A network effect is a property of a company or other system in which the more peopleuse the network, the exponentially more valuable it becomes for each user. This is one of the strongest economic advantages a system can have over competitors.

</p>This article discusses how the costBitcoin is based on its network effect, why it is difficult for competitors to squeeze this network effect, and what risks investors should be aware of when further assessing the health of the network.

This is not a short-term, but a long-term analysis of the protocol. In the short term, Bitcoin could rise or fall substantially depending on sentiment and broad macroeconomic factors.

Network Effect Examples

Before diving into the details of Bitcoin, a few examples of different networks can be highlighted.

Phone: one-way network

One early example of a network effect was the telephone. One telephone is useless, but as more and more devices began to appear, the telephone became one of the most important inventions of its era.

And you can demonstrate mathematically why, as more people use the telephone network, its value grows not linearly, but quadratically.

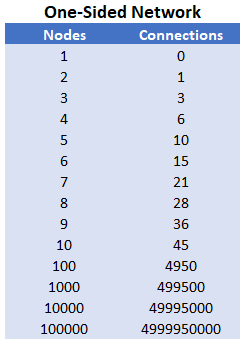

If there are two phones or "nodes" in the network, betweenonly one connection is possible. If there are three phones (A, B and C), then three connections are possible (between A and B, A and C, and B and C). If there are four phones, then six connections are possible. Jumping to ten phones, there are 45 possible connections. With 100 phones, there are 4950 possible connections.

If the number of connections is denoted by c, and the number of nodes by n, then we get the equation: c = 0.5 * n * (n-1).

As n gets very large, the equation asymptotically approaches c= 0.5*n^2. This equation is known as Metcalfe's Law and was originally introduced for computer networks.

With billions of mobile phones in the world (which are now also connected to the internet), quintillion connections are possible between them.

The telephone and the Internet are examples of one-way networkswhere users can connect to other users and each user or "node" is essentially the same. There are also infrastructural elements such as switching stations, but such services become necessary to support a user base of nodes that are similar to each other.

Payment networks: two-way network

Some networks are bidirectional, which means they have two different types of "nodes". A node of type a wants to connect to a node of type b, but generally does not want to connect to another node of type a.

An example of a two-way network is buyers and sellers.For example, eBay (EBAY) exploded in value after attracting a critical mass of buyers and sellers to its online platform. A similar principle applies to an ad network like Google AdSense: there are sites that want to make money from ads, and there are advertisers that want to place ads on popular sites. The market where they find each other through manual selection or algorithm grows exponentially in value.

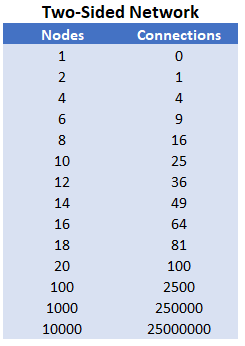

The equation for a two-way network is also exponential. The number of possible connections in a network is equal to the number of nodes on one side times the number of nodes on the other side.

If there are 2 sellers and 4 buyers, then betweenthere will be 8 possible connections. If there are 3 sellers and 3 buyers, then there will be 9 possible connections. If there are 10 sellers and 20 buyers, then there are 200 possible connections. If the number of connections is c, the number of nodes on one side is a, and the number of nodes on the other side is b, then the equation for the number of possible connections is: c = a*b.

The following table shows how scaling occurs, assuming for simplicity that there are an equal number of nodes on each side.

For a trading network of 5,000 sellers and 10,000 buyers, there will be 50 million possible connections.

When the number of users reaches millions and,therefore, with the number of possible connections reaching trillions, the chances for a seller to find buyers for their goods and for a buyer to find sellers for what they want to buy, even if it is a rare or niche product, increase. At some point, a critical mass is reached and the chain becomes a "one-stop-shop" where you can find almost anything, which makes it very valuable and dominant, so that it is difficult for smaller start-up chains to push it.

Another example of a two-way network is paymentcards, which come in several forms, such as payment, debit and credit cards. There are only four main brands in the US: Visa (V), Mastercard (MA), American Express (AXP) and Discover (DFS), which also operate worldwide with varying degrees of coverage. Among these four, the first two are the largest and operate as independent payment platforms on which banks issue cards, while the other two are smaller companies that share payment platforms with banks that issue cards.

Why haven't more appeared in decadescompetitors? Why aren't there twelve credit card brands instead of four? The reason why there are so few of them and only two or three are truly dominant has to do with the network effect.

Merchants are unwilling to accept unpopular cards,because it's not worth the effort. Consumers don't want to make cards that merchants don't accept. It turns out a vicious circle. Therefore, the network effect, once it has emerged, is difficult to dislodge. Creating a new credit card network is extremely difficult.

Only with the development of the Internet, which initiatedrare Cambrian explosion of innovation that challenged existing networks, we saw new payment networks like PayPal (PYPL) and Apple Pay (AAPL). However, even so, they worked with and in parallel to existing credit card networks, not strictly against them. In addition, the Internet has also made existing credit card networks even more valuable, since it is impossible to use cash on the network. So the Internet has expanded the available market share for these payment networks. All of them began to take more and more market share from cash. A similar jump in the cost of networks was observed in the Chinese Alipay (BABA) and WeChat Pay (TCEHY).

