The era of home mining is finally a thing of the past, but thanks to the transition of Ethereum to the PoS algorithm, thisyear to come back again. But whether it will be possible to make money on it is a big question.

Get rich on mining Bitcoin will alsomore complicated - the reward for the mined block in the Bitcoin network will be halved and mining will be profitable only at the price of MTC from $ 16,000, but according to the forecasts of many market analysts, this is more than possible.

Despite all the difficulties, the mining market is alive,develops and can bring good money. Mining-Cryptocurrency.ru figured out what equipment to use, what coins to mine and how much you can earn on this in the coming 2020.

What was the mining market like in 2019?

2018 was a tough year for miners.The Chinese authorities outlawed mining, and the industry was effectively banned in South Korea. The largest manufacturers of mining equipment - Bitfury, Bitmain, Ebang, Canaan, Genesis Mining, Nvidia, AMD - reported a decrease in demand from miners and a drop in profits, some pools and companies closed.

In 2019, the situation improved: Bitcoin and the market have grown, new generations of energy-efficient devices have appeared. The market not only survived, but continued to grow. Among the constraints, experts highlight high transaction costs, leading to low profitability.

"Depreciation, increased payback periodequipment, the lack of legislative regulation of activities, including the withdrawal of cryptocurrency to fiat, are the main problems that miners face in 2019 ”- said Sergey Arestov, founder of BitCluster.

Bitmain is fighting for the leadership position.At the same time, since the middle of last year, the largest mining company Bitmain has had difficult times: it almost went bankrupt, was mired in debt, reduced its own computing power from 2072 RN/s to 237.29 RN/s in a month and is experiencing a corporate conflict between the founders. Meanwhile, the main competitors increased their sales, and the main pools (Bitmain, BTC.com and Antpool) lost first place to competitors Poolin and F2Pool.

But Bitmain is trying to fix the situation:The company’s hashrate is now at 930 PH/s (about 1% of the total network hashrate); in October it filed for an IPO in the USA, completed the construction of a large mining center in Texas and announced the release of new models of S17 series ASIC miners with increased efficiency . Moreover, in December last year, Bitmain changed its sales strategy, taking on some of the risks of miners: now equipment can be purchased in installments or rented. Also, large customers can buy put options - contracts for the sale of military-technical cooperation on March 27, 2020 for $5,000. Customers will be able to sell the coin at an agreed price if its value drops below, making mining unprofitable. This should reduce investors' and miners' fears of Bitcoin volatility.

Obviously, Bitmain is betting on the growth of bitcoin after halving in May next year in an attempt to regain its market share. The success of the company will largely depend on the price of bitcoin in 2020.

Manufacturer competition is growing.It is unclear whether Bitmain's new strategy will be successful. But it reflects increasing competition among miner manufacturers on the eve of the halving of the first cryptocurrency. Bitfury, Canaan and Hut8 are competing for first place in BTC mining. The Chinese MicroBT released a new M30 miner and a whole line of highly efficient products to the market, Canaan held an IPO on NASDAQ and raised $90 million.

China has allowed mining.According to CoinShare, 65% of Bitcoin's hashrate comes from China—the highest figure ever. The country’s share in the complexity of the military-technical cooperation network has been growing for a whole year. Last April, China's National Development and Reform Commission (NDRC) announced that authorities were planning to ban Bitcoin mining. But they apparently changed their minds—in October, Chinese President Xi Jinping called for increased efforts in blockchain development, and in November, the NDRC officially excluded mining from the prohibited industries. China is home to some of the world's largest manufacturers of cryptocurrency miners, including Bitmain, Canaan and Ebang. The change in course is a good sign for the entire crypto industry as a whole.

Change of geography of leaders. Most likely, China's leadership in bitcoin hash rate will not last long. New generation equipment is entering the market that paves the way for miners from other countries and reduces the advantage of the Chinese in cheap electricity.

Northern Bitcoin mining companies from Germanyand Whinstone from the USA have agreed to jointly build the world's largest mining farm. Large mining centers are also opening in Canada, Northern Europe, and South America.

Technology race.In the coming years, the market will face a technology race. Manufacturers are investing in ways to increase hash rates and reduce power consumption. Increasing number of new product launches will lead to market growth.

