Prolonged consolidation, as a rule, leads to a sharp decompression in financial markets. ForFor four months, Bitcoin has been “circling” around $40,000, and the denouement may occur as early as next week.

Image Source: Cryptocurrency ExchangeStormGain

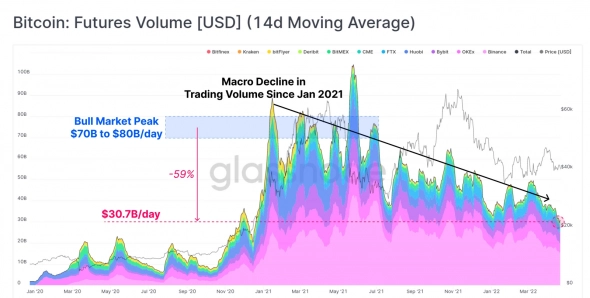

Bitcoin perpetual futures trading volume(without the actual supply of cryptocurrency) last year caught up in volume with the spot market due to a large influx of speculators and short-term investors. However, in the last eight months, a significant drop in trading volumes in derivatives has been recorded: from an average of $70-80 billion to the current $31 billion per day.

Image Source:glassnode.com

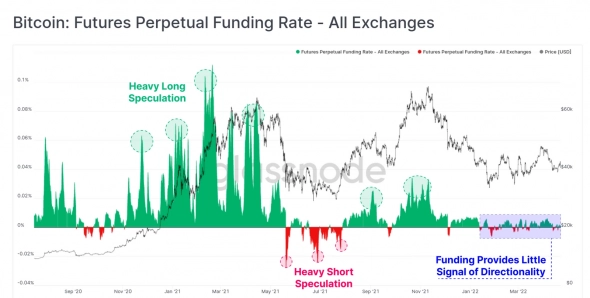

The funding rate is the trader's fee forholding a perpetual futures contract. If the majority buys, then for holding a long position (buying), they pay a bet in favor of the sellers. Accordingly, if bears prevail, the rate becomes positive for buyers.

This tool is great for visualizing moods.On the market. Now the funding rate is showing a significant contraction and indicates both a drop in the activity of traders and a growing uncertainty in the market.

Image Source:glassnode.com

The argument for the growth of Bitcoin are the strongaccumulation sentiment in the spot market. The 21st monitored exchange’s total Bitcoin holdings are at their lowest level since September 2018, according to analytics agency CryptoQuant. At the same time, the outflow of coins from cryptocurrency exchanges is close to record levels.

Image Source:twitter.com /OnChainCollege

Earlier we revealed why the efforts of somethere are not enough crypto enthusiasts to drive the price up. Institutional investors continue to curtail investment programs, and the US GDP in the first quarter went into negative territory. Currently, the yield on cryptocurrency futures is 3%, which is comparable to the yield on 10-year bonds and well below inflation of 8.5%. In the absence of confidence in the imminent growth of Bitcoin, investors are shifting to more profitable assets.

On May 3-4, the next meeting of the Fed will be held, atwhere the key rate can be raised immediately by 0.75% (under favorable circumstances, the rise is carried out at 0.25%). This would boost the long-term value of the dollar, increase the risk of a US recession, and could trigger a sell-off in risky assets like Bitcoin.

Image Source:twitter.com /whale_map

In anticipation of a new correction, variousanalytical agencies calculate the strongest level for Bitcoin, below which the price is unlikely to fall. According to Whalemap, this level is a zone of $25-27 thousand. At the same time, whales are ready for active purchases already at $34 thousand, and the current cost of Bitcoin mining for miners is approximately at the same level.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)