The Freight Network: An example of a failed innovation

Here is an example of how difficult it can be for competitors to overcome the network effect.

There are three main shipping networks in the US:corporate UPS (UPS) and FedEx (FDX), as well as the US Postal Service. They have a network effect due to their extensive infrastructure: logistics centers, road and air transport and qualified service personnel. Thanks to this existing infrastructure base, the cost of delivering a single package remains very low.

In 2002the world's largest transport company, the German Deutsche Post (DPSGY), tried to break into the lucrative American market. It was larger than UPS and FedEx, but its network was mostly in Europe. So it was a competitor with the best capital in the industry that could challenge them.

But until 2008, Deutsche Post was unable to enter the US market:

"Deutsche Post, owner of DHL Express,said it will close its U.S. package delivery business after five years of unsuccessful, $10 billion attempts to break into a $61.1 billion market dominated by UPS Inc. and FedEx Corp.

Express delivery division will close on 30January, but DHL International will continue its freight forwarding, contract logistics and international package delivery operations in the US, for which it will try to enter into an agreement with UPS for air transportation before the end of the year.

Deutsche Post, the German postal service, bought DHLInternational in 2002 and acquired Airborne Express in 2003 as a platform for US operations. But it never managed to rise above fourth place in market share behind UPS, FedEx and the US Postal Service, and by the third quarter of 2008 it had effectively lost its market share.

“The American market is a highly concentratedduopoly,” DHL Express CEO John Mullen said on November 10. “Even though we have invested enormous sums to become a trusted third option, [DHL's] lack of scale, productivity [like UPS and FedEx], market reach and brand awareness prevents us from achieving profitability.” — Jonathan Reiskin, Transport Topics, November 2008

For a while, DHL continued to operate asinternational courier, abandoning the US domestic market. Ten years later, Deutsche Post tried to find another niche and began offering delivery from online stores in certain cities.

So it's possible to find niches that aren't fully catered for by the big chains, but it's very hard to out-compete the top chains in their core business.

The Social Network: An Example of Successful Innovation

The most frequently cited example of a successful web innovation is when Facebook (FB) overtook MySpace to become the leading social network in the US.

The MySpace social network appeared in mid-2003. After some time, it attracted over 100 million users and in 2007 reached a peak value of $12 billion. Subsequently, its value quickly collapsed.

Facebook was founded aroundhalf a year later, in early 2004, and a few years later it overtook MySpace to eventually attract billions of monthly users and reach a peak value of about $800 billion to date. It also acquired Instagram, WhatsApp and other key networks (which has now come under the scrutiny of antitrust authorities).

Despite growing disapproval amonggovernments and the public due to data tracking or purchases of other networks, Facebook has experienced many exit campaigns and lawsuits and continues to grow, although the average age of users has increased. Perhaps someday it will collapse or stagnate, but so far, 18 years after its launch, it occupies a fairly strong global position.

Naturally, the question arises how Facebookmanaged to bypass MySpace, despite the brilliant start of the latter. Several reasons can be given, but I have come across two particularly compelling explanations that have played a key role.

The first reason is that Facebook started out asniche network and then expanded. Facebook users were required to use their real names instead of remaining anonymous, and the network was originally intended solely for students. She quickly achieved excellence in this niche. Then it became available to everyone. To use a slightly exaggerated analogy, this is reminiscent of how the Normandy landings in 1944 allowed the Allies to gain a foothold and begin to undermine the western front in Nazi-occupied Europe. Facebook's landing on the student scene allowed it to take hold, then to undermine the wider MySpace network.

The second reason is that MySpace is toohas been slow to adapt to mobile use, while Facebook has been quick to adapt. The value of MySpace peaked in 2007. This is the year the iPhone was released, when a wave of consumer use of the mobile Internet began, revolutionizing many industries. This year, Facebook's value was about the same as MySpace's, about $15 billion, after which it continued to grow exponentially, while MySpace's value quickly collapsed. The social scene has become a mobile scene, and Facebook has fully adapted to this.

Jeff Booth, technology entrepreneur andauthor of The Price of Tomorrow, argued that Facebook's mobile strategy was a "10x moment" for the company. The essence of the argument is that in order to push the existing network, the new competitor must be 10 times better. Since the existing network has already taken root, this gives it a great advantage, so the new network cannot be only slightly better or even twice as good. It has to be several orders of magnitude better to convince a critical mass of participants to switch to it.

Combination of real names,dominance in the student scene and rapid adaptation to the spread of smartphones, while MySpace was slow to adapt to mobile technology, made Facebook 10 times better than MySpace in terms of viral potential, and then the difference was already irreversible.

But since these companies started with a differenceAt only half a year, MySpace was not, in principle, the most difficult network to attack. Also, a couple of years before Facebook overtook it, MySpace changed management when the founders sold the company.

