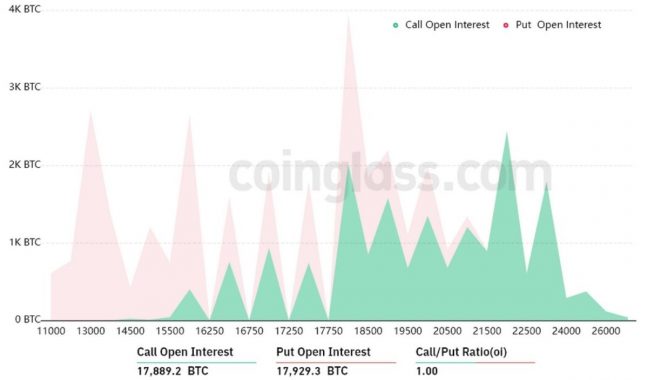

The Bitcoin cryptocurrency rate was in danger of falling due to a large number of options expiring on 18November.

According to the information portal CoinGlass,traders opened options to buy and sell almost 36,000 bitcoins, worth about $600 million at the current rate. However, if the BTC price continues to fluctuate below $17,500, then only 10% of trades will be completed.

The cost of options to buy and sell bitcoins as of November 18

If the price of bitcoin drops below $16,500, thenthe bears will earn a profit of $ 120 million. If the rate of the digital asset exceeds $ 18,000, then the bulls will receive a profit of $ 25 million. Obviously, a decrease in the value of the cryptocurrency is more profitable for traders.

At the same time, the graph data indicate thatbenefit of the upward trend. On Thursday, there was an upward breakdown of the contracting triangle, which began to form on November 11. Given the width of the figure, we can assume that Bitcoin will rise to around $19,000.

However, the bulls have little chance of storming the barrier.$18,000 resistance during this trading session. Accordingly, a scenario involving a fall in the BTC rate below $16,500 seems more likely.

Breakout of the shrinking triangle on the Bitcoin chart

News and notes about cryptocurrency and traditional financial markets, politics and technologies in Telegram.