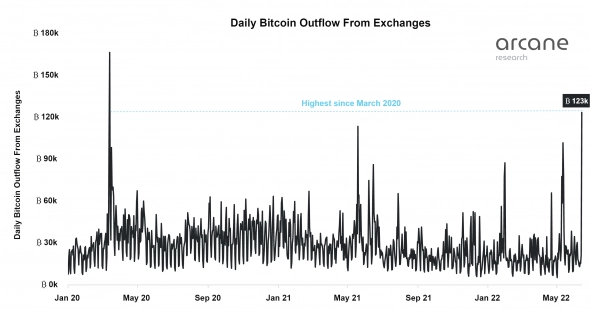

Freezing of Bitcoin withdrawals from the largest crypto exchange by turnover, crisis of a number of DeFi projects and drop in capitalizationcrypto markets below $1 trillion led to the largest one-day outflow of Bitcoin since March 2020. On June 13, 123,000 BTC were withdrawn from crypto exchanges.

Image source: arcane.no

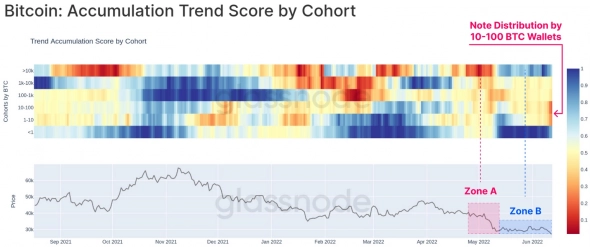

Blue whales (>10 thousand.BTC), who were actively getting rid of coins in May (zone A), switched to accumulating Bitcoin in June (zone B). Shrimp (<1 BTC) are more active; this group has bought half of the coins mined during this period since November. If they were the dominant force in the market, Bitcoin would not be trading so low.

Image Source:glassnode.com

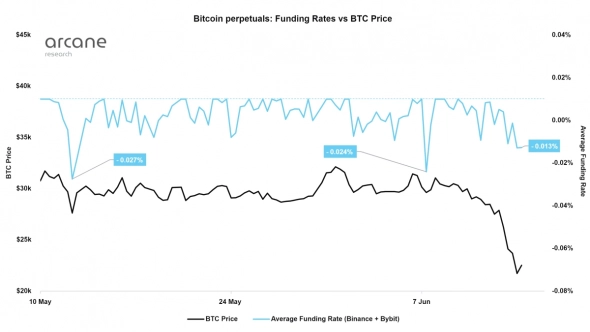

However, the market remains dominatedbears, as evidenced by the negative funding rate on futures contracts. The more sellers in the market, the more negative it becomes. Buyers at the same time receive a premium for holding a long position.

Image source: arcane.no

Today's rate hike by the Fed above the expected 0.5% will please the bears, as it is likely to trigger another wave of declines in risky assets.

Image Source: Cryptocurrency ExchangeStormGain

At the same time, the coin is already trading below the realizedprices, which historically indicates the imminent reaching of the bottom. The realized price is the cost of buying all the bitcoins divided by the total. The realized price differs from the market price, as many coins remain without movement after purchase. Now the ratio of the market price to the realized one is 0.92, the last time such a decrease was observed in March 2020.

Image source: stats.buybitcoinworldwide.com

Billionaire and CEO of GalaxyInvestment Mike Novogratz said this week that cryptocurrencies are much closer to the bottom than the US stock market. In his opinion, Bitcoin will stay near the $20,000 level, while stocks are likely to fall another 15-20%.

He was supported by former Goldman Sachs hedge fund manager Raul Pal, who wrote to a million subscribers that the bottom in Bitcoin would be reached within the next five weeks.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)