Michael Saylor, billionaire and founder and CEOMicroStrategy (MSTR), called the $100 billion threshold for a company to achieve near-guaranteed superiority. When a company with a strong network effect reaches a value of $100 billion today and far outperforms all of its competitors, the gap is almost insurmountable and the risk-to-reward ratio of betting that this leading network company will continue to do well is very favorable. In his 2012 book Mobile Wave, he accurately predicted how important mobile internet adoption will become for many industries.

If we apply Saylor's approach, then MySpace was marginalized before it achieved true network supremacy.

The Social Network: An example of a failed innovation

You can continue the Facebook story by adding moreone example of a failed attempt at innovation, similar to the previous Deutsche Post example. In 2011, Alphabet (GOOG) launched its own social network Google+ as a competitor.

Facebook at that time was the leader amongsocial networks, far surpassing MySpace at the height of its popularity. It cost several tens of billions of dollars, had nearly a billion global monthly users, and was therefore close to irreversible network dominance.

However, Google was a competitor with a very goodcapital, older and richer than Facebook, and with an already existing extensive server infrastructure. Just as Deutsche Post thought it had a good chance of breaking into the American logistics market, Google thought it had a good chance of breaking into the social media market.

Google at that time had a superior networkeffect in online advertising, and its search engine was the most visited site in the world. The link to Google+ was placed right on the main page so that a huge number of people would constantly see it. In other words, the company was trying to use its vast existing platform as a kind of "Normandy" to gain a foothold and build a network effect in another industry.

However, at its peak, Google+ had only a few hundredmillion users, never achieved very high activity and closed in 2019. It was not possible to create a 10 times better product. There was no "flavor" or combination of qualities that would have given the Internet giant a real chance to shake Facebook's impressive dominance in the social media industry.

However, Alphabet successfully acquired the YouTube platform in its infancy, which later gained superior network effect in its own niche.

Network of networks: the Amazon effect

It is very difficult to find examples of $100 networksbillion, which someone later surpassed. All the main examples of this are, in fact, “before and after the Internet”, that is, when the use of the Internet turned out to be 10 times better, which allowed newcomers to push the existing networks. For example, e-mail and e-commerce have supplanted their physical predecessors.

Beyond this key era of technologicalinnovations, there are not so many examples when it was possible to oust the dominant network. The leading financial exchanges have remained so for decades. Leading credit cards, too. When a critical mass is reached, it is almost impossible to push the leader, because it is very rarely possible to find a 10 times better solution. Older companies in declining industries fail all the time, but true network effect companies tend to have extraordinary longevity.

One company that has made good progress inundermining the network effect - Amazon. It has successfully transferred the network effect from one area to another and then to another, unlike Google and Deutsche Post, but here too there are caveats.

Amazon started out as an online bookseller in the early daysconsumer Internet in the 1990s, which was its Normandy moment, which allowed the company to establish itself. She then became the leader in e-commerce in categories other than books, built larger and larger warehouses and logistics systems, and achieved network supremacy in her industry.

Then Amazon took over cloud computing.At that time it was a new area, so there was no specific leader in it. IBM has been the leader in enterprise computing platforms, but just as MySpace has been slow to move to mobile, IBM has been slow to innovate in the space. Amazon leveraged the massive storage capacity of its e-commerce servers to offer cloud services to a number of companies and has quickly become a leading cloud service provider.

Amazon's two networks - commercial and cloud -help each other. Profits from cloud computing help keep prices low in e-commerce. E-commerce itself is usually a very marginal and often unprofitable enterprise. Amazon needs a lot of surplus server space anyway to handle traffic surges on key shopping days, so it makes economic sense to expand those capabilities even further and offer server space to others as well.

After that, Amazon set its sights on online marketplaces,by allowing other sellers to offer products to their existing user base, taking away some of the growth potential from eBay as a leading online marketplace. Facebook also launched a marketplace. However, eBay is still in business, still slowly growing, has gone through several years of mismanagement and diversion to other industries, and is now refocusing again, even though its value is still nowhere close to $100 billion.

Amazon has been expanding itslogistics network, putting pressure on FedEx and UPS. Amazon started out as a customer and remains so, but the company is increasingly looking to own the last mile of delivery as well, potentially putting pressure on the profitability of these logistics companies. In this sense, Amazon has been more successful than Deutsche Post in its bid to become the leading logistics company. And yet, UPS and FedEx continue to grow as dominant players in the last mile.

So even here Amazon has not unequivocally presseda dominant $100 billion network. At best, it became a leader in certain industries where existing companies could dominate but did not (such as IBM), became a leading competitor, partially depriving existing networks worth less than $100 billion of growth (such as eBay ), and has become an increasingly significant player influencing prices where there is an entrenched infrastructure duopoly (UPS and FedEx).

Protocol examples

We imagine the Internet as something rapidly changing, and it really is. However, it is built on a fairly old protocol foundation.

The Internet operates on a set of protocolsknown as TCP/IP. It was developed in the 1970s, four and a half decades ago, but continues to be the foundation of the Internet. There is no indication that its network effect will wane in the foreseeable future. Someday we will look back on the sixth and seventh decades of this protocol, and it will still be the backbone of the internet. And then - time will tell.

