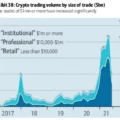

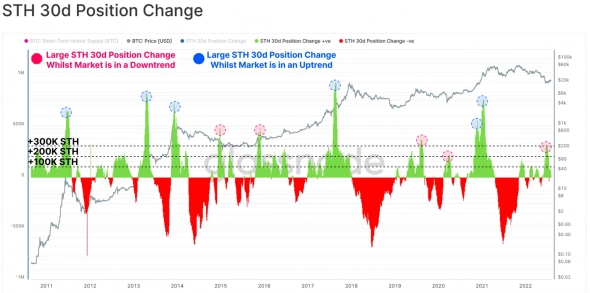

There is littlerevival: after a month-long consolidation near the $20K level, by the end of July, Bitcoin rose to $25K. Short-term holders (STH), who managed to buy the coin at a low price, increased their total supply to 330K BTC.

Image Source:glassnode.com

As can be seen from the chart, the supply extremes of this group often correspond to price highs or lows, which once again confirms the psychological significance of the level of $20-25 thousand.

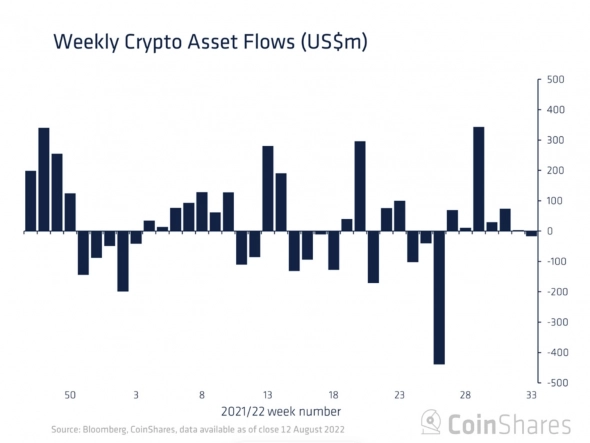

But not only STH took advantage of a smallraising prices to fix profits. A small outflow was demonstrated by cryptocurrency funds, where Bitcoin was the leader among the instruments with a weekly loss of $21 million. Some institutional investors are also in no hurry to play long.

Image Source:coinshares.com

Their fears are well founded, as the macroeconomic environment remains tense. At the same time, in the last phase of growth, Bitcoin broke the correlation with the stock markets, demonstrating weakness.

Image Source:cointelegraph.com

The reason is the ongoinginvestment crisis in the cryptocurrency market. So, in August, investors pumped up the CEL token, counting on the ability of the largest crypto fund Celcius to get out of the crisis, having dispersed the price four times in two weeks.

Image source: coinmarketcap.com

However, the updated bankruptcy reportshows that instead of a deficit of $1.2 billion, the hole in the company's balance sheet reaches $3 billion. This reduces the likelihood of a return on funds to investors, among which are various crypto projects. Mutual debt will lead to a series of bankruptcies, and new coins will be thrown into the market in the hope of paying off part of the obligations.

Image Source: Cryptocurrency ExchangeStormGain

This circumstance allows some analystspredict a new wave of Bitcoin decline. So, on August 14, gold apologist Peter Schiff predicted a drop below $10,000. But do not despair, since in 2019 he also predicted that Bitcoin would never reach $50,000.

Now much depends on the actions of regulators.China has already backed down as higher rates have slowed the economy. A number of experts are predicting similar actions by the Fed by the end of this year. The loosening of the grip will lead to a return of demand for high-risk assets and the growth of Bitcoin.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)