According to Technavio calculations, the global market volumemining equipment in 2019-2023 will grow by $2.7 billion and will show a compound annual growth rate (CAGR) of more than 23% by 2023. Also, according to the Technavio report, one of the main drivers of the mining market is the growing demand for special hardware, such as field programmable gate arrays (FPGAs) and ASICs that use hard logic chipsets designed to solve hashes. Mining pools will play an increasingly important role. The market will also be impacted by applications for mining cryptocurrencies on smartphones that require low computing power to mine, such as Dash or Litecoin.

What is the total mining profitability in 2019?

According to CoinShare, in 2019, Bitcoin mining brought in $5.8 billion, which is $0.4 billion less than in 2018, but $2.1 billion more than in 2017.

Back in 2018, mining almost ceased to existprofitable - most of the profits went to costs - and for small miners it was even unprofitable. In the spring and summer of last year, thanks to market growth, miners were doing well. But in November 2019, the fall in the price of BTC led miners to disconnect equipment from the network - the costs of electricity and maintaining farms exceeded profits - and also to sell off coins. The situation is aggravated by the fact that halving is approaching - a twofold reduction in the reward - but the rate is not growing and there are no guarantees that this will happen. Not everyone can afford to mine for the future.

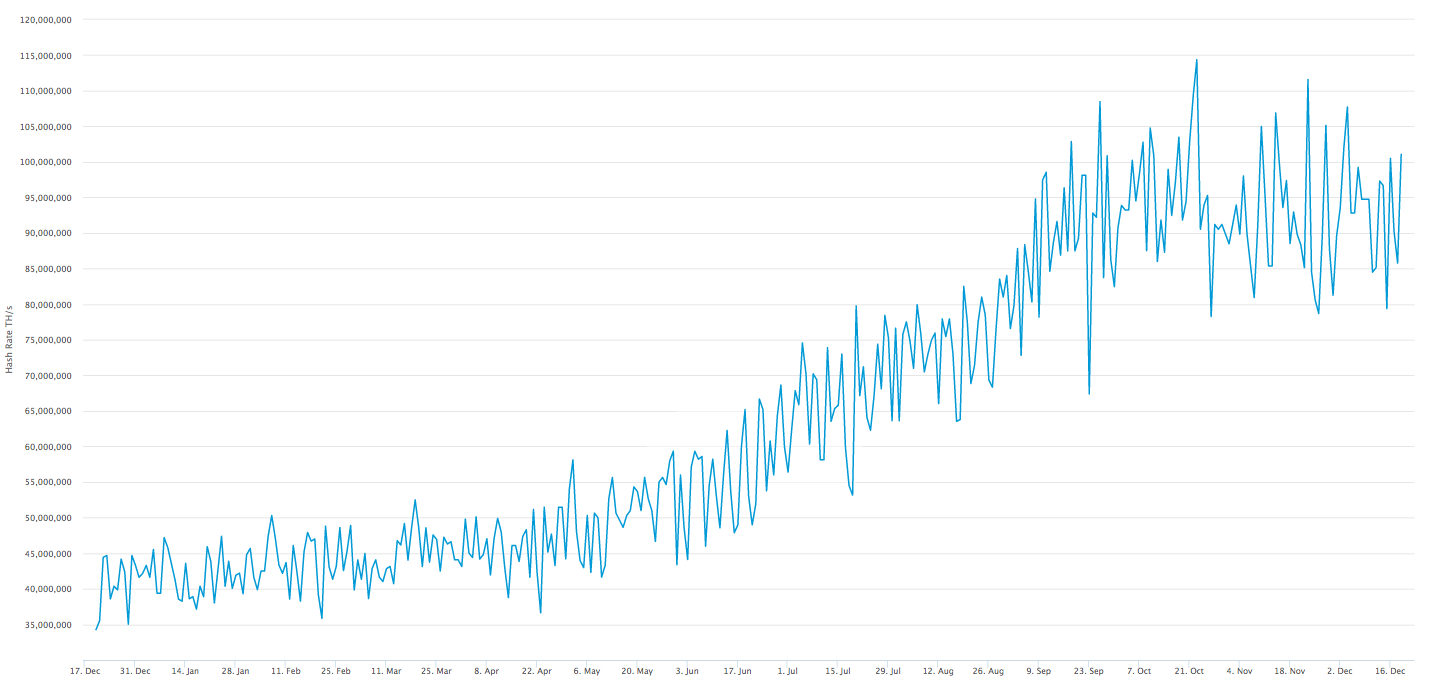

Over the year, complexity has increased almost three times. Hash rate jumps of 20-40 EH / s clearly show the inflows and outflows of miners switching to other currencies.