This base level is quite simple and flexible,so that almost anything can be built on it. In other words, most development happens at the application layer, not at the protocol layer. We don't rebuild the foundation of the internet every five years; instead, we are simply constantly revisiting the surface level.

Similarly, USB technology is 25 years old and has not beengoing nowhere. There were versions 2.0 and 3.0 that increased speed, and sometimes we change design parameters and release adapters to ensure backward compatibility.

When something simple does its job and becomes ubiquitous, it usually stays for a long time, with incremental improvements.

Suppose that I, as an engineer, design andI will patent something similar to USB, but objectively a little better. My version is 10% faster and 10% cheaper, but otherwise similar to the old one. What are the chances that I can make it the new global standard for billions of devices to replace USB? Almost zero, because even if this version is better on paper, it is actually much worse than USB in practice, because it is not compatible with the billions of existing devices or those that are currently in development.

And it will be even more difficult to promote a competitor to USB, which has made some concessions - which is better at one thing, but worse at another. It's like going to a nuclear war with a knife.

Should it surprise me that no one wantsuse my slightly better technology, and do I need to try to figure out why everyone keeps using the obsolete USB, especially since USB also goes through an upgrade cycle over time? Of course not.

In order to supplant USB, my protocol would obviously need to be an order of magnitude better, so much so that using USB would seem silly.

The same goes for TCP/IP.If a group of technology companies invested $5 billion to develop a better protocol, it probably still wouldn't be able to replace TCP/IP. Achieving a critical mass of international consensus for everyone to switch to the new protocol will be incredibly difficult.

This is relevant when analyzing Bitcoin's chances ofsuccess. It is often called old technology, especially when they are trying to sell you one of the 10,000 new cryptocurrencies. However, as with TCP/IP, simplicity is part of the Bitcoin concept, on top of which additional layers can be built. If it reaches a certain critical point and confirms its protocol status, it can hold out for a very long time.

Bitcoin Network Effect Analysis

I first wrote about Bitcoin in November 2017., during his big bull run, which attracted the attention of the whole world. I've gone through it in some detail and also looked at the digital asset space as a whole. I came up with some crude pricing models, but I was concerned about the robustness of Bitcoin's network effect and the potential loss of market share, as well as the euphoric price action.

At that time, Bitcoin was worth about $7,000 per coin.and had a total market capitalization in the order of $100 billion. However, its dominance (i.e. its share of market capitalization in the broader digital asset industry) was at a minimum and was declining. Then Bitcoin Cash also broke away from it, to some extent dividing the developer community. There were over a thousand cryptocurrencies, including some large ones such as Ethereum.

Then I failed to make a good modelrisk/reward for Bitcoin or other cryptocurrencies, especially given how much hype there was around the price, so I didn't get involved and just kept watching. The industry experienced a massive bear market for the next two years as the prices of many digital assets collapsed. Most of them have not yet recovered to previous all-time highs.

However, Bitcoin's network effect has sincecontinued to intensify. I ended up buying bitcoin in April 2020—ironically, for the same price of almost $7,000 that I had at the time of my first analysis at the end of 2017, but, in my opinion, with significantly less risk. Although the price has since risen, I still view Bitcoin as a favorable network investment, despite periods of local overbought.

Ultimately, my decision was based on network effect analysis, which showed that the protocol had probably reached "release speed".

The Strengthening Bitcoin Network

Bitcoin is primarily a savings technology and payment settlement network.

Smart contracts, applications, etc. are built on top of it, but at this stage this is not the predominant application.

Its computing power is reliably reaching all-time highs, while many cryptocurrencies had all-time highs in 2018.

With this high computing powerattempting to attack the Bitcoin network would be extremely costly because it would require as much electricity as a small country uses, as well as server farms with specialized hardware that is often in short supply.

In comparison, an attack on Litecoin, Bitcoin Cash, Bitcoin Satoshi Vision and others will require significantly less capital. They are much less protected.

