Investors are in no hurry to buy cryptocurrency on a downturn due to fuzzy entry signals and a lack of new impulses for growth.

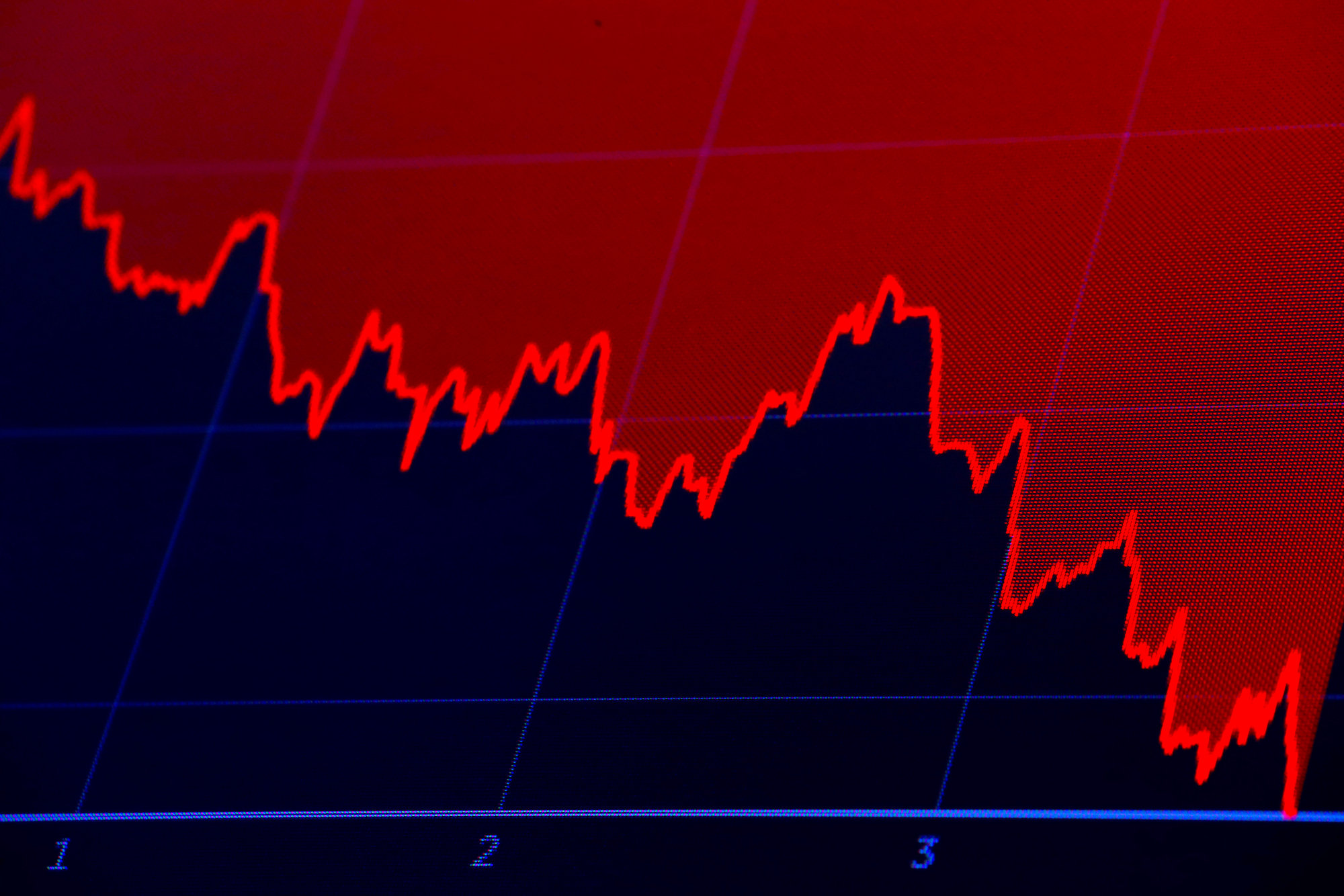

The prices of almost all digital currencies continuedecline. The Bitcoin rate has reached its lowest level in the last 5 weeks – $56 thousand, having lost 5.8% per day. The weekly decline exceeded 13%. At the time of publication, the situation has stabilized and the bulls are trying to regain control until the chart approaches the 100-day moving average, located just above $53 thousand.

Analysts believe the reason for such a long decline is a combinationseveral factors at once.First of all, they note a weakening in demand due to the lack of new impulses for growth. The protracted downturn, declining trading volumes, the 50-day MA breakout and the lack of clear entry signals are forcing buyers to be cautious in assessing the short-term outlook for Bitcoin, as many of them have already taken profits.

Another group of factors are concernsinvestors regarding regulatory changes in the US and the European Union. New amendments to the Infrastructure Investment and Jobs Act may affect tax rules for US crypto companies. In addition, the European Central Bank recently classified the cryptocurrency market as a “pocket of excess growth” that could exacerbate the financial sector downturn.

With a further decline in the bitcoin rate, the nexta significant support level will be located at about $ 53,000. It not only coincides with the 100-day MA, but also with the BTC market capitalization estimate of $ 1 trillion.

For now, renewed growth may spur strong interest in crypto derivatives and continued support from whales.

</p>