How much mining is bringing in Russia now?

At the current hashrate level, the world average pointBitcoin mining breakeven is around $8,000. At a lower price, BTC mining will not be profitable. This is only true for small “home” miners—industrial farms can afford to mine BTC at a loss.

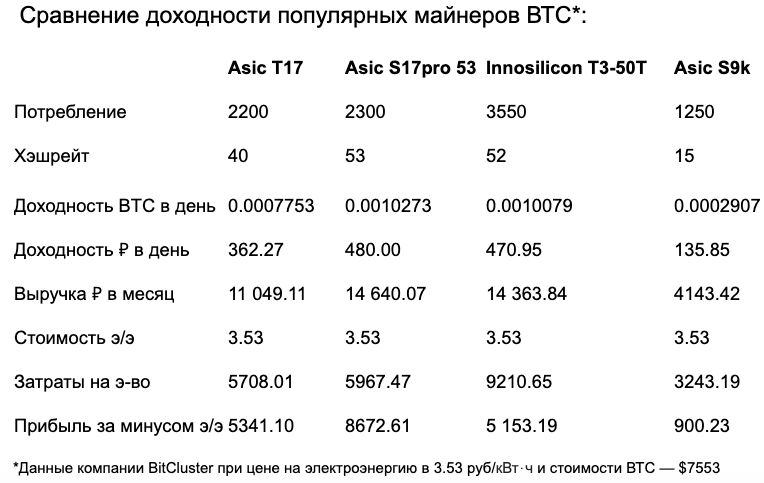

In Russia, the break-even point of MTC miningkept at around $ 5000 with an electricity price of up to 3.5 rubles. Thus, according to the calculations of Dmitry Shuvaev, development director of BitCluster, the cost of production of 1 BTC on the T3-50T device is $ 4868, on the S17 PRO - $ 4593, and the cost of production of 1 LTC on the L3 + device is $ 43.87 at an electricity price of 3.53 rubles / kW⋅ hours