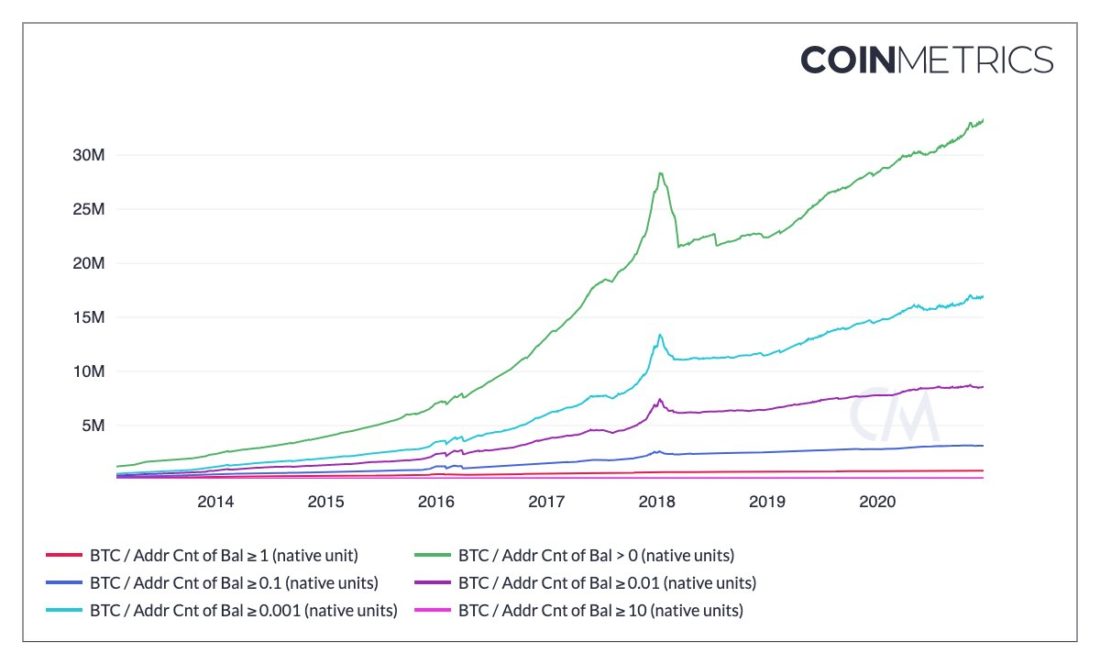

Similarly, the number of addresses holding 1 BTC, 0.1 BTC and 0.01 BTC continues to grow.

The number of addresses in the Bitcoin network. : CoinMetrics

It is difficult to calculate how many people useBitcoin or other digital assets or how concentrated the network is because one address does not necessarily correspond to one person. Large addresses are often custodial accounts for thousands or millions of users, and large users often hold their bitcoins in more than one address. However, I am glad that the number of small addresses continues to grow.

The popular crypto exchange Coinbase alone has over 40 million users. If you add up several exchanges and subtract the likely duplicates, you get more than 120 million users in the world.

If we talk about how the network effect of Bitcoin has increased over the past 2-3 years, we can start with the following:

1) Outcome of hard forks

The outcome of the hard fork between Bitcoin and Bitcoin Cash,that happened in 2017 was determined by the market over the next few years. Bitcoin for the most part maintained its market share, while Bitcoin Cash's share declined, and then it split again and again into Bitcoin Cash and Bitcoin Satoshi Vision.

Both cryptocurrencies have convincingly dropped to newprice lows relative to Bitcoin, and each is now worth less than 1-2% of Bitcoin's market capitalization. Neither has significant processing power compared to Bitcoin, and both have fewer nodes.

Bitcoin, Bitcoin Cash and Bitcoin SV hashrate chart. : BitInfoCharts

Many people ask: if the blockchain is open source and protocols can be forked, does Bitcoin really have a final offer?

Answer: Yes, if the community focuses on one protocol.

I can theoretically copy Wikipedia (everythingdata will fit on a flash drive) and put it on your server. Will this be a real challenge to Wikipedia traffic? Of course not. While I can copy the full text, I can't copy the hundreds of millions of links on the countless sites that lead to the real Wikipedia, the high search rankings and massive Wikipedia server power, or the community of people who constantly update Wikipedia. It won't be a serious competitor.

Similarly, anyone can copy the blockchainBitcoin and create your own fork. The question is whether he can convince the majority of miners, node operators, and users to consider his fork to be the “real” Bitcoin. So far, no such competitors have appeared.

2) Development of new levels

Additional layers such as the Lightning network,as well as third-party custody services have improved the scalability of Bitcoin. In 2021, major exchanges such as Kraken and OKCoin have agreed to use Lightning.

Map of Lightning nodes. : Lightning Network Explorer

Scalability, in particular, implyingthe number of transactions per second possible on the network is a measure that Bitcoin sacrifices at a basic level to maximize others such as security and decentralization. Bitcoin can only process about 120 million transactions per year - and several hundred million payments per year, since each transaction can have multiple recipients. Therefore, any layers that improve Bitcoin's scalability, including both trusted and non-trusted solutions, can favor the cost of the network and reduce future bottleneck concerns.

Looking at the global payment system,that is, large settlement layers like Fedwire, and there are levels above them that can process more transactions per unit of time, after which banks will settle these transactions "wholesale" at the basic settlement levels. Bitcoin is moving in the same direction.

Many people miscompare throughputBitcoin with something like Visa, but it's like comparing apples to oranges. Bitcoin is the level of final settlement. Visa is a layer of frequent and reversible transactions built on top of a deeper layer of final settlements.

Lightning is a level built on top ofBitcoin, which can process any number of transactions, while relying on the security of Bitcoin. Here, channels with multi-signatures are opened between the nodes, so that the user can transfer coins from one node to another through a sequence of interconnected nodes.

Difficult to estimate exactly how many nodes existor Lightning channels, as many are not public. However, Lightning developers say that the number of applications and users on the network has grown rapidly over the past 12-18 months.

