrecht, declaring independence from Spain. The document declares complete religious freedom in the Dutch territories - a freedom that will be respected in New Amsterdam. IN1588year, after the defeat of the Invincible Armada in the English Channel, Spain abandoned attempts to capture England. IN1602immigrant from Antwerp Dirk van Osbecomes one of the founders of the Dutch East India Company. He financially assists Henry Hudson's expedition to North America in 1607, signs one of the world's first stock exchange certificates, and co-founded the Bank of Amsterdam in1609year. In the same year, Spain and the Dutch Republic conclude a peace treaty. IN1620year, the Pilgrim Fathers, who laterset sail on the ship "Mayflower" and founded the Plymouth Colony, settled in the Dutch city of Leiden, finding refuge there from the religious intolerance of their native England. IN1621year Flemish-Dutch merchant WillemWillem Usselincx receives permission from the States General to found the Dutch West India Company (WIC) with a monopoly right to develop the lands of North America. IN1624The first settlers arrive on Governor's Island near Manhattan. IN1626In 1960, the Walloon Peter Minuit bought Manhattan from the Delawares and established the capital of New Netherland there, at that time a purely commercial enterprise. IN1638In 2010, Galileo Galilei’s work, “Two New Sciences,” fundamental to heliocentrism, was published in Holland (its draft was illegally exported from Italy). IN1643According to Issac Jogues' calculations, the population of Manhattan is five hundred people who speak eighteen languages. IN1644In 2010, the English poet John Milton published Areopagitica, a philosophical treatise in defense of freedom of speech and self-expression. IN1654a small group arrives in ManhattanPortuguese Jews, and after receiving a petition from the Jewish community of Europe, the governor of New Amsterdam, Peter Stuyvesant, eventually allows them to stay, setting an example of hospitality towards future settlers of other nationalities. IN1664year the British army captures NewAmsterdam and renames it New York. The population of the city at that time was 9 thousand people. In 1665, Spinoza's teacher, a refugee from Flanders, Francis Van Den Enden, published Free Political Proposals, in which he defended freedom of speech, freedom of religion, egalitarianism, abolitionism and direct democracy. IN1683In 2010, the British Count Thomas Dungan was appointed governor of New York with the task of strengthening the influence of the Anglican Church there - he still fails to cope with his task. IN1689In 2010, philosopher John Locke published A Letter Concerning Toleration, which made a compelling case for religious tolerance. IN1777New York adopts its first state constitutionwithout religious affiliation and becomes the only one of the states that declared independence where there are no religious requirements for government officials.

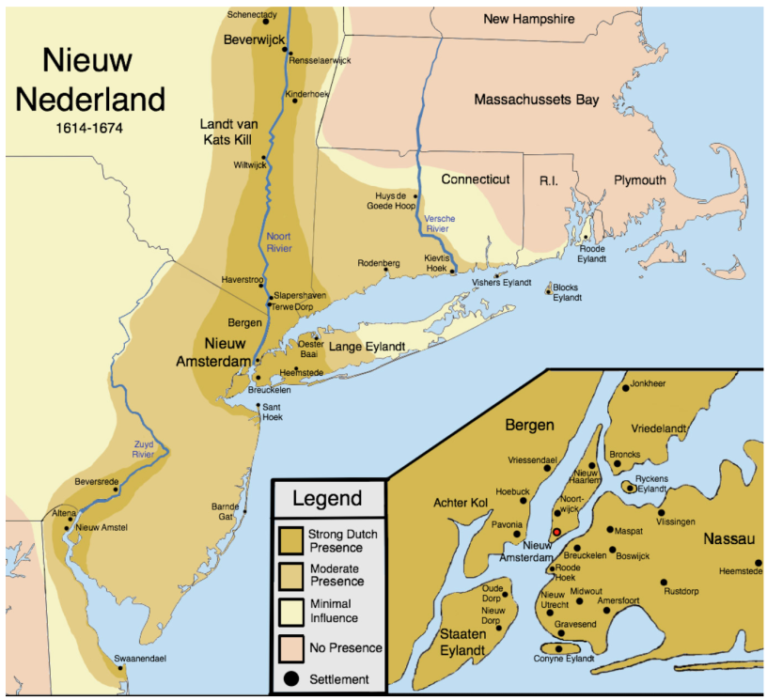

Map of New Netherlands. Most of the Dutch settlements were in the territory of modern New York

“Above all freedoms, give me the freedom to know, speak and argue freely, in accordance with my conscience,”- John Milton, 1644

“This agreement further prescribes, defines andDeclares that the free exercise of religious profession and exercise of religion, without discrimination or favor, is permitted in this State forever and to all."- New York State Constitution, 1777

Afterword

In the center of the “Battle of Shrovetide and Lent” by Bruegheldepicted a married couple. A man carries a bag - a symbol of selfishness and imperfection, and a woman - an extinguished lantern, reflecting a lack of wisdom. Supporting each other, they are removed, accompanied by a jester. We interpret these figures as a message in support of the future Reformation. Although simple men and women are not as enlightened as intellectuals would like, they, as a rule, do not participate in the war of fanatics. This lack of involvement is not a consequence of general apathy, but rather an expression of the pragmatic desire for a quiet family life and individual economic progress.

Like Bruegel, we are sympathetic and optimisticWe look at the long-term prospects for improving people's lives, even if Reformation 2.0 takes place. Of course, in any dispute, society is divided into several camps, based on prejudices and inaccurate estimates. But in the long run, the burden of blind faith and fanaticism can be dropped, and the lantern of the mind lit.

The forks of the road of history, like forks, constantly give us the opportunity to turn towards a better world.

Original

Oleg Andreev, Tony B (Bitcoin Translated), Valeria Vazhnova, Dima Zhelezov, Ivan Ivanitsky, Alexander Seleznev, Sergey Tikhomirov (the Basic Block podcast) translated and edited.

</p>