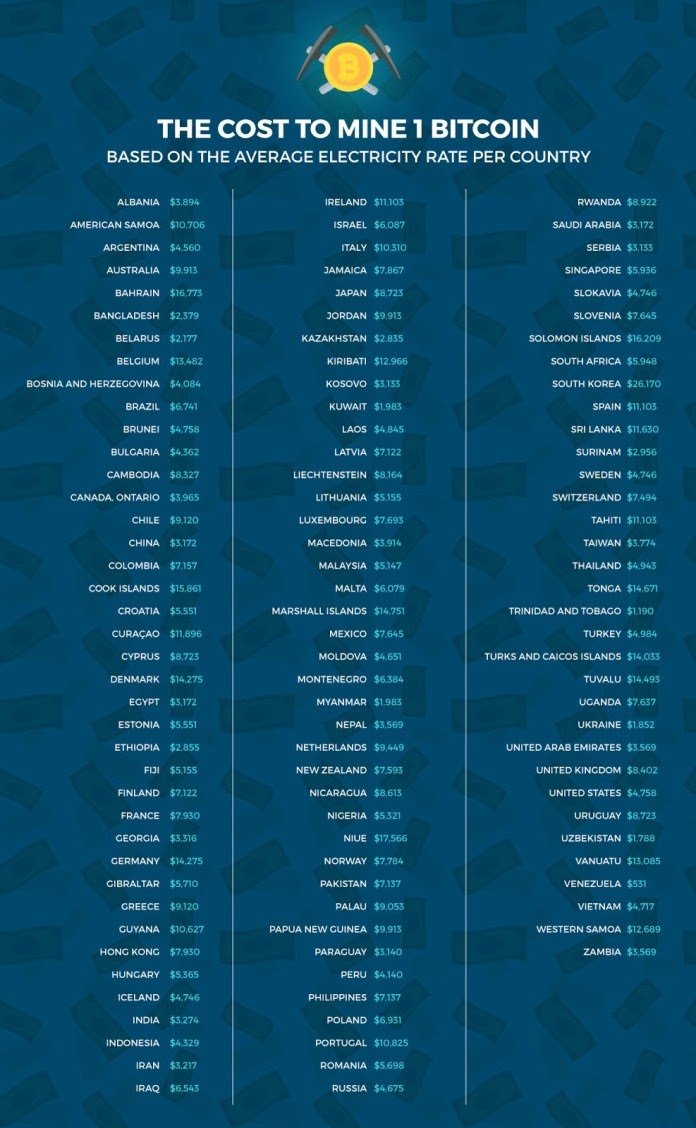

According to MarketWatch research, the cost of mining one bitcoin varies from $ 531 to $ 26,170.

Bitcoin mining halving field in May 2020

Once every four years, miners are rewarded for their minedthe block is halved, and new coins appear twice as slow. This is called halving, and the market is really looking forward to this event, because after previous halvings, Bitcoin’s price has risen tenfold.

The next halving will happen on May 14, 2020 - that’s allThe crypto community is wondering: Should we wait for the “native”? Some predict that the price of the coin will rise to $400,000, others predict that BTC will fall to $4,500 by May 2020, others believe that the market is ready for halving, and it will not have a significant impact on the price, citing the experience of the Litecoin halving in August last year - the event did not raise the price of the coin.

Most likely, Bitcoin will still bewill increase in price, after which a correction will occur in the market and then the rate will go up again. Halving will lead to the fact that the smallest miners will be disconnected from the network, especially in regions with expensive electricity. Miners with old equipment simply will not be able to mine new coins - it will become unprofitable due to the increase in the network hashrate. Thus, pools will be able to afford to wait for the growth of BTC, but home miners are unlikely to. But this situation also has a positive side: military-technical cooperation can be purchased cheaper. True, this, of course, is not profitable for miners.

As soon as miners switch to newdevices, volatility will decrease after halving, and (if) the course goes uphill, the situation will begin to improve. As the reward decreases, miners will be forced to increase transaction fees. The total amount of earnings is unlikely to change significantly. But in the future, the market will fight with miners for lower fees - they will not be able to significantly raise tariffs.

Much will depend on the course of bitcoin. If the price is high, most miners are likely to hold a coin. If the cost is low, some of the miners will drop the MTC, switching to something else. This will reduce competition.

BitCluster Dmitry Shuvaev shared a forecast on mining profitability after halving:

“If everything goes according to the scenario, then the first timeafter halving, miners will have a hard time. To predict the profitability of devices, we need to take into account the complexity of the bitcoin network. We see that the complexity has increased by 56% in 7 months from June 2019. By May 2020, we can expect from + 53% to + 87% to the complexity from the current moment (depending on how much the BTC rate rises / falls in this period). The estimated cost of producing 1 BTC with Innosilicon T3 - 50Th / s devices in May 2020 will be $ 9,000– $ 10,000. If the cost of bitcoin is less than $ 9500 after halving, then mining will be in the red before recalculating the complexity. Thus, in order for the mining rate of return to remain at the current level, after halving, the cost of BTC should be at least $ 16,000. "

How will Ethereum mining change after updating Constantinople?

Activation occurred on December 8, 2019Istanbul updates on the Ethereum mainnet. The update reduced and optimized gas costs, made Zcash compatible with Ethereum and protected the network from duplicate transactions.

January 1 in the ETH network on the block9,200,000 passed the Muir Glacier hard fork, which once again delayed the activation of the “difficulty bomb” - an increase in network difficulty every 100,000 blocks, designed to encourage miners to switch to the Proof-of-Stake (PoS) algorithm. This time the “difficulty bomb” has been delayed by 4 million blocks.

Around the middle of the year, Ethereum is waiting for the main thingupgrade to Ethereum 2.0, provided that the date is not postponed. The project will switch to a PoS algorithm (perhaps the controversial ProgPoW algorithm will become part of the update): the reward for miners for a mined block will decrease from 3 ETH to 2 ETH, transaction speed and performance will increase, and energy consumption will be reduced.