Strike Global is one of the applications associated withLightning, which I especially watch as it opens up a lot of payment options for those who don't even necessarily care about bitcoin as an asset. It will allow fiat payments through the Lightning layer built on top of Bitcoin without real exposure to the volatility of the leading cryptocurrency. In less than a second, the app can exchange dollars for bitcoins, send bitcoins through the Lightning network to a recipient address, and then exchange them for dollars, euros, yen, stablecoins, etc.

The Lightning network resembles a base layerBitcoin in the sense that its source code is open and no one owns or controls it. However, key developers such as Lightning Labs are building infrastructure tools used by many application vendors to interact with the Lightning layer.

In many ways, the network effect is relevant tothe Lightning network is even larger than for the Bitcoin base layer. The main limitation of the Lightning network is liquidity. It relies on a sufficient number of unique channels between unique nodes, while the base layer relies on broadcasting transactions to all nodes. As more and more channels are created and maintained, liquidity at this secondary level improves, leading to wider adoption and the creation of more channels. And by building and improving tools, it's easier for apps to connect to Lightning and improve the experience.

I spoke several times with the CEO of Lightning LabsElizabeth Stark, and one of her key points is that in the future, most users will not even be aware that they are using the Lightning network, just like most people are not familiar with the technology stack that they indirectly use when interacting with the Internet.

3) Institutional level custodial services

Implemented custodial solutionsinstitutional level, including from Fidelity. These solutions provide reliable entry routes into the industry for institutional money. Bitcoin's previous bull runs have been driven by retail investors and speculators, while 2020 has been a year of institutional interest.

December 2020Singapore's largest bank announced the creation of an exchange and custodial service for institutional and accredited (non-retail) investors, and which will initially support trading in only four assets, including, of course, bitcoin. Founded in 2017, NYDIG is another key custodian focusing on large clients and bitcoin.

PayPal's new program allows retailers toinvestors to buy also four leading digital assets. Square's Cash App only allows retail investors to buy Bitcoin. NYDIG recently partnered with banks and major banking software vendors to enable banks to allow their existing customers to buy and hold bitcoin in their banking applications.

4) Accession of large investors

Thanks to the above efforts, bitcoin has reached investment investors in a way that no other digital asset has.

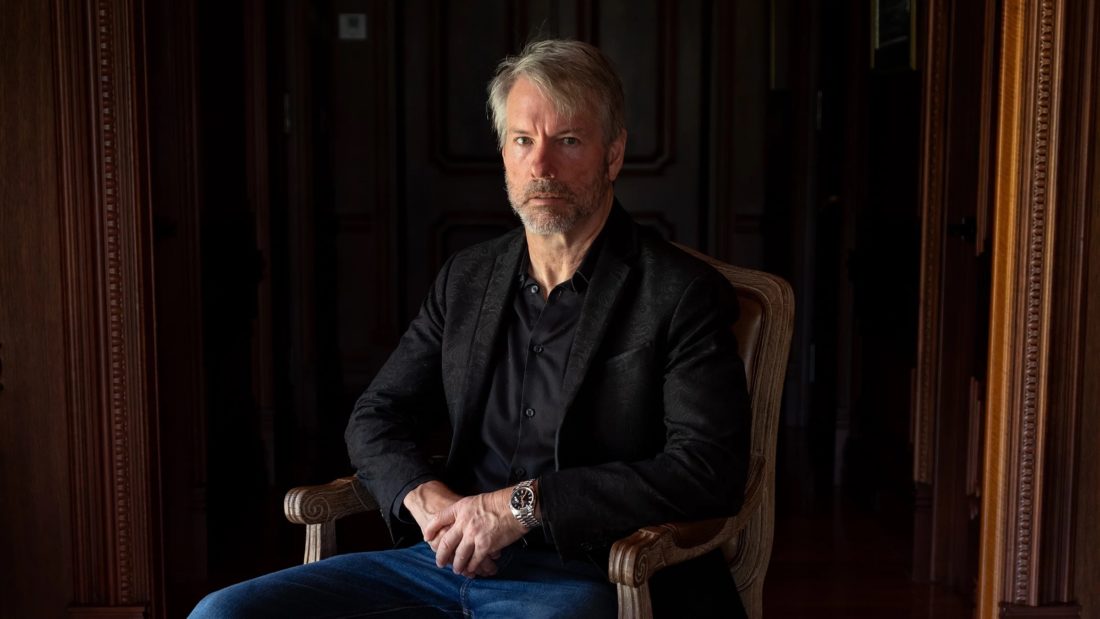

Michael Saylor, CEO of Microstrategy

Three companies listed on major USstock exchanges – MicroStrategy (MSTR), Square (SQ), and Tesla (TSLA) – now hold bitcoin directly on their corporate balance sheets. Investors like Paul Tudor Jones, Stanley Druckenmiller and Bill Miller are long bitcoin. One River Asset Management has launched bitcoin and ether funds for institutional investors, which together should reach hundreds of millions of dollars in assets under management. SkyBridge Capital also recently launched a Bitcoin fund. NYDIG has spent years building a platform for institutional investment, and over the past year it has gained significant momentum and is receiving a huge influx of funds.