This markedly reduced the profitability of mining.Coins, first of all, for small miners. In addition, after the fork, a period of high volatility should be expected. Anyone who covers the costs of the obtained coins will have a hard time. But long-term investors are likely to continue to wait for the maximum rate.

Predict in advance how the market will behave,It’s difficult, and the developers themselves can change their minds and postpone updates a few more times. Skeptics generally believe that ether mining will be a thing of the past. In any case, it is time for ETN miners to prepare for updating and switching coins to PoS - then the changes will go more calmly and painlessly. Perhaps it’s more profitable just to buy a coin to increase the rate.

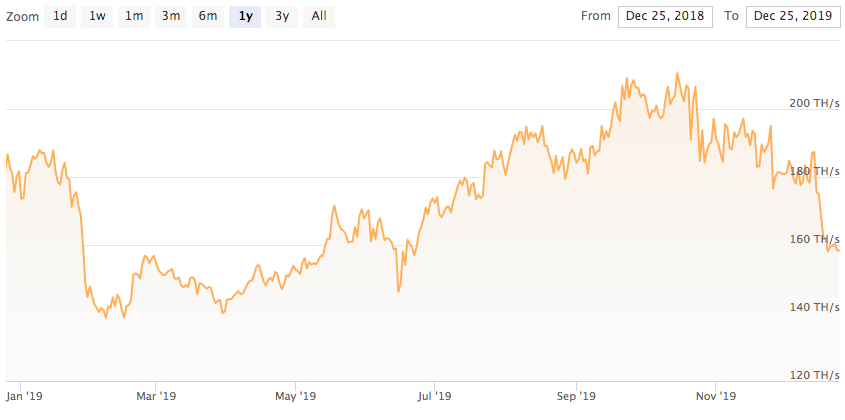

Judging by the decrease in Ethereum mining complexity, millions of miners are disconnected from the network.

Do you need to upgrade equipment?

Old equipment still widecommon, it will soon become worthless. In order not to advertise anything concrete, Dmitry Shuvaev limited himself to a simple recommendation: devices from 75TH / s and consumption of no more than 2.5 kW would be beneficial.

“New production equipment will not lose its profitability. If it also becomes ineffective for some time, then after recalculating the complexity it will again become profitable ”- the expert noted.

If your miners do not match the declaredcharacteristics and you can’t afford to go around, most likely you should think about either turning off the devices or switching to more advanced and energy-efficient ones.

Mine on obsolete equipment is not nowit makes sense - costs will be higher than profits. You should not be afraid of a new boom in buying equipment - some of the miners have not yet paid for the old, and newcomers already know that there will be no freebies.

The mining market is becoming professional

The era of home mining is over. Now, to make money on it, you need to be a technically competent and prudent businessman with a supply of resources in case of cryptozyme. Everyone who does not have cheap electricity and financial reserves leaves the market - mining is finally transferred to large players. It will be difficult to break the jackpot in it. But those who are set for long work, with a little luck and market growth, can count on stable profits.

“The market throws out all kinds ofintermediaries - from logistics to repair. The most effective mining for owners of data centers with cheap electricity. Now mining is profitable only on large volumes, that is, Interprice solutions. Home and garage mining has died forever and will never be profitable again. Only stolen electricity remains, but it ends in prison, so it’s also not relevant ”- summed up Sergey Arestov.

Experts advised to mine only the first 20 coins by capitalization. These are the most famous and understandable projects. Altcoins that seem promising now may be blown away tomorrow.

“In the long run, BTC mining is more profitable than mining any altcoin”- says Sergey Arestov.

Remember that mining is still a medium-term investment, which is unlikely to pay off before 2-3 years. It is worth entering the market only if you are ready to wait and soberly assess the risks.

What is the most profitable way to mine cryptocurrency in 2020?

For ordinary investors (conditionally with investments up to $ 100,000), the most profitable and affordable option for bitcoin mining is still cloud mining service contracts.

Cloud mining — this is a mining modelcryptocurrency based on the fact that mining equipment is rented from a contractor. It happens like this: the company buys equipment for mining, pays for maintenance, electricity, Internet - and investors buy a contract for power (hashrate) and receive the cryptocurrency mined by this equipment.

A detailed overview of cloud services with a current rating at the end of 2019 can be found here.

</p> 5

/

5

(

1

vote

)