Bitcoin has enough scale nowinstitutional buying and establishment credibility for political/legal lobbying. This could potentially mitigate regulators' attacks on him.

5) Separate (from other cryptocurrencies) Bitcoin ecosystem

There has been an increase in the number of companies focusing only or predominantly on Bitcoin.

For example, Swan Bitcoin is an accumulative firm that allows users to cheaply invest in Bitcoin by averaging dollar value, and with real customer service.

The key motive behind such cumulativebitcoin platforms comes down to the fact that you get much better conditions in terms of support and price than if you try to save on most general crypto exchanges that focus on actively trading many different tokens.

Coinkite and Specter Solutions launch hardwarebitcoin-only wallets with strong security features for IT pros, developers, and entrepreneurs, while many older wallets from other firms support multiple tokens. Similarly, the number of Bitcoin-only software wallets is on the rise.

Casa is a company that puts Bitcoin at the forefront and focuses on developing multi-signature security solutions to securely store substantial amounts in the leading cryptocurrency.

Square's Cash App allows users to save bitcoins, but not other digital assets. Square also now holds bitcoins on the corporate balance sheet.

The Strike app, as mentioned, uses the Bitcoin/Lightning network to send fiat-bitcoin-fiat payments around the world. It also implements utility protocol stablecoins.

Bitcoin ecosystem in terms of hardware,security and savings platforms are head and shoulders above any other single network in the industry, and its developer ecosystem is in the top two along with Ethereum.

6) Satellite support

The resilience of the Bitcoin network continues to improve, demonstrating how unwavering the leading cryptocurrency community is on security issues.

It used to be said that anyone with an internet connection could access Bitcoin. But now there are also bitcoin satellites.

Here is how Blockstream describes it:

“Bitcoin blockchain from space.No internet required. The Blockstream satellite network broadcasts the Bitcoin blockchain around the world for free around the clock, protecting against network outages and making it possible to use Bitcoin where there is no reliable Internet connection.”

7) Bitcoin Club Cards

Now there are club cards in bitcoin.

The Fold app allows users to earn bitcoins from their purchases. Club cards in bitcoin are launched by BlockFi. Cash Card by Cash App also allows you to earn bitcoins from purchases.

These are all automated storage platforms for those who regularly buy small amounts of bitcoin against the background of the final supply.

Many people dismiss Bitcoin and cryptocurrencies in general as “speculative”, and this is true to a certain extent, as many buyers do speculate and trade.

But, unlike many crypto tokens, likeThe "hot" fast-growing stocks it is often compared to, Bitcoin has a particularly large community of investors using dollar value averaging. This community of hodlers focuses on buying small batches on a regular basis to keep them cold for years to come.

Watching from the side, I see how some peopleTraditional views put cryptocurrencies, Bitcoin, "Wall Street betting" and retail speculators in the same category, but if you look closely at each of these communities, they actually differ significantly and only partially overlap. One of these groups is unlike the others in terms of propensity to buy and hold.

Bitcoin and other tokens

According to CoinMarketCap, the cryptocurrency market capitalization is now about $1.3 trillion.

The market capitalization of Bitcoin is $950 billion, or 60% of the total. However, Bitcoin's market share among tokens trying to optimize for decentralized store of value is even greater.

Stablecoins

Of the entire cryptocurrency market capitalization, tens of billions of dollars are in stablecoins. These stablecoins are just a variety of fiat currencies, so I don't consider them competitors to Bitcoin.

In fact, investors exchange fiat currenciesto stablecoins mainly to trade other digital assets, including bitcoin, since the liquidity inherent in these cryptocurrencies allows you to quickly transfer money between exchanges and speculate on price differences.

Money competitors

Next, $13 billion comes from Litecoin, $10 billionon Bitcoin Cash and less than $4 billion each on Bitcoin Satoshi Vision and Monero. Apart from Bitcoin, these and a few others are the biggest coins trying to be a store of value and a medium of exchange.

Compared to Bitcoin, these tokens have lessnodes, much less processing power, no specialized hardware/security ecosystem, and no institutional interest, so their network effect doesn't even come close to competing with the first cryptocurrency. Each of them has a market capitalization of less than 2% of Bitcoin's capitalization.

However, not all altcoins are equal. For example, I do not compare Litecoin with Bitcoin Satoshi Vision, as they have a different level of severity.

Ripple/XRP

XRP with a capitalization of about $20 billion belongs toseparate category. The US Securities and Exchange Commission states that these are unlicensed securities. The company behind these tokens is Ripple Labs, which is raising funds from investors and actively promoting the use of XRP, so financially this is a completely different situation than with Bitcoin. The Bitcoin launch process was completely unique, with no pre-mine and no centralized advertising campaign.

Ethereum

Finally, there is Ethereum and other utilitarian protocols like Cardano that are trying to target other uses than a store of value and a medium of exchange.

Ethereum, which has a market capitalization of around$200 billion and serving as a platform for countless tokens, is the only protocol other than Bitcoin that currently has a significant network effect. I have presented my analysis of Ethereum here. Cardano has a market capitalization of $36 billion and Polkadot has $32 billion.

Bitcoin focuses on doing very welldo one thing: be a decentralized and secure store of value and a level of payment settlement. Other layers built on top of Bitcoin can extend these capabilities, but the underlying protocol itself performs precisely these simple functions. Bitcoin has been around for over 12 years and hasn't changed radically since its inception. Change is slow when needed to improve security, and the biggest recent update is SegWit in 2017. It improved scalability and fixed some technical issues so that the Lightning network and other layers can be built on top of Bitcoin.

Depending on one's perspective, Bitcoin's baseline has been a completed (post-beta) project since 2017, when SegWit was implemented and the fork wars ended, or maybe long before that.

Store of value is not the main applicationEthereum. Instead, it aims to be the world's computer running smart contracts for a large number of decentralized applications, which suggests that its tokens could rise in value if the network continues to grow and improve. The second version of the ecosystem will have built-in liquidity pools in the form of staking and asset collateral, so holding Ethereum tokens could be attractive. It's something of an operating system with money to boot, and as such it's not exactly a direct competitor to Bitcoin, although Ethereum bulls argue that it could become one if enough factors coalesce from a technical standpoint.

Ethereum 1.0 has long been planned to be turned into Ethereum 2.0. This process has already begun and will continue for a couple more years. If successful, this will radically change the protocol and its monetary policy, and instead of a proof-of-work mechanism, proof-of-stake will be used to verify transactions. This may partially remove the current limitations of the protocol, but has significant implementation risks. I also don't see Ethereum as decentralized as Bitcoin.

Meanwhile, any significant marketTwo more utilitarian proof-of-stake protocols have capitalization: Cardano and Polkadot. Together they have roughly 30% of Ethereum's capitalization, so they are closer to the leader than some of Bitcoin's monetary competitors to the first cryptocurrency. Thus, if Ethereum transforms into Ethereum 2.0, then it has rivals vying for market share in the competitive utility protocol space.

Unlike Bitcoin, I don't have a price modelor a strong point of view about the risk and reward of Ethereum tokens. If I had to bet, I would rather be bullish on Ethereum if Bitcoin succeeds, as some investors will invest in Ethereum and there is an active trading community in the ecosystem interested in decentralized finance. But when Bitcoin is in a bear market, my views on Ethereum will also be bearish.

In late 2017, John Pfeffer published a research paper explaining why utility tokens by themselves are unlikely to acquire significant long-term monetary value.

The article caused a lot of controversy, but for now, aftermore than three years, the prediction in it comes true. Ethereum's transaction value has since nearly tripled thanks to its use for high-frequency stablecoin trading and decentralized exchanges, surpassing Bitcoin's transaction value at its peak, but Ethereum's market capitalization has not grown by the same percentage.

The utilitarian nature of the protocol does not exclude thattokens could also have store of value properties if all goes well as part of the transition to Ethereum 2.0. But this is difficult to achieve, since the protocol must be optimized for several things at the same time. It should be an optimal utilitarian protocol while also having liquidity pools and incentives to hold tokens, which Ethereum 2.0 will provide through staking if all goes as planned, and which is already the case in Ethereum 1.0 in the form of collateral.

To sum up this section, Ethereum is the only blockchain other than Bitcoin to achieve a significant network effect, but it differs from it in its level of decentralization and purpose.

Market centralization

With liquidity in mind, Bitcoin and Ethereumdominate the digital asset ecosystem. Together, Bitcoin and Ethereum account for a large percentage of the capitalization of the major (i.e., other than tiny, illiquid) crypto market protocols, excluding stablecoins.

I regularly get letters from guys that their favorite protocol is about to replace Bitcoin or Ethereum. They give a long list of reasons why they think their coin is technologically superior.

However, if she is not 10 times better, she has a verylittle chance against Bitcoin. Imagine, for example, that I invent a social network that, according to some sample of people, has a slightly better interface than Twitter or Facebook. Will I have a chance to push them? Of course not. Competing with a network with billions of users is impossible unless I do something radically better or something radically different. The same goes for the odds of any altcoin intending to become a store of value against Bitcoin.

For 12 years, no one has managed to push Bitcoin,despite the emergence of more than 8,000 competitors. In other words, "when attacking the king, it is better not to miss." So far, we see a graveyard of 8,000 misses and a small number of large protocols.

In conclusion

The answer to the question of whether or not to invest in Bitcoin ultimately depends on the investor's assessment of its network effect.

Meanwhile, this is a machine that algorithmically generatesmarket capitalization. Every two weeks (2016 blocks), the network automatically adjusts the difficulty to ensure that new blocks are created by miners on average every 10 minutes. Every four years (210,000 blocks), the number of new coins created with each new block is halved, leading to a supply shock.

This pattern appears to be pushing the price up in a consistent cycle in the long term.

It is not clear when this pattern will finallydisrupted, but given the strong track record and ongoing developments in the adjacent ecosystem (hardware, payment applications, custodial solutions, better regulation and second-tier developments), I think it's worth considering adding Bitcoin to your portfolio.

However, investors can study the protocol and ecosystem and draw their own conclusions.

</p>